YOU MUST READ STUDENT PRESENTATIONS IN ADVANCE

advertisement

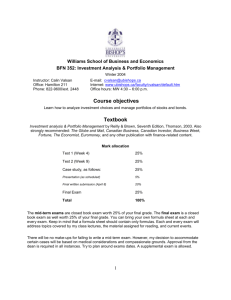

Introduction 1 Introduction • Seven years ago Gary Rolle of Transamerica donated $200,000 to establish the CU Student Investment Fund. – This fund has since grown (and shrunk) to over $270,000 – This is in spite of our scholarship program • We donate up to 4.5% of the fund to scholarships – This year, you will be managing the fund. 2 Job Stuff • Send the latest so that we can make a resume book – PDF format is best • Students have obtained jobs directly and indirectly as a result of this course • Mary Banks will talk to class 3 Purpose of the Course • Understand the investment management profession. – This profession is a blend of • theory • practice • To construct our portfolio we will apply the basic principles of – security analysis, valuation, asset pricing theory, portfolio construction and portfolio performance evaluation. 4 Learning Objectives - Quantitative This is an applied course. The idea is to apply what you learned in previous courses. 1. Stat 1 is useful. 1. 2. 2. Valuation is a noisy process. 1. 2. 3. 4. 3. Growth projections, discount rates, costs of capital are estimated. Accounting data has numerous non-persistent items. This has consequences for the (lack of) precision of valuation. Sensitivity analysis is important. What you learned about asset pricing is misleading. 1. 2. 3. 4. 5. Arithmetic and geometric means are different and it matters. Skewness matters Diversification is important but don’t use the textbook methodology to do asset allocation. The mean isn’t whet you’re likely to receive, even if it’s what you expect to receive. The asset pricing models you know don’t work. You can evaluate portfolio performance – sort of. Introduction to institutional investment management 5 Learning Objectives - Qualitative 1. When you’re valuing a company, it helps to 1. 2. Know what the company does. Understand the competitive environment and your company’s place in that environment. Understand growth prospects for the industry. Understand what makes your firm special. 3. 4. 2. You will hone your presentation skills 1. 2. 3. By giving an industry overview (a group project for some) Giving a stock presentation (an individual project) By answering questions from an adversarial audience (during your presentations) • and you are that audience. 6 Activities outside class • Burridge Center Conference 11/209 – Two of you may present. • This can be a valuable experience not only in terms of education, but also in terms of future job prospects. • CU Investment Committee Meeting – If we are lucky. • CU Investment Banking Forum 7 Prerequisites • FNCE 3010, 3020 • Accounting experience preferred but not strictly necessary • Working knowledge of statistics essential 8 Materials • • • • Damodaran, Damodaran on Valuation. Swensen, Pioneering Portfolio Management Lowenstein, When Genius Failed. HBS case 9-103-015, United Parcel Service’s IPO. • Various articles 9 Course Policies • Lecture slides will be available on the website in advance. • YOU MUST READ STUDENT PRESENTATIONS IN ADVANCE. • STUDENT PRESNTATIONS MUST BE AVAILABLE AT LEAST THREE DAYS IN ADVANCE (email ok). 10 Absences • We recognize that you are good students. This means that you will be gone for job interviews. – Let me know in advance! 11 Grading • The final grade for the course will be determined from the following: – – – – Initial presentation (there is a group component. Final presentation Other assignments and class participation Final exam: 15% 35% 30% 20% 12 The portfolio • The class has roughly $270,000 to invest • We now divide the class into groups. – Each group will analyze a different sector. – One sector has been chosen for us: the “Socially Responsible Investments” sector. Also, “Colorado companies” – Each group will be the “analyst” for the sector and will be the lead analyst for a particular stock in the sector. – Investments are equity of relatively large capitalization companies, above $1 billion and monthly volume of at least $.3B – The CU Foundation won’t allow short-selling or margin accts. – Each group should put down its top 3 choices for sectors. • The choices: • S&P companies and sectors are available on the website. 13 The Sectors – Choose Groups • Energy – Exxon • Materials – Alcoa • Industrials – 3M • Consumer Discretionary – Maytag • Consumer Staples – Kraft, Altria, Coke • health care – Merck, Amgen, US healthcare • Utilities – Duke Energy • financials – Citigroup, Met Life, American Express, Capital One • Information technology – Microsoft, Cisco, IBM, Applied materials • Telecoms (but there are so few…) – Verizon, Lucent • Socially responsible companies – Criteria for you to set 14 The first 4 Weeks • Devoted to security analysis – statistics – Accounting – Modeling – valuation • At the end, to help your presentations – case – examples of practitioner security reports – examples of student reports 15 Investment week – 2/10,2/12 • Each group will provide a 15 minute sector analysis including a brief introduction to selected securities. • For the sector analysis – Competitive structure of the sector and/or industry. – The growth and value characteristics of the industry – Cyclicality of the industry • Where are we in the cycle? • Interest rate sensitivity • Technological obsolescence risk • Each individual will be responsible for: 16 Investment week – 2/10,2/12 • Each individual will be responsible for – – – – – The investment thesis A very brief summary of the business A valuation analysis (or at least chosen metrics) A brief analysis of competitors Key risks associated with the sector and the stock • Your sector analysis may or may not be done jointly with the other person in your group. 17 Group Presentations after investment week • In each class, one or two groups will pitch his/her stock for fifteen minutes. • Then, there will be questions from the audience. • A group will be selected at random to lead the discussion and critique the presentation. • The presenting student will essentially write a research case for the stock. 18 Individual Presentations after investment week • In addition to fleshing out the details in the initial presentation (the five items immediately above), the student will analyze: – The competitive environment – Any competitive advantages the firm might have – Growth prospects • If the firm has multiple business units, these are best analyzed separately. – Determinants of the firm’s return on capital – How was the stock affected by what you considered to be the key risks. 19 Individual Presentations after investment week • At least 3 days prior to your presentation, you will distribute your report summarizing the research case for the stock along with attached financial statements, including the statement of cash flows. – You can do this by e-mail via the list that we will make on the first day. – This will provide the basis for class discussion during your presentation. • The idea is to provide the student with the flavor of pitching a stock when working for a money management firm. • Note that this is not a class in trading, but we will reexamine the portfolio in the event of big moves. 20 Data Issues • Where to get data – Wrds Account: at wrds.wharton.upenn.edu • Account: TBA • Password: TBA • You can get past returns, analyst forecasts, etc. – Research Insight – Other data sources • Look at Damodaran’s website which is – http://pages.stern.nyu.edu/~adamodar/ 21 Lectures after investment week • Portfolio theory and asset allocation. – Implications of diversification, both cross-sectionally and intertemporally. – Review of various asset classes – Asset pricing models, such as the CAPM, APT, and ad-hoc factor models. – Basics of portfolio performance evaluation: Sharpe Ratios and various alphas. – LTCM – Statistical difficulties associated with performance evaluation, and why it is difficult quantitatively to determine if a particular money manager’s superior performance is likely to continue. 22 Introduction to Valuation • Goal: To decide which assets to include in our portfolio. – One strategy would be to buy undervalued assets. – To determine whether assets are undervalued, one needs a method for estimating what they are worth. – Hence, valuation. 23 The Role of the Analyst • In this class, YOU are security analysts. • You need to investigate a business to see if money can be made buying its stock. – Must collect important facts about the business and its competition. – Must identify key investment controversies. – Must try to identify gaps between intrinsic value and market price. • And see if perhaps there’s a better deal nearby. 24 Qualitative and Quantitaive Aspects to Valuation • When using quantitative analysis, it’s very important to understand where your numbers come from and what they mean. – Inadequate or incorrect data is an obstacle. • To understand when data is inadequate or incorrect, you must have a knowledge of both – Accounting – Statistics • Confidence about the numbers is essential for valuation. – You MUST understand both the benefits and the limitations of the quantitative approach. 25 Valuation Approaches • One approach: DCF analysis – Estimates cash flows from the firm each period and discounts these cash flows at the appropriate risk adjusted rate. – How would you make this concept operational at the firm level? • The results may be less than satisfactory. – – – – A problem is that valuing a firm in isolation is hard. Dealing with estimation error is hard. What about multiple stages? What can be easier is to value a firm relative to other firms, which is why people use multiples analysis. 26 Multiples and real options • Multiples – In the cross section: find a comparable firm and compare, e.g., price earnings ratios and buy the cheaper one. Unfortunately, it is hard to find a “comparable firm.” – One could also compare with a broad market index. – But there are pitfalls to this approach too. For instance? – In the time series: Determine if the asset is undervalued relative to itself or a reference portfolio at different times. If so, buy. • The problem here is that “undervalued” things may stay that way. • A third way: contingent claims analysis, which is appropriate if firms possess a lot of real options. 27 Our application • In this part of the course, what we will do is examine these valuation strategies in turn and apply them to the problem of portfolio selection. – Your initial stock picks will be in part based on these methods of analysis. 28 What Fundamental Analysis Does • Estimates the value of a firm from fundamentals – Expected cash flows, including growth prospects, real options, etc. – Evaluates the risk profile of the firm (which is what is used to discount the cash flows. • Neither of these things is particularly easy to measure, particularly out in the far future. 29 Why Fundamental Analysis is Hard • You need to estimate future cash flows somehow. Possible inputs: – Analyst forecasts (others’ analysis) – Your own forecasts (which can include information based on analyst forecasts). • You can use past data to estimate a statistical model. – This can be misleading for multiple reasons. Why? • You can augment that by using your knowledge of the firm’s future prospects. This is just plain hard. We’ll look at the forecasting skills of real analysts later on. • And you need to discount them. That means you need a cost of capital. – Where to get that? 30