Here - Syreeta, Inc.

advertisement

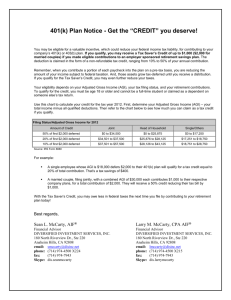

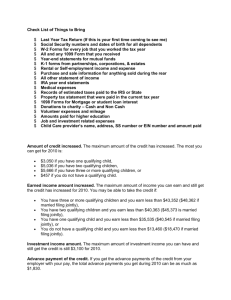

Tax Tip – Courtesy of Syreeta, Inc. With respect to expiring provisions, many taxpayer-favorable provisions expired at the end of 2013. Congressional gridlock prevented these provisions, known as the "tax extenders," from being enacted into law for 2014. Earlier this year, the Senate Finance Committee passed the Expiring Provisions Improvement Reform and Efficiency (EXPIRE) Bill of 2014, which would extend a number of these expired provisions to 2014 and 2015. Many believe that Congress wanted to wait until after the November elections to move forward on this Bill. Alternatively, any movement on the Bill may not come until 2015. Congress has been known to pass legislation in a tax year after the year to which the legislation applies and make that legislation retroactive. The Bill includes the following items which may impact your total tax for 2014: (1) Deduction for expenses of elementary and secondary school teachers This provision allows teachers and other school professionals a $250 abovethe-line tax deduction in 2014 and 2015 for expenses paid or incurred for books, supplies (other than non-athletic supplies for courses of instruction in health or physical education), computer equipment (including related software and service), other equipment, and supplementary materials used by the educator in the classroom. (2) Mortgage debt forgiveness - Under this provision, up to $2 million of forgiven mortgage debt is eligible to be excluded from income ($1 million if married filing separately) through tax year 2015. (3) Increased exclusion from income for employer-provided mass transit and parking benefits - This provision would increase, for 2014 and 2015, the monthly exclusion from income for employer-provided transit and vanpool benefits from $130 to $250, so that it would be the same as the exclusion for employer-provided parking benefits. The provision also modifies the definition of qualified bicycle commuting reimbursement to include expenses associated with the use of a bike sharing program. (4) Deduction for mortgage interest premiums - Under this provision, for 2014 and 2015, taxpayers would be able to deduct the cost of mortgage insurance on a qualified personal residence. The deduction would be phasedout ratably by 10 percent for each $1,000 by which adjusted gross income (AGI) exceeds $100,000. Thus, the deduction would be unavailable for a taxpayer with an AGI in excess of $110,000. (5) Deduction for state and local general sales taxes - This provision would extend for two years the election to take an itemized deduction for state and local general sales taxes in lieu of the itemized deduction permitted for state and local income taxes. Tax Tip – Courtesy of Syreeta, Inc. (6) Special rules for contributions of capital gain real property made for conservation purposes - This provision would extend for two years the increased contribution limits and carry-forward period for contributions of appreciated real property (including partial interests in real property) for conservation purposes. (7) Above-the-line deduction for higher education expenses - This provision would extend an above-the-line tax deduction for qualified higher education expenses. The maximum deduction, for 2014 and 2015, would be $4,000 for taxpayers with AGI of $65,000 or less ($130,000 for joint returns) or $2,000 for taxpayers with AGI of $80,000 or less ($160,000 for joint returns). (8) Tax-free distributions from individual retirement plan for charitable purposes - This provision would allow an individual retirement arrangement (IRA) owner who is age 70-1/2 or older generally to exclude from gross income up to $100,000 for 2014 and 2015 in distributions made directly from the IRA to certain public charities. Adoption Credit For taxable years beginning in 2014, the maximum credit allowed for other adoptions is the amount of qualified adoption expenses up to $13,190. The available adoption credit begins to phase out for taxpayers with modified adjusted gross income in excess of $197,880 and is completely phased out for taxpayers with modified adjusted gross income of $237,880 or more. Residential Energy Efficient Property Credit This tax credit is 30 percent of the cost of alternative energy equipment installed on or in your home. Qualified equipment includes solar hot water heaters, solar electric equipment and wind turbines. There is no dollar limit on the credit for most types of property. If your credit is more than the tax you owe, you can carry forward the unused portion of this credit to next year’s tax return. The home must be in the U.S. It does not have to be your main home. This credit is available through 2016. Premium Tax Credit – Changes in Circumstances If you purchased health insurance coverage from the Health Insurance Marketplace, you may receive advance payment of the premium tax credit in 2014. It is important that you report changes in circumstances, such as when you move to a new address, to your Marketplace. Other changes that you should report include changes in your income, employment, family size, or eligibility for other coverage. Advance credit payments provide premium assistance to help you pay for the insurance you buy through the Marketplace. Reporting changes will help you get the proper type and amount of premium assistance so you can avoid getting too much or too little in advance. Tax Tip – Courtesy of Syreeta, Inc. Child Tax Credit If you have a child under age 17, the Child Tax Credit may save you money at tax time. Here are some key facts the IRS wants you to know about the credit. Amount. The non-refundable Child Tax Credit may help cut your federal income tax by up to $1,000 for each qualifying child you claim on your tax return. Qualifications. A child must pass seven tests to qualify for this credit: Age test. The child was under age 17 at the end of 2014. Relationship test. The child is your son, daughter, stepchild, foster child, brother, sister, stepbrother, or stepsister. A child can also be a descendant of any of these persons. For example, your grandchild, niece or nephew will meet this test. Adopted children also qualify. An adopted child includes a child lawfully placed with you for legal adoption. Support test. The child did not provide more than half of his or her own support for 2014. Dependent test. You claim the child as a dependent on your 2014 federal income tax return. Joint return test. A married child can’t file a joint return with their spouse they are filing jointly only to claim a tax refund. Citizenship test. The child must be a U.S. citizen, U.S. national or U.S. resident alien. Residence test. In most cases, the child must have lived with you for more than half of 2014. Limitations. Your filing status and income may reduce or eliminate the credit. Additional Child Tax Credit If you get less than the full Child Tax Credit, you may qualify for the refundable Additional Child Tax Credit. This means you could get a refund even if you owe no tax. Child and Dependent Care Tax Credit Many of you pay for the care of their child or other dependent whether in childcare at a daycare facility, private home or in day camps during the summer while you work. If this applies to you, your costs may qualify for a federal tax credit that can lower your taxes. Here are a few facts that you should know about the Child and Dependent Care Credit: You may qualify for the credit if you paid someone to care for your child, dependent or spouse last year. Your expenses for care must be work-related. This means that you must have paid for care necessary care, to allow you to work or look for work. This also applies to your spouse if you are married and filing jointly. Your spouse meets this rule during any month they are a full-time student. They also meet it if they’re Tax Tip – Courtesy of Syreeta, Inc. physically or mentally incapable of self-care. Special rules apply to a spouse who is a student or disabled. The care must have been for ‘qualifying persons.’ A qualifying person can be your child under age 13. They may also be a spouse or dependent who is physically or mentally incapable of self-care. They must also have lived with you for more than half the year. Overnight camp or summer school tutoring costs do not qualify. You can’t include the cost of care provided by your spouse or your child who is under age 19 at the end of the year. You also cannot count the cost of care given by a person you can claim as your dependent. Special rules apply if you get dependent care benefits from your employer. The credit is worth up to 35 percent of the qualifying costs for care, depending on your income. The limit is $3,000 of your total cost for the care of one qualifying person. If you pay for the care of two or more qualifying persons, you can claim up to $6,000 of your costs. If your employer provides dependent care benefits, special rules apply. For more see Form 2441, Child and Dependent Care Expenses. You must include the Social Security number of each qualifying person to claim the credit. Keep all your receipts!! You must include the name, address and identifying number of any of your care providers to claim the credit. This is usually the Social Security number of an individual or the Employer Identification Number of a business. To claim the credit, attach Form 2441 to your tax return. If you use IRS e-file to prepare and file your return, the software will do this for you. Save TWICE With The Savers Credit If you are a low-to-moderate income worker, you can take steps now to save two ways for the same amount. With the saver’s credit you can save for your retirement and save on your taxes with a special tax credit. Here are a few things you should know about this credit: Save for retirement. The formal name of the saver’s credit is the retirement savings contributions credit. You may be able to claim this tax credit in addition to any other tax savings that also apply. The saver’s credit helps offset part of the first $2,000 you voluntarily save for your retirement. This includes amounts you contribute to IRAs, 401(k) plans and similar workplace plans. Tax Tip – Courtesy of Syreeta, Inc. Save on taxes. The saver’s credit can increase your refund or reduce the tax you owe. The maximum credit is $1,000, or $2,000 for married couples. The credit you receive is often much less, due in part because of the deductions and other credits you may claim. Income limits. Income limits vary based on your filing status. You may be able to claim the saver’s credit if you’re a: o Married couple filing jointly with income up to $60,000 in 2014 or $61,000 in 2015. o Head of Household with income up to $45,000 in 2014 or $45,750 in 2015. o Married person filing separately or single with income up to $30,000 in 2014 or $30,500 in 2015. When to contribute. If you’re eligible you still have time to contribute and get the saver’s credit on your 2014 tax return. You have until April 15, 2015, to set up a new IRA or add money to an existing IRA for 2014. You must make an elective deferral (contribution) by the end of the year to a 401(k) plan or similar workplace program. o If you can’t set aside money for this year you may want to schedule your 2015 contributions soon so your employer can begin withholding them in January. Special rules apply. Other special rules that apply to the credit include: o You must be at least 18 years of age. o You can’t have been a full-time student in 2014. o Another person can’t claim you as a dependent on their tax return. Visit IRS.gov. You figure your credit amount based on your filing status, adjusted gross income, tax liability and the amount of your qualified contribution. Other rules also apply. For more information visit IRS.gov.