Presentation to Shareholders

advertisement

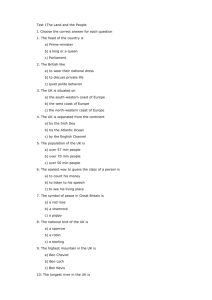

53rd AGM Presentation – March 26, 2013 Highlights and Lowlights 2012 • Highlights: – Investment Portfolio outperformed the KSE-100 Index by 7% (56% vs 49%) – Company reduced its exposure in ENGRO and DAWH and invested the proceeds in high dividend yielding stocks. – The market capitalization of the company grew by 59% from Rs.1,955 million to Rs. 3,107 million. – 40% Cash Dividend & 50% bonus payout. • Lowlights: – Share trading at 30% discount to book value 2 Our Investment Strategy Goal Achievement Generate gross returns greater than 14% on the Portfolio has beaten the agreed upon hurdle rate portfolio while generating cash flows (dividend) with YTD return of 56% vs target of 14%. Cash from investments of at least Rs.200m. target crossed PKR 300m against benchmark of Rs.200m. Portfolio allocations to be focused towards high Cyan fully offloaded its exposure in fertilizer yield/low growth investments from high sector stocks like ENGRO and DH Corp. and growth/low yield; diverted the proceeds to high dividend yielding stocks like HUBCO, POL, KAPCO. Reduce Exposure to Related Parties. Cyan fully offloaded ENGRO & substantially offloaded DH Corp. to reduce the related parties exposure. 3 Our Sector Focus Sector Banks Capital Gains: Rs. 56 Mln Dividend Income: Rs. 21 Mln Total : Rs. 77 Mln Oil & Gas Capital Gains: Rs. 78 Mln Dividend Income: Rs 49 Mln Total : Rs. 127 Mln IPP Capital Gains: Rs. 596 Mln Dividend Income: Rs 179 Total : 775 Mln Cyan Exposure In May 2012, minimum savings rate were revised upward from 5% to 6%. SBP’s aggressive stance to reduce DR by 250 bps also made this sector unattractive due to contraction in NIMs. The company preferred to stay sideline in this sector and preferred selective stocks like UBL and NBP due to dividend yielding. Due to stable Oil & gas production during the year the company has taken selective exposure in OGDC and PPL, however a decent exposure was maintained in POL being the only private play in the sector and completely immune to circular debt and with most attractive dividend yield. Due to aggressive reduction in DR together with rupee devaluation made this sector the most attractive. The company has taken full opportunity out of it and heavily invested in Hubco, Kapco and NPL. Hubco contributed Rs. 730 million (Rs. 572 million as capital gains and Rs. 158 million as dividend). 4 Our Sector Focus Sector Cement Capital Gains: Rs. 111 Mln Dividend Income: Rs 7 Mln Total: 118 Mln Telecommunication Capital loss: Rs. (21) Mln Dividend Income: Nil Total : (21) Cyan Exposure 2012 was a turn around year for the cement industry whereby cement demand was up by 3%, prices up by 7%, retention levels up 9% YoY and coal prices down by 22% on average. The company had best availed the opportunity and took timely exposure in Lucky and DG Khan cement and booked decent gains. Interest rejuvenated on back of ICH. Key ingredients were 1) increase in Approved Settlement Rate (ASR) and 2) centralized termination of inbound international calls. The company acquired a large position in PTCL and retained it till December 31, 2012 and is expected to reap the benefits from PTCL during the first quarter 2013. 5 Our Sector Focus Sector Chemicals Capital Gains: Rs. 520 Mln Dividend Income: Rs 26 Mln Total : Rs. 546 Mln Textiles Capital Gains: Rs. 18 Mln Dividend Income: Rs 5 Mln Total : Rs. 23 Mln Cyan Exposure The company has completely offloaded its stake in Engro and substantially in DH Corp. for reducing the concentration risk, however, the company maintained to remain sideline in this sector (except for Fatima) due to the following reasons: 3rd consecutive year of decline in fertilizer sales; Influx of cheap imported urea has weakened pricing power of the local industry Severe curtailment of gas supply to SNGPL based fertilizer plants. The textile sector performance has been skewed towards 2H 2012 as key triggers played out during this time-frame including (1) cumulative 250bps DR cut and 150bps decline in ERF rates, (2) implementation of EU trade preferences package (3) Rupee devaluation benefiting textile exporters. The company has taken position in leading textile company like Nishat Mills and retained it till December 31, 2012. 6 Star performer for the year 2012 – HUB Power On March 22, 2012, the company in collaboration with other Dawood Group companies entered into an arrangement to acquire 190m shares of Hub Power (HUBC) from International Power. A Share purchase agreement was executed by Cyan for 32.2 m shares of HUBC @ Rs.31.33 per share and after all the regulatory approvals the shares were transferred on 11 June, 2012. The proceeds from the sale of Engro was diverted for acquiring 32.2m shares of HUBC amounting to Rs.1.0b This strategy worked well for the company. During the year the company has offloaded 32.2m shares. This transaction has contributed Rs.528 (Rs.431 as capital gains and Rs.97 million as dividend income) 7 Capital Gains Realized – Rs.1,239 Million Equity : Mutual Fund Mutual Fund, 76 Equity, 1,163 FFCL, 38 UBL, 29 POL, 24 DGKC, 29 BAFL, 16 LUCKY, 52 MLCF, 11 Others, 46 HUBCO, 431 Engro, 487 8 Dividend Income December 31, 2012 - Rs.302 Million FFCL, 5 UBL, 5 NPL, 5 Others, 33 PPL, 6 DAWH, 7 NBP, 11 KAPCO, 14 HUBCO, 159 Engro, 20 POL, 37 9 Diversification of Investments 2011 2012 25% 14% 35% 47% Shares - related parties Shares - others 51% Mutual Funds & Debt 28% Shares - related parties Shares - others Mutual Funds & Debt The company has reduced its exposure to related parties and diverted it to cash generating assets like dividend yielding stocks i.e. KAPCO and POL; and Mutual funds. 10 Contribution to Profitability (Rs.in Million) 1,600 1,428 1,400 1,239 1,200 1,000 800 600 400 200 302 177 299 (200) Dividends capital gain Impairment (51) (400) PAT (198) (600) (601) (800) (1,000) 2012 2011 11 Investment Income (Rs.in Million) 1,736 1,800 1,300 800 300 (200) 180 2010 2011 (119) 2012 (700) 12 Dividend Income(Rs.in Million) 350 300 250 200 302 150 100 147 176 50 0 2010 2011 2012 13 Sector Breakup - Top Ten Holdings Portfolio Break-up based on Top ten * Holding as at December 31, 2012 DGKC, 9% Fatima, 3% HUBCO, 12% DLL, 4% PTCLA, 6% NML, 5% PPL, 8% Cash & Mutual Funds, 42% POL, 6% KAPCO, 5% * Top ten holdings represent 83% of the total portfolio 14 CYAN vs KSE 100 65.00% 60.00% 55.00% 50.00% 45.00% 40.00% 35.00% 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% -5.00% -10.00% 56% 49% 15 Dividend Pay out (Rs.in Million) 2012 215 2011 98 67 2010 0 50 100 150 200 250 16 Return to Shareholders’ Particulars 2012 Market Capitalization (Jan 01) – Rs. In Million 1,955 Market Capitalization (Dec 31) – Rs. In Million 3,107 Capital Appreciation (mainly due to 50% bonus pay out) Dividend Yield (payout Rs. 1 - Interim, Rs. 3 - Final) 59% 8% Return to Shareholders for the year 2012 67% KSE Index 49% 17 Outlook • The company is actively undertaking growth equity and portfolio investment business under the new structure . • Implement the new business model to deliver superior risk adjusted return to the shareholders. 18 Questions 19