2071_tinytest_costestimationSp15

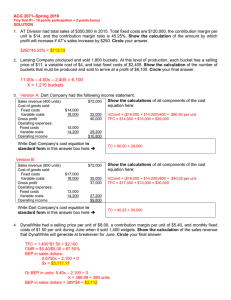

advertisement

ACG 2071 Tiny Test #1 - Chapters 1 through 3 Whimsy Company had the following income statement: Sales revenue (800 units) Cost of goods sold: Fixed costs $14,000 Variable costs 16,000 Gross profit Operating expenses: Fixed costs 12,000 Variable costs 11,200 Operating income $72,000 30,000 42,000 23,200 $18,800 1. Show the calculation for the total contribution margin. Circle the amount. $72,000 - $16,000 - $11,200 = $44,800 2. Show the calculation of the gross profit ratio. Circle the rate. $42,000/$72,000 = 58.33% 3. Show the calculation of the unit variable cost. Circle the amount. ($16,000 + $11,200)/800 = $34.00 ACG 2071 Tiny Test #1 Chapters 1 through 3 MW3:00 6 participation points possible Dart Company had the following income statement: Sales revenue (400 units) Cost of goods sold: Fixed costs $14,000 Variable costs 18,000 Gross profit Operating expenses: Fixed costs 15,000 Variable costs 14,200 Operating income $72,000 32,000 40,000 29,200 $10,800 1. Show the calculation for the total contribution margin. Circle the amount. $72,000 - $18,000 - $14,200 = $39,800 2. Show the calculation of the gross profit ratio. Circle the rate. $40,000/$72,000 = 55.56% 3. Show the calculation of the unit variable cost. Circle the amount. ($18,000 + $14,200)/400 = $80.50 ACG 2071 Review Problems Chapters 1 through 3 1. Three costs incurred by Hanson Company are summarized below at two different activity levels, 1,000 and 1,600 units: 1,000 Units 1,600 Units Cost 1 $24,000 $42,000 Cost 2 $12,000 $16,000 Cost 3 $17,500 $28,000 How much is the total variable cost of all of the costs for which the behavior is truly variable? Cost 1 = Mixed cost; Total costs and unit costs differ at the two activity levels. Cost 2 = Mixed cost; Total costs and unit costs differ at the two activity levels. Cost 3: $17,500/1,000 = $17.50 per unit $28,000/1,600 = $17.50 per unit Answer = Only cost 3: $17,500 at 1,000 units or $28,000 at 1,600 units 2. A significant weakness of the high-low method is that A. a significant amount of management expertise is necessary to break out the variable and fixed costs. B. the two data points that are used may not be representative of the general relation between cost and activity. C. the calculations are so complex that a computer is usually necessary in order to get accurate results. D. monthly data must be collected for at least three years before the method can be used. 3. Which of the following statements is correct? A. Total fixed costs are equal to revenue plus variable cost per unit times the quantity produced. B. Profit is equal to total fixed costs plus revenue. C. Total fixed costs are equal to profit minus revenue. D. Profit is equal to revenue minus total variable costs minus total fixed costs. 4. A regression analysis yields the following information: Regression Statistics Multiple R 0.961386 R Square 0.924262 Adjusted R Squ 0.916688 Standard Error 39.10106 Observations 12 ANOVA df Regression 1 Residual 10 Total 11 Intercept X Variable 1 Coefficients 824.516 2.087 SS 186578 15288.9 201867 Standard Error 225.526 0.09912 MS 186578 1528.89 F 122.0345 Sign F 6.3E-07 t Stat 4.2349 11.0469 P-value 0.00173 0.00634 Lower 95% 452.579 0.87409 Upper 95% 1457.6 1.3158 Lower 95.0% 452.58 0.8741 Upper 95.0% 1457.6 1.3158 What is the estimated cost for a production level of 900 units? TC = (2.087)(900) + 824.516 = $2,702.82 = $2,703 5. Which of the following correctly describes fixed and variable cost behavior as total volume increases? A. Unit fixed costs stay the same and unit variable costs increase. B. Total fixed costs stay the same and total variable costs increase. C. Unit fixed costs decrease and total variable costs decrease. D. Unit fixed costs decrease and unit variable costs decrease. 3 6. Florida Golf Supply has collected the following information over the last six months. Month Units produced Total costs April 10,000 $25,600 May 12,000 26,200 June 18,000 27,600 July 11,000 25,450 August 12,000 26,000 Sept 17,000 27,800 Using the high-low method, what is the estimated total cost in a month when 11,400 units are produced? VC per unit = [$27,600 - $25,600] / [18,000 – 10,000] = $0.25 per unit $27,600 = (0.25)*18,000 + FC FC = $23,100 TC = (0.25)*11,400 + 23,100 = $25,950