Schedule K-1 - Utah's Credit Unions

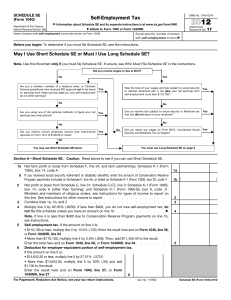

advertisement

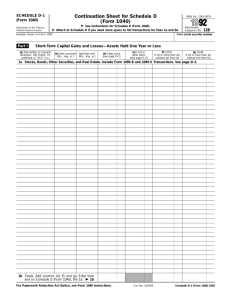

Understanding Borrowers’ Personal Tax Returns Tim Harrington, CPA T.E.A.M. Resources 7049 East Tanque Verde, PMB 136 Tucson, AZ 85715 (800) 788-9542 tharrington@forTeamResources.com www.forTeamResources.com Presented By Tim Harrington Tim Harrington is a Certified Public Accountant who has taught lending personnel how to make good loans since 1992. Since 1996, Tim has been President of TEAM Resources, a firm that provides consulting, strategic planning and training to financial institutions from coast-to-coast. He is the author of the popular lending software Lenders Tax Analyzer. Tim is a faculty member of two national financial professional schools on finance and lending, and has spoken to tens of thousands of consumer, mortgage and commercial lending personnel throughout the US 2 2 Lenders Tax Analyzer © 3 3 Form 1040 Focus on this part of the form Lines 7 through 21 Possibly Subtract the identified items. IGNORE All the other lines. 4 What are you looking for in a tax return? 1. How much cash is borrower really earning! 2. What is the earnings trend (2 or 3 years) 3. Is the income recurring? Get the whole return. 4 Sales/Capital Gains Schedule D and Form 4797 Rental/Royalty Income Schedule E, Page 1 Form 1040 Sole Proprietorship Schedule C Investment Income Schedule B Individual Income Tax Return Pension Incomes Divorce Income Tax Exempt Interest Tax Refunds Unemployment Comp Social Security Other Income or <Loss> Less Unreimbursed Employee Expenses Partnership & S Corp Schedule E, Page 2 Farm Income Schedule F 6 Taxable interest and dividends: See Schedule B 2,600 5,400 Lotto = 200, Net Operating Loss=(2,000) 7 6 Tax-exempt interest is not taxed and not included in taxable income by IRS. But for us it is extra ‘qualifying’ income. WE ADD IT. 5,400 Lotto = 200, Net Operating Loss=(2,000) 8 7 Taxable refunds are not an income and are ‘always’ ignored. You wouldn’t include them for a wage earner, why consider them for a selfemployed person 5,400 Lotto = 200, Net Operating Loss=(2,000) 9 8 Include Alimony if continuing… AND being paid. If not, ignore. See following screen for other divorce incomes that might be additional qualifying incomes. 2,600 5,400 Lotto = 200, Net Operating Loss=(2,000) 10 9 Other Divorce Income You Might Add The following incomes are not taxable but are real cash flows that could be used to pay loan payments. Since they are not taxable, they are not found on the tax return. If this income will last ‘long enough’ and is in fact being received, you may add: • Child Support • Separate Maintenance Income • Division of Assets: amount paid by one former spouse to other former spouse for value of assets that could not 11 be physically divided (a house for instance) 10 Retirement incomes: lines 15, 16 and 20. Each of these may have an untaxed amount. If the ‘a’ box is higher than the ‘b’ box, use the amount in the ‘a’ box. 2,600 5,400 Lotto = 200, Net Operating Loss=(2,000) 12 11 Unemployment compensation: if it is recurring, add it. If not recurring, ignore it. 5,400 Lotto = 200, Net Operating Loss=(2,000) 13 12 Other income: look and see if the income is recurring. If so, keep it, otherwise ignore it. NOL or Net Operating Loss, is the carrying forward of a loss that occurred in the past. Always ignore NOL. 5,400 Lotto = 200, Net Operating Loss=(2,000) 14 14 NOL = Net Operating Loss Carryover. This is a carryover to this tax year from some previous tax year. Always ignore it. 5,400 Lotto = 200, Net Operating Loss=(2,000) 15 15 2,600 5,400 Lotto = 200, Net Operating Loss=(2,000) With no adjustments, this would be borrower’s monthly income. (But there are other adjustments) $105,991/12 = 16 $8,833 per month Lenders Tax Analyzer Comparison Worksheet - 2011 Tax Return Borrower's Name: Note: Please complete only items with white boxes. All other cells are populated with information from other sheets. 1 ORIGINAL TAX RETURN Wages In order to complete a Lenders Tax Analyzer report, you will need: • Form 1040 • If borrower has Partnership Income: a Schedule K-1 for each partnership • If borrower has S-Corp Income: a Schedule K-1 or a history o distributions the borrower took from the S-Corp. The distributions paid to S-Corp shareholders are not reliably reported on K-1s ADJUSTED CASH FLOW 45,000 45,000 1 Form 1040, line 7 2 3 Wage Update (Be sure to update Wages using most recent info) Obtain from borrower, not from tax return Taxable Interest 2 7,900 6,100 3 2,100 4 565 5 Form 1040, line 8a 4 Tax-exempt Interest Moving Around the Screen: • The ENTER key will move to the next appropriate space. • Use the TAB key to move one space to the right. • Use the Arrow keys to move in the direction of the Arrow. Form 1040, line 8b 5 Ordinary Dividends 4,169 Form 1040, line 9a 6 Taxable Refunds 335 6 Form 1040, line 10 7 Alimony Received 1,450 1,450 7 Form 1040, line 11 8 Child Support 8 Obtain from borrower, not from tax return 9 10 Other Divorce Income (Separate maintenance, division of assets, etc) Obtain from borrower, not from tax return Business Income Schedule C 9 (1,644) 2,804 10 15,679 10,266 11 0 12 2,600 13 Form 1040, line 12 11 Capital gain or (Loss) Schedule D Form 1040, line 13 12 Other Gains Form 4797 Form 1040, line 14 13 IRA Distributions Form 1040, line 15 14 From line 15a From line 16b From line 16a Pensions and Annuities Form 1040, line 16 15 1,600 From line 15b Rental / Royalty Income 14 31,717 23,638 15 24,900 16 Form 1040, line 17 16 Partnership / S-Corporation Income From Schedule E, Page 2 17 Farm Income or (Loss) Schedule F (815) (20) 17 Form 1040, line 18 18 Unemployment Compensation 18 Form 1040, line 19 19 Social Security Benefits Form 1040, line 20 20 Other Income 2,400 From line 20b 5,400 19 From line 20a (1,800) 0 20 Form 1040, line 21 21 Unreimbursed Employee Business Expense 22 Annual Gross Cash Flow 23 Monthly Gross Cash Flow (line 22 divided by 12) (2,152) 21 105,991 $ 122,651 22 8,833 $ 10,221 23 - 17 FORM 1040 Likely Incomes Wages ……………………Get these via current pay stub Interest income…………..If recurring, add it If non-recurring, ignore (see Schedule B) Tax exempt interest……..If recurring, add it If non-recurring, ignore Dividends…………………. If recurring, add it If non-recurring, ignore (see Schedule B) Taxable refunds………….Always ignore Alimony……………………If recurring, add it If non-recurring, ignore it Other divorce income……Add if recurring (not found on return) 18 17 FORM 1040 Likely Incomes IRA distributions…………Add ‘Total’ amount, NOT ‘Taxable’ Pension distributions……Add ‘Total’ amount, NOT ‘Taxable’ Unemployment Comp…..If recurring, add it If non-recurring, ignore it Social security …………. Add ‘Total’ amount, NOT ‘Taxable’ Other income…………….WATCH FOR: Net Operating Loss (NOL) carryover…..ignore Income that won't recur…………....Ignore Income that will recur………………..Add it Expenses from Form 2106…Subtract Expenses for Alimony Paid…Subtract (possibly) 19 18 Schedule B If you see any Interest Income here that has come from a K-1 (partnership or S Corp), IGNORE that income. It is Phantom Income to the individual. Interest and Dividend Income If you see any Dividend Income here that has come from a K-1 (partnership or S Corp), IGNORE that income. It is Phantom Income to the individual. 09-07 09-07 20 22 If you see any Interest Income here that has come from a K-1 (partnership or S Corp), IGNORE that income. It is Phantom Income to the individual. Are these amounts going to recur in the future? If yes, then add. If not, ignore. 21 23 Chevron stock was sold this tax year Are these amounts going to recur in the future? If yes, then add. If not, ignore. If you see any Dividend Income here that has come from a K-1 (partnership or S Corp), IGNORE that income. It is Phantom Income to the individual. 09-07 09-07 22 24 Schedule B Interest and Dividend Income • Interest income that will recur: Add • Interest income that won’t recur: Ignore • Interest income from K-1: Ignore • Dividend income that will recur: Add • Dividend income that won’t recur: Ignore • Dividend income from K-1: Ignore 23 25 Types of Business Entities • Sole Proprietorship – Schedule C on 1040 • Partnership – 1065 (Ask for K-1) • Corporation – 1120 • S Corporation – 1120S (Ask for K-1, may be useful, may not) • Limited Liability Partnership (LLP) – 1065 – Taxed just like a partnership (K-1) • Limited Liability Company (LLC) – Depends – Taxed on form for a partnership, or sole proprietorship, or an S Corp 24 27 How Income Comes Out of a Business Sole Proprietorship - The owner and the business are inseparable. The person is the business and the business is the person - Pays taxes through the individual’s tax return. - The Adjusted Net Profit from Schedule C is considered real cash flow 25 28 Business Income: See Schedule C But be aware that Depreciation may be in here and we always add back depreciation 26 29 09-07 Schedule C Sole Proprietor business income 27 30 28 Depreciation, Depletion or Amortization: These are always added back. 29 32 SCHEDULE C Depreciation, Depletion or Amortization • These all represent a non-cash expense that is deducted from taxable income, but does not reduce the borrower’s cash flow. • Depreciation and amortization represent the gradual ‘wearing’ out of some asset you have purchased. The business is allowed to write off the cost of the asset little by little over the years as it wears out. • Depletion is the ‘using up’ of a natural resource, like gravel or oil. 30 33 SCHEDULE C Car and Truck Expense (line 9) If the borrower used the Standard Mileage Method… You may be able to add back 40% of the Car and Truck expense reported on this line – Only add back if the borrower used the Standard Mileage Method – The Standard Mileage Method allows the taxpayer to deduct an amount based on business miles driven during the year times so many cents per mile. – We suggest using about 40%of the amount on line 9. The ratio fluctuates from year to year but we suggest using 40% as a useful rule-of-thumb. Ask borrower, “Did you use the actual expense method or the Standard Mileage method?” If they used the mileage method, you may add 40% of the amount on line 9 as additional cash flow. If you aren’t sure of if borrower used the standard mileage method, 31 do not add any amount back from line 9. Simply ignore it. 35 Car and Truck Expense (line 9) Standard Mileage Rates If you would like to be more precise, following are the percentages of the mileage method you may consider adding back: • In 2011 there were two different rates: • Jan 1 to June 30: 51 cents, July 1 to Dec. 31: 55 cents • 22 cents was depreciation for both periods or 43% and 40% respectively • In 2010 about 46% (23 cents out of 50 cents) of that amount is considered by IRS to be depreciation. • In 2009 about 38% (21 cents out of 55 cents) of that amount is considered by IRS to be depreciation. • In 2008 about 42% (21 cents out of 50.5 cents) of that amount is considered by IRS to be depreciation. • In 2007 about 39% (19 cents out of 48.5 cents) of that amount is considered by IRS to be depreciation. 32 35 Delivery Truck $32,000 Loan term: 48 months @ $700/mo P & I Annual cost: $8,400 Interest: $2,500 Principal: $5,900 33 Borrower’s Payments per Application Home mortgage Auto loan Credit card Subtotal Delivery truck payment Total payments $1,700 400 200 $2,300 700 $3,000 34 2,600 5,400 Lotto = 200, Net Operating Loss=(2,000) With no adjustments, this would be borrower’s monthly income. (But there are other adjustments) $105,991/12 = 35 $8,833 per month Without adjustment: Home mortgage Auto loan Credit card Subtotal Delivery truck payment Total payments Effect of Payment on both sides $1700 400 200 $2300 700 $3000 $700 Payment Include w/ other pmts Monthly payments = $3,000 Monthly income = $8,833 Interest Add Back Method Include Payment w/other payments Monthly payments = $3,000 Monthly income = $9,041 Subtract Principal Method Total $1700 400 200 $2300 Add back Interest expense Debt ratio: 34% Debt ratio: 33% Remove Payment Monthly payments = $2,300 Monthly income = $8,341 Home mortgage Auto loan Credit card Interest expense not added back to return Let interest stay on return as an expense and Subtract Principal Debt ratio: 28% 36 IRS allows deduction of 50% of amount actually spent (shown here). We want to subtract the other 50%. So…subtract this amount ‘again’. 37 SCHEDULE C Meals and Entertainment Expense (line 24) • The IRS only allows ½ (50%) of Meal and Entertainment expenses to be deducted on the tax return • Therefore, we calculate the other ½ and subtract it. • Why? We assume that the full amount was actually spent, namely, the cash was paid out by our borrower, so even if it will not help them show a lower income for tax purposes, we want to lower their income by the disallowed portion. • Subtract the same amount that is already reported on line 24 b 38 45 Schedule C Worksheet - 2011 Tax Return Profit and Loss from Business - Sole Proprietorship 0 HAPPY COOKER Entity 1 1 Net Profit or (Loss) Entity 2 Entity 3 Entity 4 (1,644) From Schedule C, Part II, line 31 2 Add Back Depreciation in Car & Truck Expense Part of amount on line 9 [See note 1 below] 3 Add Back Depletion From line 12 4 Add Back Depreciation 3,500 From line 13 5 INTEREST ADD BACK METHOD (EBIDA) - Typically for use when interest is from non-real estate loans. Add Back Mortgage Interest Expense From line 16a 6 Add Back Other Interest Expense 2,500 From line 16b Or 7 SUBTRACT PRINCIPAL METHOD - Typically for use when interest is from mortgage loans. Subtract Principal Paid Calculate principal in Note 2 below After Completing ONE of the Interest Methods Proceed to Line 8. (1,552) 8 Subtract Non-Deductible Meals and Entertainment From line 24b [See note 3 below] 9 Add Back Expenses for Business Use of Home From line 30 10 Adjusted Income (Loss) per Property 11 Adjusted Income (Loss) from all Schedule Cs Carries to Comparison Worksheet 2,804 $ 2,804 0 0 0 39 46 SCHEDULE C SOLE PROPRIETORSHIP Depletion………………………… Always add back Depreciation…………………..… Always add back Amortization…………………….. Always add back Watch for depreciation hidden in Car & Truck expense Interest expense……………….. Don't double hit borrower. Use Interest Add Back Method or Subtract Principle Method. Non-deductible meal and entertainment expense………………………. Subtract Office in Home…………………. Probably add back40 47 Schedule D Capital Gains and Losses Gains and losses from the sale of ‘something’ 41 48 Top Half of Schedule D 42 Bottom Half of Schedule D 43 50 44 50 SCHEDULE D: Capital Gains or Losses These gains and losses are USUALLY ONE TIME SALES and will not have an effect on future earnings (not recurring), therefore, we act as if they never occurred by IGNORING them. • Gains or losses: (short-term or long-term) Gains:………………..………… Usually ignore Losses:………………………… Usually ignore HOWEVER: If it the gain or loss is recurring, consider adding gain or loss. Look at the borrower’s history. 45 51 FORM 6252 If recurring, add this. Line 22 This amount passes through to Sched D, but we ignore it and pick up line 22 instead. 09-07 If recurring, add this Gain or Loss from installment sales These are gains or losses that may be recurring 46 52 If recurring, add this. This is the actual cash flow from PRINCIPLE received from this sale. Interest received shows up on Sched B 47 Zero here, because the gain from sale of stock was NOT ‘recurring’ 48 54 FORM 6252: Installment Sale Income and FORM 4797: Sale of Business Property These may show gains or losses that are recurring: Installment sale: USUALLY RECURRING. Add the gain or loss as cash flow if the term of the installment sale agreement will continue for a “while longer”. ASK! “How much longer will you be receiving installment sale income?” Ask to see the Installment Sale Agreement if need be. 49 56 FORM 6252 and FORM 4797 • If borrower has an installment sale: Go to the FORM 6252 or FORM 4797. This will tell you the real amount of cash flow, not the taxable amount. • The taxable amount is often lower than the real cash flow the borrower is receiving. You want the real cash flow. 50 57 Line 17 has several potential forms of income, see Schedule E 5,400 Lotto = 200, Net Operating Loss=(2,000) 51 2,600 5,400 Lotto = 200, Net Operating Loss=(2,000) With no adjustments, this would be borrower’s monthly income. (But there are other adjustments) $105,991/12 = 52 $8,833 per month Schedule E, Page 1 Rental and Royalty Income 53 Schedule E, Page 1 Worksheet - 2011 Tax Return Rental Real Estate and Royalty Income 0 Property 1 Property 2 Property 3 Property 4 Property 5 Name of Property OIL RESERVES DUPLEX 1 Income or (Loss) as Reported 7,630 (308) From line 21 Adjustments INTEREST ADD BACK METHOD (EBIDA) - Typically for use when interest is from non-real estate loans. 2 Add Back Mortgage Interest Expense From line 12 3 Add Back Other Interest Expense From line 13 Or 4 SUBTRACT PRINCIPAL METHOD - Typically for use when interest is from mortgage loans. Subtract Principal Paid (3,299) Calculate principal in Note 1 below After completing ONE of the Interest Methods proceed to Line 7. 5 Add Back Depreciation or Depletion 7,500 12,115 15,130 8,508 From line 18 6 Other Adjustments 7 Net Cash Flow 8 Adjusted Income for Schedule E, Page 1 Carries to Comparison Worksheet 0 $ 0 0 23,638 54 Rental House: Monthly Payment $800 $800 X 12 $9,600 Less INT $6,301 Principal $3,299 55 Without adjustment: Home mortgage Auto loans Other Subtotal Rental Mortgage pmts Total payments $2700 800 500 $4000 800 $4800 $800 Payment Include w/ other pmts Monthly payments = $4,800 Monthly income = $8,833 Interest Add Back Method Include Payment w/other payments Monthly payments = $4,800 Monthly income = $9,358 Add back interest of $525 $8.833 + $525 = $9,358 EBIDA Add back Interest expense Debt ratio: 51% Effect of Payment on right side only Subtract Principal Method Remove Payment Monthly payments = $4,000 Monthly income = $8,558 Subtract Principal of $275 $8,833 - $275 = $8,558 Debt ratio: 54% Interest expense not added back to return Let interest stay on return as an expense and Subtract Principal Debt ratio: 46% 56 56 When to use Interest Add Back Method or Subtract Principal Method Subtract Principal Method is best used when the asset financed is generating a direct cash flow which covers the monthly payment. (e.g. Rental properties) Rental properties will often be most fairly treated by using Subtract Principal Method. Why? Because the property being mortgaged is generating rental income. There is a direct correlation between income generated and interest expense. The income ‘washes’ against the expense. Interest Add Back Method (EBIDA) should be used most other times. 57 Rental House: Monthly Payment $800 $800 X 12 $9,600 Less INT $6,301 Principal $3,299 58 Schedule E, Page 1 Worksheet - 2011 Tax Return Rental Real Estate and Royalty Income 0 Property 1 Property 2 Property 3 Property 4 Property 5 Name of Property OIL RESERVES DUPLEX 1 Income or (Loss) as Reported 7,630 (308) From line 21 Adjustments INTEREST ADD BACK METHOD (EBIDA) - Typically for use when interest is from non-real estate loans. 2 Add Back Mortgage Interest Expense From line 12 3 Add Back Other Interest Expense From line 13 Or 4 SUBTRACT PRINCIPAL METHOD - Typically for use when interest is from mortgage loans. Subtract Principal Paid (3,299) Calculate principal in Note 1 below After completing ONE of the Interest Methods proceed to Line 7. 5 Add Back Depreciation or Depletion 7,500 12,115 15,130 8,508 From line 18 6 Other Adjustments 7 Net Cash Flow 8 Adjusted Income for Schedule E, Page 1 Carries to Comparison Worksheet 0 $ 0 0 23,638 59 SCHEDULE E, PAGE 1 RENTAL AND ROYALTY INCOME Start with Income or Loss as reported on Line 21 Then, make adjustments: Depreciation………………… Add back Depletion…………………….. Add back Principal………………………Calculate and subtract be sure to exclude the related Monthly Payment in the Debt Ratio Calculation Probably use the Subtract Principal Method in order to get a fairer debt ratio calculation. 60 Partnerships and S Corporations 61 Types of Business Entities • Sole Proprietorship – Schedule C on 1040 • Partnership – 1065 (Ask for K-1) • Corporation – 1120 • S Corporation – 1120S (Ask for K-1, may be useful, may not) • Limited Liability Partnership (LLP) – 1065 – Taxed just like a partnership (K-1) • Limited Liability Company (LLC) – Depends – Taxed on form for a partnership, or sole proprietorship, or an S Corp 62 27 How Income Comes Out of a Partnership Partnership is a ‘pass-through’ entity. Partnership does not pay taxes directly. The taxable income is passed-through to the owners’ personal tax returns. The amounts showing up on the Form 1040 do not mean the borrower received this money. Therefore, the income passing-through onto the 1040 is useless Instead: Go to the K-1 and find the following: - Income: draws or distributions - Outflow: contributions - Guaranteed Payments (positive cash flow) - UPE - Unreimbursed Partnership Expenses (negative cash flow) 63 What is a Pass-Through Entity? Partnerships and S-Corps are Pass-Throughs Partnership or S Corp Tax Return $1,000 Form 1040 Individual’s Income Tax Return $500 Schedule K-1 Transmittal Schedule K-1 Transmittal $500 $500 A pass-through entity is not taxed. The income is ‘passed-thru’ to the individual owners, and the business income shows up on the individual’s tax return. Form 1040 Individual’s Income Tax Return $500 64 How Income Comes Out of an S Corporation S Corporation: An S Corporation is regular corporation that under special IRS rules is taxed like a partnership (pass through). Owner may receive wages and/or dividends/distributions. - Wages: appear on pay stub, W-2 or 1040 - Dividends/Distributions: S Corporation dividends/distributions are NOT taxable. Therefore, they are not on the Form 1040. They can be hard to verify. 65 65 How to Verify S Corp Income S Corporation – Dividends or Distributions: Sched K-1 Line 16D may report Distributions If line 16D is blank the other way to verify receipt is: 1. Look at S corporation’s General Ledger under equity accounts. Should show dividends paid 2. Obtain check stubs from dividend checks written to owner 3. Obtain cancelled checks of dividend payments 66 66 Schedule E, Page 2 Partnership and S Corporation income This information is probably all useless information for cash flow. Ignore it. 67 A & D = Ordinary Income from K-1. Phantom income. Do not include for Individual cash flow B = Guaranteed Payments – This is a true positive cash flow. Include in the individual’s income. C = UPE or Unreimbursed Partnership Expenses – These are out of pocket expenses a partner paid that the partnership did not reimburse. It is a true negative cash flow. Deduct from the 68 individual’s income. Schedule K-1 Partnership FORM 1065 Ignore most income or expense in Part III Most are ‘pass-through items A NOTABLE EXCEPTION!!! Guaranteed Payments: Guaranteed payments are similar to ‘wages’ paid to a partner. If a partner receives Guaranteed Payments, he will report the amount as ‘Ordinary Income’ on Schedule E, Page 2. This is REAL CASH FLOW to the individual!!!. Therefore, if you see Guaranteed Payments on a K-1 and/or on Schedule E, Page 2 be sure to add the amount as Cash Flow to 69 the individual. 69 Schedule K-1 Partnership FORM 1065 This amount is what shows up on the borrower’s tax return, but it is not ‘spendable’ income, it is taxable income. Ignore this line. 70 Schedule K-1 Partnership FORM 1065 The useful information: Line L: Contributions: Negative Cash flow Money going from the individual partner to the Partnership. It is a NEGATIVE Cash Flow to the Individual. Money coming from the Partnership to the individual partner. It is a POSITIVE Cash Flow to the Individual. The useful information: Line L: Withdrawals: Positive Cash flow or ‘Spendable income’ 71 Schedule E, Page 2 and Schedule K-1 Worksheets - 2011 Tax Return Partnerships and S-Corporations 0 For Partnerships Partnership 1 Name Partnership 2 Partnership 3 Partnership 4 Partnership 5 YELLOW RDS From Schedule E, Page 2, line 28 1 Unreimbursed Partner Expense (UPE) 2 Guaranteed Payments (4,500) 18,000 From Schedule K-1, Form 1065 3 Capital Contributed During the Year From Schedule K-1 (Form 1065) line L 4 Withdrawals & Distributions 8,400 From Schedule K-1 (Form 1065) line L or 19A 5 6 Net Cash Flow from Business 21,900 Net Cash Flow from all Partnerships 0 0 0 0 21,900 For S-Corporations S-Corp 1 Name 7 Dividends or Cash Distributions S-Corp 2 S-Corp 3 S-Corp 4 S-Corp 5 TINY CORP 3,000 From Schedule K-1 (Form 1120S) line 16d, or from check stubs, G/L history of payments, or a history of deposits. Cash Distributions will not always be included. Only include it if you can determine the borrower received it in "cash". 8 9 Net Cash Flow from all S-Corporations 3,000 Total Adjustments from Partnerships and S-Corporations Carries to Comparison Worksheet $ 24,900 72 Schedule K-1 S-Corporation FORM 1120S Ignore most income or expense in Part III Most are ‘pass-through items A NOTABLE EXCEPTION!!! Line 16 D, Distributions: Distributions are probably REAL CASH FLOW!!!. Amounts here will not appear on Schedule E, Page 2 or anywhere else. But you should Add this amount as cash flow. Therefore, if you see an amount on line 16D, be sure to add the amount as Cash Flow. NOTE: These distributions could also be ‘non-cash’ distributions, such as taking inventory, equipment or a vehicle. You may want to confirm with the borrower that they took this in cash or converted whatever they received into cash. 73 73 Schedule K-1 S-Corporation FORM 1120S Line 16D may report Distributions to shareholder 74 01/01/XX Beginning Balance 3/31/XX 6/30/XX 9/30/XX 12/31/XX Dividends paid Dividends paid Dividends paid Dividends paid 12/31/XX Net Income 5,000 If line 16D is blank, ask your borrower if they took money out of the S-Corp in the form of dividends or distributions, and can they verify them via: 12/12/XX Ending Balance 7,300 Could be verified with: Tiny Corporation, Inc. General Ledger History Shareholders Equity 5,300 750 750 750 750 $3,000 Check stubs/cancelled checks G/L history of Corporation’s Equity (Capital), payments to shareholder Check register 75 Schedule E, Page 2 and Schedule K-1 Worksheets - 2011 Tax Return Partnerships and S-Corporations 0 For Partnerships Partnership 1 Name Partnership 2 Partnership 3 Partnership 4 Partnership 5 YELLOW RDS From Schedule E, Page 2, line 28 1 Unreimbursed Partner Expense (UPE) 2 Guaranteed Payments (4,500) 18,000 From Schedule K-1, Form 1065 3 Capital Contributed During the Year From Schedule K-1 (Form 1065) line L 4 Withdrawals & Distributions 8,400 From Schedule K-1 (Form 1065) line L or 19A 5 6 Net Cash Flow from Business 21,900 Net Cash Flow from all Partnerships 0 0 0 0 21,900 For S-Corporations S-Corp 1 Name 7 Dividends or Cash Distributions S-Corp 2 S-Corp 3 S-Corp 4 S-Corp 5 TINY CORP 3,000 From Schedule K-1 (Form 1120S) line 16d, or from check stubs, G/L history of payments, or a history of deposits. Cash Distributions will not always be included. Only include it if you can determine the borrower received it in "cash". 8 9 Net Cash Flow from all S-Corporations 3,000 Total Adjustments from Partnerships and S-Corporations Carries to Comparison Worksheet $ 24,900 76 SCHEDULE E, PAGE 2 PARTNERSHIPS Partnerships: GET the K-1! IGNORE the income or loss on Schedule E, Page 2. It is useless information INSTEAD: Go to the K-1, Line L (Line N before 2007) Subtract ……………. Contributions Add …………..………Withdrawals and Distributions Line 4 Add……………………Guaranteed Payments Watch for Unreimbursed Partnership Expenses and 77 subtract them SCHEDULE E, PAGE 2 S Corps IGNORE the income or loss on Schedule E, Page 2. It is useless information INSTEAD: Go to the K-1, Line 16D Add the Dividends or Distributions from line 16D. If line 16D is blank but the borrower says he/she took money out of the S Corp: You could verify the amount received from: - G/L history of payments to owners - Check stubs - History of deposits 78 Lenders Tax Analyzer Comparison Worksheet - 2011 Tax Return Borrower's Name: Note: Please complete only items with white boxes. All other cells are populated with information from other sheets. 1 ORIGINAL TAX RETURN Wages In order to complete a Lenders Tax Analyzer report, you will need: • Form 1040 • If borrower has Partnership Income: a Schedule K-1 for each partnership • If borrower has S-Corp Income: a Schedule K-1 or a history o distributions the borrower took from the S-Corp. The distributions paid to S-Corp shareholders are not reliably reported on K-1s ADJUSTED CASH FLOW 45,000 45,000 1 Form 1040, line 7 2 3 Wage Update (Be sure to update Wages using most recent info) Obtain from borrower, not from tax return Taxable Interest 2 7,900 6,100 3 2,100 4 565 5 Form 1040, line 8a 4 Tax-exempt Interest Moving Around the Screen: • The ENTER key will move to the next appropriate space. • Use the TAB key to move one space to the right. • Use the Arrow keys to move in the direction of the Arrow. Form 1040, line 8b 5 Ordinary Dividends 4,169 Form 1040, line 9a 6 Taxable Refunds 335 6 Form 1040, line 10 7 Alimony Received 1,450 1,450 7 Form 1040, line 11 8 Child Support 8 Obtain from borrower, not from tax return 9 10 Other Divorce Income (Separate maintenance, division of assets, etc) Obtain from borrower, not from tax return Business Income Schedule C 9 (1,644) 2,804 10 15,679 10,266 11 0 12 2,600 13 Form 1040, line 12 11 Capital gain or (Loss) Schedule D Form 1040, line 13 12 Other Gains Form 4797 Form 1040, line 14 13 IRA Distributions Form 1040, line 15 14 From line 15a From line 16b From line 16a Pensions and Annuities Form 1040, line 16 15 1,600 From line 15b Rental / Royalty Income 14 31,717 23,638 15 24,900 16 Form 1040, line 17 16 Partnership / S-Corporation Income From Schedule E, Page 2 17 Farm Income or (Loss) Schedule F (815) (20) 17 Form 1040, line 18 18 Unemployment Compensation 18 Form 1040, line 19 19 Social Security Benefits Form 1040, line 20 20 Other Income 2,400 From line 20b 5,400 19 From line 20a (1,800) 0 20 Form 1040, line 21 21 Unreimbursed Employee Business Expense 22 Annual Gross Cash Flow 23 Monthly Gross Cash Flow (line 22 divided by 12) (2,152) 21 105,991 $ 122,651 22 8,833 $ 10,221 23 - 79 Lenders Tax Analyzer © 80 80 Thank You! Tim Harrington, CPA T.E.A.M. Resources 7049 East Tanque Verde, PMB 136 Tucson, AZ 85715 (800) 788-9542 tharrington@forTeamResources.com www.forTeamResources.com