Export opportunities of the agri-food sector of the Republic of

advertisement

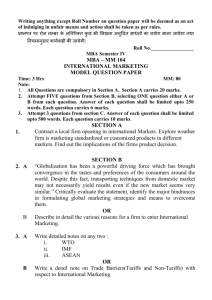

Export opportunities of the agri-food sector of the Republic of Moldova 24 June 2010, Chişinău What means agri-food sector for Moldova Agri-food sector in GDP – 15 %; Export of the agri-food products consists – about 50 % from the total export; Population involved in agri-food sector – 33%. What do we export Wines and spirits; Fruits; Vegetables; Processed food. Structure of agriculture production (%) 100 80 33 26 42 32 60 40 67 74 58 animal production 68 20 0 2006 2007 2008 2009 vegetal production Structure of processing industry production Alcoholic beverages 34,5% Others 14,4 % Milk products 9,3% Meat and meat products 10,2% Processed cerealse 9,3 % Oil 9,3% Cans from fruits and vegetables Sugar 10,2% 2,8% Production versus export 2009 (th.tones/mil. dal.) 600 500 400 Export 300 Production 200 100 0 Vegetables Fruits Wines Meat Tabacco Real potential of the Republic of Moldova (th.tones/mil. dal.) 1 600 1 400 1 200 1 000 Production 1985 800 Production 2009 Export 1985 600 Export 2009 400 200 er flo w Su n Ta ba cc o W in es Fr ui ts Ve ge ta bl es 0 Export of the alcoholic products About 95% of the alcoholic products are exported on the foreign markets. Alcoholic products are exported to around 55 countries Main markets: Commonwealth of Independent States (CIS) • Russian Federation – 39,7% • Belorussia – 32,6 % • Ukraine – 11,7 % • Kazahstan – 11,4 % European Union (EU) • Poland – 38,3% • Germany – 19,1 % • Czech Republic – 14,2 % • Romania – 12,6 % • Latvia – 3,2 % • UK – 2,0 %. Other countries • US – 14,2 % • Israel – 51,4 % Fruit exports, mil. USD 30 25 20 15 10 5 0 Seeded fruits (apples, pears, quinces) Stone fruits (apricots, cherries, etc) Other fruits (strawberries, rasberries, etc) 2008 2009 Vegetables export, mil. USD Trade regime of the Republic of Moldova Export and import activities are fully liberalized, without some other quantitative restrictions; There is not a custom tariffs for the exported goods and services; Moldova benefits from Autonomous Trade Preferences in the bilateral trade with EU from January 2008; We are part to different international and regional agreements which facilitate the trade between our major commercial partners. (Ex. CEFTA agreement, CIS agreements, ATP with EU) Export partners 2009 Top 9 trading partners for exports: Russian Federation (30%), Belorussia (11,6%), Ukraine (9,1%), Romania (9,1%), Germany (5,6%), France (4,5%), Kazakhstan (3,5%), Switzerland (3,1%), Austria (1,1%), Export structure by geographical areas Quality systems implemented in the Republic of Moldova HACCP 10 Entreprises ISO 54 Industrial enterprises GlobalGap 7 Enterprises Analysis of the export with the agri-food products Opportunities Constraints Fertile soil, good climate conditions and high productivity Existing quotas in the export with the agri-food products to the EU market Ecologic and healthy agri-food products High costs for producers to comply with EU standards of production of animal and plant products High demand for Moldovan agri-food products on the foreign markets Vulnerable to international economic and political environment (Russian case from 2006) Reliable producers and exporters Lack of promotion for agri-food products Suitable prices Low transfer of new technologies in the sector How the Ministry will contribute to the diminishing and eliminating existing constraints Negotiation of the Free Trade Agreement with EU; Elaboration and discussion of a new marketing concept and strategy for the exports of the agri-food products; Create necessary infrastructure for businesses to perform the export to foreign markets; Organization of local and international promotional events; Attract foreign assistance and investments for compliance with European norms and standards of production; Stimulate the production and export of the High Value Agriculture Products Ministry of Agriculture and Food Industry of the Republic of Moldova Tel: +(373 22) 233 427; +(373 22) 232 384 Email: adm_maia@moldova.md Website: www.maia.gov.md Thank you for your atention!