Labor

advertisement

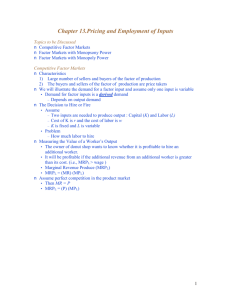

Principles of Economics Session 9 Topics To Be Covered Demand for Labor Marginal Revenue Product Supply of Labor Labor Market Equilibrium Earning Determination Rent Return on Capital Inequality of Income Distribution Topics To Be Covered General Equilibrium Pareto Efficiency Production Possibilities Frontier Externalities Production and Distribution The Circular-Flow Diagram Goods & Services sold Market for Goods and Services Firms Inputs for production Goods & Services bought Households Market for Factors of Production Labor, land, and capital Factors of Production Factors of production are the inputs used to produce goods and services. Factors of Production Capital (Physical Capital) Labor (Human Capital) Land (Natural Resources) Technological Knowledge The Market for the Factors of Production The demand for a factor of production is a derived demand. A firm’s demand for a factor of production is derived from its decision to supply a good in another market. The Demand for Labor Labor markets, like other markets in the economy, are governed by the forces of supply and demand. The Versatility of Supply and Demand The Market for Apples The Market for Apple Pickers Price of Apples Wage of Supply Apple Pickers P W Supply Demand Demand 0 Q Quantity of Apples 0 L Quantity of Apple Pickers The Demand for Labor Most labor services, rather than being final goods ready to be enjoyed by consumers, are inputs into the production of other goods. Production Function and Marginal Product of Labor The production function illustrates the relationship between the quantity of inputs used and the quantity of output of a good. Production Function with One Variable Input (Labor) Amount Amount Total Average of Labor (L) of Capital (K) Output (Q) Product Marginal Product 0 10 0 --- --- 1 10 10 10 10 2 10 30 15 20 3 10 60 20 30 4 10 80 20 20 5 10 95 19 15 6 10 108 18 13 7 10 112 16 4 8 10 112 14 0 The Law of Diminishing Marginal Product Total Product Output per Month The Law of Diminishing Marginal Product Average Product 0 1 2 3 4 5 6 7 9 Labor per Month Marginal Product The Law of Diminishing Marginal Product The Law of Diminishing Marginal Product states that the marginal product (MP) of an input declines as the quantity of the input increases. Marginal Revenue Product The marginal revenue product (MRP) is the extra revenue that would be brought in if a firm were to buy one extra unit of an input, put it to work, and sell the extra product it produced. In the perfectly competitive market, the marginal revenue equals the price, MRP is also called value of marginal product (VMP). Marginal Revenue Product MRPL MR MPL VMPL P MPL MR vs. MRP The MR is the change of total revenue resulting from increasing one more unit of product, while the MRP is the change of total revenue as a result of adding an extra unit of production factor. MR vs. MRP MRPL MR MPL Q TP MR, P MC ATC D AP MP L MR Q MR vs. VMP VMPL P MPL Q P TP MC ATC P = AR = MR AP MP L Q Q MRP of Labor L TP AP MP MR MRP 3 60 20 30 3 90 4 80 20 20 3 60 5 95 19 15 3 45 6 108 18 13 3 39 7 112 16 4 3 12 MRP of Labor MRPL ($) 90 MRP L 0 1 2 3 4 5 6 7 8 9 L MRP of Labor The MRP is measured in dollars. It diminishes as the number of workers rises because the MP is decreasing and the market price of the good is constant. MRP and the Demand for Labor To maximize profit, the competitive, profit-maximizing firm hires workers up to the point where the MRP equals the wage—the marginal factor cost (MFC). MRP MFC MRPL w MRP and the Demand for Labor The MRP curve is the labor demand curve for a profitmaximizing firm. MRP and the Demand for Labor MRP Competitive Output Market(P=MR) Market wage B A Monopolistic Output Market (P>MR) MRPL= MR ×MPL = d 0 MRPL= P×MPL = d L MRP and the Demand for Labor If MRPL > w, hire more labor. If MRPL < w, hire less labor. If MRPL = w, it is a profit maximizing amount of labor What Causes the Labor Demand Curve to Shift? Output price Technological change Supply of other factors The Supply of Labor The market supply for physical inputs is upward sloping. The market supply for labor may be upward sloping and backward bending. The Supply of Labor The choice to supply labor is based on utility maximization. Leisure competes with labor for utility. Wage rate measures the price of leisure. Higher wage rate causes the opportunity cost of leisure to increase. The Supply of Labor The Substitution Effect Higher wages encourage workers to substitute work for leisure. The Income Effect Higher wages allow the worker to purchase more goods. Even if they work less, they may maintain their previous living standard. The Backward Bending Supply Curve. If the income effect exceeds the substitution effect, the supply curve is backward bending. Backward-Bending Supply of Labor Wage ($ per hour) Income Effect > Substitution Effect Income Effect < Substitution Effect Supply of Labor Hours of Work per Day What Causes the Labor Supply Curve to Shift? Changes in tastes Changes in alternative opportunities Immigration Labor Market Equilibrium Wage (price of labor) Supply Equilibrium wage, W Demand 0 Equilibrium employment, L Quantity of Labor Labor Market Equilibrium Labor supply and labor demand determine the equilibrium wage. Shifts in the supply or demand curve for labor cause the equilibrium wage to change. Equilibrium in a Competitive Output Market DL(MRPL) = SL w = MRPL MRPL = P×MPL Markets are efficient. Equilibrium in a Competitive Output Market MR <P MRP L= MR×MPL w = MRPL Using less than the efficient level of input Productivity and Wage Growth around the World Growth Rate Growth Rate of Real Country of Productivity Wages South Korea 8.5 7.9 Hong Kong 5.5 4.9 Singapore 5.3 5.0 Indonesia 4.0 4.4 Japan 3.6 2.0 India 3.1 3.4 United Kingdom 2.4 2.4 United States 1.7 0.5 Brazil 0.4 -2.4 Mexico -0.2 -3.0 Argentina -0.9 -1.3 Iran -1.4 -7.9 Differences in Earnings in the U.S. Today The typical physician earns about $200,000 a year. The typical police officer earns about $50,000 a year. The typical farm worker earns about $20,000 a year. What causes earnings to vary so much? Wages are governed by labor supply and labor demand. Labor demand reflects the marginal productivity of labor. What causes earnings to vary so much? In equilibrium, each worker is paid the value of his or her marginal contribution (or MRP) to the economy’s production of goods and services. Earning Determination Market for Physicians W W Market for Fast Food workers W1 W2 0 L1 L 0 L2 L Some Determinants of Equilibrium Wages Compensating Human differentials capital Ability, effort, and chance Signaling Compensating Differentials Compensating differentials refer to differences in wages that arises from nonmonetary characteristics of different jobs. Coal miners are paid more than others with similar levels of education. Night shift workers are paid more than day shift workers. Professors are paid less than lawyers and doctors. Human Capital Human capital is the accumulation of investments in people. The most important type of human capital is education. Human Capital Education represents an expenditure of resources at one point in time to raise productivity in the future. College graduates in the U.S. earn about 65 percent more than workers with a high school diploma. Average Annual earnings by Educational Attainment 1978 1998 High school, no college $31,847 $28,742 College graduates $52,761 $62,588 +66 percent +118 percent High school, no college $14,953 $17,898 College graduates $23,170 $35,431 +55 percent +98 percent Men Percent extra for college grads Women Percent extra for college grads An Alternative View of Education: Signaling Firms use educational attainment as a way of sorting between high-ability and low-ability workers. It is rational for firms to interpret a college degree as a signal of ability. Wages above Equilibrium Minimum-wage laws Market power of labor unions Efficiency wages Efficiency Wages The theory of efficiency wages holds that a firm can find it profitable to pay high wages because doing so increases the productivity of its workers. High wages may: reduce worker turnover. increase worker effort. raise the quality of workers that apply for jobs at the firm. Economic Rent For a factor market, economic rent is the difference between the payments made to a factor of production and the minimum amount that must be spent to obtain the use of that factor. Economic Rent Wage A SL w* DL = MRPL B Economic Rent 0 L* Number of Workers Land Rent Price ($ per acre) Supply of Land s2 s1 Economic Rent Economic Rent D2 D1 Number of Acres Tax Incidence and Elasticity Tax reduces supply 1. When demand is more elastic than supply... Price Supply Price buyers pay Price without tax 3. ...than on consumers. Tax Price suppliers receive 0 Demand 2. ...the incidence of the tax falls more heavily on suppliers... Quantity Incidence of Tax on Land Price ($ per acre) Supply of Land P Rent without Tax D Number of Acres Incidence of Tax on Land Price ($ per acre) Supply of Land All the tax is borne by the land supplier. Price tenants pay Tax Price landlords receive D Rent after Tax Number of Acres Capital In economic theory, capital is one of the triad of productive inputs (land, labor, and capital). Capital consists of plant, equipment, and inventory. In accounting and finance, capital means the total amount of money subscribed by the shareholder-owners of a corporation, in return for which they receive shares of the company’s stock. Return on Capital ROC=Earnings/Invested Capital In September 2003, Rentex Company bought a bulldozer for $100,000 and rent it to an engineering company. In September 2004, Rentex will receive a payment of $20,000 for rent. How much is the ROC? ROC=20,000/100,000 =0.20=20% Return on Capital If Rentex agrees to be paid in 2006 for the three years’ rent and requires the same ROC be maintained. How much should be the payment? 100,000× (1+0.2)3 =100,000×1.728=172,800 Payment=72,800 Present Value Present value is today’s value for an asset that yields a stream of income over time. Valuation of such time streams of returns requires calculating the present worth of each component of the income, which is done by applying a discount rate (or interest rate) to future incomes. Present Value NCF PV t (1 r ) PV = present value NCF = Net cash flow in the future r = interest rate or discount rate t = time period Present Value Somebody offers to sell you a bottle of wine that matures in exactly 2 years and can then be sold for exactly $11. Assuming the market interest value is 5%, at most how much should you pay for the wine today? PV=11/(1+0.05)2 =9.98 Present Value Suppose Bull Company has sold three bulldozers to different companies at $100,000 each. However, one will pay the sum in 2004, another in 2005, and the other in 2007. If the interest rate is 20%, what are the present values of the three payments? Present Value PV1=100,000/(1+0.20)=$83,333 PV2=100,000/(1+0.20)2=$69,444 PV3=100,000/(1+0.20)4=$48,225 Value of a Firm Suppose a company can earn $30 million a year and it is an ongoing entity. The risk-adjusted discount rate is 5%. What’s the value of the firm? Value of a Firm T 1 2 Value of a Firm ... 2 T (1 r1 ) (1 r2 ) (1 rT ) 1 t t t 1 (1 rt ) T Value of a Ongoing Firm With Constant Returns ... Value of a Firm 2 (1 r ) (1 r ) (1 r ) 1 r 1 (1 r ) Value of a Firm Suppose a company can earn $30 million a year and it is an ongoing entity. The risk-adjusted discount rate is 5%. What’s the value of the firm? $30, 000, 000 Value of the Firm r 0.05 $600,000,000 Makeup of Personal Income Labor earnings (wages) Property income (rents, interests, dividends) Governments transfer payments Income Inequality (Percent of National income) Country Bottom Second Fifth Fifth USA 5.2 10.5 Japan 10.6 14.2 France 7.2 12.6 UK 6.6 11.5 China 5.9 10.2 Malaysia 4.5 8.3 Mexico 3.6 7.2 India 8.1 11.6 Middle Fifth 15.6 17.6 17.2 16.3 15.1 13.0 11.8 15.0 Fourth Fifth 22.4 22.0 22.8 22.7 22.2 20.4 19.2 19.3 Top Fifth 46.3 35.6 40.2 43.0 46.6 53.8 58.2 46.1 Lorenz Curve Percent of Income 100 80 Curve of absolute equality 60 40 Actual distribution of Chinese income 20 0 20 40 60 Percent of People 80 Curve of 100 absolute inequality Gini Coefficient C Percent of Income 100 80 Gini Coeffecien t Shaded Area Area of ABC 60 S 40 20 A 0 20 40 60 Percent of People 80 B 100 Gini Coefficient China’s Gini in 2000 is 0.458. Ginis of successful economies range from 0.30 to 0.40. Countries of two low a Gini tend to stagnate for lack of incentive. Too high a Gini means a serious inequality of income distribution. Market Equilibrium MR=MC Profit Maximization Market for Goods Goods & Services sold and Services Firms Least-Cost Rule MU1/ P1 = MU2 /P2 Goods & Services bought Utility Maximization Households Inputs for production MPL/ PL = MPK /PK Market for Factors of Production Labor, land, Income and capital Determination P=MRP Pareto Efficiency Pareto efficiency is a situation in which no reorganization or trade could raise the utility or satisfaction of one individual without lowering the utility or satisfaction of another individual. Under certain limited conditions, perfect competition leads to Pareto (or allocative) efficiency. Pareto Efficiency John’s Utility 300 D 130 100 0 A and C are of Pareto efficiency. C 170 A B 100 130 D is not available. 170 B is inefficient, for John’s or Tom’s utility can be improved without hurting the other’s utility 300 Tom’s Utility The Production Possibilities Frontier The production possibilities frontier (PPF) is a graph showing the various combinations of output that the economy can efficiently produce given the available factors of production and technology. Quantity of Computers Produced The Production Possibilities Frontier D 3,000 C 2,200 2,000 1,000 0 A PPF B 300 600 700 1,000 Quantity of Cars Produced Concepts Illustrated by the Production Possibilities Frontier Efficiency Tradeoffs Opportunity Cost Economic Growth Market Efficiency vs. Market Failures Recall that: Adam Smith’s “invisible hand” of the marketplace leads selfinterested buyers and sellers in a market to maximize the total benefit that society can derive from a market. But market failures can still happen. Market Failure Market failure is an imperfection in the price system that prevents an efficient allocation of resources. Important examples are externalities and imperfect competition. Externalities Externalities are activities that affect others for better or worse, without those others paying or being compensated for the activity. Externalities exist when private costs or benefits do not equal social costs or benefits. The two major species are external economies and external diseconomies. External Economies External economies (also called positive externalities) are situations in which production or consumption yields positive benefits to others without those others paying. Examples: Immunizations Education Research into new technology External Diseconomies External diseconomies (also called negative externalities) are situations in which production or consumption imposes uncompensated costs on other parties. Examples: Pollutions Cigarette smoking Loud stereos in an apartment building Internalizing Externalities Taxes are the primary tools used to internalize negative externalities. Subsidies are the primary tools used to internalize positive externalities. Pigovian Taxes Pigovian taxes are taxes enacted to correct the effects of a negative externality. Such taxes are named after Arthur Pigou, an early advocate of their use. Tradable Pollution Permits Tradable pollution permits allow the voluntary transfer of the right to pollute from one firm to another. A market for these permits will eventually develop. A firm that can reduce pollution at a low cost may prefer to sell its permit to a firm that can reduce pollution only at a high cost. The Equivalence of Pigovian Taxes and Pollution Permits Pigovian Tax Pollution Permits Price of Pollution Price of Pollution P 0 P Pigovian tax 1. A Pigovian tax sets the price of pollution... Supply of pollution permits Demand for pollution rights Q 2. ...which, together with the demand curve, determines the quantity of pollution. Quantity of Pollution Demand for pollution rights 0 2. ...which, together with the demand curve, determines the price of pollution. Q Quantity of Pollution 1. Pollution permits set the quantity of pollution... The Coase Theorem The Coase Theorem states that if private parties can bargain without cost over the allocation of resources, then the private market will always solve the problem of externalities on its own and allocate resources efficiently. Transactions Costs Transaction costs are the costs that parties incur in the process of agreeing to and following through on a bargain. Why Private Solutions Do Not Always Work Sometimes the private solution approach fails because transaction costs can be so high that private agreement is not possible. Why Private Solutions Do Not Always Work The market fails to allocate resources efficiently when property rights are not well-established (i.e. some item of value does not have an owner with the legal authority to control it). Production and Distribution Production and Distribution Digital tech lowers production costs Digital tech lowers distribution costs Examples Tape recorder lowers production, but not distribution costs AM radio broadcast lowers distribution costs, not reproduction costs Make Lower Distribution Costs Work for You Information is an experience good Must give away some of your content in order to sell rest Can use product line/versioning National Academy of Sciences Press Easy to read, hard to print Demand for Repeat Views Give away all your content, but only once Music, books, video have different use patterns Children Barney: free videos Disney: sued day care centers Adults Demand for Similar Views Free samples direct customers back to you Playboy McAfee Associates $5 million in first year $3.2 billion market value by 1997 Half of virus protection market Demand for Complementary Products Give away index and sell content Wall Street Journal, New York Times, Economist give away index Free content, organization/index is what matters Farcast sells current awareness Lower Reproduction Costs Perfection isn’t as important as commonly thought Choosing Terms and Conditions Revenue = price x quantity More liberal terms and conditions Increases price Decreases quantity sold Simple Model y = amount consumed x = amount sold p(y) = demand, assume zero cost Baseline case: max p(y)y More liberal a p(y) with a>1 y = bx with b < 1 Analysis Max ap(y) x Max (a/b) p(y)y Conclusion: y the same, profits depend on a/b Assignment Review Chapter 12 and 15 Answer questions on P224, 246, and 263 Preview Chapter 20 and 21 Thanks Indifference Curves and MRS C MRS F C (Units) C dC MRS lim F 0 F dF B A E △C △F D U3 U2 U1 F(Units) Budget Line C (Units) (M/PC) = 40 Pc = $2 Pf = $1 M = $80 A Budget Line: Pf F + Pc C = M B 30 D 20 E C M / Pc Slope F M / Pf Pf 1 Pc 2 10 G 0 20 40 60 80 = (M/PF) F(Units) Consumers’ Choice C (Units) Pc = $2 Pf = $1 M = $80 40 D A B is the optimum choice B U3 U2 U1 0 80 Budget Line F(Units) Marginal Utility and Consumers’ Choice MU F (F ) MU c (C ) F MU c C MU F F dF PC MRS F C dC P MU c PC F F MU P Equal Marginal Principle PF PC MU F MU c P1 P2 P3 PN ... 1 2 3 MU MU MU MU N Equal Marginal Principle Constraint=$20 Hot dog price=$2.5 MU of Units per hot dogs game (MUH ) 1 20 2 15 MUH /PH 8 6 Coke price=$2 MU of Cokes (MUc ) 60 40 MUc /Pc 30 20 3 12.5 5 20 10 4 5 10 7.5 4 3 16 8 8 4 6 5 2 4 2 The Theory of Optimization Budget=$2,000 TV ad price=$400 Radio ad price=$300 Number of ads 1 2 3 4 5 6 Increase in units sold MBTV MBRadio 400 360 300 270 280 240 260 225 240 150 200 120 The Theory of Optimization Budget=$2,000 TV ad price=$400 Radio ad price=$300 Number of ads 1 2 3 4 5 6 Increase in units sold MBTV MBRadio 400/400=1.00 360/300=1.20 300/400=0.75 270/300=0.90 280/400=0.70 240/300=0.80 260/400=0.65 225/300=0.75 240/400=0.60 150/300=0.50 200/400=0.50 120/300=0.40 Isoquants and MRTS K MRTS L K 5 △K K dK MRTS lim L0 L dL 4 3 △L 2 Q3 =90 Q2 =75 1 Q1 =55 1 2 3 4 5 L Marginal Rate of Technical Substitution Assume the output quantity is constant, then: MPL (L) MPK (K ) MPL K MRTS MPK L Isocost Line Assume inputs are labor (L) and capital (K) and wage and capital price are w and r respectively, then: C wL rK C w K L r r Isocost Line K (Units) (C/r) = 40 r = $2 w = $1 C = $80 A Isocost Line: K= 40 – 0.5L B 30 D 20 E K C/r Slope L C/w w 1 r 2 10 G 0 20 40 60 80 = (C/w) L (Units) Least-Cost Rule K (Units) For output Q1, point A is of least cost K2 A K1 K3 Q1 C0 L2 L1 C1 L3 C2 L(Units) Least-Cost Rule K (Units) B K2 A K1 C2 L2 L1 Q1 C1 L(Units) Least-Cost Rule MPL (L) MPK (K ) MPL K MRTS MPK L K w L r MPL w MPK r MPL MPK w r Profit Maximization Revenue, Cost and Profit($) TC TR π 0 Output Profit Maximization Revenue($) MR TR dTR(Q ) MR=f ' (TR) dQ 0 Quantity Profit Maximization Cost($) TC MC dTC (Q ) MC=f ' (TC ) dQ 0 Quantity Profit Maximization Revenue, Cost and Profit($) TC TR A B 0 q1 MR=MC π Output Profit Maximization (Q ) TR(Q ) TC (Q ) d (Q ) dTR(Q ) dTC (Q ) 0 dQ dQ dQ MR (Q ) MC (Q ) 0 MR (Q ) MC (Q ) Marginal Revenue Product MRPL MR MPL Q TP MR, P MC ATC D AP MP L MR Q Value of Marginal Product VMPL P MPL Q P TP MC ATC P = AR = MR AP MP L Q Q MRP of Labor MRPL ($) 90 MRPL 0 1 2 3 4 5 6 7 8 9 L MRP and Profit Maximization To maximize profit, the competitive, profit-maximizing firm hires workers up to the point where the MRP equals the wage—the marginal factor cost (MFC). MRP MFC MRPL w MRP and Profit Maximization MRP, w A Market wage MRPL= P×MPL = d 0 L MRP and Profit Maximization If MRPL > w, hire more labor. If MRPL < w, hire less labor. If MRPL = w, it is a profit maximizing amount of labor MRP and Profit Maximization ( L) PQ( L) Q( L) W L d ( L) dP dQ dQ Q P W 0 dL dQ dL dL dQ dP Q dQ P dL W dTR dPQ dP MR Q P dQ dQ dQ MR MP MRP w MRP and Profit Maximization ( L) P Q ( L) W L d ( L) dQ ( L) P W 0 dL dL dQ ( L ) P W dL P MP W VMP