Contents of the course - Solvay Brussels School

advertisement

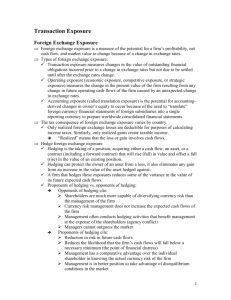

Part 2 - International Corporate Finance 2.1. Foreign Exchange Exposure 1 International Corporate Finance • Part 2 : International Corporate Finance (10 hrs) – Foreign Exchange Exposure (Chap. Eiteman 8 & 9 - 2h): Transaction exposure + decision case Operating exposure – Financing the Global Firm (Chap. 11 & 13 – 2h): Global cost and availability of capital Financial structure and international debt – Foreign Investment Decision (Chap. 15, 16 & 18 – 3h): FDI theory and strategy Multinational capital budgeting Adjusting for risk in foreign investment + decision case – Managing Multinational Operations (Chap. 21 & 22 –3h) Repositioning funds Working capital management + decision case |2 Foreign Exchange Exposure • Type of foreign exchange exposures – The three main types of foreign exchange exposure are: transaction, operating, and translation exposure. – Transaction exposure Impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange rates. – Operating exposure Change in expected future cash flows arising from an unexpected change in exchange rates. – Translation exposure Changes in reported owner’s equity in consolidated financial statements caused by a change in exchange rates. “Accounting exposure”. |3 FX - To hedge or not to hedge? • There is a debate between supporters and opponents of FX hedging. Some arguments of the two groups are: • NOT hedge, because : – Shareholders are much more capable of diversifying currency risk than the management of the firm. – Currency risk management does not increase the expected cash flows of the firm, but rather decreases the variance of the CF, and decrease them as well by the hedging costs. – Managers cannot outguess the market, if and when markets are in equilibrium with respect to parity conditions, the expected net present value of hedging is zero. – In efficient markets, investors and analysts can see across the “accounting veil” and therefore have already factored the foreign exchange effect into a firm's market valuation. |4 FX - To hedge or not to hedge? • HEDGE, because : – Reduction of risk in future cash flows reduces the likelihood that the firm’s cash flow will fall below the necessary minimum. – Management has comparative advantage over the individual shareholder in knowing the actual currency risk of the firm. – Markets are usually in disequilibrium because of structural and institutional imperfections, as well as unexpected external shocks. Management is in a better position than shareholders to take advantage of the one-time opportunities theses imperfections cause, to enhance the firm value through selective hedging. |5 Transaction Exposure • Transaction exposure – Transaction exposure arises from : Purchasing or selling on credit goods or services when prices are stated in foreign currency. Borrowing or lending funds when repayments is to be made in a foreign currency. Being a party to an unperformed foreign exchange forward contract. Otherwise acquiring assets or incurring liabilities denominated in foreign currencies. – Most common example : Transaction exposure of a firm has a receivable denominated in a foreign currency. |6 Transaction Exposure • Transaction exposure - example – Sale of telecom equipment from Trident (US multinational corporation) to a British company. – Payment is made in £ : 1 MM due in three months. – If the £ appreciate toward the $, Trident makes a bigger profit, but if the £ depreciates, Tridents loses part (or all) of its margin : transaction exposure. – Spot rate = $1.7640/£. The budget rate, the lowest acceptable dollar per pound exchange rate is established at $1.70/£ to maintain acceptable margin. – Four alternatives available to Trident to manage the exposure: Remain unhedged Hedge in the forward market Hedge in the money market Hedge in the options markets |7 Transaction Exposure • Transaction exposure - example – Forward market hedge This involves a forward (or futures) contract and a source of funds to fulfill that contract. The forward contract is entered into at the time the transaction exposure is created. The sequence is as follows : – Day 0 : sell £1 MM forward at $1.7540 (fwd rate 3 mths) – In 3 mths : receive £1 MM (from buyer), deliver £1 MM against forward sale, receive $1,754 MM (price of the fwd rate). The forward contract is “covered” or “square”, the funds on hand or to be received are matched by the funds to be paid. |8 Transaction Exposure • Transaction exposure - example – Money market hedge Like a forward market hedge, a money market hedge also includes a contract and a source of funds. The contract is here a loan agreement. The firm seeking the hedge borrows in one currency and exchange the proceeds for another currency. If funds to fulfill the contract are generated by business operations, the hedge is “covered”. If the funds are to buy of the spot market, the hedge is “uncovered” or “open”. The structure is similar to the forward hedge. Here, the price is determined by the interest rate differential between the two currencies, whereas in the fwd hedge, the price is the forward premium. In efficient fwd markets, interest rate parity states that these prices are the same. |9 Transaction Exposure • Transaction exposure - example – Money market hedge The sequence is as follows : – Day 0 : borrow enough to repay £1 MM in 3mths; that is : £1MM / 1+0.25 = £ 975,610. – Day 0 : exchange £ 975,610 against $ at spot rate (1.7640), that is $1,720,976 – In 3 mths : receive £1 MM (from buyer), deliver £1 MM to repay the loan, that is £ 975,610 principal + £ 24,390 interests. Depending on the relative prices of forward markets and interest rates differences, the money market hedge or the forward hedge will be preferable. |10 Transaction Exposure • Transaction exposure - example – Option market hedge The transaction exposure could also be covered by a £ 1 MM put option. This technique allows speculation on the upside appreciation of the pound while limiting the downside risk to a know amount (the premium of the option). The sequence is as follows : – Day 0 : buy put option to sell pounds at $1.75/£, pay $26,460 for the option. – Option cost = (size of option)x(premium)x(spot rate) = £1,000,000 x 0.015 x $1.7640 = $ 26,460 – In 3 mths : receive £1 MM. Either deliver £1 MM against put, receiving $1,750,000 or sell £1 MM spot if current spot rate > $1.75/£ |11 Transaction Exposure • Transaction exposure - example – Comparison of alternatives In order to evaluate the full cost of the option hedge, one has to include the opportunity cost of the premium paid. If one considers 12% of cost of capital ,it makes 3% a quarter. The full premium cost of the option is thus: $26,460x1.03 = $27,254. In contrast, the downside risk is limited to the premium cost incurred, in case of an option hedge. But the upside gain is unlimited. We can calculate the trading range for the £ that defines the break-even for the option compared to others alternatives. The upper bound of the range is determined compared to the forward rate. The £ must appreciate enough above the forward rate to cover the 0.0273$/£ to cover the cost of the option : $1.7540 + $0.0273 = $1.7813/£. The lower bound is is determined compared to the unhedged strategy. If the spot rate falls below $1.75/£, the option is exercised. |12 Transaction Exposure • Transaction exposure - example – Comparison of alternatives One can thus compare the various gains or losses brought by the hedge at strike price £1.75/$, depending on the realized FX rate : – Option cost (future value) : $27.254 – Proceeds if exercises : $1,750,000 – Minimum net proceeds : $1,722,746 (proceeds at strike - cost) – Maximum net proceeds : unlimited – Break-even spot rate (upside) : $1.7813/£ – Break-even spot rate (downside) : $1.75/£ – Strategy choice and Outcome Two selection criteria : risk tolerance & expectations of the direction and distance the exchange rate will move the period considered. |13 Transaction Exposure Value in US dollars of Trident’s £1,000,000 A/R Uncovered Forward rate is $1.7540/£ 1.84 ATM put option 1.82 1.80 Money market 1.78 1.76 Forward contract 1.74 1.72 1.70 1.68 1.68 1.70 1.72 1.74 1.76 1.78 1.80 Ending spot exchange rate (US$/£) 1.82 1.84 1.86 |14 Transaction Exposure • Risk Management in practice – No real consensus seems to emerge, according to international surveys. – In most firms, treasury functions are responsible for transaction exposure management and usually considered a cost function. Expected to act as conservative. – Transaction exposure generally allowed to be hedged once actually booked as receivables and payables (transaction certain). – Transaction management programs divided among those using options, and those who do not. The latter rely almost exclusively on fwd contracts and money market hedges. – Many firms establish risk mgt policy requiring proportional hedging on a % of the total exposure. The remainder is selectively hedged on the basis of expectations and views. |15 Transaction Exposure • Risk Management in practice - Decision Case – See : Lufthansa’s purchase of Boeing 737 |16 Operating Exposure • Definition – Operating exposure (OE) measures any change in the present value of a firm resulting from changes in future operating ash flows caused by any unexpected change in exchange rates. – Operating exposure analysis examines the consequences of changing FX rates on a firm’s own operations over the coming months and years and on its competitive position relative to other firms. – Operating exposure and transaction exposure are both related to future cash-flows. They differ in terms of which CF are considered and why they change when FX rates change. |17 Operating Exposure • Attributes of Operating exposure – Measuring the OE of a firm requires forecasting and analyzing all the firm’s future exposures of all the firm’s competitors and potential competitors worldwide. OE is far more important for the long-run health of a business than transaction exposure or translation exposure. – The CF can be divided in operating cash-flows and financial cashflows. Operating cash flows arise from intercompany and intracompany receivables and payables, rent and lease payments of facilities, royalties and license fees, etc. Financial cash flows are payments for the use of intercompany and intracompany loans and stockholders equity. – Each of these CF can occur in different time intervals, amounts, currencies and denomination, and each has a different predictability of occurrence. |18 Operating Exposure • Attributes of Operating exposure – Financial and Operating Cash Flows between a Parent and Affiliate |19 Operating Exposure • Attributes of Operating exposure – An expected change in FX rates is not included in the definition of OE, because it has already been included in the firm’s valuation parameters. Only unexpected changes in FX rate, or inefficient foreign exchange market should cause market value to change. – OE is not just the sensitivity of a firm’s future CF to unexpected change in FX rates, but also its sensitivity to other key macroeconomic variables. • Illustrating of Operating Exposure : Trident – Suppose an MNE US Corp. Deriving much of its profits from its German subsidiary. If the euro unexpectedly falls in value : How will Trident Europe’s revenue change (prices in euro terms and volumes) ? How will its costs change (input costs in euro) ? How will its competitors react ? |20 Operating Exposure • Illustrating of Operating Exposure : Trident – Imagine that input are bought in Europe, labeled in Euro. Half of the production is sold in Europe, half is exported to non-European countries. – All sales are invoiced in Euros, and the average collection of period account receivables is 90 days. – Following a Euro depreciation, Trident might choose to : maintain its domestic price constant in euro terms try to raise domestic prices because competing imports are now priced higher in Europe keep exports prices constant in terms of foreign currencies, in terms of euro, or some where in between (partial pass-through) |21 Operating Exposure • Illustrating of Operating Exposure : Trident – The strategy undertaken depends largely on management's opinion about the price elasticity of demand. – On the cost side, Trident Europe might raise price because of more expensive imported raw material or components. – Trident’s domestic sales and costs might also be partly determined by the effect of the euro devaluation on demand. |22 Operating Exposure • Strategic Management of Operating Exposure – The objective of both transaction and operating exposure management is to anticipate and to influence the effect of the changes in FX rates on a firm’s future cash-flows. – To this end, management can : Diversify operations : sales, location of production facilities, and raw material sources. Flexibility can allow firms to change its operating structure according to international changes (ex. Goodyear and the Mexican Peso devaluation) Diversify financing : raise funds in more than one capital market and in more than one currency. – A diversification strategy permits the firm to react either actively or passively, depending on management’s risk preferences, and to opportunities presented by disequilibirum conditions in the FX, capital, or products markets. |23 Operating Exposure • Proactive Management of Operating Exposure – Operating and transaction exposures can be partially managed by adopting policies that partially offset the effect of FX changes. The four most common used techniques are the following : – 1. Matching currency cash-flow : Ex : exporting US firm in Canada: match the in flows of CAD from its sales by the outflows of part of its debt labeled in CAD. – 2. Risk sharing agreements : contractual arrangements in which the buyer and the seller agree to split currency movements impacts on payments between them. |24 Operating Exposure • Proactive Management of Operating Exposure – 3. Back-to-back or parallel loans, or credit swaps : two business firms in separate countries agree to borrow each other’s currency from a limited period of time. At an agreed terminal date, they return to their borrowed currencies. The transaction takes place outside of the FX markets, although the spot quotation can be used as a reference point. – 4. Currency swaps : similar to a back-to-back loan but off balance sheet. Agreement between two parties to exchange a given amount of one currency for another and, after a period of time, to give back the original amounts swapped. Currency swaps can be negotiated for a wide range of maturities and currencies. The swap dealer or swap bank acts as a middleman in setting up the swap agreement. |25 Operating Exposure • Proactive Management of Operating Exposure – 4. Currency swaps : Japanese Corporation Assets United States Corporation Liabilities & Equity Inflow Assets Liabilities & Equity Inflow Sales to US Sales to Japan Debt in yen of US$ Debt in US$ of yen Receive yen Pay dollars Wishes to enter into a swap to “pay dollars” and “receive yen” Pay yen Swap Dealer Receive dollars Wishes to enter into a swap to “pay yen” and “receive dollars” |26 Part 2 - International Corporate Finance 2.2. Financing the Global Firm 27 International Corporate Finance • Global cost and availability of capital – Purpose of firms having access to global capital markets: Minimize their cost of capital Maximize the availability of capital – This allows them to : Accept more long-term projects Invest more in capital improvements and expansion – If markets are segmented : A national capital market is segmented if the required rate of return on securities differs across markets, for comparable securities. – Market segmentation : due to various market imperfections |28 International Corporate Finance Local Market Access Global Market Access Firm-Specific Characteristics Firm’s securities appeal only to domestic investors Firm’s securities appeal to international portfolio investors Market Liquidity for Firm’s Securities Illiquid domestic securities market and limited international liquidity Highly liquid domestic market and broad international participation Effect of Market Segmentation on Firm’s Securities and Cost of Capital Segmented domestic securities market that prices shares according to domestic standards Access to global securities market that prices shares according to international standards |29 Global Cost of Capital • Weighted Average Cost of Capital (WACC) k WACC E D ke k d (1 t) V V Where kWACC = weighted average cost of capital ke = risk adjusted cost of equity kd = before tax cost of debt t = tax rate E = market value of equity D = market value of debt V = market value of firm (D+E) |30 Global Cost of Capital • Weighted Average Cost of Capital (WACC) – Cost of equity : CAPM (Capital Asset Pricing Model) k e k rf j (k m k rf ) Where ke = expected rate of return on equity krf = risk free rate on bonds km = expected rate of return on the market βj = coefficient of firm’s systematic risk = jmj/m |31 Global Cost of Capital • Weighted Average Cost of Capital (WACC) – Cost of Debt Requires the forecast of : – – – – – the interest rates for the next few years, the proportions of various classes of debt used by the firm in the years the corporate income tax (t) if kd is the cost of debt before tax, then : kd(1-t) = weighted average after-tax cost of debt – WACC Usually used as the risk-adjusted discount rate whenever a firm ’s new projects are in the same general risk class as its existing projects. |32 Availability of Capital • Availability of Capital – Demand for foreign securities Role of International Portfolio Investors : international investment to increase the risk/return ratio of a portfolio invested globally in different regions, countries, stage of development. – Link between cost and availability of capital If capital in indefinitely available its cost does not rise as demand for funds increases. This requires a very liquid market, which is not the case of most domestic markets. An access to multinational markets improves the liquidity available to the firm and allows the firm to preserve its optimal financial financial structure (constant D/E ratio). |33 Availability of Capital • Availability of Capital – Link between cost and availability of capital If market are fully integrated, securities of comparable expected return and risk should have the same required rate of return in each national market, after adjustment for foreign exchange risk and political risk. Capital market segmentation is a financial market imperfection caused by government constraints, institutional practices, and investors perception. Segmentation does not imply that market are inefficient, at least a domestic level. – Influence of illiquidity and segmentation on MNE’s Higher cost of capital / Rising cost of capital / Shifts in the optimal financial structure / Rising cost of projects |34 NOVO Industri • Illustrative case : NOVO industri – Novo : Danish pharmaceuticals company Had a lack of availability and higher cost of capital than its main competitors, due to market segmentation. P/E ratio of Novo: around 5; main international competitors : around 10. Causes linked to several characteristics of the Danish equity market: – Asymmetric information base of Danish and foreign investors – Taxation : capital gains on equity taxed at 50%; capital gains on bonds tax free – Very few alternative set of feasible portfolios due to prohibition of foreign security ownership. Stock prices were then closely correlated with a high systemic risk. |35 NOVO Industri Financial risk : high leverage of Scandinavian firms compared to US/UK standards Foreign exchange risk – Steps taken by Novo to overcome the market segmentation: Closing the information gap : disclosure of information in English version; issuance of Eurobonds with a UK investment bank as underwriter. The biotechnology boom : seminar organised by Novo in NYC made investors flooding, the stock price doubled, P/E up to 16, share ownership rise from 0 to 30%. Direct share issues in the US : prospectus made for an eventual registration of NYSE. |36 NOVO Industri – Impacts on Novo’s cost of capital : Stock market reaction : price drop in Copenhagen by 10% at announcement of a US share issue (1981), where the loss was immediately recovered. Typical reaction of an illiquid market to a threat of dilution effect of the new share issue. Effect on WACC : reduction of WACC and reduction of marginal cost of capital. – Nowadays Significant reduction of market segmentation, following globalisation. But reduced gains of international portfolio diversification. |37 Cost of Capital in MNE ’s • Cost of Capital of MNE’s compared to domestic firms – Availability of capital : better. Allows firms to maintain their desired D/E ratio – Financial structure and systematic risk for MNE’s Theoretically, MNE’s should be able to afford higher D/E ratios since their cash-flow are internationally diversified and yet their variability is minimised. However, empirical studies show an opposite conclusion: international diversification does not compensate for higher agency costs, political risk, and foreign exchange risks that MNE’s face. These lead to lower D/E ratios and rather higher cost of capital. |38 Cost of Capital in MNE ’s • Cost of Capital of MNEs compared to domestic firms – Is the WACC really higher for MNEs? The explanation of this apparent contradiction may lie in the opportunity set of projects of international companies. As it increases, the firms needs to increase its capital budget to the point where its marginal cost of capital increases. In that case, at constant opportunity set, the WACC of a domestic firm is higher. See graph. Empirically: firms seems to show some risk aversion and try to avoid the point where their marginal cost of capital increases. So the observed WACC of international companies is higher. See equation. |39 Cost of Capital in MNE ’s Marginal cost of capital and rate of return (percentage) MCCDC 20% MCCMNE 15% 10% MRRMNE 5% MRRDC 100 140 300 350 400 Budget (millions of $) |40 Cost of Capital in MNE ’s Is MNEwacc > or < Domesticwacc ? kWACC = ke [ Equity Value ] + kd ( 1 – tx ) [ Debt Value ] Empirical studies : MNEs have a lower debt/capital ratio, leading to a higher cost of capital than their domestic counterparts. Indications are that : MNEs have a lower average cost of debt, leading to a lower cost of capital than their domestic counterparts. • Cost of equity required : higher for MNE’s. • Possible explanations : higher levels of political risk, foreign exchange risk, and higher agency costs of doing business in a multinational managerial environment. • However, at relatively high levels of the optimal capital budget, the MNE would have a lower cost of capital. |41 Sourcing Equity Globally • In order to benefit from global financial markets, a firm may decide to cross-list its shares on foreign stock exchanges. • More specifically, it can be motivated by one or more of the following reasons : – Improving liquidity of its existing shares and support a liquid secondary market for new equity issues in foreign markets. – Increase its share price by overcoming mispricing by a segmented, illiquid home market. – Establish a secondary market for shares used to acquire others firms in the host market. – Increase the firm’s visibility & political acceptance to its customers, suppliers, creditors and host governments. – Create a secondary market for shares that will be used to compensate local management and employees in foreign subsidiaries. |42 Sourcing Equity Globally • According to the goal pursued, the type of listing will be different : – If it is to support a new equity issue or to establish a market for share swaps, the target market should also be the listing market. – If it is to increase the firm’s commercial and political visibility or to compensate local management and employees, it should be in markets in which the firm has significant operations. – If it is to improve liquidity of a firm’s shares, the major liquid stock markets are New York, London, Tokyo, Frankfurt and Paris. • By cross-listing and selling equity abroad, a firm faces two barriers – Increased commitment to full disclosure – A continuing investor relations program |43 Financial Structure & int. debt • Financial structure and international debt – Optimal financial structure A firm should optimally have the mix of debt and equity that minimises the firm’s cost of capital for a given level of business risk. The WACC decreases when debt increases, due to the lower cost of debt and the tax deductibility of interests. But, partly offsetting this, the cost of equity increases because equity investors perceive a higher risk in a higher leveraged firm. The optimal range of debt ratio is estimated between 30% and 60%. Within that range, the optimal ratio is influenced by : the industry of the firm; the volatility of the sales and operating income; the collateral value of the assets. |44 Financial Structure & int. debt • Optimal financial structure Cost of Capital (%) ke = cost of equity 30 28 26 24 22 20 18 16 14 12 10 8 6 4 2 Minimum cost of capital range kWACC = weighted average after-tax cost of capital kd (1-tx) = after-tax cost of debt 0 20 40 Debt Ratio (%) = 60 Total Debt (D) Total Assets (V) 80 100 |45 Financial Structure & int. debt • Financial structure and international debt – Optimal financial structure : the case of the MNE Compared to domestic companies, the theory of optimal structure of capital needs to be adapted to the international case in four ways : (1) The availability of capital : that allows a MCC constant (see previous section) (2) Diversification of cash-flows : that could allow for higher D/E acceptable ratios |46 Financial Structure & int. debt – (3) Foreign exchange risk : foreign currency denominated debt should be adjusted for any foreign exchange gains or losses. – When a firm issues foreign currency denominated debt, its effective cost equals the after-tax cost of repayment in terms of the firm’s own currency. Where $ kd Sfr 1 kd x 1 s1 kd$ = Cost of borrowing for US firm in home country kdSfr = Cost of borrowing for US firm in Swiss francs s = Percentage change in spot rate – (4) Expectations of international portfolio investors : dominance of US - UK norms on global markets, for firms overcoming market segmentation. |47 Financial Structure & int. debt • Financial structure of foreign subsidiaries – Since MNE are assessed on consolidated statements, financial structures of subsidiaries are relevant only if they affect this overall goal. – Subsidiaries do not have independent cost of capital. Therefore, their financial structure should not be based on minimising it. – Empirically, studies show that country-specific environment are key determinants of debt ratios : historical development, taxation, corporate governance, bank influence, bond market, attitude toward risk… – Debts considered here : only those borrowed from sources outside the MNE : local and foreign currency loans, and Eurocurrency loans. |48 Financial Structure & int. debt • Financial structure of foreign subsidiaries – Main advantages of localization Localized financial structure reduces criticism of foreign subsidiaries that have been operating with too high proportion of debt (by local standards). It helps management evaluate return on equity investment relative to local competitors in the same industry. In economies where interest rates are high because of scarcity of capital and real resources are fully utilized, the penalty paid for borrowing local funds reminds management that unless ROA is greater than local price of capital, there is probably a misallocation of domestic real resources, such as land and labor. |49 Financial Structure & int. debt • Financial structure of foreign subsidiaries – Main disadvantages of localization An MNE is expected to have comparative advantage over local firms through better availability of capital and ability to diversify risk. If each subsidiary localizes its financial structure, the resulting consolidated balance sheet might show a structure that doesn’t conform with any one country’s norm; the debt ratio would simply be a weighted average of all outstanding debt. Typically, any subsidiary’s debt is guaranteed by the parent, and the parent won’t allow a default on the part of the subsidiary. This makes the debt ratio more cosmetic for the foreign subsidiary. |50 Financial Structure & int. debt • Financial structure of foreign subsidiaries – Compromise solution Both domestic firms and MNE’s should try to minimize their cost of capital. But if debt is available in a foreign subsidiary at equal cost than elsewhere after correcting for risk, then localizing the financial structure could be an advantage. • Financing the Foreign Subsidiary – In addition to choosing an appropriate financial structure, financial managers need to choose among the alternative sources of funds for financing. In particular, between internal and external sources of funds. |51 Financial Structure & int. debt • Financing the Foreign Subsidiary – Internal sources of funds (see graph below) In general, although the equity provided by the parent, internal sources of funds are kept to the minimum to reduce risk of invested capital. Debt is the preferable form for subsidiary financing. Since debt from host country is generally limited at early stages of the development, the foreign subsidiary must acquire its debt from the parent company or sister subsidiaries. Next, its ability to generate funds internally may become critical for the subsidiary’s future growth. The sources of internal funds include retained earnings, depreciation, and other non-cash expenses. |52 Internal Sources of Funds Cash Equity Funds From Within the Multinational Enterprise (MNE) Funds from parent company Real goods Debt -- cash loans Leads & lags on intra-firm payables Funds from sister subsidiaries Debt -- cash loans Leads & lags on intra-firm payables Subsidiary borrowing with parent guarantee Depreciation & non-cash charges Funds Generated Internally by the Foreign Subsidiary Retained earnings |53 Financial Structure & int. debt • Financing the Foreign Subsidiary – External sources of funds (see graph below) There are 3 categories of external sources : – debt from the parent’s country, – from outside the parent’s country, – and local equity. Local debt is valuable for the foreign subsidiary, since it provides a financial hedge against the fluctuations of the operating cash inflows, by matching. |54 External Sources of Funds Borrowing from sources in parent country Funds External to the Multinational Enterprise (MNE) Banks & other financial institutions Security or money markets Local currency debt Borrowing from sources outside of parent country Third-country currency debt Eurocurrency debt Individual local shareholders Local equity Joint venture partners |55 External Sources of Funds • The Eurocurrency Markets – One of the important innovation in international finance over the past 50 years. Provide a basis for many corporate finance innovation for multinational companies. • Eurocurrencies – Definition : Domestic currencies of one country on deposit in a second country. Time deposit maturities from overnight funds to longer periods. Any convertible currency can exist in “Euro-” form. – Eurocurrency markets serve two purposes : Eurocurrency deposits are an efficient and convenient money market device for holding excess corporate liquidity Eurocurrency market is a major source of short-tem bank loans to finance corporate working capital needs. |56 External Sources of Funds • International Debt Markets – Variety of different maturities, repayment structures and currencies of denomination – Three major sources of funding are: (1) International bank loans and syndicated credits (2) Euronote market (3) International bond market – Bank loan and syndicated credits Traditionally sourced in eurocurrency markets, extended by banks in countries other than in whose currency the loan is denominated |57 External Sources of Funds • Syndicated credits Enable banks to risk lending large amounts Arranged by a lead bank with participation of other bank – Narrow spread, usually less than 100 basis points • Euronote market Collective term for medium and short term debt instruments sourced in the Eurocurrency market, e.g. Euro-commercial paper (ECP), Euro medium-term notes (EMTNs). • International bond market – Fall within two broad categories Eurobonds Foreign bonds |58 External Sources of Funds • International bond market – The distinction between categories is based on whether the borrower is a domestic or a foreign resident and whether the issue is denominated in a local or in a foreign currency. – Eurobonds : underwritten by an international syndicate of banks and other securities firms, and sold exclusively in other countries than the currency of denomination. Issued by MNEs, large domestic corporations, sovereign governments, governmental enterprises and international institutions. – Success factors : absence of regulatory interference - favorable tax status (bearer from) - less stringent disclosure. – Foreign bonds : underwritten by a syndicate of members from a single country, and sold principally in that country. But the issuers is from another country. |59 External Sources of Funds Bank Loans & Syndications (floating-rate, short-to-medium term) Euronote Market (floating-rate, short-to-medium term) International Bond Market (fixed & floating-rate, medium-to-long term) International Bank Loans Eurocredits Syndicated Credits Euronotes & Euronote Facilities Eurocommercial Paper (ECP) Euro Medium Term Notes (EMTNs) Eurobond * straight fixed-rate issue * floating-rate note (FRN) * equity-related issue Foreign Bond |60 Project Financing • Project Finance – Is the arrangement of financing for long-term capital projects, large in scale and generally high in risk. – Widely used by MNEs in the development of infrastructure projects in emerging markets. – Most projects are highly leveraged for two reasons: Scale of project often precludes a single equity investor or collection of private equity investors, Many projects involve subjects funded by governments. – This high level of debt requires additional levels of risk reduction. |61 Project Financing • Four basic properties critical to the success of project financing : – (1) Separation of the project from its investors: Project is established as an individual entity, separated legally and financially from the investors; Allows project to achieve its own credit rating and cash flows. – (2) Long-lived and capital intensive singular projects. – (3) Cash flow predictability from third-party commitments Third party commitments are usually suppliers or customers of the project. – (4) Finite projects with finite lives. |62 Part 2 - International Corporate Finance 2.3. FDI Theory & Strategy 63 Why Do Firms Become Multinational? • Five categories of strategic motives: – – – – – Market seekers Raw material seekers Production efficiency seekers Knowledge seekers Political safety seekers • In markets where oligopolistic competition: subclassified into proactive and defensive investments |64 Why Do Firms Become Multinational? • Markets imperfections : a rationale for the existence of multinational firms – Imperfections in the market for products translate into market opportunities for MNEs. • Sustaining and transferring competitive advantage – First step: Identification – The competitive advantage must be firm-specific, transferable, and powerful enough to compensate the firm for the potential disadvantages of operating abroad. – It implies for an MNE to have one or several of the following elements, that would give them an edge over their local competitors to exploit these market opportunities. |65 Why Do Firms Become Multinational? • Sustaining and transferring competitive advantage – The superiority of a MNE may come from : Economies of scale and scope Managerial and marketing expertise Advanced technology Financial strength Differentiated products – Competitiveness of the Home Market It can increase firm’s competitive advantage in operating abroad. Referred to as the “diamond of national advantages”. |66 Why Do Firms Become Multinational? – “Diamond of national advantages”: Factor conditions : availability of appropriate factor production Demand conditions : demanding customers increase marketing and quality control skills. Related and supporting industries Firm strategy, structure and rivalry : a competitive home market forces firms to fine tune their strategy and operational effectiveness. – Global competitions in oligopolistic industries may substitute for domestic competition : telecom, high-tech, cosmetics... |67 Why Do Firms Become Multinational? • The OLI paradigm and internalisation – Creates a framework to explain the prevalence of FDI over other forms of international expansion. – The conditions for a successful investment require a competitive advantage to be : O : owner-specific : can be transferred abroad. Ex. Product differentiation. L : location-specific : will be exploitable in the targeted market. Ex. Market imperfections or competitive advantage. I : internalisation : the competitive position is preserved by controlling the entire value chain in the industry. Ex. Proprietary information and human capital control in research-intensive industries. |68 Where to Invest? • In theory, a firm should search the best location world-wide to take advantage of market imperfections and enjoy its competitive advantages. • In practice, firms have been observed to follow a sequential search pattern. This relates to two behavioral theories of FDI : – Behavioral approach : firms tend to invest first in countries that are not too far in psychic terms and for limited investments. Psychic distance is defined in terms of cultural, legal and institutional environment. As firms learn, they are willing to take more risks, both in terms of distance and size of investments. – International network theory : sees MNE as a member of an international network with nodes based in each of the foreign subsidiaries, competing with each other and influencing the strategy and the reinvestment decisions. |69 How to Invest Abroad? • Modes of Foreign Involvement – Exporting versus Production Abroad Exporting : none of the risks faced with FDI Disadvantages of exporting : inability to internalise and exploit the results of R&D investments. Risk of losing markets to imitators and global competitors. – Licensing and Management Contracts vs. Control of Assets Abroad Licensing : popular method to take advantage of foreign markets without committing sizeable funds. Political risk is minimized. Disadvantages of licensing : license fees lower than FDI profits |70 How to Invest Abroad? • Licensing and Management Contracts – Other disadvantages : Possible loss of quality control Establishment of a potential competitor Risk of technology stolen, or becoming outdated High agency costs – In practice, MNE’s use licensing with foreign subsidiaries or with joint ventures. – Management contracts are similar to licensing in terms of cash-flows, and reduce political risk since repatriation of managers is easy. – Cost effective of licensing with regard to FDI depends on the price host countries will pay for the services. – Since MNE continue to prefer FDI, the price is assumed to be too low (due to the lack of synergies in licensing?) – MINI - CASE : Benecol’s global licensing agreement. |71 How to Invest Abroad? • Joint Venture vs. Wholly Owned Subsidiary – Partially owned foreign business : termed as foreign affiliate (case of a joint venture). Foreign business owned at more 50%: foreign subsidiary – Key success factor of a joint venture : find the right local partner. – Some advantages of a local partner : Better understanding of the local market; Provision of competent management, and/or appropriate local technology; Enhanced contacts and reputation, eased access to the local financial markets. – Potential disadvantages : Risk of conflicts and difficulties, divergent views, decreased control over financing or over production rationalisation; Increased political and reputation risk, if the wrong partner is chosen. |72 How to Invest Abroad? • Greenfield investment vs. Acquisition – Greenfield investment : establishing a production or service facility starting from the ground up. – Cross-borders acquisitions : quicker, could be more cost-effective in gaining competitive advantage such as technology, brand names, logistic and distribution. – Disadvantages of cross-borders acquisitions : Problems of paying a too high price (but some undervaluation cases, too, especially in crisis situation), Difficulties on the post-acquisition process, and the merger of different corporate cultures. Additional difficulties from host governments intervention in pricing, financing, employment guarantees… |73 How to Invest Abroad? • Strategic alliances - different stages : – Simple exchange of share ownership (as a takeover defense); – Establishment of a separate joint venture to develop and manufacture a product or a service (common in high-tech industries); – Joint marketing and servicing agreement (often forbidden by national laws) |74 Multinational Capital Budgeting • Multinational Capital Budgeting – Same theoretical framework – The net present value criteria can be applied based on the expected cash flows of the project, like in case of a domestic investment. • Complexities of budgeting a foreign project – Parent cash flows must be distinguished from project cash flows, each contributing to a different view of value; – Financing mode, remittance of funds, tax systems, differing inflation rates and foreign exchange rate movements must be taken into account; – Political risk and government interference should be included in the analysis – Terminal value is more difficult to estimate, because of various potential purchasers, in host country or abroad, public or private. |75 Multinational Capital Budgeting • Project versus Parent Valuation – Strong theoretical statement to analyse the project from the point of view of the parent, since it is the ultimate basis for dividend payments and other reinvestment decisions. – However, this violates the rule that, in capital budgeting, financial cash flows should not be mixed with operating cash flows. – Evaluation of a project from a local viewpoint serves some useful purposes and should be subordinated to evaluation from the parent’s viewpoint. In practice, firms use both viewpoints for evaluation. |76 Multinational Capital Budgeting • General rules – Almost any project should be at least giving the same return to that on host government bonds, that is generally the local risk-free rate including a premium reflecting the expected inflation rate (Ex. 33% in India). – Multinational firms should invest only if they can earn a risk-adjusted return greater than their locally based competitors. |77 Multinational Capital Budgeting • Illustrative case : Cemex enters Indonesia – See reference textbook pp 354 - 365 – For information and illustration • Project valuation sensitivity analysis – First valuation is made on a set of “most likely” assumptions. – Next, and in particular in uncertain environments, a sensitivity analysis is required, under a variety of “what if” scenarios. – For example, in international projects : Political risk : what if the host country imposed controls on dividend payment, what if funds are blocked? Foreign exchange risk : how is the value of the project affected by a x% decrease (increase) in the host currency rate? What about the relative impacts of competitiveness and cash flows changes? Other sensitivity variables : change in the assumed terminal value, the capacity utilisation rate, the initial project cost... |78 Multinational Capital Budgeting • Real Option Analysis – For investments that have long lives, cash flows returns in later years, or higher levels of risks compared to the current business of the firm, are often rejected by the DCF approach. – When MNE’s evaluate competitive projects, DCF analysis fails to capture the strategic options that an investment may offer. – Real option analysis overcomes this weakness by applying option theory to capital budgeting decisions. It is a cross between decision-tree analysis and pure option-based valuation. – Very useful when analysing investment projects that can take very different values depending on the decisions made at certain points in time (defer, abandon, reduce capacity,..). The range of values give the volatility of the project’s value. – MINI-CASE : Trident’s Chinese Market entry. |79 Adjusting for Risk • Defining Risk – One-sided risk : only potential for loss. Example : expropriation, blocked funds. Often described in probabilities of occurrence, qualitative in character. Best thought of as “acceptable” / “unacceptable”. – Two-sided risk : risk of loss or gain. Example : foreign exchange, host government economic policies. Often assessed through statistical analysis, allowing rank-order of investments alternatives. • Risk Measurement Origins – From the market : credit spreads, sovereign spreads. – From institutions : constructed indices ranking countries on the basis of their macro risk fundamentals, i.e. political and economic stability. Inherently subjective. |80 Adjusting for Risk • Defining Foreign Investments Risks – Firm-specific risks : micro risks, at project or corporate level – Country-specific risks : macro risks, affecting the project, but originated at the country level – Global-specific risks – see illustration |81 Adjusting for Risk Firm-Specific Risks Country-Specific Risks Global-Specific Risks • Business risks • Transfer risk • Terrorism • Foreign-exchange • War and ethnic strife • Anti-globalization risks • Governance risks • Nepotism and corruption • Defective economic and social infrastructure • Macroeconomic disequilibrium movement • Cyber attacks • Poverty • Environmental • Sovereign credit risk safety • Cultural and religious heritage • Intellectual property rights |82 Adjusting for Risk • Strategies of Foreign Investments Risks Management – Sensitivity Analysis – Minimize Assets at Risk – Diversification – Insurance – see illustration |83 Risk Management Strategies Sensitivity Analysis Minimize Assets at Risk Simulating business plans Adjusting discount rate Adjusting cash flows Minimize equity in subsidiary Borrow locally Diversification Insurance Plant location Source of debt & equity Currency of denomination Supply sources Sales locations Hedging currency risk Risk-sharing agreement Country investment agreements Investment guarantees |84 Adjusting for Risk • Measuring and Managing Foreign Investments Risks – Business risk : project viewpoint measurement vs. parent viewpoint measurement (adjusting discount rates or adjusting cash flows), and portfolio risk measurement – Foreign exchange risk : see previous lectures – Governance risk management : Negotiate investment agreements Investment insurance and guarantees : specific institutions Operating strategies after FDI decisions : local sourcing, facility location, control of transportation, control of technology, control of markets, brand name and trademark control, thin equity base, multiple-source borrowing. |85 Adjusting for Risk • Country-specific risks – Transfer risk : limitations on the MNE’s ability to transfer funds into and out of the host country without restrictions. Restrictions usually decided by a government running out of foreign currency reserves. Most severe form of restriction is non convertibility. – Three types of reactions for MNE’s : Prior to investment : analyse the risks and their effects in the project design During operations : move funds using various techniques If movements of funds are impossible, find the best reinvestment alternatives in the host country. |86 Adjusting for Risk • Country-specific risks – Moving blocked funds : techniques Use of alternative conduits Adapt transfer pricing of goods and services between parent and subsidiaries Use leading and lagging payments – and : Fronting loans : parent to subsidiary loan channelled through a financial intermediary in a third country (“link financing”) Create unrelated exports : help easing the currency shortage for the host currency Obtain special dispensation : possible for some key industries. |87 Country-Specific Risks Country-Specific Risks: Measurement and Management Transfer Risk Cultural Differences Protectionism • Blocked funds • Religion • Defense industry • Macroeconomic disequilibrium • Nepotism and corruption • Agriculture • Intellectual property rights • Infant industry • Economic infrastructure • Sovereign credit risk |88 Adjusting for Risk • Global-specific risks – Terrorism – Anti-globalization movement The role of international institutions such as the IMF and World Bank – Environmental concerns – Poverty – Cyber attacks |89 Part 2 - International Corporate Finance 2.4. Repositioning Funds and Working Capital Management 90 Repositioning Funds • As an MNE aims at maximizing the shareholder value, one of its tasks is to reposition the profits as legally and as practically as possible, in low tax environments. • Repositioning profits is also useful to redeploy cash-flows or fund in more value-creating activities, or to minimize exposure to a currency collapse, or political crisis. • To this end, it can use a variety of techniques : – Unbundling fund transfers – Dividend remittances – Payment of fees – Home overhead charges • Example : Trident has operations in Brazil, China and Europe, each with their own constraints and opportunities for Trident to reposition funds |91 Repositioning Funds Trident Corporation (Los Angeles, USA) Country: Currency: the dollar (US$) Tax rate: 35% Capital restrictions: None Trident Europe Trident Brazil Trident China (Hamburg, Germany) (Sáo Paulo, Brazil) (Shanghai, China) Greenfield Investment Acquisition Investment Joint Venture Investment Country: Currency: the euro (€) Tax rate: 45% Capital restrictions: None Country: Currency: the real (R$) Tax rate: 25% Capital restrictions: Some Country: Currency: the renminbi (Rmb) Tax rate: 30% Capital restrictions: Many Subsidiary status: Subsidiary status: Subsidiary status: Business: mature Business: immediate growth potential Business: long-term growth potential |92 Repositioning Funds • The strategy for each subsidiary will be – Trident Europe – reposition profits from Germany to the US while maintaining the value of the European market’s maturity – Trident Brazil – reposition or in some way manage the capital at risk subject to foreign exchange risk while still providing adequate capital for growth – Trident China – reposition the quantity of funds in and out of China to protect against transfer risk while balancing the needs of the joint venture partner |93 Repositioning Funds • Constraints on Positioning funds: – Political constraints : governments can block the movement of funds (transfer risk). – Tax constraints : tax liabilities may prohibit fund transfer; tax structures may be complex and possibly contradictory. – Transaction costs : foreign exchange conversion and fees for money transfers. Become significant for large or frequent transfers. MNE avoid then unnecessary back-and-forth transfers. – Liquidity needs : each subsidiary needs to maintain adequate working capital. |94 Conduits for Moving Funds Foreign Subsidiary’s Income Statement Payment to Parent Company Sales Cost of goods sold Gross profit Payments to parent for goods or services General & administrative expenses License fees Royalties Management fees Operating profit (EBITDA) Payments for technology, trademarks, copyrights, management or other shared services Depreciation & amortization Earnings before interest & taxes (EBIT) Foreign exchange gains (losses) Interest expenses Earnings before tax (EBT) Corporate income tax Net income (NI) Dividends Retained earnings Before-Tax in the Host Country Payments of interest to parent for intrafirm debt Distribution of dividends to parent After-Tax in the Host Country |95 Transfer Pricing • Transfer pricing : pricing of goods and services transferred to a foreign subsidiary from an affiliated company. • A parent wishing to reposition funds out of or into a particular country can charge higher or lower prices on goods sold among subsidiaries – This will affect the income statement of the subsidiary and effectively raise or lower taxes, with an opposite effect on the selling subsidiary. – Efficient conduit to avoid high taxation environments, but subject to abuses and, therefore, controls by the fiscal authorities. (see examples) |96 Transfer Pricing • Methods of determining transfer prices – Comparable Uncontrolled Price Method Regarded as the best evidence of arm’s length pricing A market determined price – Resale Price Method Subtracts appropriate markup for the distribution subsidiary from the final selling price to an independent purchaser – Cost-Plus Method Sets price by adding a appropriate profit markup to the seller’s full cost Often used where semi-finished products are sold between subsidiaries – Other Pricing Methods Some tax authorities allow low pricing for establishment of new market so long as the cut price is passed on to final customer |97 License, Royalty Fees & Shared Services • License fees : remuneration paid to the owners of the patents, technologies, trade names, etc. – Usually based on a percentage of the value of the product or the volume of production • Royalty fees : similar compensation paid for the use of intellectual property • Such fees are typically paid for identifiable services received by the subsidiary • Shared services : also referred to as distributed charges or overhead, are charges to compensate the parent for costs incurred in the general management of international operations and other corporate services provided to the subsidiary. |98 Dividend Remittances • The classic way in which funds are transferred from subsidiary to parent • Dividend payout policies have change over the years and now incorporate several variables in determining the payout strategy. These are : – Tax implications : dividends are very tax-inefficient – Political risk : incite firms to remit all funds locally generated that are not necessary to locally. – Foreign exchange risk : if an FX loss is anticipated, the MNE will speed the transfer of funds. – Distributions and cash flows : growth is not always accompanied with liquidity, especially is working capital funding are high. – Joint venture factors : firms may be reluctant to vary the level of dividends paid, and tying its obligations toward the partner. |99 Leads and Lags • Firms can reduce both operating and transaction exposure by accelerating or decelerating the timing of payments that must be made or received in foreign currencies • To lead is to pay early – A firm holding a “soft currency” or debts denominated in “hard currency” will lead by using the soft currency to pay off the debts before the soft currency loses value. • To lag is to pay late – A firm holding a hard currency and debts denominated in soft currency will lag by using the hard currency to pay off the debts in hopes of having to use less of the hard currency • Leading and lagging is more feasible within a related firm |100 Reinvoicing Centers • A reinvoicing center is a separate corporate subsidiary that serves as an intermediary between the parent and all foreign subsidiaries. Title of ownership and invoices pass through the center but the physical movement of goods is direct. • Advantages – Managing foreign exchange exposure is centrally located for all subsidiaries allowing center to attain specialized expertise – Guaranteeing the exchange rate for future orders can be done through the center by setting firm local currency costs in advance – Managing intra-subsidiary cash flows, including leads and lags of payments is better managed and allows center to hedge only the net exposure of cash flows • Disadvantage : that the cost of center may be greater than the benefits attained. |101 Working Capital Management • The operating cycle of a business generates funding needs, cash inflows and outflows – the cash conversion cycle – and foreign exchange rate and credit risks. • The funding needs generated by operations of the firm constitute working capital. • The cash conversion cycle is the period of time extending between cash outflows for purchased inputs and cash inflow from cash settlement. • The entire process from stage t0 to t5 is the company’s operating cycle. |102 The Operating Cycle Operating Cycle Accounts Payable Period Input Sourcing Period Quotation Period Price Quote The Firm t0 Order Placed t1 Accounts Receivable Period Inventory Period Inputs Received t2 Order Shipped t3 Payment Received t4 time t5 Cash Outflow Cash Intflow Cash Payment for Inputs Cash Settlement Received Cash Conversion Cycle |103 Working Capital Funding • Net Working Capital (NWC) is the net investment required of the firm to support on-going sales. NWC components typically grow as the firm buys inputs, produces product, and sells finished goods. Net workin g capital(NW C) (A/R Inventory) - (A/P) • Days working capital is a common method used to calculate the NWC of a firm : – This method is based on using a “days sales” basis : if the value of A/R, inventories and A/P are divided by the annual daily sales – The firm’s NWC can be summarized in the number of days sales of NWC. These results vary among industries and countries. |104 Working Capital Financing • Managing Receivables – A firm’s operating cash inflow is derived primarily from the collection of receivables – There are several factors that go into the management of receivables Independent customers – requires decisions about currency of denomination and payments terms Payment terms Self-liquidating bills – secured by physical inventory that has been sold and the funds are lent based on the securitization Other terms • Inventory Management – Anticipating devaluation – management must decide whether to build inventory of items that carry foreign exchange exposure – Anticipating price freezes |105 International Cash Management • International cash management is the set of activities determining the levels of cash balances held throughout the MNE, cash management, and the facilitation of its movement cross border, settlements and processing • Cash levels are determined independently of working capital management decisions – Cash balances, including marketable securities, are held partly for day-today transactions (transaction motive) and to protect against unanticipated variations from budgeted cash flows (precautionary motive) • Cash disbursed for operations is replenished from two sources – Internal working capital turnover – External sourcing, traditionally short-term borrowing |106 International Cash Management • All firms engage in some sort form of the following steps: – Planning – a financial manager anticipates cash flows over future days, weeks, or months. – Collection – controlled through time lags between the shipment date and the payment date. – Disbursement – steps included are avoiding unnecessary early payment, maximizing float and selecting a disbursement bank. – Covering cash shortages – anticipated cash shortages can be managed by borrowing locally. – Investing surplus cash – if a subsidiary of an MNE generates surplus cash, the MNE must decide whether to handle its own short-term liquidity or whether surplus funds should be controlled centrally. |107 International Cash Settlements • Four techniques for simplifying and lowering the cost of settling cash flows between related and unrelated firms – Wire transfers : Variety of methods but two most popular for cash settlements are CHIPS and SWIFT – Cash pooling – Payment netting – Electronic fund transfers |108 International Cash Settlements • Cash Pooling and Centralized Depositories – Businesses with widely dispersed operating subsidiaries can gain operational benefits by centralizing cash management. – Subsidiaries hold minimum cash for their own transactions and no cash for precautionary purposes. – All excess funds are remitted to a central cash depository. – Information advantage is attained by central depository on currency movements and interest rate risk. – Precautionary balance advantages as MNE can reduce pool without any loss in level of protection. |109 International Cash Settlements • Multilateral Netting – Defined as the process that cancels via offset all, or part, of the debt owed by one entity to another related entity. – Netting of payments is useful primarily when a large number of separate foreign exchange transactions occur between subsidiaries. |110 Financing Working Capital • All firms need to finance working capital and most of the short-term financing needs is done through the use of bank credit lines. • Banking sources available to MNEs are : – In-house Banks : set of functions performed by the existing treasury department, providing banking services to the various units of the firm. – Commercial Banking Offices : Correspondent Banks with local banks across the world Representative Offices established in a foreign country Branch Banks and Affiliates |111