Chapter 2

advertisement

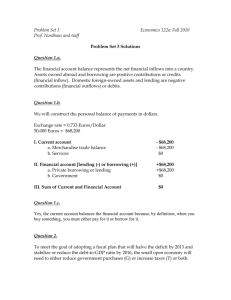

US and Global Financial Institutions Financial Systems Overview 101 Lesson Overview Economic System • System Basics Banking • Banking System Basics • Impacts on Money Creation • Impacts on Capital Flows in the Intl. Economy Security Markets • Security Mkt Basics • Impacts on the Intl. Economy Currency Exchanges • Currency Exchange Basics • Impact on the Intl. Economy 2-2 Economics Microeconomics is the study of how individual households and firms make decisions and how they interact with one another in markets. Prices and selection of products Macroeconomics is the study of the economy as a whole. Its goal is to explain the economic changes that affect many households, firms, and markets at once. Inflation Unemployment Economic Growth The Circular-Flow Diagram • The Circular-Flow Diagram: a visual model of the economy, shows how dollars flow through markets among households and firms • Two types of “actors”: households firms • Two markets: the market for goods and services the market for “factors of production” THINKING LIKE AN ECONOMIST 4 FIGURE 1: The Circular-Flow Diagram Households: Own the factors of production, sell/rent them to firms for income Buy and consume goods & services Firms Households Firms: Buy/hire factors of production, use them to produce goods and services Sell goods & services THINKING LIKE AN ECONOMIST 5 The Circular-Flow Diagram: Economic System Model Revenue G&S sold Markets for Goods & Services Firms Factors of production Wages, rent, profit THINKING LIKE AN ECONOMIST Spending G&S bought Households Markets for Factors of Production Labor, land, capital Income 6 Circular Flow Issues • Doesn’t account for… Taxes Intl. Trade Intl. Monetary Flows THE MARKET FORCES OF SUPPLY AND DEMAND 7 Financial System • …the group of institutions in the economy that help to match one person’s savings with another person’s investment. Financial Markets: Direct match between savers and borrowers • ie. Stock and bond markets Financial Intermediaries: Indirectly match savers and borrowers • ie. banks and mutual funds, THE MARKET FORCES OF SUPPLY AND DEMAND 8 Banking System • How does a bank work? • Where does money come from? • Where does it go? THE MARKET FORCES OF SUPPLY AND DEMAND 9 Banking Money Creation with Fractional-Reserve • This T-Account shows a bank that… First National Bank Assets accepts deposits, Reserves $10.00 keeps a portion as reserves, Loans and lends out $90.00 the rest. • It assumes a reserve ratio of 10%. Total Assets $100.00 Liabilities Deposits $100.00 Total Liabilities $100.00 The Money Multiplier in the Money SupplyBank = First Increase National Bank Second National $190.00! Assets Liabilities Reserves $10.00 Deposits $100.00 Loans Reserves $9.00 Liabilities Deposits $90.00 Loans $90.00 Total Assets $100.00 Assets $81.00 Total Liabilities $100.00 Total Assets $90.00 Total Liabilities $90.00 THE MARKET FOR LOANABLE FUNDS • Financial markets coordinate the economy’s saving and investment in the market for loanable funds. • The market for loanable funds is the market in which those who want to save supply funds and those who want to borrow to invest demand funds. Supply and Demand for Loanable Funds • Loanable funds refers to all income that people have chosen to save and lend out, rather than use for their own consumption. • The supply of loanable funds comes from people who have extra income they want to save and lend out. • The demand for loanable funds comes from households and firms that wish to borrow to make investments. Supply and Demand for Loanable Funds • Interest rate the price of the loan the amount that borrowers pay for loans and the amount that lenders receive on their saving in the market for loanable funds, the real interest rate Supply and Demand for Loanable Funds • Financial markets work much like other markets in the economy. • The equilibrium of the supply and demand for loanable funds determines the real interest rate. Figure 1 The Market for Loanable Funds Interest Supply Rate 5% Demand 0 $1,200 Loanable Funds (in billions of dollars) Intl. Capital Flows Open-Economy Macroeconomics: Basic Concepts • An open economy interacts with other countries in two ways. It buys and sells goods and services in world product markets. It buys and sells capital assets in world financial markets. The Flow of Financial Resources: Net Capital Outflow • Net capital outflow refers to the purchase of foreign assets by domestic residents minus the purchase of domestic assets by foreigners. • A U.S. resident buys stock in the Toyota corporation and a Mexican buys stock in the Ford Motor corporation. The Flow of Financial Resources: Net Capital Outflow • When a U.S. resident buys stock in Telmex, the Mexican phone company, the purchase raises U.S. net capital outflow. • When a Japanese residents buys a bond issued by the U.S. government, the purchase reduces the U.S. net capital outflow. The Flow of Financial Resources: Net Capital Outflow • Variables that Influence Net Capital Outflow The real interest rates being paid on foreign assets. The real interest rates being paid on domestic assets. The perceived economic and political risks of holding assets abroad. The government policies that affect foreign ownership of domestic assets. Figure 3 How Net Capital Outflow Depends on the Interest Rate Real Interest Rate Net capital outflow is negative. 0 Net capital outflow is positive. Net Capital Outflow World Financial Centers - Securities Financial Markets • The Stock Market Stock represents a claim to partial ownership in a firm and is therefore, a claim to the profits that the firm makes. The sale of stock to raise money is called equity financing. • Compared to bonds, stocks offer both higher risk and potentially higher returns. The most important stock exchanges in the United States are the New York Stock Exchange, the American Stock Exchange, and NASDAQ. What about the primary Korean markets? Financial Markets • The Stock Market Most newspaper stock tables provide the following information: • Price (of a share) • Volume (number of shares sold) • Dividend (profits paid to stockholders) • Price-earnings ratio Financial Markets • Reading the stock page… Financial Markets • • • • • • • • • Columns 1&2 52-Week Hi-Lo Range Column 3 Company Name and Type of Stock: If there are no special symbols or letters following the company name, it is common stock (shares without a fixed rate of return of investment.) Other types of stock are “pf“ or preferred, etc. Column 4 Ticker symbol: This alphabetic symbol is a unique stock identifier. Column 5 Dividend Payment: This indicates the annual dividend payment per share. Column 6 Percent Yield: This figure represents the dividend return an investor can expect on each share of stock. It is calculated by dividing the annual dividend each share pays by its current market value, and is expressed as a percentage. Column 7 Price-Earnings Ratio (PE): This calculation is one way of evaluating a stock's relative performance and value. It is computed by dividing the stock's price by the company's per-share earnings for the most recent four quarters. Higher Price-Earnings multiples suggest the investors are more optimistic about a stock's prospects than comparable lower-PE stocks, but the reason for high and low PEs also include the company's growth outlook, the industry the company is engaged in, company accounting policies, and whether the firm is a startup or a more established business. Column 8 Trading Volume: This figure shows a total number of shares traded for the day, listed in hundreds. Column 9 Hi/Lo: This indicates the trading price range of the security during the day's trading. Column 10 Close and Net Change: Financial Markets • The Bond Market A bond is a certificate of indebtedness that specifies obligations of the borrower to the holder of the bond. Characteristics of a Bond • Term: The length of time until the bond matures. • Credit Risk: The probability that the borrower will fail to pay some of the interest or principal. • Tax Treatment: The way in which the tax laws treat the interest on the bond. Bonds can be from companies (private/public) or the government (local-municipal, regional, provincial or national) levels Municipal bonds are federal tax exempt. World Trade Flows The Flow of Goods: Exports, Imports, Net Exports • Net exports (NX) are the value of a nation’s exports minus the value of its imports. • Net exports are also called the trade balance. The Flow of Goods: Exports, Imports, Net Exports • Factors That Affect Net Exports The tastes of consumers for domestic and foreign goods. The The prices of goods at home and abroad. exchange rates at which people can use domestic currency to buy foreign currencies. The Flow of Goods: Exports, Imports, Net Exports • Factors That Affect Net Exports The incomes of consumers at home and abroad. The costs of transporting goods from country to country. The policies of the government toward international trade. The Equality of Net Exports and Net Capital Outflow • For an economy as a whole, NX and NCO must balance each other so that: NCO = NX • Why? When a nation is running a trade surplus (NX>0), it is selling more goods/services to foreigners than it is buying. What is it doing with the foreign currency received? Must be buying foreign assets. Capital is flowing out of the country (NCO>0). When a nation is running a trade deficit (NX<0), it is buying more goods and services from foreigners than it is selling. How is it financing the purchase? It must be selling assets abroad. Capital is flowing into the country (NCO<0). THE PRICES FOR INTERNATIONAL TRANSACTIONS: REAL AND NOMINAL EXCHANGE RATES • International transactions are influenced by international prices. • The two most important international prices are the nominal exchange rate and the real exchange rate. Nominal Exchange Rates • The nominal exchange rate is the rate at which a person can trade the currency of one country for the currency of another. Real Exchange Rates • The real exchange rate is the rate at which a person can trade the goods and services of one country for the goods and services of another. Figure 1 The Market for Loanable Funds Real Interest Rate Supply of loanable funds (from national saving) Equilibrium real interest rate Demand for loanable funds (for domestic investment and net capital outflow) Equilibrium quantity Quantity of Loanable Funds The Market for Foreign-Currency Exchange Real Exchange Rate Supply of dollars (from net capital outflow) Equilibrium real exchange rate Demand for dollars (for net exports) Why does demand slope downward? Why is the Equil. Qty vertical? Equilibrium quantity Quantity of Dollars Exchanged into Foreign Currency The Effects of Government Budget Deficit 1. A budget deficit reduces the supply of loanable funds . . . (a) The Market for Loanable Funds Real Interest Rate r2 r 2. . . . which increases the real interest rate . . . S (b) Net Capital Outflow Real Interest Rate S B r2 A r 3. . . . which in turn reduces net capital outflow. Demand NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E2 5. . . . which causes the real exchange rate to appreciate. E1 S S 4. The decrease in net capital outflow reduces the supply of dollars to be exchanged into foreign currency . . . Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange