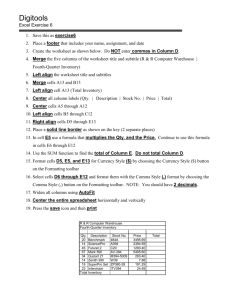

File - Davison Accounting

advertisement

Chapter 14 Accounting Theory Worksheet Used to plan adjustments and summarize information for financial statements Can be done as many times as necessary for a business (done at least once a year) Extensions Moving over numbers from the trial balance and adjustments to the balance sheet and income statement columns Dividing line is income summary Everything above income summary go to balance sheet Everything income summary and below goes to the income statement Adjustments Some ledger accounts need to be brought up-to-date Matching Expenses with Revenue Recording expenses in the fiscal period in which the expenses contribute to earning revenue Planning for adjustments is done in the worksheet Accounts are not brought up-to-date by the worksheet….journal entries still need to be made to bring accounts up-to-date Required adjustments Debit 1. 2. 3. 4. 5. 6. 7. 8. Supplies Expense-Office Supplies Expense-Store Insurance Expense Uncollectable Accounts Expense Depreciation Expense-Office Equip. Depreciation Expense-Store Equipment Income Summary/Merchandise Inventory Federal Income Tax Expense Credit 1. 2. 3. 4. 5. 6. 7. 8. Supplies-Office Supplies-Store Prepaid Insurance Allowance for Uncollectables Accumulated DepreciationOffice Equip. Accumulated DepreciationStore Equip. Income Summary/Merchandise Inventory Federal Income Tax Payable Supplies/Prepaid Insurance The value of supplies on hand and prepaid insurance not expired are during a fiscal period are assets to the business To calculate the adjustment: Take the January 1 (trial balance amount) and subtract out the December 31 balance (the amount given in the directions) The difference is the amount of the adjustment Uncollectable accounts When businesses sell merchandise on account, they take the risk that customers won’t pay their accounts. Uncollectable accounts…accounts receivable not collected Must report expense in same period that the revenue is earned The uncollectable amount is estimated as a percentage of sales There is not a required percentage…it varies based on past experience Accounts receivable book value Reflects the amount the business expects to collect in the future (after uncollectables) Merchandise Inventory Merchandise inventory keeps track of the amount of goods on hand for sale to customers Trial Balance represents the amount of inventory on hand on January 1 Adjustment has to made to show the difference between the purchases and sales as well as account for theft If the Dec. 31 amount is more than the Jan. 1, then a debit must be made to Merchandise inventory If the Dec. 31 amount is less than the Jan. 1, then a credit must be made to Merchandise inventory The other account in the adjustment is income summary (a temporary account) to calculate net income/loss Depreciation Expense Straight line depreciation Original cost – salvage value Years of useful life Book value Assets account balance – related contra account Net Income/Federal Income Tax Net Income Amount is entered into the income statement debit column and balance sheet credit column Net loss Amount is entered into the income statement credit column and balance sheet debit column Federal Income Tax Estimated income tax is paid in quarterly installments The federal income tax increases as net income before federal income tax increases To calculate federal income tax: Take the total from the income statement debit column (not including federal income tax expense) and subtract the total from the income statement credit column Use the percentage table to calculate tax payable Subtract this total from the planned federal income tax expense Miscellaneous Trial balance All accounts are listed whether they have a balance or not General ledger accounts are listed in the worksheet’s account title column in the same order in which they appear in the general ledger Total the columns of a worksheet Adding up the totals of the worksheets income statement and balance sheet columns The totals in the income statement will not equal the totals in the balance sheet