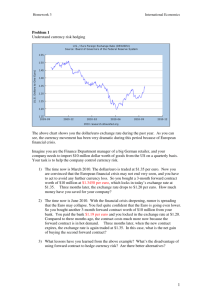

The implications of introduction of Euro on Dollar

advertisement

The implications of introduction of Euro on Dollar - by Sowmya Kumblekere As a Foreign Reserve currency As a Choice of Currency for oil trade Contents Introduction Chronology of world currencies Dollar as international currency Euro as emerging international currency Dollar VS Euro Foreign Reserve currency OPEC choice of currency Study findings References Introduction On Jan 1, 1999, Euro was inaugurated in Frankfurt, Germany to serve as a single currency to its member nations. Membership of EU increased from 10 to 25 countries on may 1, 2004. 56 countries outside the Euro allow euro in their exchange rate regime. Euro has potential of becoming the second largest currency reserve for the world’s financial system. Introduction What are the implications of this introduction of euro on US dollars? Some other issues: – How fast will the dollar bubble burst? – How soon will euro be able to reduce unemployment and improve European economies? Chronology of World Currencies Byzantine gold nomisma (in 5th –7th century) Arab Dinar (mancus or marabotin, 8th –12th century) Florentine fiorino (13th -14th century) Venetian ducato (15th century) UK pound sterling (16th century till WW2) US dollar (from second world war) Factors for currency to be International currency Size of the economy – determines potential share of currency in international trade Importance in international trade – size linked to importance in international trade Size, depth, openness, liquidity of domestic financial markets Convertibility of currency – important factor. Restrictions limit use of currency Macroeconomic policies – affect country's growth and openness of markets. The US dollar 80% of hard currency reserves globally US currency used outside US– as store of value. Making it easy for US to maintain stable dollar prices and have huge trade deficits. Dollar has remained stable. It has enjoyed exchange rate arrangements. Risk on returns is very low. In 1960, ½ of circulation outside, In 1990, 2/3rd of federal reserve currencies in circulation abroad. Dollar: Reasons for acceptance Size and ability to grow. Faith in stability of US political system and transparency of the political and financial system Availability of large amount of dollars around the world. Dollar: benefits as a dominant currency Benefits: US consumers, traders, tourists (can use dollar anywhere) and military. Plus, US treasuries get interest on assets held by federal reserve (approximately 12 billion per year) Benefited as reserve currency – US was able to finance its current account deficits by issuing more currencies. Euro Euro system – a macroeconomic framework with one currency and one monetary policy, managed by one central bank. Provide credible alternative to the dollar. Is second largest in terms of liquidity, depth and width. Its growth will add stability to international financial system. Reserve positions - euro area has much larger reserves as compared to US. Euro Vs Dollar EURO area GDP: 15% Used as Reserve currency: 12.5% Economy: Much smaller World exports: 19.5% Economies as large as US and net creditors to the world. Euro will take time to reach similar status as dollar. US GDP: 20.5% Used as Reserve currency: 66% Economy: much larger World exports: 15% Dollar will still prevail, especially in unstable economies, due to worldwide acceptance. Foreign reserve currency Definition: one which is widely held in international central bank reserves. The dollar is currently the dominant reserve currency. Developing countries: reserves play crucial role. To finance imports, foreign debt, and to intervene in currency markets to manage exchange rates. In industrial nations, reserves mainly used for intervention functions. Currency reserves in developing countries important to determine composition of reserve currency. Studies Reserve of dollars and euros in developing nations Reserves in industrial nations Reserves globally held by all nations Shift in NE Asia Shift in NE Asia China sold US dollars in April, 2000. Hong Kong purchase of US treasuries gone down since march 2000 Taiwan net purchase of US dollars is zero Euro saw a boost in 20billion in April, compared to largest selling of US dollars. Central banks of countries, esp. China has accumulated large foreign reserves due to growing trade surpluses + direct investment. To prevent interest rate rise hold currency low, they invest in euro. Inferences: from foreign reserves study ECB notes portfolio shifts “are expected to take place at a slower pace in the central bank community than in the private sector.” Gradual shift unlikely to have much impact. Euros increased acceptance as reserve currency might increase interest rates in US, increase borrowings in the euro area. To have these negative impacts, euro share should rise with an absolute decline of US share. There is no evidence to suggest this (Binder 1996) OPEC- dollar VS euro Will euro establish in the financial market changing the dominancy of the dollar? Recently Venezuela, China, Kuwait, Iraq change reserves to Euro. OPEC’s interest in Euro – due to increasing value and influence of euro among commodity traders and analysts. OPEC has 45% trade imports from Euro zone, while OPEC member countries are major supplier of oil to euro zone. Issue: Whether UK and Norway will join Euro? OPEC: why dollar? US chief importer of oil. (But euro zone is even larger.) Advantageous to US: no currency exchange risk. OPEC interested in currency that brings stable store of value. Does not show shift to any other currency in near future. In short run, dollars will be used. In the long run, will dual currency prevail? Inferences: from OPEC study Major goal is not to jeopardize or threaten market stability in any way. Depends a lot on member countries and the countries they trade with. If trade mainly with Asia or US, then Euro may not play key role. Common interest of both buyer and sellers. If Euro used, both buyers and sellers will have to share currency risks. To increase value of euro needs to be equal or near dollar as reserve currency + role of financial institutions is also crucial in assimilating euro into world market. Stability of Europe Study findings: Conclusion Central banks role is key. Any dollar weakness may increase and hasten interest towards euro and its acceptance. “ Central banks traditionally refrain from abrupt and large changes in the composition of their foreign reserves” (ECB 1991). Euro has potential for growth. But needs acceptance – needs to establish itself and gain credibility. Its diversity might pose problems and EU might need to resolve many fundamental issues. Study findings - Conclusion As reserve currency depends largely on what developing countries prefer. They show a tendency towards the dollars at present. Sale of dollar and the purchase of euros by central bank –will lead to a drop in the value of dollar relative to euro. This will lead to increased interest rates on US Government securities. In contrast, Euro value would increase and euro interest rate would drop. The whole process however will take substantial time. References http://www.epinet.org/content.cfm/webfeatures_viewpoints_helsinkis peech - Euro and impact on dollar 1999 http://www.ecb.int/key/00/sp000113.htm - international impact of the euro http://www.federalreserve.gov/boarddocs/testimony/1998/19981008. htm - General reading on currencies, particularly dollar http://www.hsbc.com.tw/tw/product/fund/images/gs_200307_e.pdf Euro as a reserve currency http://www.rense.com/general27/rec.htm - euro as asia’s second currency http://www.opec.org/NewsInfo/Speeches/sp2002/spAraqueSpainApr1 4.htm - SPEEDH BY OPEC MINISTER REGARDING EURO AS RESERVE CURRENCY http://research.stlouisfed.org/publications/review/01/09/septoct.pdf the creation of euro and role of dollar in international markets http://research.stlouisfed.org/wp/1997/97-021.pdf - role of euro as an international currency