Chapter 04

advertisement

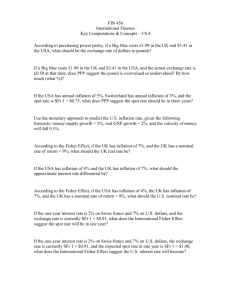

Chapter 04 International Parity Conditions 1 International Parity Conditions • Foreign exchange rate quotations • Measuring a change in spot rates • Prices and exchange rates – Law of one price – Absolute Purchasing Power Parity (PPP) – Relative Purchasing Power Parity • Interest rates and exchange rates – – – – The Fisher effect International Fisher effect Forward rate Interest Rate Parity (IRP) • Covered/Uncovered Interest Arbitrage • Forward rates as an unbiased predictor of future spot rates 2 Foreign Exchange Rates & Quotations • Direct and Indirect Quotes • A direct quote is a home currency price of a unit of a foreign currency – Sfr1.6000/$ is a direct quote in Switzerland • An indirect quote is a foreign currency price of a unit of the home currency – Sfr1.6000/$ is an indirect quote in the US, – $0.6250/Sfr is a direct quote in the US and an indirect quote in Switzerland 3 Measuring a Change in Spot Rates • Assume that Swiss franc is quoted at Sfr1.6000/$ (same as $0.6250/Sfr). Suddenly it strengthens to Sfr1.2800/$ (same as $0.78125/$). What is the percentage change in the dollar value of the franc? (Home currency is dollar) • Using Direct Quotes: %ΔDQ Ending Rat e-Beginnin g Rate $0.78125Sfr-$0.6250 /Sfr x100 x100=+25% Beginning Rate $0.6250 /Sfr S2$ / FC -S1$ / FC S1$ / FC SAME • Using Indirect Quotes: %ΔIQ Beginning Rate-Endin g Rate Sfr1.6000 /$-Sfr1.2800 /$ x100 x100=+25% Ending Rat e Sfr1.2800 /$ S1FC / $ -S 2FC / $ S 2FC / $ 4 Prices and Exchange Rates • The Law of one price states that all else being equal (no transaction costs) a product’s price should be the same in all markets • The law of one price states that $ P xS ¥/$ =P ¥ • Where the price of the product in US dollars (P$), multiplied by the spot exchange rate (S, yen per dollar), equals the price of the product in Japanese yen (P¥) • Conversely, if the prices were stated in local currencies, and markets were efficient, the exchange rate could be calculated from the relative local product prices S ¥ /$ P¥ = $ P 5 Prices and Exchange Rates • What if you have the following scenario: • You live in Switzerland and observe that a product costs Sfr6.20 in Switzerland while the same product costs $2.65 in the US • Also assume that Homer trades Sfr and $ from his couch and that he stands ready to sell you one dollar for Sfr1.36 – This is also to say he is going to buy Sfr1.36 for a buck • Can you make any arbitrage profits? – Buy the product in the US and sell it in Switzerland – Buy: need to spend $2.65 for the purchase. Since you are a Swiss person ask Homer to sell you dollars for Sfr. You need to pay him $2.65 x Sfr1.36/$ = Sfr3.604 – Sell: receive Sfr6.20 for the sale of the product that you just spent Sfr3.604 for – What is your profit (Sfr6.20/Sfr3.604) – 1 = + 72% – Thanks to Homer!!! 6 The Big Mac Hamburger Standard • The Economist developed the Big Mac Standard to track PPP: – Assuming that the Big Mac is identical in all countries, it serves as a comparison point as to whether or not currencies are trading at market prices – Big Mac in Switzerland costs Sfr6.20 while the same Big Mac in the US costs $2.65 – The implied PPP of this exchange rate is Sfr6.20 = Sfr2.34/$ $2.65 7 The Big Mac Hamburger Standard (Continued) • If the actual exchange rate is Sfr1.36/$, then we can determine relative valuation Indirect Quote (FC/$) over ( ) under ( ) valuation : Theorethical Exchange Rate 1 Actual Spot Exchange Rate • The Swiss franc is overvalued against dollar by Sfr 2.34 /$ 1 72% Sfr1.36 /$ • Above equation applies when we have an “Indirect Quote” (FC/$) to measure Sfr value against the dollar 8 The Big Mac Hamburger Standard (Continued) • If Direct Quotes ($/FC) are used the equation would become Direct Quote ($/FC) over ( ) under ( ) valuation : Actual Spot Exchange Rate 1 Theorethical Exchange Rate • Since home currency is $, Direct Quotes are: • Theoretical = 1 / Sfr2.34/$ = $0.4274/Sfr and • Actual = 1 / Sfr1.36/$ = $0.7353/Sfr $0.7353 /Sfr 1 72% $0.4274 /Sfr • Again we are measuring the value of Sfr against the dollar 9 Homer’s Solution • Homer should change his conversion rate, Spot Exchange Rate, to Sfr2.34/$ = (Sfr6.20/$2.65) – Buy the product in the US and sell it in Switzerland – Buy = need to spend $2.65 for the purchase. Since you are a Swiss person ask Homer to sell you dollars for Sfr. You need to pay him $2.65 x Sfr2.34/$ = Sfr6.20 – Sell = receive Sfr6.20 for the sale of the product that you just spent Sfr6.20 for???? – What is your profit (Sfr6.20/Sfr6.20) – 1 = 0% 10 Purchasing Power Parity & The Law of One Price • If the Law of One Price were true for all goods, the purchasing power parity (PPP) exchange rate could be found from any set of prices • Prices of individual products can be determined through the PPP exchange rate • This is the absolute theory of purchasing power parity • Absolute PPP states that the spot exchange rate is determined by the relative prices of similar basket of goods 11 Relative Purchasing Power Parity • If the assumptions of absolute PPP theory are relaxed, we observe relative purchasing power parity – The idea is that the relative change in prices between countries over a period of time determines the change in exchange rates – Moreover, if the spot rate between 2 countries starts in equilibrium, any change in the differential rate of inflation between them tends to be offset over the long run by an equal change in the spot rate. Higher inflation currency should depreciate – Using the direct quotes mathematically the following relationship should hold: $ S 2$/FC - S1$/FC (1 π ) $ FC $/FC $/FC = π π and S S 2 1 S1$/FC (1 π FC ) – Using indirect quotes, we have: FC S1FC / $ -S 2FC / $ ( 1 + π ) $ FC FC / $ FC / $ = π - π and S 2 = S1 FC / $ S2 ( 1+ π$ ) 12 Relative Purchasing Power Parity • High inflation currency should depreciate PPP Line π$ – πFC 1 4 Increased purchasing power of foreign goods. Cheaper to buy foreign goods. 3 Home inflation rate is higher, but home currency does not depreciate as much (direct quote goes up). Foreign goods become relatively cheaper to US consumers. 2 S2$ / FC -S1$ / FC S1$ / FC or 1 0 -4 -3 -2 -1 0 1 2 3 -1 -2 2 -3 Decreased purchasing power of foreign goods. Cheaper to buy domestic goods. 4 S1FC / $ -S 2FC / $ S 2FC / $ -4 13 Does PPP Hold? • Empirical tests of both relative and absolute purchasing power parity show that for the most part, PPP is not accurate in predicting future exchange rates • Reasons: – – – – Price indexes include non tradable goods Goods baskets are not similar Differential inflation rates might be inaccurate Test periods are subject to government interventions • Two general conclusions can be drawn from the tests: – PPP holds up well over the very long term but is poor for short term estimates – The theory holds better for countries with relatively high rates of inflation and underdeveloped capital markets 14 Exchange Rate Indices: Real and Nominal • In order to evaluate a single currency’s value against all other currencies in terms of whether or not the currency is “over” or “undervalued,” exchange rate indices were created – These indices are formed by trade-weighting the bilateral exchange rates between the home country and its trading partners • The nominal exchange rate index uses actual exchange rates to create an index on a weighted average basis of the value of the subject currency over a period of time 15 Exchange Rate Indices: Real and Nominal • The real effective exchange rate index indicates how the weighted average purchasing power of the currency has changed relative to some arbitrarily selected base period $ C ER$ = E N$ x FC C $ E • R The real effective rate for the US dollar $ • E N The nominal rate index • C$ US dollar costs FC • C Foreign currency costs (CFC) – If changes in exchange rates just offset differential inflation rates – if purchasing power parity holds – all the real effective exchange rate indices would stay at 100 – If a rate strengthened (overvalued) or weakened (undervalue) then the index value would be above or below 100, respectively 16 Real Effective Exchange Rate Indices Undervalued Overvalued IMF’s Real Effective Exchange Rate Indexes for the United States & Japan (2000 = 100) 17 Exchange Rate Pass-Through • Incomplete exchange rate pass-through is one reason that country’s real effective exchange rate index can deviate from it’s PPP equilibrium point • The degree to which the prices of imported & exported goods change as a result of exchange rate changes is termed pass-through • Example: assume BMW produces a car in Germany and all costs are incurred in euros. When the car is exported to the US, the price of the BMW should be the euro value converted to dollars at the spot rate • Where P$ is the BMW price in dollars, P€ is the BMW price in euros and S is the spot rate $ Pr oduct P P FC Pr oduct $/FC xS 18 Exchange Rate Pass-Through • If the euro appreciated 20% against the dollar, but the price of the BMW in the US market rose to only $40,000 from $35,000, and not $42,000 as is the case under complete pass-through, the pass-through is partial • The degree of pass-through is measured by the proportion of the exchange rate change reflected in dollar prices $ PBMW, 2 $ PBMW, 1 $40,000 1.1429, or 14.29% $35,000 • The degree of pass-through in this case is partial, 14.29% ÷ 20.00% or approximately 0.71. Only 71.0% of the change has been passed through to the US dollar price 19 Fisher Effect • Prices between countries are related by exchange rates and now we discuss how exchange rates are linked to interest rates • The Fisher Effect states that nominal interest rates in each country are equal to the required real rate of return plus compensation for expected inflation. As a formula, The Fisher Effect is (1 i) (1 r)(1 π) i r π rπ • Where i is the nominal rate, r is the real rate of interest, and π is the expected rate of inflation over the period of time • The cross-product term, rπ , is usually dropped due to its relatively minor value 20 Fisher Effect • Applied to two different countries, like the US and Japan, The Fisher Effect would be stated as i r π ; i r π $ $ $ ¥ ¥ ¥ • It should be noted that this requires a forecast of the future rate of inflation, not what inflation has been, and predicting the future can be difficult! • International Fisher Effect assumes that the real rates across countries are the same. 21 International Fisher Effect (IFE) • The International Fisher Effect, or Fisher-open, states that the spot exchange rate should change in an amount equal to the difference in interest rates between countries – if we were to use the US dollar and the Japanese yen, the expected change in the spot exchange rate between the dollar and yen should be – Using direct quotes: $ S 2$ / FC -S1$ / FC ( 1 + i ) $ FC $ / FC $ / FC = i - i and S 2 = S1 $ / FC S1 ( 1 + i FC ) – Using indirect quotes: FC S1FC / $ -S 2FC / $ ( 1 + i ) $ FC FC / $ FC / $ = i - i and S 2 = S1 FC / $ S2 ( 1 + i$ ) 22 International Fisher Effect (IFE) • Justification for the international Fisher effect is that investors must be rewarded or penalized to offset the expected change in exchange rates • The international Fisher effect predicts that currencies with low interest rates are expected to appreciate relative to currencies with high interest rates • This reasoning is due to the fact that low interest rates imply low expected inflation rates • Similar to PPP except that expected inflation rather than past inflation figures are incorporated 23 International Fisher Effect (IFE) • High interest rate currency should depreciate International Fisher Effect i$ – iFC 4 3 Lower returns from investing in foreign deposits. Invest in the US. Home interest rate is higher, but home currency does not depreciate (direct quote goes up) as much. It is better to invest in the US. Foreigners will do the same. 1 2 S2$ / FC -S1$ / FC S1$ / FC or 1 0 -4 -3 -2 -1 0 1 2 3 -1 -2 Higher returns from investing in foreign deposits. Invest abroad. 4 S1FC / $ -S 2FC / $ S 2FC / $ -3 -4 24 Does International Fisher Effect Hold? • Empirical studies indicate that the IFE theory holds during some time frames. However, there is also evidence that it does not consistently hold • Since the IFE is based on PPP, it will not hold when PPP does not hold • For example, if there are factors other than inflation that affect exchange rates, the rates will not adjust in accordance with the inflation differential 25 Interest Rates and Exchange Rates • The Forward Exchange Rate – A forward rate is an exchange rate quoted today for settlement at some future date – The forward exchange agreement between currencies states the rate of exchange at which a foreign currency will be bought or sold forward at a specific date in the future (typically 30, 60, 90, 180, 270 or 360 days) – The forward rate is calculated by adjusting the current spot rate by the ratio of euro currency interest rates of the same maturity for the two subject currencies 26 Interest Rates and Exchange Rates • The Forward Rate (using direct quotes) F $ / FC =S $ / FC ( 1 i$ ) ( 1 i FC ) FC ) The equation for determining the FC/$ FC/$ ( 1 i 1.F =S Forward Rate ( 1 i$ ) 2. Equilibrium condition where the 1 investment return in $ is the same 2.( 1+i $ )=S FC/$( 1+i FC ) FC/$ regardless where the investment is F made after taking into account the FC/$ FC F ( 1 i ) change in exchange rate 3. FC/$ 1 $ S (1 i ) 3. Another way of stating equilibrium condition • Note each one of these equations can be driven from one another 1. 27 Interest Rates and Exchange Rates • The Forward Rate example with spot rate of Sfr1.4800/$, a 90-day euro Swiss franc deposit rate of 4.00% p.a. and a 90-day euro-dollar deposit rate of 8.00% p.a. Home currency is US $. Sfr/$ F90 90 1 0.04 x 360 Sfr1.4800/$ x 90 1 0.08 x 360 Sfr1.4800/$ x 1.01 Sfr1.4655/$ 1.02 28 Interest Rates and Exchange Rates • The forward premium or discount is the percentage difference between the spot and forward rates stated in annual percentage terms – When stated in direct terms (home currency per foreign currency units, $/FC) then formula is Foward-Spot 360 $/FC f x x 100 Spot days – For indirect quotes (FC/$), then (S – F) / F should be applied Spot - Foward 360 FC/$ f x x 100 Foward days 29 Interest Rates and Exchange Rates • Using the previous Sfr example, the forward discount or premium would be as follows: Spot - Foward 360 FC/$ f x x 100 Foward days f Sfr/$ Sfr1.4800 /$ - Sfr1.4655 /$ 360 x x 100 3.96% p.a. Sfr1.4655 /$ 90 • The positive sign indicates that the Swiss franc is selling forward at a premium of 3.96% per annum (it takes 3.96% more dollars to get a franc at the 90-day forward rate – it would be the same if direct quotes are used) 30 Interest Rates and Exchange Rates • Same example with direct quotes: 1 Spot RateDirect Quote $0.6757 / Sfr Sfr1.4800/$ 1 Forward RateDirect Quote $0.6824 / Sfr Sfr1.4655/$ f $ / FC f $ / Sfr Foward-Spot 360 x x 100 Spot days $0.6824 /Sfr-$ 0.6757 /Sfr 360 x x 100 3.96% $0.6757 /Sfr 90 31 Interest Rate Parity (IRP) • Interest rate parity theory provides the linkage between foreign exchange markets and international money markets • The theory states that the difference in the national interest rates for securities of similar risk and maturity should be equal to the forward rate discount or premium for the foreign currency, except for transaction costs • If not true then there exists risk-free profit opportunities (arbitrage) 32 Interest Rate Parity (IRP) • In the diagram in the following slide, a US dollar-based investor with $1 million to invest, is shown indifferent between dollardenominated securities for 90 days earning 8.00% per annum, or Swiss francdenominated securities of similar risk and maturity earning 4.00% per annum, when “cover” against currency risk is obtained with a forward contract 33 Interest Rate Parity (IRP) i $ = 8.00 % per annum (2.00 % per 90 days) Start $1,000,000 S = SF 1.4800/$ End 1.02 $1,020,000 Dollar money market $1,019,993* 90 days F90 = SF 1.4655/$ Swiss franc money market SF 1,480,000 1.01 SF 1,494,800 i SF = 4.00 % per annum (1.00 % per 90 days) Note that the Swiss franc investment yields $1,019,993, $7 less on a $1 million investment. 34 Covered Interest Arbitrage (CIA) • Because the spot and forward markets are not always in a state of equilibrium as described by IRP, the opportunity for arbitrage exists • The arbitrageur who recognizes this imbalance can invest in the currency that offers the higher return on a covered basis • This is known as covered interest arbitrage (CIA) • The following slide describes a CIA transaction in much the same way as IRP was transacted 35 CIA – Example • • • • Assume that you observe the following (HC is $): i$ = 8% p.a. and i¥ = 4% p.a. S¥/$ = ¥106.00/$ and six-month F¥/$ = ¥103.50/$ Compare interest differential to forward premium/discount • Interest differential = i$ – i¥ = 8% – 4% = 4% • Forward premium/discount: f ¥ /$ ¥106.00 /$ - ¥103.50 /$ 360 x x 100 4.83% p.a. ¥103.50 /$ 180 • This observation would be below the IRP line, therefore we borrow $ and invest in ¥ 36 CIA – Example Eurodollar rate = 8.00 % per annum Start End 1.04 $1,000,000 $1,040,000 $1,044,638 Arbitrage Potential Dollar money market S = ¥ 106.00/$ F180 = ¥ 103.50/$ 180 days Yen money market ¥ 106,000,000 1.02 ¥ 108,120,000 Euroyen rate = 4.00 % per annum 37 Uncovered Interest Arbitrage (CIA) • A deviation from CIA is uncovered interest arbitrage, UIA, wherein investors borrow in currencies exhibiting relatively low interest rates and convert the proceeds into currencies which offer higher interest rates • The transaction is “uncovered” because the investor does not sell the currency forward, thus remaining uncovered to any risk of the currency volatility 38 Uncovered Interest Arbitrage (UIA): The Yen Carry Trade Investors borrow yen at 0.40% per annum End Start ¥ 10,000,000 Then exchanges 1.004 Japanese yen money market ¥ 10,040,000 Repay ¥ 10,500,000 Earn ¥ 460,000 Profit the yen proceeds for US dollars, S = ¥ 120.00/$ investing in US 360 days S360 = ¥ 120.00/$ dollar money US dollar money market markets for one year $ 83,333.33 1.05 $ 87,500.00 Invest dollars at 5.00% per annum Note that the final outcome is determined by future spot rate. It is likely to test some nerves!!! ¥ appreciates to below ¥114.74/$ you face losses. 39 Does Interest Rate Parity Hold? • Various empirical studies indicate that IRP generally holds • While there are deviations from IRP, they are often not large enough to make covered interest arbitrage worthwhile • This is due to the characteristics of foreign investments, including transaction costs, political risk, and differential tax laws 40 Forward Rates as an Unbiased Predictor • If the foreign exchange markets are thought to be “efficient” then the forward rate should be an unbiased predictor of the future spot rate • This is roughly equivalent to saying that the forward rate can act as a prediction of the future spot exchange rate, and it will often “miss” the actual future spot rate, but it will miss with equal probabilities (directions) and magnitudes (distances) • Evidence indicate that forward rates are biased predictors of future spot rates • Forecasting services should have value otherwise would not exist 41 Forward Rates as an Unbiased Predictor Exchange rate F2 S2 Error Error S1 F1 F3 Error S3 S4 Time t1 t2 t3 t4 The forward rate available today (Ft,t+1), time t, for delivery at future time t+1, is used as a “predictor” of the spot rate that will exist at that day in the future. Therefore, the forecast spot rate for time St2 is F1; the actual spot rate turns out to be S2. The vertical distance between the prediction and the actual spot rate is the forecast error. When the forward rate is termed an “unbiased predictor,” it means that the forward rate over or underestimates the future spot rate with relatively equal frequency and amount, therefore it misses the mark in a regular and orderly manner. The sum of the errors equals zero. 42