Finance Society, Stockholm Business School Weekly Newsletter

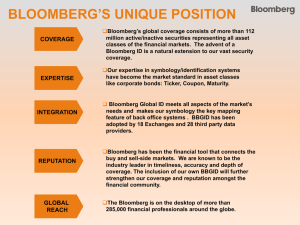

advertisement

Finance Society, Stockholm Business School Weekly Newsletter - Equities & Markets Week 49 Asian Currencies in Longest Weekly Declining Streak in Six Years as the USD Soars to 5-Year High The dollar soared to a five-year high after a report showing added U.S. employees in November, reporting the most workers in almost two years, leaving the Federal Reserve considering when to raise interest rates next year. The greenback headed for its strongest week in more than a year as American companies added 321,000 jobs, topping all forecasts in a Bloomberg survey, Labor Department figures showed in Washington. Norway’s krone and Malaysia’s ringgit slid to five-year lows as a slump in crude oil damped the economic outlook for the nations. As economic data boosted demand for the dollar, supported by the high U.S. interest rates, the Asian currencies dropped for the sixth week resulting in the longest declining streak since 2008. “There’s a firmer dollar in general and that’s having a broad-based negative impact on Asian currencies,” said Mitul Kotecha, head of AsiaPacific currency strategy at Barclays Plc in Singapore. “Being a net exporter of oil, Malaysia suffers more than others.” 12 are driving the ethanol surge. The U.S. is producing about 66 million metric tons more corn than a decade ago, almost as much as the rest of the world will export this year. Global demand for U.S. ethanol is helping ward off a glut after the government eased obligations to blend the fuel with gasoline.3 Best Weekly Rally for Chinese Stocks Since 2009 on Record Volumes China’s stocks capped the steepest weekly rally since 2009 in a volatile session that spurred the benchmark index’s biggest swings in four years and sent turnover above 1 trillion Yuan for the first time. Some examples for the volatile market at the moment is The Shanghai Composite Index, which rose 1.3 percent at the close, after gaining as much as 2.7 percent and falling 3 percent. Haitong Securities Co. and China Construction Bank Corp. led a rally for financial shares, adding more than 7 percent. Bank of China Ltd. jumped 4.5 percent after losing as much as 3.1 percent. “The market is becoming very speculative,” said Wang Zheng, the chief investment officer at Jingxi Investment. “Such a rally is unsustainable for sure. The market will be in for a very wild ride up and down next week.”4 Olle Green 5th December 2014 Ethanol is Recovering From a 4-Year Low Exports from the U.S. showing additive derived from corn rose 31 percent this year, the highest level since 2011, meeting demand from South Korea to Persian Gulf oil producers. A tripling of gasoline and diesel exports since 2009 follows the growth in sales. While the shale-oil boom created a stream of refined products flowing overseas, record crops 1 http://www.bloomberg.com/news/2014-12-05/asiancurrencies-set-for-longest-weakening-streak-in-sixyears.html 2 http://www.bloomberg.com/news/2014-12-05/dollarrises-as-u-s-economy-adds-more-workers-thanforecast.html 3 http://www.bloomberg.com/news/2014-12-05/ethanolrecovering-from-four-year-low-thanks-to-exports.html 4 http://www.bloomberg.com/news/2014-12-05/shanghaistocks-head-for-best-week-in-four-years-as-futuresgain.html