Task 1. What do the following acronyms stand for. (add 4)

advertisement

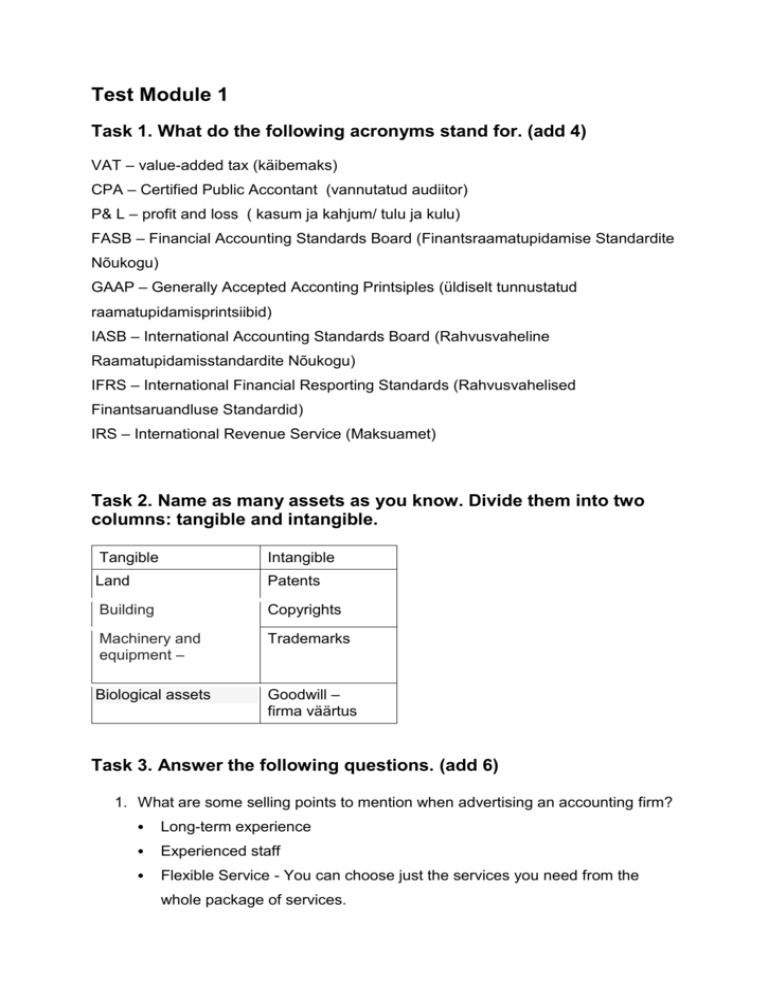

Test Module 1 Task 1. What do the following acronyms stand for. (add 4) VAT – value-added tax (käibemaks) CPA – Certified Public Accontant (vannutatud audiitor) P& L – profit and loss ( kasum ja kahjum/ tulu ja kulu) FASB – Financial Accounting Standards Board (Finantsraamatupidamise Standardite Nõukogu) GAAP – Generally Accepted Acconting Printsiples (üldiselt tunnustatud raamatupidamisprintsiibid) IASB – International Accounting Standards Board (Rahvusvaheline Raamatupidamisstandardite Nõukogu) IFRS – International Financial Resporting Standards (Rahvusvahelised Finantsaruandluse Standardid) IRS – International Revenue Service (Maksuamet) Task 2. Name as many assets as you know. Divide them into two columns: tangible and intangible. Tangible Intangible Land Patents Building Copyrights Machinery and equipment – Trademarks Biological assets Goodwill – firma väärtus Task 3. Answer the following questions. (add 6) 1. What are some selling points to mention when advertising an accounting firm? Long-term experience Experienced staff Flexible Service - You can choose just the services you need from the whole package of services. 2. What kind of taxes does the Estonian tax system constist of? Estonian tax system consists of state taxes and local taxes. State taxes are received to the state budget, local taxes, local government budgets. 3. What kind of depreciation methods are used? Straight-line depreciation evenly decreases the value of a depreciable asset through the entire recovery periood. (for example computers) Accelerated depreciation accounts for more wear and tear during the first years of a tangible asset’s use. (for example cars) 4. What kind of reports does the Estonian annual report consist of? In Estonia the annual report consist of balance sheets, income statements, cash flow statements, reports of the Board and supplements. 5. How do companies set prices? The companies set sales price by using markups or the cost-plus method. They start with the cost of producing something. Then add a certain percentage. This percentage includes the desired profit and fixed expense recovery. 6. How to calculate return on sales? Net Income ÷ Revenue = Return on Sales 7. What is the basic formula for balance sheet? Assets = Liabilities + Owner’s Equity Task 4. Explain the following terms. (add 6) Depreciation method – an accounting technique that records reductions in value raamatupidamise meetod, mis kirjeldab vara väärtuse vähenemist Fixed assets – any piece of property that is not easily converted to cash igasugune vara, mis ei ole kergesti konverteeritav sularahaks Investory – the value of products that a company has bought and intends to sell for profit Varud – toodete väärtus, mida ettevõte on ostnud ja kavatseb müüa kasumiga Back-office – Office space containing a business’s accounting, IT, human resources, and ohter administrative departments Inflow – cash coming into a company General and administrative costs – the amounts of Money thatmust be spent to organize and run a company Overdraft – a transaction conducted without sufficient funds Task 5. Translate the following words into Estonian. (add 8) 1. Liability – võlg, kohustus 2. Overdraft – arvelduskrediit, ülekulu 3. Accounts payable – maksmisele kuuluvad arved 4. Outflow – väljaminek 5. Obsolescence – moraalne või tehniline vananemine 6. Recovery periood – tasuvusperiood 7. Return on sales –müügitulu 8. Salvage value – jääkväärtus 9. Wear and tear – kulumine 10. Dumping – alla omahinna müümine Task 6. Translate the following words into English. (add 8) 1. Müügitulu – sales revenue 2. Võlg – debt, liability 3. Omakapital- owner’s equity 4. Rahavoogude aruanne – cash low statement 5. Käibevara – current assets 6. Lühiajalised kohustused – current liabilities 7. Aktsionär - shareholder 8. Raamatupidamise tarkvara - accounting software 9. Ostuarve - purchase invoice 10. Järjepidev - consistent Task 7. Taxes. Explain the terms, translate then into Estonian. (add 6) 1. Tax allowance - is the part of the income which a person is allowed to earn and not pay tax on (maksuvaba tulu) 2. Value-added tax – consists of fees that are charged every time materials are transferred from one company to another during the manufacturing process 3. Corporate tax – money that businesses pay to a government (ettevõtte tulumaks) 4. Sales tax – a fee that goverments charge when goods are sold 5. Property tax – a fee that local goverments charge when goodis are sold 6. Excise tax – a fee for produsing certain non-essential products like tabacco and fuel 7. Inheritance tax – money that is paid to a government arter aperson died Task 8. Write a comment on the following topic “Leaving Estonia“ (appr. 100 words) Some leave the country to get experience, broaden their minds, learn languages and so on. That kind of people usually have a certain plan to come back later. But there are others that are strongly disappointed in the government of Estonia and do not wish to ever come back. Our prices are equal to those of another European countries, but the salaries are up to 10 times smaller. It goes the same way with the social benefit. Sometimes it’s easier for an Estonian to get financial assistance abroad than in own country. I think that it’s sad when parents go to work in foreign countries, but leave their children here to be either alone or with their grandparents. It might cause a whole generation of broken families. *Task 9. Do the following crossword. (12 -20 words) http://puzzlemaker.discoveryeducation.com/CrissCrossSet up Form.asp ACCOUNTING Across 2. alist of employees and their salaries or wages 6. to decrease rapidly 7. means that two things are the same 8. someone isto initiale legal proceedings against them 10. the process of money moving into and out of a company 11. to achieve and maintain a steady level 12. money that individuals and businesses are required to pay to a government Down 1. a certain amount of money that companies add to their costs when setting sales prices 3. a machine that produces duplicates of paper dokuments 4. something is to create it 5. the act of moving money from one account to another 9. a customer or person for whom services are provided 12 of 12 words were placed into the puzzle. Created by Puzzlemaker at DiscoveryEducation.com