Depreciation Depreciation is best defined as the cost of the assets is

Depreciation

Depreciation is best defined as the cost of the assets is spread over the life of the assets. For example, the cost of the assets is 100000 and the life is 5 years so the deprecation will be 20000 for the year. Under straight line method the depreciation is constant for the whole life, but under accelerated method the depreciation is charged more in early years, then later years.

The straight line is used for those assets which are non productive such as furniture and fixture, but for assets like machine which are productive in early years as compared to later years, the accelerated depreciation method is preferred. Other methods of depreciation such as declining, double declining, sum of the years digit etc, accelerates the investment in such a way that if the depreciation from the straight line is 20000 so depreciation from the other methods will be more and the firm will enjoy tax advantage as there is tax shield on depreciation expense. The more the depreciation the more the tax advantage firm will get and automatically the cash flows will be more, so they will produce the good NPV with the required rate of return.

In this way the depreciation helps in accelerating the investment.

It can be understood with help of an example, the company purchases the equipment of

200000 and the life of the asset is 5 years and the depreciation method is double declining, the rate will be1/5*2 = .4 or 40%. The depreciation for the first year will be 80000 (200000*.4) and assume that the tax is 30%, so then the company will enjoy the benefit of 24000(30% of 80000) in first year and the cash flow will increase by 24000. But if we use the method of straight line then the depreciation will be 40000(200000/5) then the company will enjoy only 12000 benefit.

So the method other than the straight line increases the investment in this way.

Depreciation is the non cash expense, therefore in the cash flow statement it is added back to the income.

When we talk about the book value of the assets, we say that the balance sheet value of the assets. Book value is the value which we can get from the balance sheet of the company. In which all depreciation is deducted from the asset and then the value of asset is quoted in balance sheet.

The users of the balance sheet need this book value for their buying and selling of shares, because the value show the company financial position and help them for analyzing company’s position.

Next come the market value of the company which is quite different from the book value. As this show the current value of the asset in market, not the value stated in company balance sheet. Some companies want to revalue their assets so then they use this market value and state the asset in balance sheet as the market value of asset .Book value refers to the value of assets from start less any depreciation but the market value refers to the current value of asset.

There after the tax allocation comes, in which the company decided or estimated the tax for the current year. There are two typed of taxes one is deferred tax liability and other is deferred tax assets. The deferred tax liability is that in which the company is liable to pay further taxes to tax authorities. In this case we can say that the company has estimated low amount of tax than the actual amount. This will increase the company liability section in the balance sheet. It is a very vital point for the stake holders of the financial statements of the company. Likewise when we talk about the other part of tax then comes the deferred tax assets, in which the company

will take the amount from the tax authorities or we can say that the tax authorities have the company’s amount in advance which they will adjust in next year.

But this will increase the assets side of the balance sheet and it is also a very important part for the stake holder of the company.

If we remove the tax part from the year of purchase then the cash flow of that year will be low because in that year we will not enjoy the tax advantage and the result of cash flow will be low as compare to the years which are enjoying the tax advantage. This because the tax authorities allow depreciation as the taxable allowance and provide this a shield.

Hurdle Rate

Hurdle rate is the combination of both the cost of capital and business risk. Business risk the risk which in inherent of business, without of which business can’t run. There is a good saying that High risk High return and low risk low return. Government regulation, selling price per unit, variable cost, demands, technology change etc are some examples of business risk, changes in these things can take business up to the sky or down towards earth. The firm has no significant control on business risk because like government regulation, they can’t do anything if government changes there laws.

Second come the Cost of capital, in which we have two elements the equity and the debts.

The cost of capital is the required rate of return of the investor but it is the cost for the company directors. The directors must only y invest the money of investors only those project which provide the required rate of return of the investors which we can calculate via many theories or formulas.

The cost of capital is consists of two elements the cost of equity and the cost of debts. The cost of debt is calculated as the coupon rate if the debts are straight, if the debts are redeemable then the interest rate will be the cost of debt and if the debts are IRR redeemable then the IRR will be the cost of debt. But in the case of cost of equity we can calculate K.E with the help of

Dividend valuation model and the Capital asset pricing mode (CAPM). The preferred model is the CAPM model because it covers the risk element in that also. The formula for the dividend growth is that K.E =div (1+g)/market values of share –Gothic module doesn’t consider the risk element in it. While the CAPM model has the ability to cover the risk area which is more reliable and efficient method for the investor. There are two risk in CAPM model one the whole market risk which is known as the Beta Asset and other this the risk for the company itself known as beta equity the cost of equity via CAPM model is calculated as K.E= RF (RM-RF)*B.E.

Then come the sources of finance by which the company can raise money to invest in difference projects for the expansion of the company. There are two main sources of finance one is Debt and other is Equity. It depends on the company that from which source they raise finance, or which source is more beneficial for them. If the company gets financed themselves via debt then they have to pay annual interest to the Bank because normally the debt is raise from banks. To be get financed by bank the company first have to check their gearing ratio

because if they get wholly finance from debt they will face liquidity problem and the problem of payment for the interest. But they also have the advantage of low cost of debt because banks usually have low interest rate as compare to the cost of equity because bank have low risk as compare to the equity owners. This is because if the company goes in liquidation the bank will receive their payment first then the equity holders.

This is why the equity holders ask for the more return and there cost of equity is more than the cost of debt because as said above high risk high return. If the company raises finance from the equity section then they have to pay more return to them but have also an advantage that if the company goes in liquidation the firm do not have tension to pay the equity owners first. But the company again has to check their position that they shouldn’t have wholly financed by the equity. Because if they get wholly financed by the equity than their cost of capital will be huge.

The company has to make balance between the equity and debts so they can reach the optimum level of cost of capital and enjoys good profits.

The balance can be maintained by the ratio analysis or the company can check from the market that how much capacity is further remaining for the debt section. E.g. the market trend is that the gearing must be in this ratio such as 40 percent equity and 60 percent debt, but the company is current in this situation 60 percent equity and 40 percent debts so it can further raise debt finance up to 20 percent so then it will come to the market levels.

Future Plan

After

Future value

16 years 18 years 23 years Total

20000 25000 30000

FVIF at10% 35.94973 45.59917 79.54302

PV 556 548 377 1482

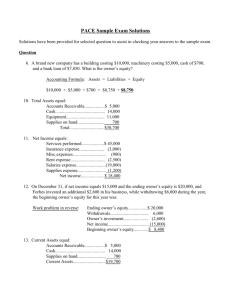

The above schedule shows that the father will have to make deposit of $1482 each year for first

16 years then, when the payment of $20000 will be withdrawn at the age of 16, the payment should be made for further two years equal to $ 926 (1482-556), when at the age of 18 when the $ 25000 will be taken back, the per year payment for last 5 years will be $ 377. It was calculated by using the concept of time value of money, the amount which is needed at the end of each targeted period is the future cash flows will be needed, then the present value to be determined by using the future value interest factor of annuity to be deposited at the end of each year for 10% rate of interest, which will be calculated by using this formula, (1+r^n-1)/r, here the r is the rate of interest and the n is the number of years, the n is different in all three scenarios but the r is same for all which is 10^ or can be written as 0.1. The calculation for 16 years will be (1.1^16-1)/.1 = 35.9498, divide future value of $ 20000 by this to arrive at $ 556.

The calculation for 18 years will be (1.1^18-1)/.1 = 45.5992, divide future value of 25000 by this to arrive at $ 548. The calculation for 23 years will be (1.1^23-1)/.1 = 79.543, divide future value of 30000 by this to arrive at $ 377.