2006.4.UT.Dallas - Vanderbilt University

advertisement

Post-Merger Product Repositioning

Luke Froeb, Vanderbilt

University of Texas

Arlington, TX

April 28, 2006

FTC

1

Joint Work & References

Co-authors

Amit

Gandhi, University of Chicago & Vanderbilt

Steven Tschantz, Math Dept., Vanderbilt

Greg Werden, U.S. Department of Justice

Merger Modeling Tools

Vanderbilt Math: “Mathematical Models

http://math.vanderbilt.edu/~tschantz/m267/

in Economics”

http://www.ersgroup.com/tools

FTC

2

Talk Outline

Policy Motivation: why are we doing this?

How does this fit into economic literature?

Computing Equilibria without calculus

Model & Results

FTC

3

FTC: Man Controlling Trade

FTC

4

1900

Laws enacted in 1900 or before

FTC

5

1960

Laws enacted in 1960 or before

Note: EU introduced antitrust law in 1957

FTC

6

1980

Laws enacted in 1980 or before

FTC

7

1990

Laws enacted in 1990 or before

FTC

8

2004

Laws enacted in 2004 or before

FTC

9

Enforcement Priorities

US & EC

1.

Cartels

2. Mergers

3. Abuse of dominance (monopolization)

New antitrust regimes

1. Abuse

of dominance

2. Mergers

3. Cartels

FTC

10

QUESTION: Which is best?

ANSWER: Enforcement R&D

How well does enforcement work?

How should we allocate scarce enforcement resources?

Cartels; Mergers; Monopolization

Merger question: how do we predict post-merger world?

FTC

What can we do to improve?

Market share proxies

Natural experiments

Structural models

11

FTC

Year

12

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

1994

1500

1993

1992

1991

1990

1989

1988

1987

1986

1985

1984

1983

1982

1981

Number of HSR Transactions

5000

4500

Merger Activity

4000

3500

3000

2500

2000

Billable filings under the post January 2001

system

1000

500

0

5.00%

4.50%

Second Requests as a Percentage of Total Filings

Merger Investigations

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

1994

FTC

1995

1996

1997

1998

1999

Year

2000

2001

2002

2003

2004

13

FTC Merger Challenges, 96-03

90

80

Number of Markets

70

60

50

40

30

20

10

0

2 to 1

FTC

3 to 2

4 to 3

5 to 4

6 to 5

7 to 6

Significant Com petitors

Enforced

Closed

8+ to 7+

14

What’s wrong with structural

proxies?

Competition does not stop at market

boundary

Shares may be poor positions for

“locations” of firms within market.

No mechanism for quantifying the

magnitude of the anticompetitive effect.

Benefit-cost

FTC

analysis?

15

Merger Analysis Requires

Predictions about Counterfactual

Back-of-the-envelope merger analysis

What is motive for merger?

Are customers complaining?

What will happen to price?

Price predictions are difficult

Natural Experiments

Model-based analysis

FTC

Good if nature has been kind

Model current competition

Predict how merger changes competition

16

Natural Experiment:

Marathon/Ashland Joint Venture

Combination of marketing and refining assets of

two major refiners in Midwest

First of recent wave of petroleum mergers

January

FTC

1998

Not Challenged by Antitrust Agencies

Change in concentration from combination of

assets less than subsequent mergers that were

challenged by FTC

17

Natural Experiment (cont.):

Marathon/Ashland Joint Venture

Examine pricing in a region with a large change

in concentration

Change

in HHI of about 800, to 2260

Isolated region

uses

Reformulated Gas

Difficulty of arbitrage makes price effect possible

FTC

Prices did NOT increase relative to other regions

using similar type of gasoline

18

Differences-in-Differences Estimation

Difference Between Louisville's Retail Price and Control Cities' Retail Price

25.00

Merger Date

20.00

15.00

10.00

11/1/1999

9/1/1999

7/1/1999

5/1/1999

3/1/1999

1/1/1999

11/1/1998

9/1/1998

7/1/1998

5/1/1998

3/1/1998

1/1/1998

11/1/1997

9/1/1997

7/1/1997

5/1/1997

-5.00

3/1/1997

0.00

1/1/1997

Cents

5.00

-10.00

-15.00

-20.00

-25.00

Week

Chicago

FTC

Houston

Virginia

19

Bertrand (price-only) Merger Model

Assumptions: Differentiated products, constant

MC, Nash equilibrium in prices.

Model current competition

Estimate demand

Recover costs from

FTC

FOC’s (P-MC)/P =1/|elas|

Prediction: Post-merger, MR for the merging

firms falls as substitute products steal share

from each other

Merged firm responds by raising prices

Non-merging firms raise price sympathetically

20

Structural Model Backlash

How reliable are model predictions?

Test merger predictions

Yes

(Nevo, US breakfast cereal)

No (Peters, 3/5 US airlines; Weinberg, US

motor oil and breakfast syrup)

Test over-identifying restrictions, i.e.,

does (p-mc)/p=1/|elas| ?

Yes

FTC

(Werden, US bread; Slade, UK beer)

21

Backlash (cont.)

Does model leave out features that bias its predictions?

Related research

Ignoring demand curvature can under- or overstate merger effect

Ignoring vertical restraints can under- or overstate merger effect

Ignoring capacity constraints likely overstates merger effect

Ignoring promotional competition likely understates merger effect

This research,

FTC

Static, Price-only competition, MC constant

Ignoring repositioning likely overstates merger effect

22

Backlash (cont.)

Tenn, Froeb, Tschantz “Mergers When Firms

Compete by Choosing both Price and

Promotion”

Ignoring promotion understates estimated

merger effect

“estimation

bias” (estimated demand is too priceelastic); and

“extrapolation bias” caused by assuming that postmerger promotional activity does not change (it

declines).

FTC

23

What if Firms Compete in Other

Dimensions?

Other dimensions of competition?

Repositioning in Horizontal Merger Guidelines

4 P’s of marketing: Price, Product, Promotion, Place

Thought to have effect similar to entry

Non-merging brands move closer to merging brands

Our BIG finding: merging brands move

increased product variety as all brands spread out

2 Price effects

FTC

Cross elasticity effect (merged products move apart) attenuates

merger effect

Softening price competition effect (all products spread out) amplifies

merger effect

24

Related Economics Literature

Berry and Waldfogel, “Do Mergers Increase

Product Variety?”

Radio

stations change format post-merger

Norman and Pepall, “Profitable Mergers in a

Cournot Model of Spatial Competition?”

Anderson et al., “Firm Mobility and Location

Equilibrium”

simultaneous

intractable”

FTC

price-and-location games “analytically

25

Econ. Lit Review (cont.):

“too much rock and roll”

Andrew Sweeting (Northwestern)

Following mergers among (rock n roll) stations,

play

lists of merged firms become more differentiated.

Merged stations steal ratings (listeners) from nonmerging stations.

No increase in commercials

FTC

These findings Match our theoretical

predictions

26

Why do we need to compute

Equilibria?

IO methodology now allows estimation of

game parameters without equilibrium

Bertrand

(BLP)

Dynamic (Bajari)

Auctions (Vuong)

must have equilibria for benefit-cost analysis

How

FTC

else to compute policy counterfactual?

e.g., what does post-merger world look like?

27

Computing Equilibria

Fixed-point algorithms

Require

smooth profit functions

Require good starting points

Can’t find Multiple equilibria

Stochastic response dynamic

All

FTC

it needs are profit functions.

28

How does methodology work?

Players take turns moving.

Player i picks a new action at random

If i’s new action improves Profit(i)

If i’s new action does NOT improves Profit(i)

choose new action with probability P and go to next player.

Let P tend towards zero

FTC

then accept move, and go to next player.

quickly reach state where no one wants to move.

this is a Nash equilibria

29

Why does methodology work?

FTC

Consider RV’s X and Y w/joint pdf p(x, y).

The conditionals p( x | y ) and p( y | x ) are

enough to determine the joint p(x, y).

Let the conditionals p( x | y ) and p( y | x ) each

be unimodal. If (x∗, y∗) is a local maxima of the

joint p(x, y), then x∗ maximizes the conditional p(

x | y∗ ) in the direction of X and y∗ maximizes the

conditional p( y | x∗ ) in the direction of Y.

30

Why? (cont.)

Suppose we want to generate a draw (x, y) from

the distribution of (X, Y ). Here is a recipe for

doing so:

Start

at any initial state (x0, y0).

Draw x1 from p( x | y0 ) and y1 from p( y | x1 ).

Repeat

FTC

After enough repetitions, the draws (xn, yn) can

be treated as a sample from joint distribution (X,

Y). This is the Gibbs Sampler.

31

Why? (cont.)

Think of each profit function Ui(a−i, ai) as a conditional

profit Ui(a−I | ai)

Normalize conditional profit to be positive and integrate

to 1, e.g., g(ai | a−i ) ∝ exp[Ui(a−I | ai) /t]

Interpret conditional utility as conditional probability.

Let t → 0. This causes the sampler to get stuck in a local

mode of g.

FTC

The normalization does not change game.

Multiple runs for multiple modes.

Each node is a Nash equilibria

32

Why? (cont.)

Note that g(a′i|at−i)/g(ati|at−i)=

exp[(Ui(a′I,at−i) -Ui(ati,at−i))/t]

We are back to the painfully easy

algorithm.

FTC

33

How do we actually make draws?

Pick action a′i uniformly at random from Ai

Set at+1i = a′i with probability

Max[1,

g(a′i|at−i)/g(ati|at−i)

Else, set at+1i = ati

Let t0

FTC

34

Example: Cournot equil.={1/3,1/3}

FTC

35

Example, 2 equil={{5,8},{8,5}}

FTC

36

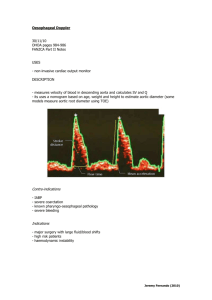

Demand Model

Consumers on Hotelling line

Indirect utility is function of price +

travel cost + random shock

vij i B( pi t * d ( xi, xj )) ij

Resulting demand is logit

FTC

qi (p, x)

e

N

vi ( pi , xi , x )

e

j

dF ( x)

e vj ( pj, xj , x )

37

Supply Model

Vendors simultaneously choose price and

location

profiti ( pi ci )qi (p, x)

Nash Equilibrium in two dimensions

Post merger, merged firm maximizes sum of

vendor products

FTC

38

Pre-merger Locations

FTC

39

Merger Decomposition

PRE-merger LOCATION POST-merger

LOCATION=Pre-merger

ownership at post-merger

locations

“Softening price competition” effect

LOCATION - PRE

Amplify merger effect

relative to no repositioning

“Cross-elasticity” effect

POST – LOCATION

Attenuate merger relative

FTC

to no repositioning

Total Effect=Softening + Cross-elasticity

40

Pre- (dashed) and Post- (solid)

Merger Locations (outside good)

FTC

41

Net Merger Effect =

Cross elasticity + Softening

FTC

42

Non Merging Firms Softening

FTC

43

Profit Changes

FTC

44

Price-only models can miss a lot

Taxonomy of effects

As

As

products separate, price competition is softened

merged products separate, smaller incentive to

raise price

As non-merging products spread out, smaller

sympathetic price increases.

Relative to a model with no repositioning

Total

and consumer welfare may be higher

Merging firms raise price

Non-merging firms may reduce price

FTC

45

What Have We Learned?

Repositioning by merged firms is more significant than

repositioning by non-merging firms

Pre-merger substitution patterns likely overstate loss of

competition.

Non merging firms can do worse following merger

Price can go up or down;

Consumers can be better or worse off

New algorithm for finding Nash equilibria

FTC

Similar to effect of capacity constraints on merger.

Important complement to existing estimation methods

46