financial_accounting_last

advertisement

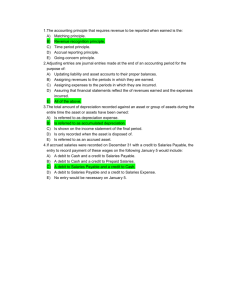

BS 352 FINALEXAM PART II NAME: __________________________ I promise I worked on this exam alone and didn’t seek or accept help. I worked independently of my classmates and co-workers and family. Signed___________________________________________________ 1. All of the following are operating activities except which one? A. B. C. D. 2. Collection of cash from a customer on account. Selling equipment. Payment of advertising expenses. Payment of salaries to employees. On October 28, Sierra Corporation employees had earned and were paid salaries of $4,000. How is this recorded on Sierra’s books? A. B. C. D. DEBIT 4,000 Salaries expense Cash CREDIT 4,000 Salaries payable Cash 4,000 Salaries expense Salaries payable 4,000 Salaries payable Salaries expense 4,000 4,000 4,000 4,000 1 3. On December 1, 2011, stockholders invest $20,000 into McGladrey Corporation in exchange for stock. What entry does McGladrey makes? DEBIT A. B. C D. 4. Cash Common stock 20,000 Common stock Cash 20,000 Cash Due to stockholders 20,000 Due to stockholders Cash 20,000 CREDIT 20,000 20,000 20,000 20,000 SAMS COMPANY sold merchandise to HOME COMPANY for $5,000. The merchandise sold had a cost of $3,000. What entry should SAMS make on the day the merchandise is sold to HOME COMPANY? A. B. C. D. DEBIT 3,000 Cost of goods sold Merchandise inventory CREDIT 3,000 Accounts receivable Sales Cost of goods sold Merchandise inventory 4,900 Accounts receivable Sales 5,000 Accounts receivable Sales Cost of goods sold Merchandise inventory 5,000 4,900 3,000 3,000 5,000 5,000 3,000 3,000 2 5. When SONIC CORPORATION prepared their financial statements for this year, there are no personal transactions of the company’s officers, managers or employees reported. This BEST reflects which of the following assumptions in financial reporting? A. B. C. D. 6. 7. Monetary Unit Economic Entity Periodicity (Time period) Going concern Mrs. Smith worked as a cash manager for ARRCO INC. for 20 years without taking a vacation. ARRCO just found out that she has been embezzling money for nearly that whole time. She should have been required to take vacations every year. Hint: Who makes you take vacation every year? An internal control feature that would have addressed this situation would be: A. Physical, mechanical, & electronic control devices B. Establishment of responsibility C. Segregation of duties D. Human resource controls E. Documentation procedures DAVID SCOTCH is getting ready to start a small business. DAVID met with his accountant today to review some of the procedures that should be implemented, His accountant suggested that the following procedures be put in place: 1. 2. 3. PROCEDURE: A background check should be conducted on all employees. Approved purchase orders should be submitted before payment is made to a supplier. A cash register should be used which only opens when a sale is made. In the order of 1, 2 and 3, which of the following correctly describes the nature of the internal control procedures suggested by the accountant? PROCEDURE 1 Segregation of duties PROCEDURE 2 Physical, mechanical, & electronic control devices PROCEDURE 3 Physical, mechanical, & electronic control devices B. Human resource controls Segregation of duties Physical, mechanical, & electronic control devices C. Documentation procedures Establish responsibility Documentation procedures. D. Human resource controls Documentation procedures Physical, mechanical, & electronic control devices A. 3 8. The person who is authorized to sign checks approves purchase orders for payments. Which internal control principle best fits the problem described? A. B. C. D. E. 9. The three points of the FRAUD TRIANGLE are: A. B. C. D. 10. Physical, mechanical, & electronic control devices Establishment of responsibility Segregation of duties Human resource controls Documentation procedures A clothing store is experiencing a high level of inventory shortages because customers try on clothing and walk out of the store without paying for the merchandise. Which internal control principle best fits the problem described? A. B. C. D. E. 12. Financial pressure, opportunity, and rationalization. Opportunity, low pay, and bad company policies. Rationalization, financial pressure, and some type of addiction. Bad company policies, some type of addition, and prior criminal history. Some cash payments are not recorded because checks are not prenumbered. Which internal control principle best fits the problem described? A. B. C. D. E. 11. Physical, mechanical, & electronic control devices Establishment of responsibility Segregation of duties Other controls Documentation procedures Physical, mechanical, & electronic control devices Establishment of responsibility Segregation of duties Human resource controls Documentation procedures Two persons handle cash sales from the same cash register drawer. Which internal control principle best fits the problem described? A. B. C. D. E. Documentation procedures Physical, mechanical, & electronic control devices Establishment of responsibility Segregation of duties Independent internal verification 4 13. Sierra Corporation had the following transactions during 2011: 1. 2. 3. 4. 5. 6. 7. 8. Sales to customers Dividends to shareholders Purchases of equipment Repayment of loans Collections from customers on account Payment of rent. Stock issued to investors Salaries paid to employees 2011 operating activities include which of the above events? A. B. C. D. E. 14. On January 10, Sierra Corporation purchased equipment from a supplier on account for $15,000. How is this recorded on Sierra’s books? A. B. C. D. 15. DEBIT 15,000 Equipment Cash CREDIT 15,000 Equipment Accounts payable 15,000 Cash Accounts payable 15,000 Accounts payable Cash 15,000 15,000 15,000 15,000 An accountant DEBITED an asset account for $900 and CREDITED a liability account for $500. What can be done to complete the recording of the transaction so that the accounting equation is in balance? A. B. C. D. 16. 2, 3, 7, 8 2, 3, 4, 7 1, 5, 6, 8 5, 6, 7, 8 3, 4, 5, 6 DEBIT a stockholders’ equity account for $400. DEBIT another asset account for $400. CREDIT a different asset account for $400. Nothing further must be done. Which of the following activities illustrates “FINANCING ACTIVITIES” for a business? A. B. C. D. The company purchases new machinery and equipment for $50,000. The company borrows $50,000 from the bank. The company provides $50,000 in services to customers. The company pays $50,000 in advertising for a new marketing campaign. 5 17. 18. On October 1, 2007, CARR COMPANY places a new asset into service. The cost of the asset is $30,000 with an estimated 5-year life. CARR COMPANY depreciates equipment on the basis of the actual months held during the year. What is the depreciation expense for 2007 if CARR COMPANY uses the straight-line method of depreciation? A. $1,500 B. $2,000 C. $4,000 D. $8,000 A truck that cost $18,000 and on which $10,000 of accumulated depreciation has been recorded was disposed of for $9,000 cash. The entry to record this event would be: A. B. C. D. 19. CREDIT 18,000 Cash Accumulated depreciation Truck Gain on sale of truck 9,000 10,000 Cash Truck Accumulated depreciation Gain on sale of Truck 9,000 18,000 18,000 1,000 10,000 17,000 Cash Loss on sale Truck 9,000 9,000 18,000 Which of the following activities reflects investing activities? A. B. C. D. 20. DEBIT 9,000 9,000 Cash Loss on sale of truck Truck Purchasing advertising for the business. Borrowing money from the bank. Purchasing inventory to sell to customers. Buying a competitor’s plant. Which of the following is not properly classified as property, plant, and equipment? A. B. C. D. Building used as a factory Land used in ordinary business operations A truck held for resale by an automobile dealership Land improvement, such as parking lots and fences 6 21. AT H&T GROCERS, the shift supervisor counts the cash in the cash drawer of each cashier clerk when the clerk finishes their shift at the checkout counter. Which internal control principle best fits the procedure described? A. B. C. D. E. 22. A check written for $167 is incorrectly recorded by JONES CORPORATION’S bookkeeper as $176 in the company books. On the bank reconciliation, the $9 error should be: A. B. C. D. 23. $35 in monthly service charges $175 in outstanding checks $500 deposit in transit $1,250 note collected by the bank Which of the following would be DEDUCTED from the BALANCE PER BOOKS on a bank reconciliation? A. B. C. D. 25. Added to the balance per books. Deducted from the balance per books. Added to the balance per bank. Deducted from the balance per bank. Which of the following would be DEDUCTED from the BALANCE PER BANK on a bank reconciliation? A. B. C. D. 24. Independent internal verification Establishment of responsibility Segregation of duties Human resource controls Documentation procedures $35 in monthly service charges $175 in outstanding checks $500 deposit in transit $1,250 note collected by the bank Noreen Williams reconciles the bank statement every month for her company, BREWER ENTERPRISES. One of the items which Noreen had to handle was a NSF check of $250 written by a BREWER customer. What should Noreen do with the $250 NSF check on the monthly bank reconciliation? A. B. C. D. Addition of $250 to the balance per books Deduction of $250 from the balance per bank Addition of $250 to the balance per bank Deduction of $250 from the balance per books 7 26. Depreciation is the process of allocating the cost of a plant asset over its useful life in a(n): A. B. C. D. Equal and equitable manner. Accelerated and accurate manner. Systematic and rational manner. Conservative market-based manner. Label each account as asset, liability, owner’s equity, revenue, or expense. And the list the normal balance, debit or credit, for each. 27. Cash Accounts Payable Accounts Receivable Interest Expense Rent Expense Notes Payable Accounts Receivable Inventory Furniture and Fixture Capital Withdrawals Property, Plant, and Equipment 8