October 29 Internal Control lesson BAT4M

advertisement

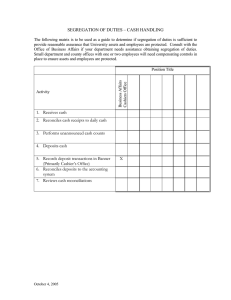

CHAPTER 7 INTERNAL CONTROL AND CASH INTERNAL CONTROL ACTIVITIES Authorization Segregation of duties Documentation procedures Safeguarding assets and records Independent verification Other Controls INTERNAL CONTROL ACTIVITY Segregation of duties: This is the most important control activity. Duties should be divided up so that one person can not commit a fraud and cover it up. The work of one employee should provide a reliable basis for evaluating the work of another employee. INTERNAL CONTROL ACTIVITY Segregation of duties: 1. The responsibility for related activities (such as ordering and paying / ordering and receiving) should be assigned to different individuals. 2. The responsibility for accounting for an asset should be separate from the responsibility for physical custody of that asset. 3. Let’s get into groups of 3 people and make skit or cartoon or , song, which describes this Bestbuy example or any other creative story. PRINCIPLES OF INTERNAL CONTROL Documentation procedures: Documents should provide evidence that transactions and events have occured. For example, if a customer paid cash, but the worker did not record this transaction, then there is not any evidence or proof. This means that the worker can steal the company’s money. Another example, the workers who work in storage room, must keep the documents such as purchase invoice or shipping documents. PRINCIPLES OF INTERNAL CONTROL Documentation procedures: If there is no document (or source document), then an employee can easily steal an asset from his or her company. Procedures should be estabilished for documents. First, whenever possible, documents should be pre-numbered and all documents should be accounted for. Prenumbering helps to prevent a transaction from being recorded more than once or not at all. PRINCIPLES OF INTERNAL CONTROL Documentation procedures: Second, documents should be prepared when the transactions happen. (Otherwise employees might forget to make the transactions.) Third, source documents for accounting entries should be sent to the accounting department immediately so that a bookkeeper can record an accounting transaction asap. These control activities increase the accuracy and reliability of the accounting records. PRINCIPLES OF INTERNAL CONTROL Physical Controls : Physical controls include mechanical, and electronic controls to safeguard (protect) assets and improve the Tand reliability of the accounting records. Examples are safes, vaults, safety deposits, locked warehouse, storage cabinets, passworded computers, alarms, TV monitors, Time clock which keeps track of employee’s work hours and attendance PRINCIPLES OF INTERNAL CONTROL 1. 2. 3. Performance Review (or Auditing) : Most internal control systems include internal reviews and external reviews of records. This means having someone else review or confirms the accounting data. The review should be done periodically or on a surprise basis. The review should be done by someone who is independent of the employee who is responsible for the information. Discrepancies and exceptions should be reported to a management level, who can correct situation. Performance Review Internal Review An independent reviewer would compare accounting records with existing assets or with the source documents. For example, they would review that cash register sales records with cash in the register. They would also review that expensive assets are physically at the store or storage room as it is recorded in ledger account. Performance Review Internal Review: • In large companies, controal activities (including internal review) are monitored by internal auditors. • Internal Auditors are company employees who evaluate the internal control system of the company. (whether the system is effective) • They periodically review the activities of departments and individuals to determine whether the correct control activities are being followed. ILLUSTRATION 8-3 RELATIONSHIP BETWEEN SEGREGATION OF DUTIES AND INDEPENDENT INTERNAL VERIFICATION Segregation of Duties Accounting Employee A Maintains cash balances per books Assistant Cashier B Maintains custody of cash on hand Independent Internal Verification Assistant Comptroller C Makes monthly comparisons: reports any irreconcilable differences to comptroller Classwork / Homework P377 BE7.1 and BE7.2 P378 Ex 7-1 P383 P7-1