Chapter 6 – Reporting and Analyzing Inventory Page Topic 282

advertisement

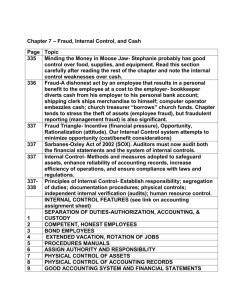

Chapter 6 – Reporting and Analyzing Inventory Page 282 283 284 286291 315 291 292 292 293 295 295 296 297 299 330 Topic Classifying inventory- For a merchandising firm, we refer to items for resale as “inventory” or “merchandise inventory.” For a manufacturing firm, inventory is classified as raw materials, work in process, and finished goods. Valuing inventory- 1) determine inventory quantities, 2) price the inventory Determining ownership- goods in transit, consigned goods Inventory costing methods- 1) Specific identification, 2) First-in, first-out (FIFO), Last-in, first-out (LIFO), and Average Cost (aka, weighted average) Use text problem (E6-5) to illustrate calculations Goods Available – Ending Inventory = Cost of Goods Sold $12,000 - $5,400 = $6,600 Effects of inventory methods on income statement (cost of goods sold and income tax expense), balance sheet (inventory, taxes payable, retained earnings) Use of Inventory methods in US (FIFO=44%) Effects on taxes this year and next year Effects on cash due to taxes paid Consistency required once a method is chosen Mention the Lower-of-Cost-or-Market method- Very conservative Inventory Turnover Ratio – Cost of Goods Sold / Average Inventory Days in Inventory – 365 / Inventory Turnover Ratio These are similar to the Receivables Turnover Ratios Mention the use of the LIFO Reserve – the difference between the ending inventory using LIFO and FIFO. Required footnote disclosure for companies using LIFO. A Look at IFRS (Accounting for Inventory) Chapter 7 – Fraud, Internal Control, and Cash Page Topic 335 Minding the Money in Moose Jaw- Stephanie probably has good control over food, supplies, and equipment. Read this section carefully after reading the rest of the chapter and note the internal control weaknesses over cash. 336 Fraud-A dishonest act by an employee that results in a personal benefit to the employee at a cost to the employer- bookkeeper diverts cash from his employer to his personal bank account; shipping clerk ships merchandise to himself; computer operator embezzles cash; church treasurer “borrows” church funds. Chapter tends to stress the theft of assets (employee fraud), but fraudulent reporting (management fraud) is also significant. 337 Fraud Triangle- Incentive (financial pressure), Opportunity, Rationalization (attitude). Our Internal Control system attempts to minimize opportunity (cost/benefit considerations) 337 Sarbanes-Oxley Act of 2002 (SOX). Auditors must now audit both the financial statements and the system of internal controls. 337 Internal Control- Methods and measures adopted to safeguard assets, enhance reliability of accounting records, increase efficiency of operations, and ensure compliance with laws and regulations. 337- Principles of Internal Control- Establish responsibility; segregation 338 of duties; documentation procedures; physical controls; independent internal verification (audits); human resource control. INTERNAL CONTROL FEATURES (see link on accounting assignment sheet) SEPARATION OF DUTIES-AUTHORIZATION, ACCOUNTING, & 1 CUSTODY 2 COMPETENT, HONEST EMPLOYEES 3 BOND EMPLOYEES 4 EXTENDED VACATION, ROTATION OF JOBS 5 PROCEDURES MANUALS 6 ASSIGN AUTHORITY AND RESPONSIBILITY 7 PHYSICAL CONTROL OF ASSETS 8 PHYSICAL CONTROL OF ACCOUNTING RECORDS 9 GOOD ACCOUNTING SYSTEM AND FINANCIAL STATEMENTS 10 11 12 13 AUDIT-INTERNAL AND EXTERNAL UNANNOUNCED PHYSICAL COUNTS REASONABLENESS TESTS (ratio analysis) PERFORMANCE EVALUATIONS 340 Anatomy of a Fraud Lawrence Fairbanks- purchased items for self- missing control was segregation of duties Angela Bauer- issued company checks to herself—missing control was segregation of duties Multiple employees submitted vouchers for reimbursement for same trip- missing control was documentation procedures Alex Parviz received commissions for sales he didn’t makemissing control was physical control over mailroom and insurance applications Bobbi Jean filed expense reimbursement reports for purchase of her own clothes- missing control- segregation of duties and independent verification Ellen and Josephine never took vacations. Embezzled funds by keeping cash paid by hotel guests- missing control was human resource control as Ellen had been fired by previous employer for same scheme Limitations on Internal Control- reasonable assurance, not absolute assurance Internal Controls over Cash INTERNAL CONTROL OVER CASH (see same link on accounting assignment sheet) ALL OF ABOVE FEATURES APPLY CHECKING ACCOUNT BANK RECONCILIATION PETTY CASH FUND Must consider control over cash receipts and controls over cash disbursements Journal entry for cash sale where there is a shortage or overage (Cash Short or Over) Use of the Voucher System- Verify purchase order, purchase invoice, and receiving report- attach all three to voucher. Responsible individual then authorizes payment. Petty Cash Fund (Journal entries illustrated in Appendix- page 367- 340 340 341 342 343 344 345 346 1 2 3 4 346 348 349 351 351 352 353 355356 357 357 360361 363 367368 393 368) Proper use of a checking account is a good control over cash Illustration of Laird Company Bank Statement from the National Bank & Trust Bank Reconciliation procedure Laird Company’s Bank Reconciliation and required journal entries Cash account, bank reconciliation, and Cash balance on Balance Sheet should all agree- Laird Company, $12,204.85 Madoff’s Ponzi Scheme Principles of good Cash Management1. Increase speed of cash collections (offer cash discount) 2. Keep inventory levels low (Just-in-Time Inventory system) 3. Delay payment of liabilities (take advantage of cash discounts but pay on last day to receive discount, e.g., 2/10, n/30) 4. Plan the timing of major expenses (Capital Budget) 5. Invest idle cash (Prepare cash budget to determine funds available to invest or funds needed to borrow. Cash Budget for Hayes Company Journal entries for Petty Cash (establish the fund, replenish it, and enlarge fund) A Look at IFRS (Internal Control) Chapter 8 – Reporting and Analyzing Receivables Page 398 400 400 401 402 402 402 403 404 405 407 408 409 410 412 Topic Types of Receivables- Name those that we have used previously Note entry for accrued interest earned. Valuing Accounts Receivable- we won’t collect all that is owed to us Direct write-off method. Simple and useful if there are few bad debts (aka, uncollectible accounts). However, it doesn’t provide a good matching of revenues and expenses. You are not responsible for this Allowance method- provides a good matching of revenues and expenses by estimating bad debts at the end of a period. How do we estimate bad debts? Look at past experience. Apply a percentage of net sales or percentage of receivables that occurred in the past. Better yet, age the accounts receivable. Adjusting entry to record estimated bad debts Entry to actually write off a bad debt in the following period Entries to collect an account that had been previously written off Aging Schedule, Journal entry, and T account presentationSTUDY THIS! Notes Receivable. Illustration of a promissory note Computing interest- we’ve been doing this since Basic Training Recognizing notes receivable- loan money and receive a note; make a sale and receive a note; receive a note as an extension of a past due account receivable. Journal entries for the collection of a note and another entry to accrue interest on a note at the end of the period. Managing Receivables: 1. Determine to whom to extend credit 2. Establish a payment period (COD, n/20, 2/10, n/30) 3. Monitor collections 4. Evaluate the liquidity of receivables (aging schedule) 415 423 444 5. Accelerate cash receipts when possible Ratios for evaluating receivables 1) Receivables turnover ratio (net sales/average receivables) (Some use net credit sales/average receivables) 2) Average collection period (aka, days in receivables) 365 / Receivables Turnover Ratio We’ll compute similar ratios to evaluate inventory in the next chapter Review the “Comprehensive Do It!” A Look at IFRS (Receivables) Chapter 10 – Reporting and Analyzing Liabilities (Current Liabilities pages 504-512) Page 506 507 508 508 509 510-511 Topic Long-term liabilities were covered earlier- Long-term notes payable and bonds payable. Our discussion today focuses on current liabilities. A current liability is one that is paid out of current assets (usually cash) or creation of other current liability (AP converted into NP), and paid within one year or the company’s operating cycle (the longer). Most operating cycles are for far less than one year. Entries for Notes Payable and Interest Payable Entry for Sales Tax Payable Entry for Unearned Revenue Current maturity of long-term debt Payroll Taxes Payable- entry to record the payroll and entry to record the employer’s payroll tax expense