Cost Share Officer - Amazon Web Services

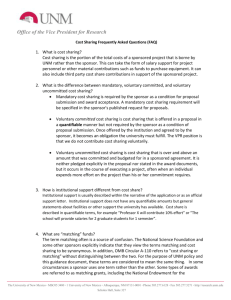

advertisement

Cost Sharing: Management, Challenges, and Impacts Kelly Morrison Grant and Cost Share Officer Office for Sponsored Research Elizabeth Adams Executive Director, Evanston Office for Sponsored Research What is Cost Sharing? • Cost Sharing represents the sponsored project or program costs (direct and indirect) that would normally be borne by the sponsor but instead are covered by an institution or a third party, such as a subcontractor or an unfunded collaborator. • “Cost matching” is often treated interchangeably with the term “cost sharing” • Term “cost matching” often refers to cost sharing agreements in which the amount of sponsor funding is based on an equal or proportionate commitment (e.g., 1:1) from the University. Mandatory Cost Sharing • Required by the sponsor as a condition of eligibility for an award • Typically, a mandatory cost sharing requirement must be communicated in a proposal solicitation • In mandatory situations, a proposal must demonstrate/commit to the required cost sharing • Typically is explicitly referenced in an award document • Must be properly documented and tracked for cost accounting and compliance purposes Voluntary Committed Cost Sharing • Not required by the sponsor as a condition of eligibility for an award but provided at the discretion of the institution • Referenced within the proposal and becomes a binding, auditable obligation • Often (though not always) referenced in an award document • Must be properly documented and tracked for cost accounting and compliance purposes Voluntary Uncommitted Cost Sharing • • • • Not required by the relevant program solicitation Not referenced in the proposal or award Not formally tracked (or auditable) For example, faculty or researcher effort additional to the level of effort originally committed to the sponsored project Forms of Cost Sharing - Cash • Cash contributions used to cost share must come from allowable, non-sponsored sources – Appropriated, Gift, Endowed, Discretionary • Can be used to fund salaries, fringe benefits, travel, equipment, supplies, and other allowable direct costs as defined by OMB Circulars A-21 and A-110 Forms of Cost Sharing - Effort • Effort commitment represents a contractual obligation to a project, whether the effort is charged or cost shared. • Cost shared effort can occur either at the proposal stage as a commitment or at the award stage. • When an investigator makes an effort commitment without requesting the associated salary, the investigator is establishing a cost share commitment. • Salary Cap Cost Sharing Forms of Cost Sharing - Unrecovered F&A • Facilities & Administrative costs (F&A or indirect costs) are real costs associated with conducting sponsored activity. • If an allowable direct cost is cost shared, the indirect costs associated with these direct costs cannot be assessed – but they still represent a quantifiable loss and should be considered cost sharing. • Intention to count unrecovered F&A as cost sharing should be presented at the proposal stage. Forms of Cost Sharing – Graduate Student Fellowships • Graduate student fellowships represent the salary/stipend, any associated fringe benefits, and tuition provided to support graduate students. • These are funded by non-sponsored funds (including general appropriations and endowments) and can be used as cost sharing when provided by the department, school, or The Graduate School. Forms of Cost Sharing – Third-Party • Third party contributions represent cost sharing provided by an entity external to the University. • Commitments and expenditures must follow the same guidelines that the University follows in order for them to be considered allowable and appropriate cost sharing. • Examples include subawardee cost sharing and contributed time or services from an extramural party. Why Cost Share? • Eligibility issue for certain programs • Makes an institution’s proposal more competitive • Helps institutions allocate resources to areas of strategic national importance Cost sharing can help a university fulfill its mission as a premier research institution. Institutional Impacts Negative • • • • • Financial Administrative Compliance Investigator F&A Rate Financial Impact • Cost sharing can redirect resources from departments, schools, and/or central units, limiting those units’ capabilities. • Inherent forfeiture of indirect costs produced by cost sharing represents a further University subsidy. Administrative Impact • Cost sharing represented in a proposal becomes a binding obligation at the award stage that the University must monitor, document, and report on. • This represents a significant organizational administrative burden across many units and management levels at the University. Compliance Impact • In general, cost sharing increases the compliance risk of a sponsored project. • Cost sharing increases the University’s audit exposure, and any audit findings determining that cost sharing did not occur or did not occur to the committed level could result in consequences including, but not limited to: • Disallowance of Costs • Termination of Award Investigator Impact • In situations where faculty effort is cost shared in support of a mandatory or voluntary committed cost share requirement, faculty members’ ability to conduct other research may be limited. • Investigators can also be affected by the burden to monitor, document, and report on cost sharing. F&A Rate Impact • The University’s total amount of mandatory and voluntary committed cost sharing (salary and nonsalary) must be included in the direct cost base for calculating the F&A rate. • The higher the overall amount of cost sharing, the lower the overall F&A rate for Organized Research. Cost Share Officer • Manage institutional process of requesting cost share support – Proposal Stage – Post-Award Award Establishment • Provide daily guidance to departmental, school, and central administration • Serve as resource and subject-matter expert on cost sharing policy, process, and guidelines, and other more complex compliance issues. Institutional Policy “A University policy is defined as one with broad application throughout the University, that helps ensure coordinated compliance with applicable laws and regulations; promotes operational efficiencies; enhances the University's mission; or reduces institutional risk.” • Cost Sharing Policy identified for review (May 2012) Cost Sharing Policy • Critical University policy relating to both research administration and finance • Determined that significant rewrite was necessary – – – – Financial Value & Risk External and Internal Changes Ownership Process vs. Policy Northwestern’s Position on Cost Sharing Northwestern University engages in cost sharing when it is in the best overall interest of the University, but limited to situations in which it is mandated by the sponsor per solicitation or policy guidelines, or deemed appropriate in light of specific and compelling circumstances. Northwestern’s Position on Cost Sharing • Cost sharing helps Northwestern fulfill its mission as a premier research institution. • However, cost sharing represents an administratively complex and high-risk business objective. Cost sharing also increases the audit risk of a sponsored project. Northwestern’s Position on Cost Sharing • Northwestern does not typically cost share on a voluntary basis, consistent with its objective of maximizing sponsored cost reimbursement to support the continued growth of the research enterprise. • A voluntary cost sharing commitment should be made only when the competitive forces and perceived institutional benefit of receiving the award are deemed to be sufficiently strong to warrant the commitment. Process of Obtaining Institutional Support • All requests for institutional (Office for Research) cost share support should be directed to the Cost Share Officer in the Office for Sponsored Research. • In both mandatory and voluntary cost sharing situations: – Any commitment of University resources is at the discretion of the Office for Research typically in consultation with the appropriate Deans’ Offices. – Provision of institutional cost share is contingent upon the grant being awarded in the amount proposed, and upon the fulfillment of all department and school cost share commitments. A decrease in awarded budget typically reduces the cost share proportionally. Institutional Cost Share Requests • Used for investigators requesting institutional resources • PI Appointments drive cost share distribution • Cash requests leveraged Department(s) make commitments, School(s) match total department commitments, Office for Research matches total school and department commitments Process of Obtaining Institutional Cost Share Support 1. 2. Development Notification to of Cost Share OSR Cost Share Officer by Budget, PI Justification, and Letter of Support • PI or designate advises Cost Share Officer of upcoming proposal • OSR-EZ is developed through collaboration between department and Cost Share Officer 3. Negotiation and Formal Request of Cost Sharing Commitments • Cost Share Officer sends formal requests for cost share support to involved Chairs and/or Deans, depending on school model • Once all school approvals are gathered, OR makes a decision on their portion 4. Generation of Official Cost Share Letter of Support • All cost sharing commitments, including draft letter, are given to VPR for review and endorsement • Cost Share Officer scans letter to PI and sends original via intercampus mail Improvements to Process • Central guidance and assistance with cost share budget throughout proposal development • Cost Share Officer advises home department so each school’s expectations and processes are considered • Cost share form (OSR-EZ) provides a complete snapshot of request • All involved units receive consistent requests from one central person • Central review of complicated process is provided from start to finish ensuring seamless transition to unit’s cognizant Grant Officer Post Award Project Establishment • For awards involving institutional cost share support • Three Steps for Establishment 1. Notification and Evaluation of Award 2. Confirmation of Commitments 3. Establishment of 191 and 192 Chart Strings Current Philosophy: Fund 191 & 192 • 191 – Used to manage mandatory cost sharing and voluntary committed non-salary cost sharing – Expense budget (spending plan) established – Budget journals are run to establish revenue budgets (invoices) for all contributing units • 192 – Used to manage voluntary committed salary cost sharing and over-the-cap cost sharing – No expense budget in the financial system; no budget journals are run to establish revenue budgets (invoices) – Funded after-the-fact via transfer journals Problems • Current function does not allow clear distinction between mandatory and voluntary committed cost sharing, as the 191 captures both • No clear way to capture over-the-cap cost sharing, as 192 includes both over-the-cap and voluntary committed salary cost sharing • In many voluntary committed cost sharing situations, units are required to manage both a 191 and 192 for their salary and non-salary items – due to this management issue, units have often requested only one fund (usually, 191) be opened instead of 192 192 Issues • No expense budget (spending plan) established – Home unit must manually track on the total amount of cost sharing they must meet on an annual basis • No budget journals run for individual contributions under the contributing units’ department IDs – Home unit must separately track on which units have outstanding commitments and must communicate with those units directly to have them initiate transfer journals 192 Issues • Without the budget journal to establish the revenue budget (invoice), contributing units: – Have no formal way of approving their cost share commitments in the financial system – No way to easily view any outstanding commitments and fund them Recommended Changes • Clearly illustrate mandatory cost sharing, voluntary committed cost sharing, and over-the-cap cost sharing • Allow departments to more effectively manage the cash commitments associated with voluntary committed cost sharing • Change to the function of the fund 191 and 192, and creation of an additional cost share fund – the 193. • 191 and 193 would function the same way Recommended Changes 191 192 193 Current Model Mandatory (Salary & Non-Salary) Voluntary Committed (Non-Salary) Voluntary Committed (Salary) Over-the-Cap N/A Proposed Model Mandatory (Salary & Non-Salary) Over-the-Cap Voluntary Committed (Salary & Non-Salary) Future of Cost Sharing • Proposed OMB Uniform Guidance – If cost sharing will be considered, solicitation must specifically address how it will be considered – If cost sharing will not be considered, it should not be “encouraged” to eliminate ambiguity for applicants – Effectively – voluntary committed cost sharing is not expected and will not be used as a factor in review Future of Cost Sharing • National Science Foundation (NSF) has already taken the approach of prohibiting voluntary committed cost sharing – Still see requests for “institutional support” that are then captured in the Facilities & Other Resources section with no quantification • Shrinking federal budgets – Sequestration Questions? Kelly Morrison Grant and Cost Share Officer Office for Sponsored Research kellym@northwestern.edu Elizabeth Adams Executive Director, Evanston Office for Sponsored Research eadams@northwestern.edu