FIN-OVPR.09.27.12-Cost Share FAQ

advertisement

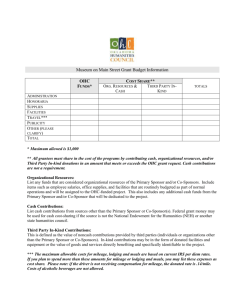

Office of the Vice President for Research Cost Sharing Frequently Asked Questions (FAQ) 1. What is cost sharing? Cost sharing is the portion of the total costs of a sponsored project that is borne by UNM rather than the sponsor. This can take the form of salary support for project personnel or other material contributions such as funds to purchase equipment. It can also include third party cost share contributions in support of the sponsored project. 2. What is the difference between mandatory, voluntary committed, and voluntary uncommitted cost sharing? Mandatory cost sharing is required by the sponsor as a condition for proposal submission and award acceptance. A mandatory cost sharing requirement will be specified in the sponsor's published request for proposals. Voluntary committed cost sharing is cost sharing that is offered in a proposal in a quantifiable manner but not required by the sponsor as a condition of proposal submission. Once offered by the institution and agreed to by the sponsor, it becomes an obligation the university must fulfill. The VPR position is that we do not contribute cost sharing voluntarily. Voluntary uncommitted cost sharing is cost sharing that is over and above an amount that was committed and budgeted for in a sponsored agreement. It is neither pledged explicitly in the proposal nor stated in the award documents, but it occurs in the course of executing a project, often when an individual expends more effort on the project than his or her commitment requires. 3. How is institutional support different from cost share? Institutional support is usually described within the narrative of the application or as an official support letter. Institutional support does not have any quantifiable amounts but general statements about facilities or other support the university has available. Cost share is described in quantifiable terms, for example “Professor X will contribute 10% effort” or “The school will provide salaries for 2 graduate students for 1 semester”. 4. What are “matching” funds? The term matching often is a source of confusion. The National Science Foundation and some other sponsors explicitly indicate that they view the terms matching and cost sharing to be synonymous. In addition, OMB Circular A-110 refers to "cost sharing or matching" without distinguishing between the two. For the purpose of UNM policy and this guidance document, these terms are considered to mean the same thing. In some circumstances a sponsor uses one term rather than the other. Some types of awards are referred to as matching grants, including the National Endowment for the _________________________________________________________________________________________________________ The University of New Mexico ∙ MSC05 3480 ∙ 1 University of New Mexico ∙ Albuquerque, NM 87131-0001 ∙ Phone 505.277.6128 ∙ Fax 505.277.5271 ∙ http://research.unm.edu Scholes Hall, Suite 327 Humanities Challenge Grants and the Kauffman Foundation Entrepreneurship Grants. With such awards the sponsor may require the university to match the sponsor's support with an equal or proportionate commitment of funds. Some matching grants require that the additional funds be obtained from sources outside the university. Some are paid in installments, the payments coinciding with the attainment of prespecified levels of funding. Matching grants are especially common in the sciences for large equipment grants, and they are standard practice in some government agencies. In the arts and humanities, matching grants may require additional layers of review, certification, and documentation in order to meet very rigid standards established by the sponsoring agencies. When required by the sponsor as a condition for proposal submission, this kind of matching is actually mandatory cost sharing. Awards with terms and conditions for matching may introduce administrative complexity, but they do not constitute a distinct class of sponsored agreements nor do the terms constitute a distinct type of cost sharing. When not required by the sponsor, an offer to match the sponsor's support is voluntary committed cost sharing. 5. What is In-kind cost sharing? An In-kind contribution is an item of cost for which institutional support is already in place, such as investigator effort; no new cash outlay is required. The most common form of in-kind contribution occurs when salary and fringe benefits paid by the university are committed to a specific sponsored project. By contrast, a cash contribution is a new, incremental cost such as for equipment, travel, or additional staff necessary to conduct the sponsored project, and for which a new funding source must be identified. The line between in-kind and cash cost sharing can be blurry, given that ultimately the two types may be indistinguishable to the sponsor when included in the proposal budget. And, indeed, it is not important to establish a firm distinction between the two types of contributions. However, among some administrators these terms are commonly used – and in-kind contributions of salary and fringe benefits should always be an investigator's first choice when offering cost sharing in a sponsored project proposal. 6. How does voluntary cost share negatively impact UNM? A specific and quantifiable offer of cost sharing in a proposal becomes an obligation that the university must fulfill. Generally, the university seeks to minimize these obligations because a voluntary commitment to cost share: Reduces a PI's flexibility to conduct other research/public service, because their effort is pledged to specific projects. Increases the requirements for auditable record-keeping. Cost sharing imposes a substantial tracking, monitoring, recording, and documenting burden on the PI and university administrators. Redirects departmental, school, or central resources from other mission-critical uses to support sponsored agreements. Every dollar of cost sharing results in the university forfeiting not only the recovery of a direct cost, but also the recovery of the associated indirect (facilities and administrative, or F&A) cost FIN-OVPR.11.01.12-Cost Share FAQ Page 2 of 5 (except in the case of cost-shared capital equipment or tuition, for which there is no associated F&A). Increases the university's exposure to audit liability. Cost sharing commitments are subject to audit. A failure to provide the level of cost sharing reflected in the approved award budget may result in disallowance of award costs, refund of award funds to the sponsor, and possible termination of the award. Typical audit findings involving cost sharing have pertained to: (1) grantee accounting systems not capturing cost sharing identified with a particular project, (2) failure to keep adequate source documentation for claimed cost sharing, (3) unclear valuation of in-kind donated contributions, and (4) lack of support for cost sharing contributions by sub- recipients. 7. Does a university waiver of F&A on a NSF proposal constitute cost sharing? Yes, NSF considers “waived F&A” to be voluntary cost sharing and inclusion of voluntary committed cost sharing in proposals to the NSF is prohibited. 8. If a proposal voluntarily offers cost sharing does that represent a binding commitment if the proposal is awarded? Yes, cost sharing that is identified in the proposal represents a binding commitment if awarded, regardless of whether it is mandatory or voluntary. 9. What is Third Party cost sharing? Contributions from an organization other than the prime recipient that is participating in the costs of the project. Most common instance would occur when subcontractors supply part of the cost share contributions. 10. Why is Third Party cost sharing risky? Dangerous because you must rely on someone else’s accounting. If the third party does not meet their cost share obligation, you must cover the commitment. 11. What is needed from a third party that is contributing cost share to a project? 1. Any cost sharing from a third-party source must be included in the proposal. Documentation must include a letter from such party on company letterhead signed by an individual authorized to commit the resources. 2. The cost sharing criteria are the same for the third party as it is for the university. 3. Because these expenditures will never appear in the university's accounting system, it is the principal investigator's responsibility to obtain an after-the-fact documentation of the cost sharing in a timely manner. The cost share documentation should include the expense categories and cumulative cost share expenditures and signature from the third party contributor certifying that the expenses have not been used as cost sharing for any other program or sponsor and were funded from nonfederal sources. This documentation must be forwarded to Contract & Grant FIN-OVPR.11.01.12-Cost Share FAQ Page 3 of 5 Accounting to file in the university's official record. The PI is responsible for reviewing the documentation to ensure the cost share commitment is being met. It should be noted that this documentation is subject to audit. 4. Unmet cost sharing by a third party will become the responsibility of the principal investigator and his/her department. 11. A PI commits effort and requests salary on a sponsored project, but then re-budgets his salary mid-year without reducing his effort. Is this considered cost sharing? Yes, because the PI is providing the effort committed in the proposal, the effort must be captured either on the sponsored project or in a cost sharing index. 12. If a proposal states that existing University equipment will be used to complete the project, do we have to account for this as cost sharing? No. UNM does not allow the cost sharing of equipment (already in-house), unless the receipt of the award is contingent upon such cost sharing. This is because this is included in the determination of the F&A rate and not charged as a direct expense, and because removing cost-shared equipment from the equipment depreciation cost pool requires cumbersome accounting procedures. 13. Can University facilities such as laboratory space be offered as cost sharing? No, University facility costs are charged to sponsors through the indirect cost rate. Instead of characterizing the use of facilities as cost sharing, the proposal budget justification may state that the facilities are "available for the performance of the sponsored agreement at no direct cost to the project." 14. I am concerned that my proposal will not be considered if I don’t show some voluntary committed cost sharing commitments. Will I have a better chance of being funded if I show voluntary committed cost sharing? No. If the proposal instructions include neither an eligibility requirement nor review criteria for cost sharing then there should be no advantage gained by including voluntary committed cost sharing. The Federal Register Vol. 68 No. 120 June 23, 2003 Section III, 2. Cost Sharing or Matching-Required states that agencies must state whether there is required cost sharing. 15. How do we account for cost sharing for emeriti faculty since they have no salary in the Banner system? If the emeritus faculty member is named as the PI on the award, the emeritus PI is volunteering his or her services on the research agreement. Volunteer services furnished by professional and technical personnel, consultants, and other skilled and unskilled labor may be counted as cost sharing or matching if the service is an integral and necessary part of an approved project or program. Rates for volunteer services shall be consistent with those paid for similar work in the recipient's organization. In the case of emeriti working on sponsored projects, it is generally acceptable to calculate the value of the contribution using the last salary rate multiplied by the percentage of time worked. FIN-OVPR.11.01.12-Cost Share FAQ Page 4 of 5 16. What are the consequences if a proposer includes voluntary committed cost sharing in a proposal to the National Science Foundation (NSF)? Inclusion of voluntary committed cost sharing is prohibited for proposals submitted or due on or after January 18, 2011, unless otherwise specified in the solicitation. While references to voluntary committed cost sharing may not always be identified during initial administrative screening of proposals, should violations of the policy be found during merit review or budget negotiation, the proposer does run the risk of the proposal being returned without review or declined. See the following link for the complete NSF report: http://www.nsf.gov/pubs/2009/nsb0920/nsb0920_1.pdf 17. Why does Contract and Grant Accounting (CGA) set up a separate index for cost sharing? Per OMB Circular A-110, costs must meet the same allowabilty standards of the sponsored agreement and be documented. If the cost share is effort, it must be certified in using the effort certification process. 18. Why do I have to spend cost share the same way as the award? Per OMB Circular A-110, costs must be allowable under the same applicable cost principles. 19. How does the funding get moved into the cost share index? CGA creates the Journal Entry to transfer money each year from the index that is funding the cost share to the cost share index. This is typically done at the beginning of the award and then annually for the duration of the award. FIN-OVPR.11.01.12-Cost Share FAQ Page 5 of 5