Under Armour

advertisement

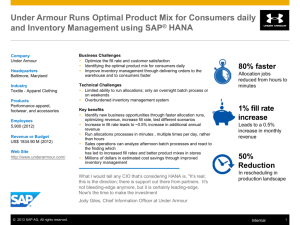

Under Armour Danny Fields PEST/Industry Analysis Snapshot • Headquartered in Baltimore, MD • Employ approximately 2200 people • Under Armour has built a leading brand name in hi-tech athletic gear – which is broken down into HeatGear, ColdGear, AllSeasonGear • Expanded into wider range of sportswear, casual apparel, and footwear Snapshot • Under Armour is the clear leader in the athletic apparel market in the U.S. (75% market share, $30 billion industry) • They have 31% market share of the overall U.S. athletic market (Nike leader at 36%) • 2010 net income of $68 million ($46 million – 2009) Company 2010 Net Income Under Armour $68 million Nike $1.9 billion Adidas $800 million Snapshot • Under Armour depends heavily on the U.S. Market Country Percentage of Sales (2008) United States 91% Canada 4.4% Other 4.6% PEST- Political • Some leagues and organizations across the U.S. have banned certain accessories that can be worn during games – Could reduce the number of potential customers in certain regions of the country • The U.S. Government has put pressure on performance apparel companies to reduce their carbon footprints – Under Armour has started producing apparel that is made with “green” technology, leaving less of a carbon footprint • Unrest in countries where manufacturing takes place – Approximately half of Under Armour’s products are manufactured in Central America and Mexico, relatively unstable regions with some political violence – This could possibly lead to factories being shut down, shipments being delayed PEST- Economic • The economic recession that started in 2008/2009 that led to a significant increase in unemployment – Under Armour’s products tend to be more expensive than their competitors and that could lead to people looking for cheaper alternatives • Exchange rate fluctuations – Under Armour has used foreign currency forward contracts to reduce some of the risk of exchange rate fluctuations • Increase in raw material prices – This has increased the cost to produce Under Armour products PEST- Social • The marketplace is becoming more eco-conscious – More pressure from performance apparel companies to reduce their carbon footprint and create eco-friendly products • Consumer trends in the performance apparel industry: – Compression (clothing that fits closely to the body, increases circulation and can increase strength, stamina, endurance, and recovery time) – Moisture wicking synthetics (takes moisture away from the body and is hydrophobic, meaning that it won’t become wet and heavy like cotton) – Antimicrobial fabrics (prohibits growth of bacteria) – Lifestyle integration (performing outside of fitness club, use in everyday life) – Fashionable (looks attractive to wear) PEST- Social • Dominance of soccer in foreign countries – Getting involved with soccer in these countries could help increase market share and awareness overseas PEST- Technological • E-Commerce – Websites allow for customers to purchase apparel over the internet without having to go through retailers • Social Networking – This allows for companies to interact with their consumers and increase interest in their products PEST- Summary Factor Trend Evaluation Political League bans Threat 2 Carbon footprint Opportunity 3 Unrest in manufacturing countries Threat 4 Recession Threat 5 Exchange rate fluctuations Threat 3 Increase in raw material prices Threat 5 Eco-Conscious market Opportunity 4 Economic Social Technological Impact (1=low 5=high) Performance apparel trends Opportunity 5 International Sports (soccer) Opportunity 3 E-Commerce Opportunity 4 Social Networking Opportunity 3 Rank in terms of importance 4 1 2 3 Defining the Industry • The performance apparel industry has been growing significantly over the past few years • Performance apparel accounts for over 10% of the sportswear market • Forecast to be worth $4.29 billion in 2012 • Sold to the individual consumer at retail prices and businessto-business at wholesale prices • The competition is global with the major players (Under Armour, Nike Adidas) selling products worldwide Industry Analysis - Buyers • Retailers are the major buyer in this industry – Including: Dick’s Sporting Goods, Modell’s, The Sports Authority, Footlocker, Finish Line, etc – In 2010, 73% of Under Armour’s net revenue came from wholesale distribution • Individual consumers are another buyer – Through factory house stores, website, catalog, specialty stores, etc – In 2010, 23% of Under Armour’s net revenue were from direct sales to consumers (through e-commerce and factory stores) Industry Analysis - Suppliers • Under Armour products are supplied from manufacturers all over the world Country/Region Units produced Asia 53% Central America 25% Mexico 19% • The suppliers have low power since Under Armour has many suppliers and they could easily switch to suppliers in other countries. Industry Analysis – Intensity of Rivalry • The intensity of rivalry is high in the performance apparel industry • The industry has continued to grow – The market is estimated at $6.40 billion, up 19.4% over the past 4 years – Expected to grow another 18.75% by 2014 • Many competitors – Nike, Adidas, Columbia, Champion, Russell, etc. Industry Analysis – Threat of Substitute Products • Substitute products for this industry could include: – Brands like Polo or Tommy Hilfiger – Consumers opting to dress more casual or professional, instead of going with the sports apparel look Industry Analysis – Threat of New Entrants • The threat of new entrants into the performance apparel market is relatively high • Even though there are well-known established brands in the industry (Nike, Adidas) the barriers to entry are relatively low – Low switching costs, access to distribution channels, low government restrictions • Under Armour is an example of a new entrant to come into the industry and have success using innovation and a differentiation strategy Industry Analysis Summary Factor Evaluation Buyer Power Strong Force (UA relies too heavily on few number of distributors. They rely on good faith policy and do not enter into any long-term customer contracts.) Supplier Power Benign (UA has many suppliers and it would be easy to switch) Intensity of Rivalry Strong (Due to the fact that the industry has been growing continually and the number of competitors in the industry) Threat of Substitute Products Benign (The possible substitutes don’t seem like they will have a likely impact on the industry) Threat of New Entrants Strong Force (Low switching costs, access to distribution, and low government restriction) Industry Analysis – Suggestions • Under Armour relies too heavily on a limited number of distributors – 31% of their 2008 sales came from two retailers (Dick’s Sporting Goods and The Sports Authority) • Under Armour needs to work harder on direct customer sales – If they increase their direct sales through their website, factory stores, or specialty stores, then they would lower their dependency on retailers • They could also look into forward integration and buying retail space to sell their products Conclusion • Performance apparel is a growing industry – Market is up 19.4% over the past 4 years • The recession and increase in raw material prices are major threats to companies in the industry • The biggest opportunities come from the trend of more active lifestyles, e-commerce, and international sports • Overall the economic factor is the most important to companies in the performance apparel industry Competitor/ Market Analysis Key Competitors Company Headquarters Brands Sales (2009) Nike Beaverton, OR Umbro, Converse, Hurley, Jordan $5.24 billion (apparel only) Adidas Herzogenaurach, Germany Reebok, Ashworth, Rockport $14.6 billion (total) Columbia Portland, OR Sorel Corporation, Mountain Hardwear, Pacific Trail, Montrail $1.24 billion Russell Corporation (subsidiary of Berkshire Hathaway) Bowling Green, KY Spalding, Huffy, Brooks N/A Champion (subsidiary of HanesBrands) Winston-Salem, NC N/A Under Armour Baltimore, MD $606 million Strategic Grouping Company Product Diversity Geographic Coverage Marketing Effort Nike Performance apparel, casual apparel, jerseys, footwear, equipment Global Strong brand identity, well known logo and slogan, athlete sponsorships Adidas Footwear, performance apparel, casual apparel, jerseys, soccer kits, equipment Global Focus on promoting running and soccer products, international sports and events sponsorships Columbia Outerwear, footwear, headgear, camping equipment, accessories, skiwear Global Focus on outdoors activities (skiing, hiking, camping) Russell Footwear, apparel, sports equipment, uniforms Global Lower cost clothing, provides uniforms for some high schools and colleges Champion Sportswear (Hoodies, t-shirts, mesh clothing) Global Lower cost clothing, urban fashion Under Armour Performance apparel (Heatgear, Coldgear, AllSeasongear), footwear Global High quality products, international sponsorships to increase global reach Strategic Grouping • Because of the similar products and geographic coverage, Nike, Adidas, Russell, and Champion are the main competitors to Under Armour in performance apparel How they compete • Strong marketing campaigns – Nike, Adidas, Under Armour are well known for their marketing campaigns – Adidas was sponsor for the FIFA World Cup but Nike is better known for their commercial using popular players like Ronaldo, Rooney, Ronaldinho, Landon Donovan, etc – UA used “Click-Clack” and “We must protect this house” slogans • Low cost outsourcing for manufacturing • Innovation • Distribution – Through retailers and factory stores • Endorsements – Nike – Michael Jordan, Tiger Woods, Lance Armstrong, Ronaldinho, LeBron James, etc – Adidas – David Beckham, Lionel Messi, etc – UA – Michael Phelps, Ray Lewis, Lindsey Vonn, etc Product Scope • The products are all sports related in some fashion – – – – Performance apparel that is used for a sport activity Licensed apparel that is worn casually Footwear that can be used for both sport and everyday life Uniforms provided to leagues, teams, and schools Geographic Scope Company Regions Percentage of Sales (2009) Nike United States 34.1% Europe 28.7% Middle East and Africa 17.3% Asia Pacific/Latin America 20% North America 22.9% Asia/Latin America 34.8% United States/Canada 91% (2008) Rest of the world 4.6% (2008) Adidas Under Armour • Nike and Adidas have a much bigger global reach than Under Armour. • All 3 have sponsorship deals with international sports teams and events to help increase exposure and awareness Core Competencies Company Core Competencies Nike Innovative products, marketing, globalization, teamwork, competitiveness Adidas Brand identity with running and soccer Columbia Brand association with outdoor activities Champion Staple in hip-hop and urban fashion Under Armour High quality, innovative products that increase athlete performance Market Size • Performance sportswear global market is estimated at $6.40 billion • Risen 19.4% over the past 4 years • Forecasted to rise to $7.6 billion by 2014 Key trends • Consumers are becoming more eco-conscious – Impacts the type of technology that will be used in performance apparel • Performance apparel being worn in everyday life – This makes style and fashion more important in product design • People are more conscious about their health – An increase in active lifestyles will increase the demand for performance apparel products Market/Product Growth • Performance apparel is a fast growing retail segment in Asia – Average sales of $3 billion annually – 2008 Beijing Olympics helped increase exposure of performance apparel • Competitors are also looking to other emerging markets like Turkey, Russia, and Brazil for growth opportunities – Sales for competitors have increased over the years in these countries Target Market Company Target Consumer Nike Active people who want high quality sporting goods Adidas Athletes mainly involved in running and soccer Columbia People who enjoy the outdoors (hiking, skiing, camping) Russell People looking for low cost alternatives to Nike, UA, Adidas Champion Low cost alternative to Nike, UA, Adidas. As well as people living in urban areas Under Armour Athletes who are serious about increasing performance in their respective sport BCG Matrix Social Media • Social Media allows companies to reach consumers directly and receive feedback – Under Armour ran a social media advertising campaign to try to engage hard-to-reach females – Nike’s Jordan brand uses social media to increase brand loyalty – During the 2009 NBA All-Star Game, Adidas allowed fans of their facebook page to follow Dwight Howard throughout the All-Star Game with videos and photos from him Conclusion • The main competitors to Under Armour are Nike, Adidas, Russell, and Champion due to their similar product categories – Nike and Adidas compete on a differentiation strategy with Under Armour, while Champion and Russell compete on a low cost strategy • They compete using effective marketing campaigns – Well known logos and slogans • Nike and Adidas have large geographical coverage – Which lowers the dependency on their home country for sales: Nike (U.S.), Adidas (Germany) Conclusion • The performance apparel market continues to increase – 19.4% rise in worth over the past 4 years • People are having more active lifestyles – Increased demand for performance apparel • Emerging markets will be important for future growth – Competitors have seen an increase in sales in China, Turkey, Russia and Brazil Internal Analysis/SWOT/Strategy Business Model • Under Armour develops innovative products • They outsource their production to low cost subcontractors • They distribute to large retail stores (Dick’s, Sports Authority) and have their own retail stores • Secure endorsements with high-profile athletes and sponsorships with teams and events • Develop a strong brand Performance Year Sales Net Income 2010 $1.06 billion $68.5 million 2009 $856.4 million $46.8 million 2008 $725.2 million $38.2 million 2007 $606.6 million $52.6 million 2006 $430.7 million $39 million Performance • Increased performance was a result of higher revenue margins in their Direct-to-Consumer channel – Expansion of factory house stores – Less reliant on retailers (Dick’s, Sports Authority) Product Performance 2010 2009 % Change Apparel $853,493 $651,779 30.9 Footwear $127,175 $136,224 (6.6) Accessories $43,882 $35,077 25.1 Total Net Sales $1,024,550 $823,080 24.5 Licensing Revenues $39,377 $33,331 18.1 Total Net Revenues $856,411 24.2 $1,063,927 BCG Matrix Performance Apparel Footwear Accessories Value Chain Analysis Primary Activity Inbound Logistics Manufacturers receive raw materials Operations Raw materials used to create UA products Outbound Logistics Finished products are sent to retailers and UA owned stores Marketing and Sales UA has well recognized athletes to endorse their products and sponsorships deals with many teams around the world Service Websites and social media allow for interaction with customers SWOT Strengths Weaknesses Opportunities Threats • Brand Equity • Innovation •Quality of Products • Lack of international sales • Prices • Relies heavily on distributors • Emerging Markets • Performance apparel industry is growing • Consumers are more health conscious • Increase in active lifestyles • E-Commerce • Increasing cost of raw materials • Rules and Regulations for performance apparel • Economic Recession • Exchange rate fluctuations Generic Strategy Generic Strategy • UA has always used a differentiation strategy • Originally, they just sold performance apparel but now that are broadening their scope by adding footwear, accessories and more casual apparel Grand Strategy Innovation Continue to create innovative products to stay ahead of competitors (Nike, Adidas) Market Development They need to work on getting their existing products into new markets. UA relies too heavily on North America Market Penetration They are very successful with performance apparel in the NA market but they need to work on other product categories that are not as successful (footwear, accessories) Product Development They have also been successful at developing new products in their existing NA market Ansoff Matrix •They are very successful in their market (90% of sales) • They should focus on developing new markets • If they can successfully get their existing products into those new markets, then they can move towards diversification International Performance • UA is highly dependent on North America for sales – Around 90% of sales comes from North America – About 4% from Europe • UA is using sponsorships and licensing to increase international exposure – – – – French rugby club ASM Clermont– French champions last year Wales national rugby team Tottenham Hotspur (EPL)– Champions League Quarter-finalists Other teams in Mexico, Greece, Germany Conclusions • UA has seen an increase in sales over the past 5 years • They have increased their revenue in the Direct-to-Consumer channel – Expanded factory house stores – Lowered reliance on retailers • Strengths include innovation and brand equity (North America) • Biggest weakness is international sales – About 10% of sales from outside North America • Competes using a differentiation strategy and moving towards a broad scope Recommendations • Find recognizable international athletes to endorse UA products – They have endorsers that are well recognized world-wide but are U.S. based (Michael Phelps, Tom Brady) • Continue to expand on factory house stores (locally and globally) – Lowers dependence on retailers – Will increase their profit margin • Remain innovative to differentiate from competitors (Nike, Adidas)