GST - Ficci

advertisement

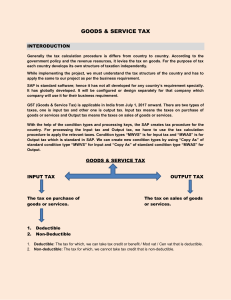

GST – Why? Legal Requirements for proposed GST Features of GST Model Procedural Aspects Current State of Play Issues under Discussions Impact on Industry Areas where Industry can contribute 2 Reduce barriers of inter-state trade & create a Common National Market Redress the imbalance in taxation between manufacturing & the service sector Private Investment choices should be influenced by economic considerations and not by tax rates or tax exemptions Reduce multiplicity of taxes and ensure transparency Reduce the incidence of taxation by expanding the taxable base Mitigation of cascading / double taxation 3 Constitutional amendment to enable the Centre to levy & collect CGST manufacturing stage the States to levy & collect SGST on Services Model legislation for CGST, IGST & SGST Rules to be drafted for Place of Supply Rules beyond to determine location of supply of goods or services to determine whether supply is intra-state or inter-state Rules to be drafted for laying down procedures for the administration of CGST, IGST & SGST specific measures to be made for Dispute Resolution & 4 Advance Ruling Destination based taxation Dual GST Model Central GST (CGST) & State GST (SGST) on intra-state supplies Integrated GST (IGST) on inter-state supplies Integrated GST (IGST) on imports Additional Tax not exceeding 1% on inter-state supplies of goods alone Taxation on a common base Common taxable event - Supply of goods or services or both for a consideration Export of goods or services – Zero rated Common list of exempted goods or services 5 Optional Threshold exemption for both components of GST Optional Compounding scheme for taxpayers having taxable turnover up to a certain threshold above the exemption All goods or services likely to be covered under GST except: Alcohol for human consumption - State Excise plus VAT Electricity - Electricity Duty Real Estate - Stamp Duty plus Property Taxes Petroleum Products – to be brought under GST from a later date on recommendation of GST Council Tobacco products – under GST plus Central Excise 6 Three tier GST Rate structure – Merit rate for essential goods Standard rate for goods and services in general Special rate for precious metals Floor rate with a small band of rates for standard rated goods or services for CGST & SGST HSN based classification of goods Service Tax Accounting based classification of services 7 Centre’s Taxes proposed to be subsumed- in the nature of indirect taxes on supply of goods or services Central Excise Duty Additional Excise Duty Excise Duty levied under the Medicinal & Toiletries Preparation Act Service Tax Additional Customs Duty commonly known as Countervailing Duty (CVD) Special Additional Duty of Customs (SAD) Surcharges & Cesses 8 State Taxes proposed to be subsumed- in the nature of indirect taxes on supply of goods or services State VAT / Sales Tax Central Sales Tax Purchase Tax Entertainment Tax (not levied by the local bodies) Luxury Tax Entry Tax (All forms) Taxes on lottery, betting & gambling Surcharges & Cesses 9 Tax payments by supplying dealers in their own State Availability of seamless credit to buying dealers Utilization of Input Tax Credit by buying dealers CGST credit for paying CGST & IGST in that order SGST credit for paying SGST & IGST in that order IGST credit for paying IGST, CGST & SGST in that order No credit of Additional Tax 10 Credit of SGST used for payment of IGST – to be transferred by Exporting State to the Centre Credit of IGST used for payment of SGST – to be transferred by Centre to Importing State Inter-Governmental Transfers to take place at the end of Tax Period based on the Return filed by the taxpayer Fund settlement a matter between Centre & States No role of taxpayer in inter-governmental fund settlement Central Government to act as a clearing house and transfer the funds across States 11 Uniform State wise e-Registration Common e-Return for CGST, SGST, IGST & Additional Tax Common periodicity of Returns for a class of dealers Uniform cut-off date for filing of Returns Mandatory reporting of supply & purchase invoice details prior to or along with filing of e-Return System based verification of returns on monthly basis System based validations of ITC availed, utilized & Tax payments 12 Single challan for all four type of tax payments Constitution Amendment Bill passed in Lok Sabha Pending with Select Committee of Rajya Sabha GST Council to be constituted after enactment of Constitution Amendment Bill Reports under approvals: Place of Supply Rules IGST Model Business processes relating to Registration, Refunds, Return & Payments 13 Model GST Law being drafted: Authorizing the Central & State Governments to levy GST on intra-state supplies (CGST & SGST) Authorizing the Central Government to levy GST on inter-state supplies (IGST) Levy of GST on imports GSTN already incorporated as a Section 25 company in March 2013 GSTN already received bids for establishing IT framework 14 Rates of CGST, IGST & SGST Threshold limits of exemptions & compounding List of exempted goods & services Transitional provisions for treatment of accumulated CENVAT credit Dispute Resolution Mechanism Centre-State mechanism for deciding on future changes in rates & changes in the exemption list for goods and services Distribution of responsibility between the Centre & State in implementing the three pillars of the compliance verification system – Return Scrutiny, Audit & Anti-evasion Treatment of existing area based exemptions Treatment of current exemptions 15 Operational Procurement Inter-state procurement of goods & services – location no longer a constraint due to credit eligibility Inter-state vs. Intra-state GST – no longer impact the sourcing decision Manufacturing Multiple small size plants vs. mega plants Decision based on impact on logistics cost vs. manufacturing cost Relocation of plants based on overall costs & service levels Costing Impact on cost of input /service - rate change, full creditability and/or withdrawal of exemptions 16 Operational Distribution Warehouse need not be State specific One warehouse can supply to more than one state & one state market can actually be serviced by more than one warehouse Location of warehouse may get decided by the center of gravity of demand cutting across many states Size of warehouse would be more determined by the market opportunities proximate to the warehouse location Distribution network to align with market demand & competitive advantage Warehousing may need relook 17 Operational Pricing Impact on overall pricing of the goods & services – factoring of GST credits Supply Chain Impact on cost of operations o Compression of the supply chain o Disintermediation o Unfettered credit throughout the supply chain o Uniformity in Sourcing Decisions – Centralization Tax Challenges Place of Supply Rules; Transition stock; Negative list; saving 18 clauses, etc. Financial Working Capital / Cash Flow – likely increase Higher tax outgo on procurement of goods & services Shift in taxable event from manufacture to supply Shift in point of tax collection Replacement of exemption by refund schemes Taxability of branch transfers/inter office supplies/captive consumption Input credits Availability of accumulated credits on transition to GST Continuity of ISD concept Amplified credit availability Credits for mixed supplies Credits on goods from excluded sectors 19 Infrastructural Redesign IT systems Training / Communication Accounting Change in formats of invoices, reports, returns, etc. Redefining the logic & updating the masters Staff training on compliance requirement Realigning with procurement & distribution partners Regular communication with stake holders Compliance requirement Registration Tax payments Statutory declarations and Returns 20 Tax Management GST would lead to de-centralization of indirect tax function Focus on strategy, processes & technology to manage indirect taxes Greater stake in accurate reporting due to significant input tax credits as compared to the present scenario Tax administration to use IT enabled platform & processes, e.g. tax data warehouse, online tracking of inter-state movements, information exchange etc. Need to re-design & re-engineer the tax function 21 Treatment of procurement of goods & services for exports Treatment of royalty/license fee in valuation of imported goods under GST regime Valuation in case of stock transfers Treatment of deemed sale (i.e. lease, works-contract, etc.) Classification of goods & services Manner of exemptions for backward areas Place of Supply Rules Transitional issues Dispute resolution mechanism 22 THANK YOU