GST on Entertainment Invoice for Visitors Clients

advertisement

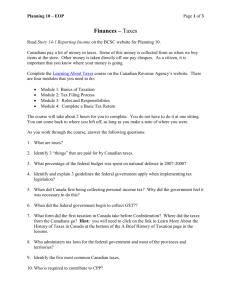

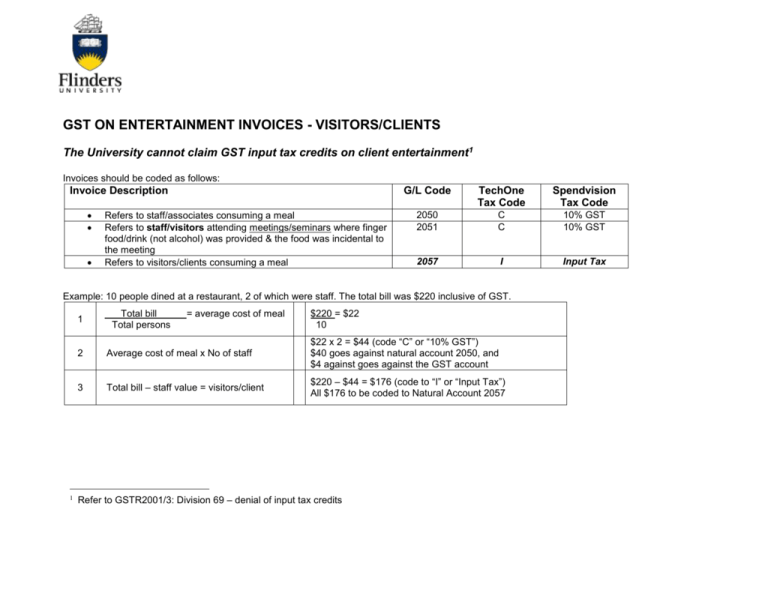

GST ON ENTERTAINMENT INVOICES - VISITORS/CLIENTS The University cannot claim GST input tax credits on client entertainment1 Invoices should be coded as follows: Invoice Description Refers to staff/associates consuming a meal Refers to staff/visitors attending meetings/seminars where finger food/drink (not alcohol) was provided & the food was incidental to the meeting Refers to visitors/clients consuming a meal G/L Code TechOne Tax Code Spendvision Tax Code 2050 2051 C C 10% GST 10% GST 2057 I Input Tax Example: 10 people dined at a restaurant, 2 of which were staff. The total bill was $220 inclusive of GST. 1 1 Total bill Total persons = average cost of meal $220 = $22 10 2 Average cost of meal x No of staff $22 x 2 = $44 (code “C” or “10% GST”) $40 goes against natural account 2050, and $4 against goes against the GST account 3 Total bill – staff value = visitors/client $220 – $44 = $176 (code to “I” or “Input Tax”) All $176 to be coded to Natural Account 2057 Refer to GSTR2001/3: Division 69 – denial of input tax credits