5. Course Planning and Assessment

advertisement

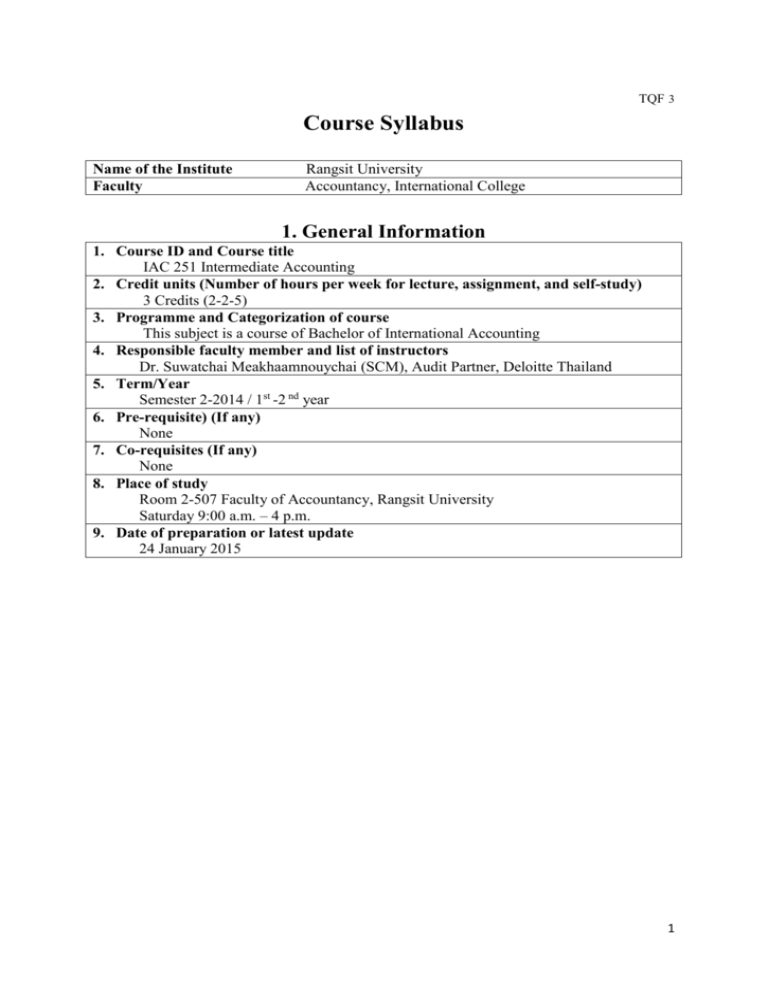

TQF 3 Course Syllabus Name of the Institute Faculty Rangsit University Accountancy, International College 1. General Information 1. Course ID and Course title IAC 251 Intermediate Accounting 2. Credit units (Number of hours per week for lecture, assignment, and self-study) 3 Credits (2-2-5) 3. Programme and Categorization of course This subject is a course of Bachelor of International Accounting 4. Responsible faculty member and list of instructors Dr. Suwatchai Meakhaamnouychai (SCM), Audit Partner, Deloitte Thailand 5. Term/Year Semester 2-2014 / 1st -2 nd year 6. Pre-requisite) (If any) None 7. Co-requisites (If any) None 8. Place of study Room 2-507 Faculty of Accountancy, Rangsit University Saturday 9:00 a.m. – 4 p.m. 9. Date of preparation or latest update 24 January 2015 1 TQF 3 2. Learning Objectives and Development Objectives 1. Goals of the unit The students will be able to learn and understand about IFRS conceptual framework for the general purpose financial statements; overall concepts of the statements of financial position, the statement of comprehensive income, the statement of cash flows; accounting for cash and receivables, inventories, property, plant and equipment, intangible assets, and investments. 2. Objectives of the unit and improvement 1. Understanding IFRS conceptual framework for the general purpose financial statement; the statement of financial position; the statement of comprehensive income; the statement of cash flows.. 2. Understanding how to IFRS based accounting principles to account for cash and receivables. 3. Understanding how to IFRS based accounting principles to account and value for inventories. 4. Understanding how to IFRS based accounting principles to account for property, plant and equipment, and intangible assets. 5. Understanding how to IFRS based accounting principles to account and value for investments. 3. Course Content and Activities 1. Course content IFRS-based accounting for cash and receivables, inventories, property, plant and equipment, intangible assets, and investments. 2. Number of hours used per semester Lecture Tutorial Lecture 45 hours per semester Upon requested Practice/Field job/Internship Homework, assignment, presentation Personal Study 5 hours per week 3. Number of hours per week for advising and academic counseling for individual students - Students can request for academic advices prior/after classes or in class hours. - Students can make appointment or stop by at the faculty members’ offices during the specified office hours (15 hours per week). - Students can request academic help through the Department or emails of faculty members. - Students can contact instructor by email, phone, Facebook on emergency event. 2 TQF 3 4. Learning Outcomes 1. 2. Morals and ethics The course aims to develop students to have morals, understand ethics and codes of conducts in their real life. The students will be able to possess ethical, moral and honest behavior academically and professionally. 1.1 Morals and ethics needed to develop - The students will be developed to perform ethical and honest behavior to comply with professional codes of conducts, rules and regulations of the organizations and the society. - The students need to have self-disciplinary and punctuality in attending the class and submitting assignments. - The students need to pay respect to other’s people’s rights and opinions. 1.2 Methodology - Lecture and give case studies on IFRS-based accounting. - Encourage students to express their opinions in class. - Case study analysis on IFRS-based accounting and giving effective presentations. - Check attendance and apply the classroom policies. 1.3 Assessment - Observing students behavior and manner in class. - Evaluating case study analysis and presentation. Knowledge The students will be able to understand IFRS conceptual framework for the general purpose financial statements; overall concepts of the statements of financial position, the statement of comprehensive income, the statement of cash flows; accounting for cash and receivables, inventories, property, plant and equipment, intangible assets, and investments. They also will be able to apply what they learned into the real world situation. 2.1 2.2 2.3 Expected knowledge to be gained The students will be able to: - Obtain a sound foundation on IFRS-based accounting. - Learn basic IFRS-based financial statement preparation. - Understand the basic IFRS-based accounting including measurement and recognition, derecognition, presentation and disclosure. Methodology Lecture and give case studies on how to effectively improve and expand one’s IFRS-based accounting skills so that students can apply knowledge in the real world situation. Assessment - Examinations on theories and application related to IFRS-based accounting. - Homework, quizzes and examinations on contents from time to time. - Evaluating case study analysis and presentation. - Check class attendance. 3 TQF 3 3. Intellectual Skills The students will be able to critically and logically analyze IFRS concepts and ideas in problem solving and decision making and also utilize theoretical knowledge to record basic accounting transactions for assets and related accounts, and to prepare financial statements relevant to the assets. 3.1 4. Intellectual skills needed to develop The students will be able to: - Critically and logically analyze IFRS concepts and ideas in problem solving and decision making. - Successfully find solutions to record basic accounting transactions and decision making related to business entities. - Have innovative and initiative ideas in utilizing theoretical knowledge to record basic accounting transactions and prepare financial statements. - Solve the problems intellectually and professionally. - Analyze and predict the expected outcomes from decision making, problems solving. - Initiate and develop systematic, effective, efficient working process with respect to the real world situation. 3.2 Methodology - Lecture and give case studies on IFRS-based accounting; how to record basic accounting transactions and prepare financial statements build one’s analyzing skills. - Encourage students to express their opinions in class. - Case study analysis on adjusting entries and preparing financial statements. - Check attendance and apply the classroom policies. 3.3 Assessment - Observing students behavior and manner in class. - Evaluating case study analysis and presentation. Interpersonal skills and responsibility The students will be able to cope with changing environmental issues and continuously engage in self and professional development. 4.1 Interpersonal skills and responsibility needed to develop The students will be able to: - Identify the cause of problems and develop effective action plans for personal and business solutions under IFRS-based concepts. - Open and willing to learn and reasonably accept criticism. - Work as a team to analyze IFRS-based accounting. - Have responsibility in the homework and assigned term paper. - Possess ability of being a good leader and a good follower and solving problems based on their priority in the assigned term paper. - Contribute in making effective solutions to group problems in the assigned term paper. 4.2 Methodology - Homework and quizzes from time to time. - Case study analysis on IFRS-based accounting and presentation to the class. - Discuss basic accounting transaction and prepare financial statements. 4 TQF 3 4.3 5. Assessment - Examinations on theories and application related to IFRS concepts and measurement of IFRS-based ideas. - Homework, quizzes and examinations on contents from time to time. - Evaluating case study analysis and presentation. - Check class attendance. Quantitative skills, communication skills, and Information Technology skills - The students will be able to possess ability in acquiring and analyzing information in making personal and business decisions on mathematical issues. - The course also develops quantitative analysis skills and Information Technology skills to facilitate an IFRS-based study. 5.1 5.2 5.3 Quantitative skills, communication skills, and Information Technology skills The students will be able to: - Possess and able to apply appropriate IFRS-based accounting skills and techniques to solve business entity problems. - Possess ability in acquiring and analyzing information in making business entity and global decisions. - Possess ability in summarizing, communicating and presenting information effectively. - Possess discretion in the use of communication and information in an appropriate manner. Methodology - Self-study in IFRS-based accounting and decision making related to business entity and global problems from the website. - Assign group assignments and discuss article on basic accounting transaction and current global news. Assessment - Examinations on theories and application related to IFRS concepts and measurement of IFRS-based ideas. - Homework, quizzes and examinations on contents from time to time. - Evaluating case study analysis and presentation. - Check class attendance. 5 TQF 3 5. Course Planning and Assessment 1. Course Planning Class Topics/Details 1-2 24/1/15 3-4 31/1/15 5-6 14/2/15 Financial Reporting and Accounting Standards (CH1) Conceptual Framework of Financial Reporting (IFRS) (CH2) Income Statement and Related Information (CH4 (LO1-5) and IAS 1) Statement of Financial Position and Statement of Cash Flows (CH5 (excluding LO6-7), IAS 1 and IAS 7) Cash and Receivables (CH7, IAS 7 and IFRS 9 (partial)) 7-8 28/2/15 Inventories (CH8 and CH9) MID TERM CH 1, 2, 4, 5, 7, 8 and 9 9 - 10 14/3/15 Acquisition and Disposal of Property, Plant and Equipment (CH10 and IAS 16) Hours 6 Activities and Medias Lecture and Discussion using PowerPoint Slides Lecturer SCM 6 Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions SCM 6 Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions SCM Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions SCM 6 6 SCM 6 TQF 3 Class Topics/Details Hours 11 – 12 21/3/15 Depreciation, Impairment and Depletion (CH11, IAS 16, IAS 36, and IAS 38) 6 13 – 14 28/3/15 Intangible Assets (CH12 and IAS 38) 6 Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions SCM 3 Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions SCM Investment Property (IAS 40) 15 25/4/15 Investment (CH17 and IFRS 9 (partial)) Activities and Medias Quiz Lecture and Discussion using PowerPoint Slides Case Studies, Exercises and SelfStudy Questions Lecturer SCM FINAL 2. Assessment Activities Learning Evaluations outcomes 1 1.1,1.6,1.7,2.1, Test 1 (class 1 – 4) 2.4-2.6,3.2 Midterm Examination Test 2 (class 9 – 12) Final Examination 2 1.1,1.6,1.7,2.1, Case studies, research, and 2.4-2.6,3.2, assignments 4.1,5.3-5.4 3 1.1-1.7,3.1 Attendance, class participations and sharing and Q&A during the classes Class (Date) 5 (14/2/15) During 8 – 9 13 (28/2/15) After 15 Throughout the semester Throughout the semester Proportion of the Evaluation 5% 30% 5% 35% 25 % 7 TQF 3 6. Course Resources 1. Required text books and readings Kieso, Donald.E., Weygandt, Jerry J., Warfield, Terry.D., , Intermediate Accounting, 2nd edition, ISBN 978-1-118-443965. Wiley. 2. Supplementary reading list/references Journal of Accounting Professions Journal of Accounting Research Journal of Accounting and Economics The Accounting Review Contemporary Accounting Research 3. Recommended reading list/references - Website WileyPLUS at www.wileyplus.com/experience - The Securities and Exchange Commission website at www.sec.or.th - The Stock Exchange of Thailand website at www.set.or.th - The International Federation of Accountants website at www.ifac.org - IFRS foundation website at www.ifrs.org - Deloitte www.iasplus.com - PwC www.pwc.com/ifrs - KPMG www.kpmg.com/ifrs - EY www.ey.com/ifrs 8 TQF 3 7. Course Feedback and Improvement 1. 2. 3. 4. 5. Course evaluation by students - Discussion with students - End-semester questionnaire - Class evaluation/peer evaluation - Questioning and answering session in class Other methods of course evaluation - Discussion with other faculty member and staff Course development and improvement - Course workshop and meeting - Course mentor - Class observation - Knowledge sharing Quality assurance of the course - Internal committees - External committees - Internal quality assurance - External quality assurance Course revision and development plan - Major revision every 5 years - Minor revision where appropriate 9