Course Outline - University of Canterbury MBA

advertisement

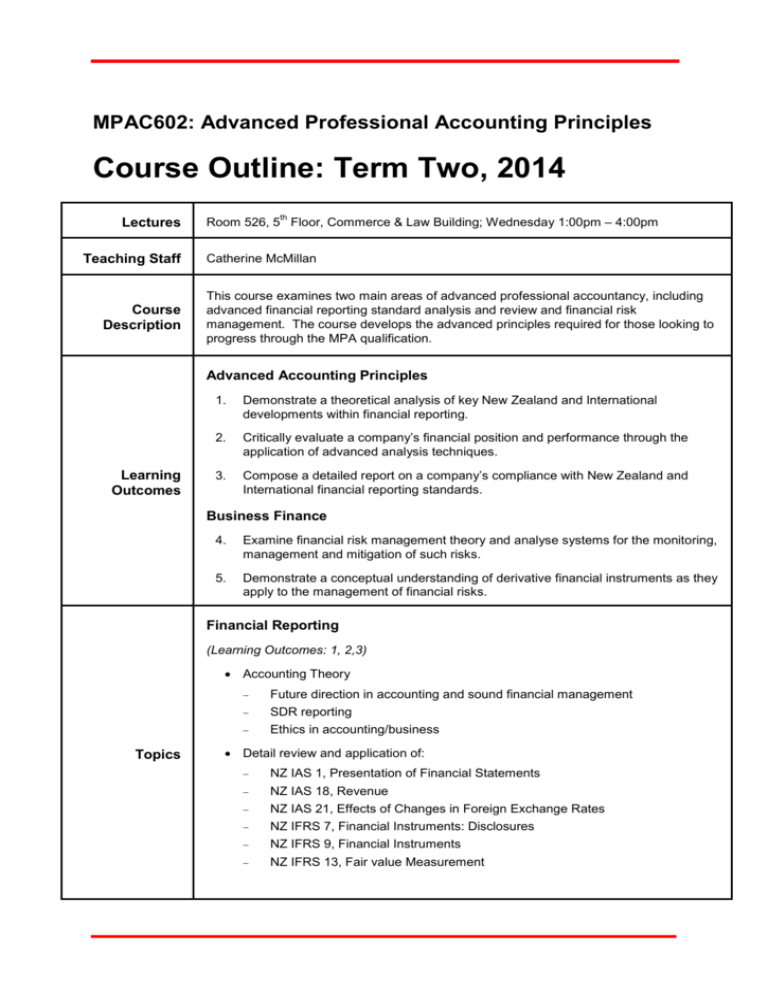

MPAC602: Advanced Professional Accounting Principles Course Outline: Term Two, 2014 Lectures Teaching Staff Course Description th Room 526, 5 Floor, Commerce & Law Building; Wednesday 1:00pm – 4:00pm Catherine McMillan This course examines two main areas of advanced professional accountancy, including advanced financial reporting standard analysis and review and financial risk management. The course develops the advanced principles required for those looking to progress through the MPA qualification. Advanced Accounting Principles Learning Outcomes 1. Demonstrate a theoretical analysis of key New Zealand and International developments within financial reporting. 2. Critically evaluate a company’s financial position and performance through the application of advanced analysis techniques. 3. Compose a detailed report on a company’s compliance with New Zealand and International financial reporting standards. Business Finance 4. Examine financial risk management theory and analyse systems for the monitoring, management and mitigation of such risks. 5. Demonstrate a conceptual understanding of derivative financial instruments as they apply to the management of financial risks. Financial Reporting (Learning Outcomes: 1, 2,3) Accounting Theory Topics Future direction in accounting and sound financial management SDR reporting Ethics in accounting/business Detail review and application of: NZ IAS 1, Presentation of Financial Statements NZ IAS 18, Revenue NZ IAS 21, Effects of Changes in Foreign Exchange Rates NZ IFRS 7, Financial Instruments: Disclosures NZ IFRS 9, Financial Instruments NZ IFRS 13, Fair value Measurement MPAC602: Term Two, 2014 Analysis of Financial Statements, including: Detailed ratio analysis Trend and sensitivity analysis Qualitative consideration Major impact due to unusual events Finance risk management (Learning Outcomes: 4,5) Critique of financial risk management techniques, including: Hedging using derivative instruments ● Swaps ● Options ● Futures contracts ● Forward exchange Analysis of the treasury management function within organisations Required Text: Textbook Deegan, C, Samkin, G. (2013). New Zealand financial accounting; 6th ed; McGraw-Hill, 2013 The text is available for purchase from UBS (The University Bookshop) and is also available on 3-hour restricted loan in the Central Library. Mitrione, L., M. Rankin, K Chambers, J.J. Weygandt, D .E Kieso and P. D Kimmel (2013). rd Principles of Financial Accounting, 3 edition, Milton Qld: John Wiley & Sons Australia Ltd. Additional reading Alfredson, K. et al. (2010). Applying international financial reporting standards; 2nd ed; John Wiley & Sons Australia, 2010. New Zealand Institute of Chartered Accountants; Chartered accountants journal of New Zealand (Topical articles). A number of NZ IFRS and NZ IAS’s. Readings as advised on LEARN. 2 MPAC602: Term Two, 2014 Assessment Summary Type Due Weight Essay 1:00pm, Wednesday 21 May 2014 20% Group Presentation Weeks 3 - 6 (Group mark) 20% Group Project Distributed Wednesday 4 June; Due 1:00pm Wednesday 25 June 2014 (Group mark) 20% Participation Weekly 10% Exam Distributed 25 June; Due 10:00am, Monday 7 July 30% Note that aegrotats are not available for any item of assessment in this course without the prior approval of the MBA Director in consultation with the lecturer. Wherever possible and with the lecturer’s agreement, a replacement assessment will be sought in each case where a student has not been (with valid reason) able to submit or has been disadvantaged in some way. Lecture Contact hours 30 hours Preparation for lectures 35 hours Essay 20 hours Group Presentation and Project 45 hours Exam (including preparation) 20 hours Workload Total MPA Policies 150 hours See current Student Guide - Copies available from Executive Development Programmes Office 3 MPAC602: Term Two, 2014 Lecture Schedule Week/Date Topic Reading Week 1: 30 April Accounting Theory D&S Chapters 2 and 3 Week 2: 7 May Future directions D&S Chapter 32 SDR Articles on LEARN Accounting Theory Articles on LEARN Ethics in accounting/business Week 3: 14 May Week 4: 21 May Week 5: 28 May Week 6: 4 June Week 7: 11 June Financial reporting framework D&S Chapter 17 NZ Framework D&S Chapter 4, pp133-135 Presentation and disclosure D&S Chapter 10, pp320-321 NZ IAS 1 Presentation of Financial Statements NZ Framework NZ IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors NZ IAS 1 Financial Instruments D&S Chapter 15 NZ IFRS 7 Financial Instruments: Disclosures NZ IFRS 7 NZ IFRS 9 Financial Instruments (2013) NZ IFRS 9 Revenue recognition D&S Chapter 16 NZ IAS 18 Revenue NZ IAS 18 Fair Value and Foreign Currency D&S Chapters 30 and 31 NZ IFRS 13 Fair Value Measurement NZ IFRS 13 NZ IAS 21 Effects of Changes in Foreign Exchange Rates NZ IAS 21 Analysis of Financial Statements Mitrione et al. Chapter 19 NZ IAS 8 D&S Chapter 23 Week 8: 18 June Analysis of Financial Statements (as above) Week 9: 25 June Financial Risk Management D&S Chapter 15 Week 10: 2 July Treasury Management Function TBA 4