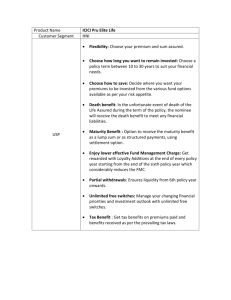

For sale by person resident outside India

advertisement

Visakhapatnam Branch of SIRC INBOUND INVESTMENTFEMA PROVISIONS 23rd October 2008 CA Manoj Shah Shah & Modi Phone :+ 91 22 2512 6399 E-Mail :manoj@shahmodi.com “If you learn only methods you will be tied to your methods, but if you learn principles you can device your own methods.” FEMA Overview STRUCTURE OF THE FEMA (ACT) FEMA has in all 49 sections of which 9 (section 1 to 9) are substantive and the rest are procedural/administrative. Section 46 of the Act grants power to Central Government to makes rules and section 47 of the Act grants power to RBI to make regulations to implements its provisions and the rules made there under. Thus RBI is entrusted with the administration and implementation of FEMA CA Manoj Shah - Shah & Modi 3 Difference in implementation of Income Tax Act & FEMA Under Income Tax, issue is of taxability of income which is determined for the full year, therefore generally amendments are annual. Whereas FEMA regulations are there for undertaking transaction itself, therefore clarity at the time of undertaking transaction is a must and therefore amendments keep pace with changes taking place in economy. CA Manoj Shah - Shah & Modi 4 Current & Capital A/c Transactions Capital A/c transactions means a transaction which alters assets or liabilities including contingent liabilities outside Indian of person resident in India and vice-versa. It’s a economic definition rather than accounting or legal definition Current A/c transaction - transaction other than a current a/c transaction CA Manoj Shah - Shah & Modi 5 Current & Capital Account Transaction Difference between concept of Capital Assets and Capital A/c transaction e.g. Import of machinery on payment of cash. From FEMA perspective it is current a/c transaction ( to be looked from Balance of payment position of Country) CA Manoj Shah - Shah & Modi 6 Current & Capital A/c transactions General Policy is Current A/c transactions are freely permitted unless prohibited whereas Capital A/c transactions are prohibited unless generally permitted. Current A/c transactions are regulated by Central Government whereas Capital A/c transactions are regulated by RBI Sec. 6(3) of FEMA, prescribes the class of capital a/c transactions which are regulated. CA Manoj Shah - Shah & Modi 7 Sec. 6(4) & 6(5) Sec. 6(4) A Person Resident in India, may hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India- If such property was acquired, held or owned by such persons when he was resident outside India or inherited from a person who was resident outside India Sec. 6(5)- Similar provisions for Persons Resident Outside India and assets held in India CA Manoj Shah - Shah & Modi 8 Inbound Investments FEMA Provisions CA Manoj Shah - Shah & Modi 9 “If u want 1 year of prosperity grow grains, If u want 10 year of prosperity grow trees & If u want 100 years of prosperity grow people” CA Manoj Shah - Shah & Modi 10 Destination India A decade and a half ago the prospect of India becoming a major player in the global economy seemed a distant dream, only a theoretical possibility. During the last 14 years there has been a sea change not only in the world’s perception about India’s future, but in our own perception about ourselves. The world has acknowledged the ‘arrival of India’. We no longer discuss the future of India: we say “the future is India”. CA Manoj Shah - Shah & Modi 11 Background of Inbound Investment FDI policy is formulated by Government of India. FEMA regulations prescribe the mode of investments i.e. manner of receipt of funds, issue of shares/convertible debentures and preference shares and reporting of the investments to RBI. CA Manoj Shah - Shah & Modi 12 Inbound Investment – Check Points NRI Investor (Other than citizen & entity of Pakistan) Non-Resident Prohibited Activities Proposed Activity in India Approval Route Automatic Route Mode of Remittance NRE Inward Remittance Procedural Compliance at the time of Investment CA Manoj Shah - Shah & Modi Annual Compliance 13 Inbound Investments Non Corporate Entity (Notification 24) Corporate Entity (Notification 20) J/V, WOS Establishment of Branch / Liaison office/Project Office (Notification 22) Transfer of existing Shares To Non Resident (Regulation 10A) By Non Resident (Regulation 9 & 10B) Overview of Inbound Investments A. Fresh Investment. Schedules 1. FDI Scheme. i. Private / Direct Investment. ii. ADR / GDR Issue. 2. Investment by FIIs under PIS. 3. Investment by NRIs under PIS. 4. Purchase & Sale of shares by NRIs on Non Repatriable basis. 5. Purchase & Sale of Securities other than Shares or CDs by Non Resident. 6. Investment in Venture Capital undertaking by Regd. Foreign VC. B. Right Shares. (Regulation 6) C. Effect of Shares on Merger / Demerger. (Regulation7) D. ESOP. (Regulation 8) CA Manoj Shah - Shah & Modi 14 Foreign Direct Investment (Schedule I - Notification 20) Automatic Route Approval Route: Activities Prohibited: • Annexure A activities. • Retail Trading. • Annexure B activities • Automatic Energy. beyond sectoral cap. • Lottery Business. • Gambling & Betting. • Housing & Real Estate Business. CA Manoj Shah - Shah & Modi 15 Provisions of Notification No.20 Important Definitions: Capital - equity, Preference shares, Convertible Preference, Convertible debentures Entity incorporated outside India - entity incorporated or registered under the relevant statutes Govt. Approval - from SIA - DIPP or FIPB Investment on repatriation basis- sale proceeds net of taxes eligible for repatriation out of India CA Manoj Shah - Shah & Modi 16 Notification No.20.. Regulation 4- An Indian entity shall not issue any security to any person resident outside India or record in its books any transfer of security from or to such person Regulation 5 prescribes the various schemes under inbound investment for NR and NRIs Reg 6 & 7 Acquisition of Right Shares & under merger/demerger Reg 8-Issue of shares under ESOP Reg 9 & 10- provisions relating to transfer of shares by/to Non Resident Reg 11- Repatriation of sale proceeds CA Manoj Shah - Shah & Modi 17 Basic Framework Schedule 1 : FDI Scheme Schedule 2 : FII Scheme Schedule 3 : Portfolio Investment Scheme for NRI (Repatriable) Schedule 4 : Investment Scheme for NRI (Non-repatriable) Schedule 5 : Investment Scheme for securities other than share / convertible debentures Schedule 6 : Investment Scheme for Foreign Venture Capital Investment CA Manoj Shah - Shah & Modi 18 Foreign Direct Investment Available Financial Instruments Equity Shares, Compulsorily Convertible Preference Shares and compulsorily Convertible Debentures. Not Available to Investors who are Citizens of Pakistan OR Entities of Pakistan Available with approval of FIPB (AP (DIR) No.22 dt.19/12/2007) To Citizens & Entities of Bangladesh CA Manoj Shah - Shah & Modi 19 FDI Scheme FDI Scheme can be categorized in following 3 segments: Sectors/activities where FDI is prohibited Sectors/activities which require Approval from Govt.Approval Route Sectors/activities which require procedural compliance and intimation to RBI without any approval- Automatic Route of RBI CA Manoj Shah - Shah & Modi 20 FDI Prohibited in following activities or items Retail Trading (except single branded product retailing) Atomic Energy Lottery Business Gambling and Betting Housing and Real Estate business, (other than construction of integrated township) Agriculture (excluding Floriculture, Horticulture, Development of seeds, Animal Husbandry, Pisiculture and Cultivation of vegetables, mushrooms etc. under controlled conditions and services related to agro and allied sectors) and Plantations (Other than Tea plantations) CA Manoj Shah - Shah & Modi 21 FDI Prohibition…continued.. Other activities prohibited are-Business of chit fund and Nidhi company, trading in TDRs, Construction of farm houses (in terms of Notification No.1- Permissible Capital Account Transactions) CA Manoj Shah - Shah & Modi 22 Automatic Route for FDI Available in following cases: Company which is not engaged in items included in Annexure A to Schedule I of Not.20 (Annex. A lists out activities which are prohibited and automatic route is not available) Shares are issued up to the limits specified in Annexure B (prescribes Sectoral cap) to Schedule I (provided activity doesn’t require industrial license under Industries (Development & Regulation Act) or under the locational policy under Industrial Policy of 1991 CA Manoj Shah - Shah & Modi 23 Automatic Route for FDI (Continue..) Shares are not issued by the Indian company with a view to acquire existing shares of any Indian Company Shares can be issued to provider of technology, or against royalty payment or against ECB, subject to sectoral guidelines CA Manoj Shah - Shah & Modi 24 Approval Route for FDI Activities/Sectors requiring prior approval of Government: Proposals in which foreign collaborator has an existing financial or technical collaboration in the same field (Press Note 1 of 2005) Proposals falling outside sectoral policy/cap Activities listed in part A of Annexure A Investment in SSI unit manufacturing items reserved for small scale sector CA Manoj Shah - Shah & Modi 25 Provisions for Certain Specific Sectors _________________________ CA Manoj Shah - Shah & Modi 26 FDI in SSI units SSI unit can’t have more than 24% from any industrial undertaking either foreign or domestic More than 24% FDI requires Government approval if items are reserved for small scale sector, it will also require industrial license. An SSI unit, not manufacturing items reserved for Small sector, can have more than 24% equity by giving up SSI status and can go under Automatic route. An EOU can have more than 24% equity participation from Non Resident CA Manoj Shah - Shah & Modi 27 Trading Sector Investment can be made under Automatic route for Up to 100% in Wholesale/ cash & carry trading (PN 7/2008) Up to 100% in Trading for exports (PN/4 of 2006) Under approval from FIPB, investment is permitted Up to 51% for Retail trade of “Single brand” products (PN/3-06) Any addition to the product/product categories to be sold under ‘Single Brand’ would require a fresh approval of the Government. Up to 100% for Items sourced from small scale sector Up to 100% for Test marketing of such product for which company has approval CAfor manufacture Manoj Shah - Shah & Modi 28 Construction Sector 100% FDI permitted under Automatic route in – Construction Development projects including housing, commercial premises, resorts educational institutions, recreational facilities, city and regional level infrastructure, townships Note: FDI is not allowed in Real Estate Business. CA Manoj Shah - Shah & Modi 29 Construction Sector.. Continued.. Minimum area to be developed under each project: Development of serviced housing plots, a minimum land area of 10 hectares Construction-development projects, a minimum built-up area of 50,000 sq.mts Combination project, any one of the above two conditions Capitalization and lock-in requirements: Minimum capitalization of UDS 10 million for wholly owned subsidiaries and USD 5 million for joint ventures with Indian partners The funds would have to be brought in within six months of commencement of business of the company Original investment cannot be repatriated before a period of three years from completion of minimum capitalization Investor may be permitted to exit earlier with prior approval of the Government through FIPB CA Manoj Shah - Shah & Modi 30 Construction Sector .. Continued.. 50% of the project to be developed within 5 years Investors not allowed to sell undeveloped plots* The project to conform to norms and standards as laid down in applicable regulations Obtain all necessary approvals State Government/Municipal/Local Body concerned, which approves the building/development plans, to monitor compliance of above conditions undeveloped plots” would mean where roads, water supply, street lighting, drainage, sewerage, and other conveniences, as applicable under prescribed regulations, have not been made available. Investor needs to provide this infrastructure and obtain completion certificate from concerned local body/service agency before he would be allowed to dispose off serviced housing plots. CA Manoj Shah - Shah & Modi 31 Construction Sector.. Continued.. Exclusion from the applicability of Press Note 2 of 2005: Hotel & Tourism (Press Note 4 of 2001) Hospitals (Press Note 2 of 2000) Special Economic Zones (Special Economic Zones Act, 2005) Industrial Parks (PN 3/ 2008) CA Manoj Shah - Shah & Modi 32 Construction sector for NRIs 100% investment permitted under Automatic Route in following: Development of serviced plots and construction of built-up residential premises Investment in real estate covering construction of residential and commercial premises including business centers and offices Development of townships City and regional level urban infrastructure facilities, including both roads and bridges Investment in manufacture of building materials Investment in participatory ventures in (a) to (e) above Investment in housing finance institutions which is also opened to FDI as an NBFC. CA Manoj Shah - Shah & Modi 33 NBFC Sector- 100% under Automatic Route in 18 activities Minimum Capitalization Norms Fund based NBFC FDI up to 51% - US$ 0.5 million to be brought upfront. FDI above 51% to 75% - US$ 5 million to be brought upfront. FDI above 75% to 100% - US$ 50 million, of which US$ 7.5 million upfront and balance in 24 months. CA Manoj Shah - Shah & Modi Non-Fund based NBFC Minimum US$ 0.5 million 34 FDI Scheme- General Provisions Issue Price Listed Company- As per SEBI guidelines Unlisted Company-CCI Valuation Dividend balancing requirement abolished Rate of dividend on Preference shares Cannot exceed 300 basis points over the PLR of SBI Mode of payment for inbound investment Inward remittance through banking channels Debit to NRE/FCNR A/c Capitalization of lumpsum fee, royalty and ECBs (other than import dues deemed as ECB or Trade Credit) CA Manoj Shah - Shah & Modi 35 Acquisition of Right Shares NR may acquire equity/preference or CDs offered on right basis subject to following conditions: Sectoral cap to be maintained Existing shares were acquired in accordance with the regulations Price is not lower than the price which is offered to resident shareholders Same conditions to apply regarding repatriability as are applicable to original shares CA Manoj Shah - Shah & Modi 36 Acquisition of shares after merger/demerger In case the percentage of shareholding likely to increase on account of merger/de-merger, Govt., approval & RBI approval needed New company should not carry on agricultural, plantation or real estate business or trading in TDRs. To file a report in 30 days with RBI CA Manoj Shah - Shah & Modi 37 Issue of shares under ESOP Indian company can issue shares to employees of its J/V or WOS abroad The scheme should be approved by SEBI Face value of the shares to be allotted under scheme to the non resident employees not to exceed 5% of the paid up capital CA Manoj Shah - Shah & Modi 38 PIS by NRIs Limit of 5% by single NRI, 10% by all NRIs (this can be increased to 24%) to be maintained Payment to come from NRE/FCNR or NRO (in case of non repatriable investment) Delivery based purchase and sale permitted Shares purchased under PIS cannot be transferred under private arrangements to person resident in India or outside India without prior approval of RBI OCBs are not permitted after 29/11/2001 to invest in PIS CA Manoj Shah - Shah & Modi 39 Investment in Shares/CDs on non repatriation basis by NRIs Scheme applies to investment other than PI NRIs may acquire without any limit, shares under public issue, private placement or right issue Central Govt., approval needed if investor has previous JV or technical collaboration or trade mark agreement in the same or allied field Not permitted- investment in companies engaged in chit fund/nidhi, agricultural/plantation or real estate business or construction of farm house or dealing in TDRs CA Manoj Shah - Shah & Modi 40 Investment in securities other than shares or CDs by Non Resident Scheme available to FIIs & NRIs Investment on repatriation basis in - dated Govt., securities/treasury bills, NCD and Units of Domestic MF Other conditions on FII for composition of investment and registration with SEBI NRIs can also invest in shares of Public Sector enterprise in disinvestment process Investment on Non Repatriation basis by NRIs in – units of money market funds in India or National Plan/Saving Certificates. CA Manoj Shah - Shah & Modi 41 Procedure under Automatic Route Intimation to Authorized Dealer within 30 days from receipt of funds in Annexure II to Form FC-GPR Intimation to be filed along with KYC Report (Annexure III to Form FC-GPR gives KYC Report) To file report in form FC-GPR (Part A of Annexure I) within 30 days from the date of issue of shares Annual Return in FC-GPR (Part B of Annexure I) by 31st July CA Manoj Shah - Shah & Modi 42 Procedure under Approval Route Applications for NRI investment, EOU and Retail Trading (Single Brand) should be submitted to SIA in DIPP Applications for FDI other than above should be submitted to FIPB unit, DEA, MoF Application in Form FC-IL CA Manoj Shah - Shah & Modi 43 Time Limit for issue of shares/CDs Notification No.170 dt. Nov 29, 2007,( AP (DIR) Series Circular No. 20 dated 14th Dec 07) Shares & CDs to be issued within 180 days from the date of receipt of inward remittance or date of debit to NRE/FCNR A/c. In case Share Application is outstanding beyond a period of 180 days – .. application to be made with sufficient reasons for refunding share application If 180 days have elapsed on Nov 28, 2007- approval of RBI needed either for issue or for refund CA Manoj Shah - Shah & Modi 44 Transfer of Shares- without RBI approval/ or any procedure Transferor PROI- other than NRI & OCB Transferee PROI (including NRI) NRI/OCBs NRI Mode of Transfer Sale or gift (prior approval of Govt., by transferee, in case transferee has previous J/V or technical collaboration in same field) Sale or gift (conditions same as above) Note: above conditions not to apply to IT sector & certain international CA Manoj Shah - Shah & Modi 45 financial institutions/bank. Transfers without any permission/procedural compliance Transferor PROI Transferee Mode of Transfer for shares/C.Deb., of Indian Company Person Res. Gift in India PROI PROI Indian Company Sell on Recognized Stock Exchange Under buy back/ capital reduction scheme (other than financial serv sector) CA Manoj Shah - Shah & Modi 46 Transfer of security with prior permission Transferor Transferee Mode Person Resident in India Person Resident Outside India (Not being erstwhile OCBs) Gift NRI Non Resident Sale CA Manoj Shah - Shah & Modi 47 Transfer of Shares/CDs by way of Sales From Resident to Non Resident Applicable to industries of Annexure B to FDI schedule, except Banking, NBFC & Insurance and Financial Services sector. Transfer doesn’t fall under SEBI takeover regulations (RBI approval for Fin services & SEBI takeover) Sectoral caps are maintained (if not then first Govt., approval & then RBI approval) From Non Resident to Resident Applicable to other than those covered under Reg.9 Both the above categories of transfer are Subject to P, D & R (pricing guidelines, Documentation & Reporting Requirements) CA Manoj Shah - Shah & Modi 48 Pricing, documentation & reporting for transfer by way of sale Transfer between resident & non resident Parties involved Seller (non resident/ resident) Buyer (non resident/ resident) Duly authorized agents of seller/ buyer AD Branch Indian Company CA Manoj Shah - Shah & Modi 49 Pricing Guidelines For transfer from Res to NR (non OCBs) Price shall not be less than Ruling market price for listed shares CA certified fair valuation as per CCI guidelines for unlisted shares CA Manoj Shah - Shah & Modi 50 Pricing Guidelines For transfer from NR (including OCBs) to Resident- In case of listed shares At prevailing price & sale effected through merchant banker or registered stock broker In other cases- avg. (avg of daily high and low) quotations of one week preceding the date of appln with 5% variation Price could be higher up to a ceiling of 25% as arrived above, if shares are sold to Indian promoters for passing management control CA Manoj Shah - Shah & Modi 51 Pricing Guidelines (NR TO R). Contd.. For thinly traded shares 1- consideration per seller per company is up to INR 20.0 lacs- mutually agreed price between seller & buyer, based on current valuation methodology and valuation certificate from statutory auditors 2- for consideration exceeding INR 20 lacs-at seller’s option (a) higher of the price based on EPS multiple or NAV linked to book value multiple OR (b) prevailing market price in small lots so that entire shareholding is sold in not less than 5 trading days CA Manoj Shah - Shah & Modi 52 Pricing Guidelines (NR TO R). Contd.. In case of unlisted shares At a price lower of two valuations- one by Statutory Auditors and other by CA or Cat-I merchant banker registered with SEBI CA Manoj Shah - Shah & Modi 53 Documentation Form FC-TRS in quadruplicate For sale by person resident in India Consent letter from both seller & buyer or their agent (PoA in case signing by agent) Share holding pattern after investment by Non Resident CA cert for valuation/ broker’s note Undertaking from the buyer that he is eligible to acquire shares and FDI limit complied with Undertaking from FII/sub account that individual ceiling prescribed by SEBI not breached CA Manoj Shah - Shah & Modi 54 Documentation For sale by person resident outside India Consent letter from both seller & buyer or their agent (PoA in case signing by agent) Copies of RBI approval for NRI/OCBs to determine investment on repatriation/non repatriation basis Fair valuation certificate from CA No objection/Tax clearance certificate from income tax authority/ Chartered Accountant Undertaking from buyer for adherence to pricing guidelines. CA Manoj Shah - Shah & Modi 55 Reporting by AD R return for actual inflow/ outflow of forex Two copies of FC-TRS to FED Recording of transfer in Indian company On submission of A.D. certified copy of FCTRS Note- Shares purchased under PIS cannot be transferred by way of sale under private arrangement CA Manoj Shah - Shah & Modi 56 Investment in Firm or Proprietary Concern Permitted to NRIs/PIOs PIOs who are not citizen of Bangladesh, Pakistan or Sri Lanka Firm should not undertake- Print Media, Agricultural/ Plantation & dealing in land and immovable property Capital invested can’t be repatriated Income can however be repatriated CA Manoj Shah - Shah & Modi 57 Establishment of Branch or Liaison office in India (Notification No 22) Permitted activities for a branch in India of a person resident outside India: Export/Import of goods. Rendering professional or consultancy services. Carrying out research work, in which the parent company is engaged. Promotional technical of financial collaborations between Indian companies and parent or overseas group company. Representing the parent company in India and acting as buying/selling agent in India. Rendering services in IT and development of software in India. CA Manoj Shah - Shah & Modi 58 Establishment Branch or Liaison office in India (Notification No 22) Continue. Permitted activities for a Liaison office in India of a person resident outside India: Rendering technical support to the product supplied by parent/group companies. Foreign airline/shipping company. For Liaison Office Representing in India the parent company/group company. Promoting export import from/to India. Promoting technical/financial collaborations between parent/ group companies and companies in India. Acting as a communication channel between the parent company and Indian company. CA Manoj Shah - Shah & Modi 59 Application to RBI for opening branch or liaison office A person resident outside India desiring to establish a branch or liaison office in India shall apply to RBI, in form FNC 1. CA Manoj Shah - Shah & Modi 60 Remittance of profit or surplus A person resident outside India shall produce following documents to the authorised dealer through whom the remittance is effected For remittance of profit of a branch: Certified copy of the audited balance sheet and profit and loss account for the relevant year A CA’s Certificate certifying: • The manner of arriving at the remittable profit • That the entire remittable profit has been earned by undertaking the permitted activities, and • That the profit does not include any profit on revaluation of the asset of the branch CA Manoj Shah - Shah & Modi 61 Remittance of profit or surplus Continue… For remittance of surplus on completion of project Certified copy of the final audited project account A CA’s certificate showing the manner of arriving at the remittable surplus Income tax assessment order or either documentary evidence showing payment of income tax and other applicable taxes, or a CA’s certificate stating that sufficient funds have been set aside for meeting all Indian tax liabilities Auditor’s certificate stating that no statutory liabilities in respect of the project are outstanding CA Manoj Shah - Shah & Modi 62 FIRST DESERVE AND THEN DESIRE THANK YOU CA Manoj Shah - Shah & Modi 63