73-Measurement of Market Risk

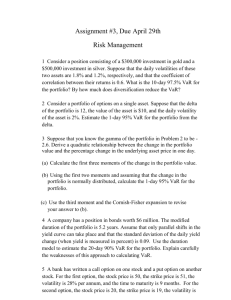

Measurement of Market Risk

Market Risk

• Directional risk

• Relative value risk

• Price risk

• Liquidity risk

Type of measurements

– scenario analysis

– statistical analysis

Scenario Analysis

• A scenario analysis measures the change in market value that would result if market factors were changed from their current levels, in a specified way. No assumption about probability of changes is made.

• A stress test is a measurement of the change in the market value of a portfolio that would occur for a specified unusually large change in a set of market factors.

Value at Risk

• A single number that summarizes the likely loss in value of a portfolio over a given time horizon with specified probability.

• C-VaR states expected loss conditional on change in value in the left tail of the distribution.

• Three approaches

– Historical simulation

– Model-building approach

– Monte Carlo simulation

Historical Simulation

• Identify market variables that determine the portfolio value

• Collect data on movements in these variables for a reasonable number of historical days

• Build scenarios that mimic changes over the historical period

• For each scenario calculate the change in value of the portfolio over the specified time horizon

• From this empirical distribution of value changes calculate VaR

Model Building Approach

• Portfolio of n-assets

• Calculate mean and standard deviation of change in the value of portfolio for one day

• Assume normality

• Calculate VaR

Monte Carlo Simulation

• Value of the portfolio today

• Draw samples from the probability distribution of changes of the market variables

• Using the sampled changes calculate the new portfolio value and its change

• From the simulated probability distribution of changes in portfolio value calculate VaR

Pitfalls of Normal Distribution Based VaR

• Normality assumption may not be valid for tail part of the distribution

• VaR of a portfolio is not less than weighted sum of VaR of individual assets (not sub-additive)

• Expected shortfall conditional on the fact that loss is more than VaR is a sub-additive measure of risk

Pitfalls of Value-at-Risk

• VaR is a statistical measurement of price risk

• VaR assumes a static portfolio. It does not take into account

– Structural change in the portfolio that would contractually occur during the period

– Dynamic hedging of the portfolio

• VaR calculation has two basic components

– Simulation of changes in market rates

– Calculation of resultant changes in the portfolio value

Value-at-Risk

VaR (Value-at-Risk) is a measure of the risk in a portfolio over time.

Quoted in terms of a time horizon and a confidence level.

Example: 10 day 95% VaR is the size of loss X that will not happen 95% of the time over the next 10 days.

5%

Value-at-Risk

X

95%

(Profit/Loss Distribution)

Value-at-Risk Levels

Two standard VaR levels are 95% and 99%.

95% is 1.645 standard deviations from the mean

99% is 2.33 standard deviations from the mean mean

Value-at-Risk Assumptions

1) Percentage change (return) of assets is Gaussian: dS

Sdt

Sdz or dS

dt

dz

S

S

t

z

S

Normal Distribution

Value-at-Risk Assumptions

2) Mean return m is zero:

S

t

z

S

Mean of

t is .

t ~ O (

t )

Standard deviation of ∆t is.

z ~ O (

t

1 / 2

)

Time is measured in years, hence t or change in time is insignificant. Hence the mean μ is not taken into consideration and the mean return is stated as:

S

S

z

VaR and Regulatory Capital

Regulators require banks to keep capital for market risk equal to the average of VaR estimates for past 60 trading days using confidence level of 99% and number of days (N) =10, times a multiplication factor

(multiplication factor equals 3).

Advantages of VaR

• Captures an important aspect of risk in a single number

• Easy to understand

• Indicates the worst loss that could happen

Daily Volatilities

• Option pricing (volatility is express as volatility per year)

• aR calculations (volatility is express as volatility per day)

day

year

252

0 .

063

year

6 %

year

Daily Volatility

• day is defined as the standard deviation of the continuously compounded return in one day

• In practice it is also assumed that it is the standard deviation of the proportional change in one day

Example

• Based on 60 days prior trading data the following computations have been made

• Volatility of a bank is 2% per day (about 32% per year)

• Assume N =10 and confidence level is 99 %

• Standard deviation of the change in the market price (₹

60,000) in 1 day is ₹ 1,200 (2% x 60,000)

• Standard deviation of the change in 10 days is

1,200 x = 3,794.733 (1,200 x )

10

Example (continued)

• Assume that the expected change in the value of the bank’s share is zero

• Assume that the change in the value of the bank’s share is normally distributed

• Since N(0.01)= -2.33, ({Z<-2.33}=0.01) the VaR is

2.33 x 3,794.733 = ₹ 8,846.728.

Example (continued)

• VaR for one year (252 days) = ₹ 44,385.12

• Bank’s Gross Income = ₹ 1,869,906

• 15% of Gross Income = ₹ 280,485.

• Capital charge for operational risk = ₹ 280,097.

• Bank’s current share capital will be related to risk weights assessed by the capital charge.

Value-at-Risk

• An estimate of potential loss in a

– Position

– Asset

– Liability

– Portfolio of assets

– Portfolio of liabilities

• During a given holding period at a given level of certainty

Value-at-Risk

• Probability of the unexpected happening

• Probability of suffering a loss

• Estimate of loss likely to be suffered

• VaR is not the actual loss

• VaR measures potential loss and not potential gain

• VaR measures the probability of loss for a given time period over which the position is held

Bank for International Settlement (BIS)

• VaR is a measurement of market risk

• Provision of capital adequacy for market risk, subject to approval by banks' supervisory authorities

• Computation of VaR changes based on the estimated time period

– One day

– One week

– One month

– One year

Bank for International Settlement (BIS)

• Holding period for an instrument will depend on liquidity of the instrument

• Varying degrees of certainty changes potential loss

• VaR estimates that the loss will not exceed a certain amount

• VaR will change with different levels of certainty

VaR Methodology

• Computed as the expected loss on a position from an adverse movement in identified market risk parameter(s)

• Specified probability over a nominated period of time

• Volatility in financial markets is calculated as the standard deviation of the percentage changes in the relevant asset price over a specified asset period

• Volatility for calculation of VaR is specified as the standard deviation of the percentage change in the risk factor over the relevant risk horizon

VaR Computation Method

• Correlation Method

– Variance – covariance method

– Deterministic approach

– Change in value of the position computed by combining the sensitivity of each component to price changes in the underlying assets

VaR Computation Method

• Historical Simulation

– Change in the value of a position using the actual historical movements of the underlying assets

– Historical period has to be adequately long to capture all possible events and relationships between the various assets and within each asset class

– Dynamics of the risk factors captured since simulation follows every historical move

VaR Computation Method

• Monte Carlo Simulation

– Calculates the change in the value of a portfolio using a sample of randomly generated price scenarios

– Assumptions on market structures, correlations between risk factors and the volatility of these factors

VaR Application

• Basic parameters

– Holding period

– Confidence interval

– Historical time period (observed asset prices)

• Closer the models fit economic reality, more accurate the estimated

• There is no guarantee that the numbers returned by each VaR method will be near each other

VaR Application

• VaR is used as a Management Information System (MIS) tool in the trading portfolio

• Risk by levels

• Products

• Geography

• Level of organisation

• VaR is used to set risk limits

• VaR is used to decide the next business

VaR Limitation

• VaR does not substitute

– Management judgement

– Internal control

• VaR measures market risk

– Trading portfolio

– Investment portfolio

• VaR is helpful subject to the extent of

– Measurement parameters

Back Testing

• Backtests compare realized trading results with model generated risk measures

• Evaluate a new model

• Reassess the accuracy of existing models

• Banks using internal VaR models for market risk capital requirements must backtest their models on a regular basis

Back Testing

• Banks back test risk models on a monthly or quarterly basis to verify accuracy

• Observe whether trading results fall within pre-specified confidence bands as predicted by the VaR models

• If the models perform poorly establish cause for poor performance

– Check integrity of position

– Check market data

– Check model parameters

– Check methodology

Stress Testing

• Banks gauge their potential vulnerability to exceptional, but plausible, events

• Stress testing addresses the large moves in key market variables that lie beyond day to day risk monitoring but that could potentially occur

Stress Testing

• Process of stress testing involves

– Identifying potential movements

– Market variables to stress

– How much to stress them

– What time frame to run the stress analysis

– Shocks are applied to the portfolio

• Revaluing the portfolios

– Effect of a particular market movement on the value of the portfolio

– Profit and Loss

– Effects of different shocks of different magnitudes

Stress Testing Technique

• Scenario analysis

• Evaluating the portfolios

– under various expectations

– evaluating the impact

• changing evaluation models

• volatilities and correlations

• Scenarios requiring no simulations

– analyzing large past losses

Stress Testing Technique

• Scenarios requiring simulations

– Running simulations of the current portfolio subject to large historical shocks

• Bank specific scenario

– Driven by the current position of the bank rather than historical simulation

• Subjective than VaR

• Identify undetected weakness in the bank's portfolio

Efficiency of a Stress Test

• Relevant to the current market position

• Consider changes in all relevant market rates

• Examine potential regime shifts (whether the current risk parameters will hold or break down)

• Consider market illiquidity

• Consider the interrelationship between market and credit risk

Application of Stress Tests

• Stress tests produce information summarising the bank’s exposure to extreme but possible circumstances

• Role of risk managers in the bank is gathering and summarising information to enable senior management to understand the strategic relationship between the bank’s risk taking

– Extent and character of financial leverage employed

– Risk appetite

– Stress scenarios created on a regular basis

– Stress scenarios monitored over time

Application of Stress Tests

• Influence decision-making

• Manage funding risk

• Provide a check on modelling assumptions

• Set limits for traders

• Determine capital charges on trading desks’ positions

Limitations of Stress Test

• Stress tests are often neither transparent nor straightforward

• Depends on a large number of practitioner choices

• Choice of risk factors to stress

• Methods of combining factors stressed

• Range of values considered

Limitations of Stress Test

• Time frame to analyse

• Risk manager is faced with the considerable tasks of analyzing the results and identifying implications

• Stress test results interpretation for the bank is based on qualitative criteria

• Manage bank’s risk-taking activities is subject to interpretations