1_OverviewofSBAProgramsCertifications

advertisement

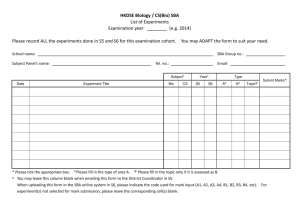

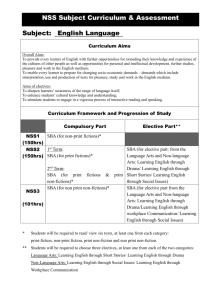

1 SBA San Antonio District Office Hipolito F. Garcia Federal Building 615 E. Houston, 2nd Floor, Ste 298 San Antonio Texas 78205 (210) 403-5900 sado.email@sba.gov www.sba.gov Overview of SBA Programs & Certifications Stephanie Rapp Business Opportunity Specialist 2 Yolanda Olivarez Regional Administrator – Region VI Pamela Sapia District Director – San Antonio Ronald E. Dear Deputy District Director 3 SAN ANTONIO DISTRICT “Servicing 55 Counties” San Angelo Irion Tom Green Concho Schleicher Mcculloch San Saba Lampasas Menard Crockett Llano Mason Sutton Kimble Blanco Travis San Marcos Bastrop Lee Hays Kerr Edwards Williamson AUSTIN Gillespie Val Verde Burnet Kendall Real Comal Fayette Caldwell Bandera San Antonio Kinney Uvalde Medina Bexar Guadalupe Gonzales Wilson Maverick Zavala Frio Atascosa De Witt Karnes Eagle Pass Dimmit Lavaca Jackson Victoria Victori Goliad Calhoun La Salle Webb Live Oak Mcmullen Bee Refugio Laredo 4 SBA Programs & Services • Capital - Loan Guarantee Programs • Contract Opportunities – 8a Business Development Program, HubZone Program & Woman Owned Small Business Program • Counseling & Training – SBA Resource Partners i.e. Small Business Development Centers, Contract Resource Centers, Women Business Centers and SCORE • Advocacy, Laws & Regulations for small businesses • Special Initiatives i.e. legislation and provisions Disaster Assistance 5 SBA Loan Guaranty Programs 7(a) Loans: • 7(a) Regular and Preferred Lender Program - $5,000,000 • SBA Express Loan Program – $350,000 • Small/Rural Lender Advantage - $350,000 • Patriot Express Loan Program - $500,000 • Export Express Loan Program - $500,000 • Export Working Capital and International Trade $5,000,000 • Small Loan Advantage and Community Advantage - $250,000 temporary through 2013 • Dealer Floor Plan - $5 million – temporary through 9/27/2013 Phone (210) 403-5900 or Email sado.email@sba.gov Non-7(a) Loans: • CDC/504 Loan Program $5,000,000 up to $5.5 million for land, building and equipment • Microloans - $50,000 Complete details at: http://www.sba.gov/category/navigation-structure/loans-grants/small-business-loans 6 Lender Relations Team Cindy Solano, Lead Lender Relations & SBDC Technical Officer (210) 403-5919 cindy.solano@sba.gov Annie Hudspeth, Lender Relations Specialist, Women’s Business Center Representative (210) 403-5918 annie.hudspeth@sba.gov Aixa Leath, Lender Relations Specialist, District Public Information Officer & Small Business Week Coordinator (210) 403-5920 aixa.leath@sba.gov • Lional Davila, Lender Relations Specialist & International Trade Officer (210) 403-5917 lional.davila@sba.gov 7 The 8(a) Business Development Program Sections 8(a) and 7(j) of the Small Business Act authorize a Minority Small Business and Capital Ownership Development program designated as the 8(a) Business Development Program. The purpose of the 8(a) Business Development Program is to assist eligible small disadvantaged business concerns compete in the American economy through business development. The mission of the 8(a) Business Development Program is to provide participating businesses with managerial, technical, and procurement assistance to assist them in achieving their full competitive potential. Regulations: 13 CFR Part 124 & SBA Standard Operating Procedure 80 05 3A http://www.sba.gov/aboutsba/sbaprograms/8abd/ 8 Business Development Team • Mary Alice Blanco – Lead Business Opportunity Specialist , SCORE Liaison & Surety Bond Representative (210) 403-5929 mary.blanco@sba.gov • Theresa Scott - Business Opportunity Specialist & Primary HubZone Coordinator (210) 403-5912 theresa.scott@sba.gov • Stephanie Rapp – Business Opportunity Specialist, Native American Representative & Disabilities Representative (210) 403-5927 stephanie.rapp@sba.gov • Sean Smith – Business Opportunity Specialist, District IT Representative & 7J Technical Assistance Representative (210) 403-5921 sean.smith@sba.gov • Eric Spencer – Business Opportunity Specialist, District Website Content Coordinator & Minority Development Week Representative, (210) 403-5940 eric.spencer@sba.gov 9 Federal Contracting Facts • The world’s largest buyer of goods and services is the Federal Government, with purchases totaling more than $500 billion per year. • Contracts exist from health care staffing to armored tanks • Federal agencies are required to establish contracting goals, with at least 23 percent of all government buying targeted to small firms through set-aside programs. 10 What is a Set-Aside? • A set-aside is the reserving of an acquisition exclusively for participation by a category of small business concern(s). • Helps ensure a level playing field so that small businesses who are certified concerns can compete for Federal contracting opportunities; – 8(a) (formal SBA on-line application for certification) http://www.sba.gov/content/8a-business-development-0 – HUBZone (formal SBA on-line application) http://www.sba.gov/category/navigation-structure/contracting/working-withgovernment/small-business-certifications-au-0 – SDVOSB (self certification/representation and through the Veteran Administration www.vetbiz.gov ) – WOSB (self certification/representation) http://www.sba.gov/content/contracting-opportunities-womenowned-small-businesses 11 – small business (self certification) Federal Contract Opportunities SBA is an advocate for Small Business Set-asides 23% Small Business GOAL that includes: • Small Disadvantaged Business 5% - SBA certified in the 8(a) Business Development Program • HubZone Small Business 3% - SBA certified firms in Hubzone designated area • Service Disabled Veteran Owned Small Business 3% self certification and through Veterans Administration • Woman Owned Small Business 5% - includes SBA 8(m) WOSB Program set-asides 12 How the Government Buys • Less than $3,000 usually purchased by credit card (micropurchases- are not small business set-asides) • Less than $3,000 up to $150,000 set-aside for small business and simplified acquisition procedures • Greater than $150,000 – first consideration/offer must be 8(a), HUBZone, SDVOSB and WOSB (parity): – then Small Business Set-aside is considered – and lastly “Unrestricted/Full and Open” (all businesses large and small may participate) 13 8(a) Business Development Program Sec. 204 of Public Law 100-656 What is the objective of the 8(a) Business Development Program? “Promote the business development of small business concerns owned and controlled by socially and economically disadvantaged individuals…” 14 Socially Disadvantaged • Must be a U.S. Citizen and • Member of one of the following groups: - Black American - Hispanic American (includes individuals of Spanish & Portuguese descent). - Native American (Alaska Natives, Native Hawaiians or enrolled members of a Federally or State recognized Indian Tribe) - Asian Pacific American - Subcontinent Asian Americans See CFR 124.103 15 Persons not members of designated groups must: • Establish their case by a preponderance of the evidence; • The disadvantage may stem from race, ethnic origin, gender, physical handicap, long term environmental isolation, or other similar causes; • The applicant must have personally suffered disadvantage in the United States; • The disadvantage must be substantial & chronic; • The discrimination must have had a negative impact on business advancement. 16 Economically disadvantaged Socially disadvantaged persons whose ability to compete in the free enterprise system has been impaired due to diminished capital and credit. What does this mean? 17 Personal Net Worth Criteria At time of application - may not exceed $250,000.00 * Net Worth exclusions from calculation: less less less less equals equity in primary residence equity in business individual retirement accounts (IRAs) income that is from an S corporation, LLC or Partnerhsip adjusted net worth * Once in the 8(a) BD Program the net worth can go up to $750,000 maximum. CFR 124.104 18 Control of Business The Disadvantaged Individual must: • Hold the position of President or Chief Executive Officer, Managing Partner or LLC Managing Member • Be the highest compensated individual • Have the ability to Hire and Fire • Set Policies • Have the ability to commit firm to contracts • Have the ability to the control Budget and Financial Disbursement 19 Potential for Success – Factors to Consider • Proof of two years of operation in the firm’s primary industry as verified by revenues reported in business tax returns. Waiver of 2 year rule – can be requested if less than 2 years in business. 1. There is no form to complete during the online application process. 2. Applicant must explain how it meets the following objectives as listed below and include with their hard copy of the application: • Substantial demonstration of business management experience • Demonstrated technical expertise to carry out business plan • Adequate capital • Record of successful performance on contracts (please provide copies of contracts that will reflect the different sizes the firm can handle and the different services/products, billing invoices and bank statements reflecting deposit of receipts). Evidence also to include letters of reference from the firm’s clients. • Ability to obtain the personnel, facilities, equipment, and any other requirements to perform on contracts 20 Potential for Success Factors cont … • Financial capability - sufficient capitalization, financial performance, bonding capacity, manageable debts. • Technical capability – performance on previous contracts – has the necessary personnel, licenses, certifications, facilities, prior experience. • Managerial capability - education, experience and training of CEO and other managers, magnitude and complexity of past/current jobs, management systems. • Qualifications - ability to perform on Federal contracts: relevant contracting experience, ability to meet Federal procurement policies. 21 Term of Participation START = date of approval into 8(a) Program Year Year 1 2 3 4 5 6 7 8 9 developmental stage transitional stage 22 8(a) Program Benefits Business Development and Training Contract support through 8(a) set-asides – - sole source contract opportunities (threshold up to $6.5M for manufacturing and up to $4M for all other industries) - competitive contract opportunities (over $4M) SBA Mentor Protégé Program Joint Venture Agreements (only for 8(a) set-asides only) Texas Facilities Commission Surplus Property Program 23 Supporting Federal Procurement Agencies – – – – – – – – – – – – – – U.S. Coast Guard Defense Commissary Agency Defense Logistics Agency Department of Agriculture Department of Defense Department of Energy Department of Health and Human Services Department of Homeland Security Department of Justice Department of Labor State Department Department of the Air Force Department of the Army Department of the Army & Air Force – – – – – – – – – – – – – Corps of Engineers International Water Commission Department of Interior Department of the Navy Department of Transportation Department of Veterans Affairs Federal Bureau of Prisons General Services Administration Air National Guard Internal Revenue Service National Guard Bureau Small Business Administration SPAWAR Detachment 24 8(a) Business Development Program Important Websites: • Code of Federal Regulations: 13 CFR 124 http://ecfr.gpoaccess.gov(use drop down and click on Title 13) • Standard Operating Procedure: SOP 80 05 3A http://www.sba.gov/about-sba-services/7481/11513 • Federal Acquisition Regulation: FAR Part 19 http://www.arnet.gov/far/index.html • Part 8.4 – Federal Supply Schedules • Part 13 – Simplified Acquisitions • Part 14 – Sealed Bidding • Part 15 – Contracting by Negotiation • Part 19 - Small Business Programs • Part 22 - Application of Labor Laws to Government Acquisitions 25 8(m) Women Owned Small Business (WOSB) Program Small Business Reauthorization Act of 2000 Regulated by 13 CFR 127 • Purpose - assist in achieving congressionally mandated Federal 5% contracting goal to WOSBs • Tied to the authority of the contracting officer to set-aside the requirement which limits the competition to Women Owned Small Businesses (WOSBs) or Economically Disadvantaged Women Owned Small Businesses (EDWOSBs). • Contract value is less than $5 million in manufacturing or $3 million in all other industries (including options). • Competition must exist - reasonable expectation of 2 or more offers by WOSBs or EDWOSB (rule of 2 for competition). Advertised at FedBizOpps. • Benefit – more federal contract opportunities for women in underrepresented industries (NAICS) ! 26 WOSB Certification… • SBA role at present is to market and guide women to the website as well as advocate to federal procuring agencies to set-aside work for women owned small businesses. • SBA is not the certifier like in the 8(a) BD Program • No cost to for women - if they choose to self-certify themselves • Self-certification instructions and registration located at www.sba.gov/wosb 27 HUBZone Program Historically Underutilized Business Zones Requirements: • Must be a small business by SBA size standards • Concern must be 51% owned and controlled by US Citizens, Community Development Corporation or Indian Tribes • The principal office must be located in a HUBZone (high-unemployment and low-income areas in economically distressed communities), to promote job growth, capital investment and economic development in these areas, including Indian reservations. • At least 35% of the concerns employees must reside/live in any HUBZone area • To find out if your location is in a HUBZone, go to http://www.sba.gov/hubzone 28 HUBZone Contract Opportunities • Applies to purchases over $3000; • Competitive and sole source set-aside program benefits; • Sole source: Up to $6.5M (mfg) and $4.0M (all other industries) Regulation: FAR 19.13 http://www.arnet.gov/far/index.html On-line application and approval by SBA-HQ. No term limits. Must be approved as a HubZone, before you can receive contract set-asides in this program. 29 Website for All Things Acquisition • Federal Acquisition Central https://www.acquisition.gov/ – web site for the federal acquisition community and partners. – designed to create an easily navigable resource. – access shared systems and tools to help you conduct business efficiently. – learn about regulations, systems, resources, opportunities, and training. 28 29 31 First Thing To Do – Get Registered In order to win federal contracts, your business must be registered in the System Award Management government’s database at www.sam.gov (update once a year). - You need to obtain a “DUNS Number” at this same website (for free) to identify your business to the federal government. At the end of your SAM Registration, register on the SBA Profile Link which links to the Dynamic Small Business Search (DSBS). Online Representations and Certifications Application (ORCA) https://orca.bpn.gov/ (update at least annually) Read more about registration at: http://www.sba.gov/content/register-government-contracting 32 How to Identify Contract Opportunities • Federal Agency Procurement Forecasts: http://acquisition.gov/comp/procurement_forecasts/index.html • Federal Business Opportunities (FedBizOpps) identifies federal contracts over $25,000 www.fbo.gov – Training videos - available to familiarize users with the features and functionality of FBO 33 – Sources Sought Notices – federal agency notices looking for sources to respond to potential contract requirements – Contract awards and special notices - are also publicized in the FBO. 34 Program Assistance • Visit the Small Business Development Center in your area for more information and assistance: – Small Business Development Centers (SBDC) Find your local center at: http://www.asbdc-us.org/ – UTSA-SBDC-Procurement Technical Assistance Center 210/458-2458 www.ptac.txsbdc.org/ - SBA San Antonio District Office Phone 210/403-5900 For Information regarding the Affordable Care Act, please visit www.sba.gov/healthcare 35