Basic Guidelines for selection of ORP vs. TRS

advertisement

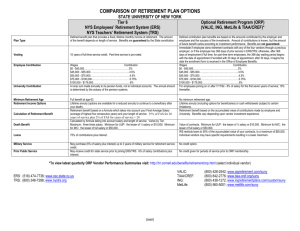

Basic Guidelines for Selection of ORP vs. TRS Elena Gaidouk Michael Sergi Clint T. Skipper Why Our Problem Is Important? • UH faculty have to choose between TRS and ORP. • Enrollment in ORP in lieu of TRS is a one-time, irrevocable decision. • Therefore some ORP-eligible employees may have difficulties in making this choice, which would ultimately affect their past-retirement income. Procedures Used • In this project we outlined major points that should be considered while making this decision and provided basic guidelines for the selection. • We also developed linear compensatory model using three major cues: age of the employee, attitude towards risk, and job security (such as tenure). Findings TRS • Provides benefits for service retirement, disability retirement, and death of a member or retiree • Statutory retirement formula: years of service x average of highest five annual salaries x 2.3% Findings (cont.) ORP • An individualized retirement plan in which each participant selects from a variety of investment products provided by several companies that are authorized by the employing institution. Major Difference • The essential difference is that TRS is a defined benefit program, while ORP is a defined contribution program. What Does It Mean? Optional Retirement Program Teacher Retirement System • Benefits are determined by the contributions and investment earnings in a person's account. • Benefits are determined by a formula, and benefit levels are guaranteed. • The employee bears the investment risk. • The employer bears the risk. • The employer's responsibility is to make the scheduled contributions. • Investment performance affects funding, and does not directly affect benefits. • Members have individual choices among investments. • Members have no individual control of benefit levels. • Benefits consist of the account balance, which can be annuitized for lifetime income. • Benefit levels are guaranteed for a retiree's lifetime. Other Differences ORP TRS Vesting One year plus one day Five years Portability Full None Disability Does not provide benefits Provides benefits Survivor Does not provide benefits Provides benefits Other Differences (cont.) Risk of Insolvency • Currently, the TRS has an actuarial valuation of assets at $89,299 M with an accrued actuarial liability of $102,495 M. This is a $13,196 M deficit or assets equal to 87.1% of liabilities • The percentage of assets to liabilities has been eroding since 2000 TRS Financial Condition (1) Valuation as August 31 2000 2001 2002 2003 2004 2005 Funding Ratio Assets as a % of AAL (2)/(3) 107.40% 102.5 96.3 94.5 91.8 87.1 Year 2000 2001 2002 2003 2004 2005 Annual Required Contributions Percentage Rate Contributed 4.92 122 4.12 146 5.7 105 7.15 84 7.39 81 7.31 82 The state may need to increase its contribution to the program to meet the shortfall. ORP and Market Risk • Enrollees in the ORP plan are exposed to market risk. • Enrollees can be over exposed to risk at different stages of their career. • Returns from proper investment mix can increase retirement benefit. • How much risk must be taken to achieve the 8% TRS return? Other Differences (cont.) Cost of Living Adjustment • Currently no recurring inflation adjustment to pension plan “Ad-hoc” adjustments to “catch-up” with inflation Legislation can pass benefit increase when fund is “sufficiently sound” for 31 years In other words, cannot when unfunded liabilities of plan exceed 31 years Every legislation since 1975 has made “COLA” adjustments • 1993 Four installment plan to replenish fund purchasing power Round Round Round Round 1 2 3 4 in 1993- 5-15% increase, with older retirees getting high end in 1995- 14% increase in 1997- 7.5% increase was supposed to occur in 2001, but instead changed multiplier • Currently active pursuit to urge Texas Legislature to annualize a minimum pension “COLA” Other Differences (cont.) Cost of Living Adjustment cont’d • To put into perspective- imagine employee who entered the TRS plan in 1992 • 1993- 5% increase (assuming minimum adjustment) • 1995- 14% increase • 1997- 7.5% increase • Total of 26.5% increase, or roughly 2% per year • 26.5% increase/14 years= 1.90% per year • Assuming TRS auditor’s 3% inflation estimate, this individual’s pension should have been adjusted by 42% • 14 years times 3%= 42% • Proposal for 80th Legislation session to waive “31 year” rule and grant annualized pension cost-of-living adjustments • Bottom line: The “Rule of 31” Law is eroding the purchasing power of TRS retirement benefits Who Should Choose ORP? • Employees who terminate employment at a young/middle age • Employees hired at young ages • Employees with modest pay increases over a career • Employees who achieve a higher rate of investment return, through personal investment selection • Employees with short life expectancy Who Should Choose TRS? • Employees who retire early • Employees hired in mid-career • Employees with substantial pay increases at the end of career • Employees who try to avoid any risk associated with the investment decisions • Married employees, because of survivor benefits • Employees with long life expectancy More Complicated Cases Use Linear Compensatory Model O=A+R+S Limitations • We are not experts • In our linear compensatory model we use only three cues, while there are other ones • The weights assigned to cues in the model may be wrong • Our model mostly addresses strong preferences cases • Our model has not been tested Thank you! We wish you all