2011 Tax Return Checklist

advertisement

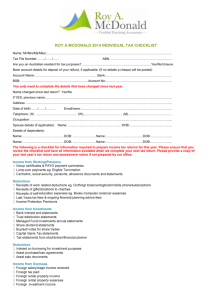

Stamford Financial – Tax Return Checklist – Individual 2011 2011 Tax Return – Individual Client Checklist Important Note Individual Tax Returns are not due for lodgement until March 2012, please advise your Accountant if you require your 2011 Income Tax Return urgently. Please allow up to 4 weeks turnaround for processing of post tax returns. If you would prefer an appointment, please contact your Accountant. Name_________________________________________________ DOB_____/______/______ Occupation____________________________________________ Phone (day time)________________(after hours)________________Email___________________________________ Name of spouse__________________________________________ DOB_____/______/______ Names of dependants ___________________________________ DOB_____/______/______ ___________________________________ DOB_____/______/______ ___________________________________ DOB_____/______/______ ___________________________________ DOB_____/______/______ Please tick if appropriate and attach relevant documentation Income Tick if included Group Certificates (including pensions & termination payments) Interest Received Bank Account No Interest Received $ Joint account? (Y/N) 1 Stamford Financial – Tax Return Checklist – Individual 2011 Dividends (please provide copies of dividend statements showing income received throughout the year. eg Woolworths direct shares) Trusts & Partnerships (please provide annual taxation summary to show income from your managed funds. (eg Aviva, Colonial First State, MLC, etc) Capital Gain (did you sell any assets such as shares or property that were acquired after 20 September 1985?) If applicable please provide the following documents:Purchase documents including date of purchase and cost Sale documents including date of sale and proceeds Rental Property (please provide the annual statement for your rental property from the real estate agent or for a property purchased after 1/7/08 please provide settlement documents. Please review the following list of documents to consider and include if applicable for your rental property. Rent received (from annual statement or bank statement) Tenant advertising Body corp Borrowing expenses Cleaning Council rates Depreciation Gardening Insurance Interest (please include bank statements) Deductions Please ensure you are able to substantiate all claims, even if less than $300. Loans for Trusts & Partnerships (please provide bank loan statements used to fund investments (eg NAB loan, Colonial Margin Lending, Calia, etc) Financial Adviser Service Fee (please provide tax invoice) Motor Vehicle (did you use your own car for business / work purposes through the year? Kilometres method – you use your car for work, but have not kept a logbook. Let us know how many km’s you would have travelled for work. The maximum the ATO allows you to claim is 5000 km’s. Kilometres travelled _________________________km’s Car engine size (in litres ie 1.6,2.0 etc)___________litres Work Uniform (if you have to wear a logo uniform or protective clothing please provide receipts of your out of pocket purchases (ie protective work boots, logo embroidery, logo uniforms) 2 Stamford Financial – Tax Return Checklist – Individual 2011 Other Work Related Expenses Diary/stationery/work materials Union fees/registrations/professional bodies Sickness & accident insurance/income protection Donations/school building fund Seminar costs or self education (please include HECS statement if applicable) Other Rebates Private Health Insurance (please provide us with a copy of the health fund statement) Membership Number__________________________ Medical Expenses (you may be entitled to a rebate if your out of pocket expenses exceed $1,500. This means, if you are in a private health fund, the portion of expenses that you did not get any money back on. If the total NET medical expenses exceed $1,500 you are entitled to a 20% rebate on the amount over the $1,500 threshold. If applicable, please provide documents from your healthcare providers as well as Medicare and any prescription receipts. Education Tax Refund (new to 2008-2009)(if you had eligible education expenses for a child’s primary or secondary education or you are an independent student, you can claim an education tax refund of up to 50% of those expenses. To be eligible you must be a person who is entitled to receive FTB Part A (with a taxable income of less than $45,114) or receives payments that stops them from receiving FTB Part A, for a child undertaking primary or secondary school studies or an independent student in primary or secondary school (for specific conditions and eligibility please discuss with your Accountant). If eligible, please provide documents for any of the following items. You can claim the cost of buying, establishing, repairing and maintaining any of the following items Laptops and home computers Computer related equipment such as printers, USB flash drives, etc Home internet connections Computer software for educational use (including antivirus software) School text books and other paper based school learning material, including prescribed text books, associated learning materials, study guides and stationery. Prescribed trade tools Other notes If you are unsure of the category information belongs, please include details of any other information here. __________________________________________________________________________________________________ __________________________________________________________________________________________________ 3