2012 Tax Return Checklist

advertisement

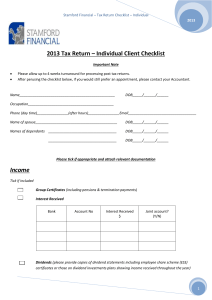

Stamford Financial – Tax Return Checklist – Individual 2012 2012 Tax Return – Individual Client Checklist Important Note Individual Tax Returns are not due for lodgement until March 2013, please advise your Accountant if you require your 2012 Income Tax Return urgently. Please allow up to 4 weeks turnaround for processing of post tax returns. If you would prefer an appointment, please contact your Accountant. Name_________________________________________________ DOB_____/______/______ Occupation____________________________________________ Phone (day time)________________(after hours)________________Email___________________________________ Name of spouse__________________________________________ DOB_____/______/______ Names of dependants ___________________________________ DOB_____/______/______ ___________________________________ DOB_____/______/______ Please tick if appropriate and attach relevant documentation Income Tick if included Group Certificates (including pensions & termination payments) Interest Received Bank Account No Interest Received $ Joint account? (Y/N) Dividends (please provide copies of dividend statements showing income received throughout the year. eg Woolworths direct shares) 1 Stamford Financial – Tax Return Checklist – Individual 2012 Trusts & Partnerships (please provide annual taxation summary to show income from your managed funds. (eg Aviva, Colonial First State, MLC, etc) Capital Gain (did you sell any assets such as shares or property that were acquired after 20 September 1985?) If applicable please provide the following documents:Purchase documents including date of purchase and cost Sale documents including date of sale and proceeds Rental Property (please provide the annual statement for your rental property from the real estate agent or for a property purchased after 1/7/08 please provide settlement documents. Please review the following list of documents to consider and include if applicable for your rental property. Rent received (from annual statement or bank statement) Tenant advertising Body corp Borrowing expenses Cleaning Council rates Depreciation Gardening Insurance Interest (please include bank statements) Deductions The ATO have increased their compliance and as such you must be able to substantiate all claims with a receipt or no deduction will be claimed. Loans for Trusts & Partnerships (please provide bank loan statements used to fund investments (eg NAB loan, Colonial Margin Lending, Calia, etc) Financial Adviser Service Fee (please provide tax invoice) Motor Vehicle (did you use your own car for business / work purposes through the year? Kilometres method –the ATO allow for maximum claim of 5000 km’s. To claim the kilometre method you must provide evidence of a logbook or odometer records. Kilometres travelled _________________________km’s Car engine size (in litres ie 1.6,2.0 etc)___________litres Work Uniform (if you have to wear a logo uniform or protective clothing please provide receipts of your out of pocket purchases (ie protective work boots, logo embroidery, logo uniforms) 2 Stamford Financial – Tax Return Checklist – Individual 2012 Other Work Related Expenses Diary/stationery/work materials Union fees/registrations/professional bodies Sickness & accident insurance/income protection Donations/school building fund Seminar costs or self education (please include HECS statement if applicable) Rebates Private Health Insurance (please provide us with a copy of the health fund statement) Membership Number__________________________ Medical Expenses - you may be entitled to a rebate if your out of pocket expenses exceed $2,060. This means, if you are in a private health fund, the portion of expenses that you did not get any money back on. If the total NET medical expenses exceed $2,060 you are entitled to a 20% rebate on the amount over the $2,060 threshold. If applicable, please provide documents from your healthcare providers as well as Medicare and any prescription receipts. Other Flood Levy - A temporary one-year flood levy applies to your taxable income for the 2011–12 income year. If your taxable income is: from $50,001 to $100,000 then the levy is 0.5% of any taxable income over $50,000 more than $100,000 then the levy is $250 plus 1.0% of any taxable income over $100,000. No flood levy is payable if: your taxable income is less than $50,001, or an exemption applies to you because you, a child you principally care for, or an immediate family member were affected by a natural disaster in the 2010–11 or 2011–12 income year. You will need to confirm your exemption when you lodge your 2012 tax return so that the flood levy is not included in your income tax assessment. Any flood levy amounts overpaid by you during the year will be credited in your 2012 income tax assessment. Removal of Education tax Refund - The Government announced in the 2012 Budget that the education tax refund (ETR) would be replaced by a new payment called the Schoolkids Bonus. You cannot claim the ETR for expenses incurred in 2011–12, or any excess eligible expenses you carried forward from the previous year. Transitional arrangements provided for the Department of Human Services to make a one-off payment to eligible families in June 2012. If you think you are eligible and have not received this payment, contact the Department of Human Services. 3 Stamford Financial – Tax Return Checklist – Individual 2012 Notes If you are unsure of the category information belongs, please include details of any other information here. __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ 4