Tax Checklist DOCX

advertisement

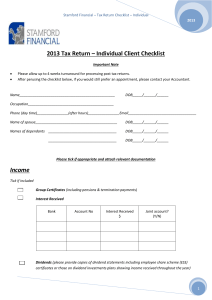

ROY A MCDONALD 2014 INDIVIDUAL TAX CHECKLIST Name: Mr/Mrs/Ms/Miss:............................................................................................................................................ Tax File Number: ……/……/…… ABN: .................................................................... Are you an Australian resident for tax purposes? ............................................................................ Yes/No/Unsure Bank account details for deposit of your refund, if applicable: (If no details a cheque will be posted) Account Name: ..................................................................... Bank: .......................................................................... BSB: ........................................................................... Account No: .......................................................................... You only need to complete the details that have changed since last year. Name changed since last return? Yes/No If YES, previous name: ............................................................................................................................................. Address: ................................................................................................................................................................... Date of birth:……/……/………. Email/www: ..................................................................................................... Telephone: (H) .............................................. (W)........................................... (M) ................................................. Occupation: .............................................................................................................................................................. Spouse details (if applicable): Name: ............................................................ DOB: ............................................... Details of dependents: Name: .............................................. DOB: .......................... Name: ......................................... DOB: ........................ Name: .............................................. DOB: .......................... Name: ......................................... DOB: ........................ The following is a checklist for information required to prepare income tax returns for this year. Please ensure that you review the checklist and have all information available when we complete your next tax return. Please provide a copy of your last year’s tax return and assessment notice if not prepared by our office. Income from Working/Pensions oup certificates & PAYG payment summaries Deductions -education expenses eg. Books /computer costs/car expenses tax fees & ongoing financial planning advice fees Income Protection Premiums Income from Investments Deductions Income from Overseas salary/wage income received Other useful information -contributions Private Health Insurance Rebate Statement - Your tax return cannot be lodged without the correct information being disclosed.. Note: the amount of the private health insurance rebate entitlement will vary depending on which income threshold tier the individual falls into – this is based on the individual’s income (either as a single or family) and their age. Broadly, singles and families will not be entitled to any private health insurance offset where the income for surcharge purposes is $136,001 or $272,001 for singles and families for the 2014 year. Obtain details of net medical expenses - A 20% offset will be available where the total of all the net medical expenses of a taxpayer (and dependants) exceeds $2,162 for individuals whose adjusted taxable income is equal to or less than $84,000 for singles or $168,000 for families . For taxpayers with adjusted taxable income above $84,000 for singles, or $168,000 for families, a 10% offset will be available for net medical expenses of a taxpayer (and dependants) exceeding $5,100. Tax tip: the rebate applies to most medical and related therapeutic treatment of a taxpayer and dependants but excludes certain cosmetic surgery. Note: The medical expense offset is phased out from 1 July 2013. Only those taxpayers who received an offset in their 2012-13 income tax assessment will continue to be eligible for the offset for the 2013-14 income year if you have eligible out-ofpocket medical expenses above the relevant claim threshold. The proposed changes will not apply to all taxpayers - the offset will continue to be available for taxpayers with out-of-pocket medical expenses relating to disability aids, attendant care or aged care expenses until 1 July 2019. Spouse Income Details - If your spouse’s tax return is not prepared by this office, please provide the following income details for your spouse as your tax return cannot be lodged without the information being provided on your tax return (a) Taxable Income (b) Reportable Employer Superannuation Contributions (c) Reportable Fringe Benefits (d) Tax Free Govt pensions (e) Other exempt pension income If you have an Investment Property (Contact our office for a schedule/checklist) If you have Income from Business (contact our office for a schedule/checklist) If you have Capital Gains (Contact our office for a schedule/checklist) Please complete and return with all relevant documentation Expenses Other Deductions ns By signing this document you confirm that you believe that you can prove the expenses that you wish to claim in your tax return; and that you understand that you could be fined for lodging a false tax return. Dated the …… day of ………………………201…… -------------------------------------------------------Signature of Taxpayer