differences between federal and new jersey tax law

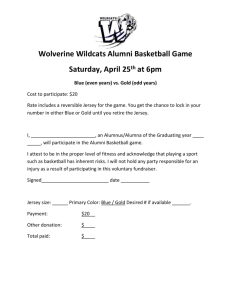

advertisement

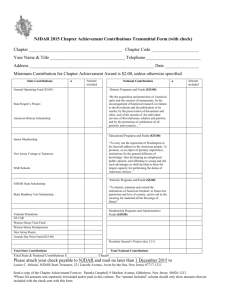

DIFFERENCES BETWEEN FEDERAL AND NEW JERSEY TAX LAW DIFFERENCES BETWEEN FEDERAL AND NEW JERSEY TAX LAW DIFFERENCES BETWEEN FEDERAL AND NEW JERSEY TAX LAW General Losses are not permitted anywhere on the New Jersey tax return; leave line blank Itemized Medical Expense in excess of 2% of NJ Gross Income reduce taxable income. NJ allows either a Property Tax Deduction or a Property Tax Credit NJ allows a credit for Income Taxes paid to other jurisdictions. No deduction for Sales Tax Exemptions - Line 6 Taxpayer always gets a deduction for self on New Jersey return May be disallowed on Federal return Civil Union Partner Exemption allowed on New Jersey return Not allowed on Federal return Domestic Partner Exemption allowed on New Jersey return Not allowed on Federal return Exemptions - Line 7 Additional Exemptions for age on New Jersey return Addition(s) to Standard Deduction for age on Federal return Civil Union Partner allowed on New Jersey return Not allowed on Federal Return Exemptions - Line 8 Additional Exemptions on New Jersey return if Blind or Disabled Addition(s) to Standard Deduction on Federal return for blind No addition(s) to Standard Deduction on Federal return for disability Civil Union Partner allowed on New Jersey return Not allowed on Federal return Exemptions - Line 11 Additional Exemption(s) on New Jersey return TaxWise: Must be entered Adjustment to income or tax credit on Federal return Income not taxable on New Jersey return Federal Social Security and Tier 1 Railroad Retirement Benefits May be partially taxable on Federal return Tier 2 Railroad Retirement Benefits May be fully or partially taxable on Federal return Income not taxable on New Jersey return United States military pensions reported on Form 1099-R by the US Defense and Accounting Service Fully taxable on Federal return Qualifying scholarships or fellowship grants May be fully or partially taxable on Federal return Unemployment Compensation Fully taxable on Federal return Income not taxable on New Jersey return New Jersey Lottery winnings Fully taxable on Federal return [Maybe offset with a Schedule A entry for gambling losses] Interest and capital gains from direct Federal obligations exempt under law Fully taxable on Federal return Income not taxable on New Jersey return Distributions paid by mutual funds attributable to interest earned on Federal obligations Fully taxable on Federal return Certain distributions from New Jersey Qualified Investment Funds Fully taxable on Federal return Income not taxable on New Jersey return Homestead rebates and Property Tax Reimbursements May be taxable or reduce Schedule A deduction on Federal return Line 14 - Wages: Box 16 (State Wages) from the W-2(s) must be used on Form NJ-1040, Line 14. This box is often different than Box 1 (Wages) Line 15 a – Taxable Interest Income Taxable categories differ from Federal rules See New Jersey Instructions and Chapter 7 Publication 17. TaxWise: Make these adjustments on the Interest Statement worksheet and/or the Dividend Statement worksheet. Line 15b – Tax Exempt Interest Exempt Categories differ from Federal rules See New Jersey Pub GIT-5. TaxWise: Make these adjustments on the Interest Statement worksheet and/or the Dividend Statement worksheet. Line 18 – Net gains from disposition of property: Exclude gains and losses from NJ Exempt securities as defined in GIT-5. TaxWise: Make adjustments with a scratch pad to NJ Schedule B line 1. [See NJ EFC Handbook, pages 16 & 17.] Line 19 – Pensions, Annuities and IRA Withdrawals Exclude: Federal Social Security Railroad Retirement (Tier 1 and Tier 2) TaxWise: Check Railroad Retirement box on the 1099-R screen. United States military pensions [See TAX TIP for Line 19] TaxWise: Check box 2 of the 1099-R screen. Line 19 – Pensions, Annuities and IRA Withdrawals General Rule or 3 Year Rule (if applicable) allowed for NJ calculation. TaxWise: If 3 Year Rule is/was used, adjustment to lines 19 will be required. [See NJ EFC Handbook, page 16.] Federal tax exempt distributions from an IRA for charitable gifts are NJ taxable. TaxWise: Must complete NJ IRA Withdrawal Worksheet for every IRA withdrawal Line 23 – Net Gambling Winnings: Net gambling winnings (excluding New Jersey Lottery winnings and losses) are reported. TaxWise: Fill in gambling losses on the W-2G screen even if Schedule A will not be used. If the winnings are from the NJ lottery, check the state return box on the W-2G screen. NJ Lottery losses are only entered on a W-2G reporting NJ Lottery winnings. Line 27a – Pension Exclusion Line 27 b – Other Retirement Income Line 27 c – Total exclusion Allowed within age and income restrictions. Unused Pension Exclusion amount may be carried over to Line 27 b - Other Retirement Income Exclusion. Paper returns use Worksheet D TaxWise: Automatic Calculation Line 28 – Gross Income If gross income is less than $20,000 ($10,000 Single or Married-Sep), no NJ Tax return is required. Return should be filed if a refund is due. TaxWise: If federal return is being e-filed and no NJ return is required for any reason, then check paper return on page 3 of the NJ 1040. When it prints, write “DO NOT FILE” on it. However, if a tenant rebate is requested, e-file the NJ return, even if it is not needed for any other reason. Line 30 – Medical Expenses Out-of-pocket expenses exceeding 2% of NJ Gross Income (line 28). If doing manually, complete Worksheet E. TaxWise: enter medical expenses on the Schedule A detail worksheet, even if Schedule A will not be filed. Pre-tax Federal/After-tax NJ medical deductions (Flex Savings Accounts, for example) should be included as NJ medical expenses. TaxWise: enter these using a scratch pad to line 30. (See NJ EFC Handbook, page 17.) Line 36a - Property Tax Paid Property Tax Due and Paid on taxpayers qualified principal residence. May be equal to, less than or greater than the amount deducted on Schedule A, Form 1040. Use the amount shown for Real Estate Tax from Form 1098, sum of actual payments and/or 18% of principal residence rent paid. TaxWise: Amount must be entered on page 3, Schedule 1, Line 1 Property taxes you paid … . Line 36b – Home Owner? Line 36b should not be completed if Taxpayer is a tenant or is not a homeowner on October 1 of Tax Year Line 36c - Property Tax Deduction or Line 48 Property Tax Credit Use Schedule 1 to determine the greater benefit. Only one of these lines can be used. Property taxes and/or 18% of rent paid on principal residence only. Taxpayers eligible for Property Tax Reimbursement must use base year property tax as Property Tax Paid TaxWise: enter property tax and/or rent on Schedule 1 on page 3 of the return. Do not make entry on 36c or 48. Line 50 - NJEITC: An individual who is eligible for a federal earned income tax credit will be allowed a NJEITC credit equal to a percentage of the federal earned income tax credit allowed. The percentage of the federal earned income tax credit allowed for Tax Year 2008 will be 22.5% TaxWise: Automatic Calculation Lines 51 & 52 - Excess UI/DI: If two or more employers, complete Form 2450 to determine if excess UI/DI was withheld. UI/DI information is usually found in Box 14 of the W-2 Statement. TaxWise: UI/DI always entered in Box 14. Confirm entries on the W-2 screen read “NJSDI” and “NJSUI”. If needed, Form 2450 will calculate automatically. DIFFERENCES BETWEEN FEDERAL AND NEW JERSEY TAX LAW