exercise – tax administration

advertisement

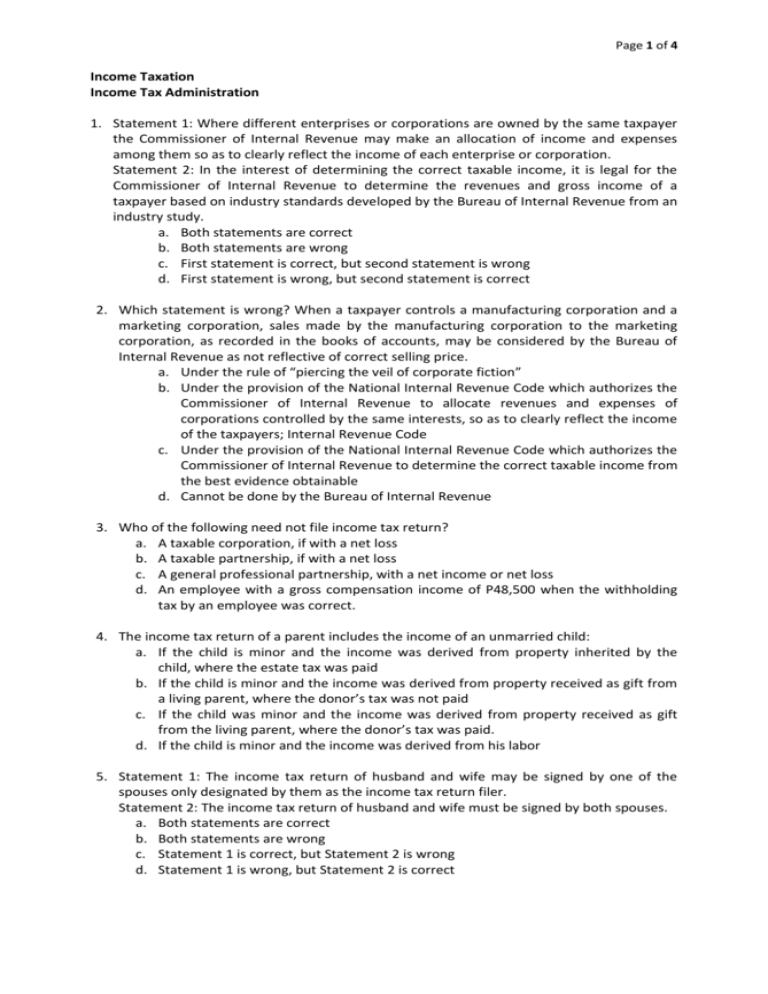

Page 1 of 4 Income Taxation Income Tax Administration 1. Statement 1: Where different enterprises or corporations are owned by the same taxpayer the Commissioner of Internal Revenue may make an allocation of income and expenses among them so as to clearly reflect the income of each enterprise or corporation. Statement 2: In the interest of determining the correct taxable income, it is legal for the Commissioner of Internal Revenue to determine the revenues and gross income of a taxpayer based on industry standards developed by the Bureau of Internal Revenue from an industry study. a. Both statements are correct b. Both statements are wrong c. First statement is correct, but second statement is wrong d. First statement is wrong, but second statement is correct 2. Which statement is wrong? When a taxpayer controls a manufacturing corporation and a marketing corporation, sales made by the manufacturing corporation to the marketing corporation, as recorded in the books of accounts, may be considered by the Bureau of Internal Revenue as not reflective of correct selling price. a. Under the rule of “piercing the veil of corporate fiction” b. Under the provision of the National Internal Revenue Code which authorizes the Commissioner of Internal Revenue to allocate revenues and expenses of corporations controlled by the same interests, so as to clearly reflect the income of the taxpayers; Internal Revenue Code c. Under the provision of the National Internal Revenue Code which authorizes the Commissioner of Internal Revenue to determine the correct taxable income from the best evidence obtainable d. Cannot be done by the Bureau of Internal Revenue 3. Who of the following need not file income tax return? a. A taxable corporation, if with a net loss b. A taxable partnership, if with a net loss c. A general professional partnership, with a net income or net loss d. An employee with a gross compensation income of P48,500 when the withholding tax by an employee was correct. 4. The income tax return of a parent includes the income of an unmarried child: a. If the child is minor and the income was derived from property inherited by the child, where the estate tax was paid b. If the child is minor and the income was derived from property received as gift from a living parent, where the donor’s tax was not paid c. If the child was minor and the income was derived from property received as gift from the living parent, where the donor’s tax was paid. d. If the child is minor and the income was derived from his labor 5. Statement 1: The income tax return of husband and wife may be signed by one of the spouses only designated by them as the income tax return filer. Statement 2: The income tax return of husband and wife must be signed by both spouses. a. Both statements are correct b. Both statements are wrong c. Statement 1 is correct, but Statement 2 is wrong d. Statement 1 is wrong, but Statement 2 is correct Page 2 of 4 6. A corporation which is included in exempt corporations under Section 30 of the National Internal Revenue Code (e.g., organized and operated for charitable purposes) which did not file its articles of incorporation and bylaws with the Bureau of Internal Revenue: a. Is required to file an income tax return and pay the income tax b. Is required to file an income tax return although not required to pay the income tax c. Needs to file only an information return and will not be required to pay the income tax d. Needs to file an information return and pay the income tax 7. A general professional partnership is exempt from income tax, but is required to file an income tax return: a. For statistical purposes b. Because the net income of the partnership will be traced into the income tax return of the partners c. Because all income earners are required to file income tax returns d. None of the above 8. When an individual taxpayer is under temporary disability: a. Income tax return is required to be for him by his guardian b. No income tax return is required of him c. Income tax return for the period when he was under disability shall be required only when he becomes able d. None of the above statements is correct 9. Statement 1: A corporation with an annual income tax paid or payable of at least P1,000,000 for the preceding taxable year is a large taxpayer. Statement 2: When a corporation is dissolved and is under receivership, the corporation is still the taxpayer until the close of the liquidation. a. First statement is correct, while second statement is wrong b. First statement is wrong, while second statement is correct c. Both statements are correct d. Both statements are wrong 10. Which statement is wrong? When an individual, notwithstanding withholding income tax during the year on his compensation income, is required to file an income tax return at the end of the year, he: a. May pay the income tax in two installments if the income tax on his taxable income for the year, before credit for withholding income tax, exceeds P2,000 b. May pay the income tax in two installments if the income tax on his taxable income for the year, after credit for withholding income tax, exceeds P2,000 c. May credit the income tax withheld against the first installment tax due d. May still pay the income tax in one lump sum even if it exceeds P2,000 and credit the withholding income tax against it 11. Which of the following withholding income tax should be remitted to the Bureau of Internal Revenue within ten days after the end of each month? a. Withholding income tax on compensation income b. Withholding final income tax on passive income c. Withholding income tax under the Expanded Withholding Tax System d. All of the above 12. Which is not a creditable withholding income tax? a. Expanded withholding income tax b. Withholding income tax on passive income Page 3 of 4 c. Withholding income tax at source d. None of the above 13. One of the following statements is correct. A choice by an individual of the Optional Standard Deduction means that: a. His income tax return need not be accompanied by financial statements b. He need not keep books of accounts c. He need not have records of gross income d. His choice can still be changed by filing an amended return 14. Which of the following is a taxpayer required to file an income tax return? a. An estate which is under administration b. A trust where the fiduciary must accumulate the income of the trust c. A trust where the fiduciary may accumulate or distribute the income of the trust, at his discretion d. All of the above 15. Which is correct? The income tax return shall be accompanied by the following: a. Statement of Net Worth and Operations, if the gross receipts from business or profession do not exceed P50,000 in any one quarter b. Balance Sheet and Income Statement, if the gross receipts from business or profession exceed P50,000, but do not exceed P150,000 in any one quarter c. Balance Sheet AND Income Statement certified by an independent Certified Public Accountant, if the gross receipts from business or profession exceed P150,000 in any one quarter d. All of the above 16. A corporation files a quarterly return within a. 30 days after the end of each of the first 3 quarters b. 60 days after the end of each of the first 3 quarters c. 30 days after the end of each of the first 4 quarters d. 60 days after the end of each of the first 4 quarters 17. A final or annual return is file a. On or before the 15th day of the month following the close of the taxable year b. On or before the 15th day of the 2nd month following the close of the taxable year c. On or before the 15th day of the 3rd month following the close of the taxable year d. On or before the 15th day of the 4th month following the close of the taxable year 18. A corporation on a fiscal year ending March 31, should file it’s annual return a. On or before April 15 of the same year b. On or before April 15 of the following year c. On or before July 15 of the same year d. On or before July 15 of the following year 19. Which of the following statements is not true and incorrect? a. A tax assessment is necessary to a criminal prosecution for willful attempt to defeat and evade payment of taxes. b. A conviction for tax evasion is not a bar for collection of unpaid taxes. c. Criminal proceedings under the Tax Code is now a mode of collection of internal revenue taxes, fees, and charges. d. If the taxpayer is acquitted in a criminal violation of the tax Code, this acquittal does not exonerate him from his civil liability to pay the taxes. Page 4 of 4 20. Who must report their income under the cash basis? a. Those who keep records under the cash receipts and disbursement method b. Those who do not keep books and records c. Those whose books and records are inadequate to reflect the taxable income d. All of these 21. Who are required to compute their taxable income on the basis of calendar year only? a. Individuals b. Estates or trusts c. General public d. All of these 22. Statement 1: The Commissioner of Internal Revenue can, if he makes a finding that the nature of stock on hand (e.g., scarcity, liquidity, marketability or price movements) is such that inventory gains should be considered realized for tax purposes, require a change in the inventory valuation method of a taxpayer. Statement 2: The accrual method of accounting is required of trading, manufacturing and service enterprises. a. First statement is correct, second statement is wrong b. First statement is wrong, second statement is correct c. Both statements are correct d. Both statements are wrong 23. Statement 1: Where different enterprises or corporations are owned by the same taxpayer, the Commissioner of Internal Revenue may make an allocation of income and expenses among them so as to clearly reflect the income of each enterprise or corporation. Statement 2: In the interest of determining the correct taxable income, it is legal for the Commissioner of Internal Revenue to determine the revenues and gross income of a taxpayer based on industry standards developed by the Bureau of Internal Revenue from an industry study. a. Both statements are correct b. Both statements are wrong c. First statement is correct, but second statement is wrong d. First statement is wrong, but second statement is correct -EndAnswer Key: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. A D D B C B B A C A D B A D D B 17. 18. 19. 20. 21. 22. 23. B C A D D A A *End*