Supplier Consolidation

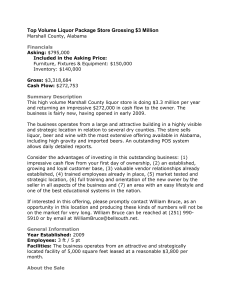

advertisement

Consolidation It’s Just Beginning – You Ain’t Seen Nothing Yet! Monday, October 27th, 2008 Charlotte, North Carolina Topics • • • • Supplier consolidation Distributor consolidation Retailer consolidation Other consolidation Supplier Consolidation Supplier Consolidation • • • • • • • • • • It will continue More appropriately – Polarization Expect consolidation among larger players In turn, spawning lots of small players and one or two mega players Perhaps even a “beer, wine and liquor” mega player In total today, though, it is still very fragmented!!! Be prepared for the entry of completely new players These new players, as you will see, might well impact control states Vertical integration? For sure – Lots of ongoing change! Still Fragmented – Fair Size Players Diageo Bacardi Pernod Ricard Moet Hennessy Gruppo Campari Remy Cointreau Edrington Group Fortune Brands Brown-Forman SPI UB Group William Grant Marnier Lapostolle Grupo Cuervo C&C International TCC Bols Suntory Group Hite (Jinro) Heaven Hill CL Financial TaKaRa Mast-Jagemeister ILLVA Saronno La Martiniquaise DeKuyper Henkell & Sohnlein Nolet Distillery E&J Gallo Tanduay Industrias Muller Russian Standard Bank Nikka / Asahi Drambuie Group San Miguel Osborne Group Oaktree Capital Barton Brands Antiqueno Berentzen Bohae Mostly ignores beer and wine. In All, 215 medium / large players Boisset Borco Marken Brugal Caninha Da Roca Caninha Oncinha Capel Daesun Fratelli Branca Glen Catrine Godo Shusei (Oenon) Halewood Vintners Hardenberg Industrias Reunidas Independent Distillers J&G Grant Jagajit Keumbokju Kikkoman Kirin Kyongwoul Kyowa Hakku Mercian Corp Mohan Meakin Muhak Nemirov Vodka Company Pitu Rhadico Khaitan Ron Matusalem Russian Wine & Spirits Co. Santa Teresa Sanwa Satsuma Seralles Tekel Unkai Ypioca First Ireland Mou Tai Wuliangyie Antigua Distillers Inner Circle Highwood Distillers Soyuz Victan Uto Nederland RC Cooymans Arcus Polarization – Emergence Of Small Players Gemini Spirits & Wine Kobrand Corporation Infinium Spirits Shaw Ross International Craft Distillers (Hangar One) Phillips Distilling Castle Brands Fifth Gen Inc (Tito's) AV Imports Luctor International Sans Wine & Spirits W.J. Deutsch Mutual Wholesale (Monopolowa) Terlato Spirits Admiral Imports Niche Import Company Palm Bay Imports MHW Limited BenDistillery Crillon Nicholas Enterprises Preiss Imports Capstone International Jinro America LIPS Imports Chatham Imports Drinks America International Beverage Halby Marketing Heartland Distributing Clear Creek Distilling Bardenay Distilling Sovereign Brands Icon Brands Specialty Spirits Imports 42 Other Contenders 3D Spirits Altamar Bacmar International Belmont Farms Camus Cognac Carnivo Unlimited Cognac Ferrand USA, Inc. Distillery No. 209 Distillery Resources, Inc. Duggans Distilled Products Frank Pesce Group Frederick Wildman Gil Schy Harbrew Imports Ltd. Hardy USA Heck Estates (Korbel) Koenig Distillery Magic Spirits Maine Distilling Maison JMRE Mango Bottling Marsalle Company Mystique Brands (Royal) Natural West Oliphant USA Opici Imports Pacific Edge Wine & Spirits Parliament Imports Pasternak Imports Philadelphia Distilling Quadro Group, LLC Reformed Spirits Co. RU Brands, LLC Seashore Marketing Speyside Importing Co. Stellar Imports Terlato Total Beverage Solution Wein-Bauer, Inc. White Gold USA, LLC Winebow, Inc. World Contact To Give You A Flavor For The Battle At The Top…. Company Exxon = $355.0 B Mkt Cap Anheuser Busch $42.4 Diageo $36.0 LVMH $31.5 InBev $22.6 SAB Miller $20.2 Pernod Ricard $11.8 Heineken $11.1 Foster's $10.3 Bacardi* $8.0 Asahi Brewing $7.8 Brown-Forman $7.0 Fortune Brands $5.3 Carlsberg $5.0 Constellation Brands $2.9 Modelo $1.8 Campari $1.8 Remy Cointreau $1.7 Excludes Debt Numbers New Players To The U.S. InBev SPI UB Group Grupo Cuervo / Proximo TCC CL Financial Belevdere S.A. / Imperial Brands Russian Standard Bank Oaktree Capital So What? • • • • • For the Xenophobes = They are all “Foreigners” Not used to the 21st Amendment Not used to a mandated three tier system InBev SPI Not used to “Control States” UB Group Grupo Cuervo No one knows what changes they TCC might start lobbying for CL Financial Belevdere S.A. • Many trade associations, Russian Standard Bank Oaktree Capital government lobbying groups, are controlled by foreign entities Distributor Consolidation Distributor Consolidation • • • • • • • • • • • It will continue Will it bifurcate into sales and logistics? Public flotation? What would a distributor be worth? Would suppliers try to prevent it? Could suppliers prevent it? CEDC – Publicly traded wholesaler, market capitalization of $1.0 billion It is possible that there may be only one logistics distributor in a market Be prepared for the entry of completely new players These new players, as you will see, may impact control states Certain major suppliers have explored the “new player” options Current Paradigm • • • • • • • Southern W&S Young’s Market RNDC Glazer Charmer-Sunbelt Wirtz Control States Tomorrow’s Paradigm • • • • • • • Southern W&S Young’s Market RNDC Glazer Charmer-Sunbelt Wirtz Control States • DHL / Exel • UPS • FedEx • Centrex, Rhode Island • Food Brokers • Sysco • US Foodservice • Performance Food Group • Reyes Holdings • Ben E. Keith • Crescent Crown • Self Distribution Who is CEDC? Originally founded in 1990 NASDAQ listed since 1998 with current market capitalisation of over US$1 billion The leading distributor and importer of alcoholic beverages in Poland. The leading producer of vodka in Poland and the 4th largest producer of vodka worldwide. 2006 forecasted sales of US$931 m to US$956 and forecasted EPS of US$1.90 to US$2.10 A battle is brewing between Anheuser-Busch and the beermaker's sole distributor in Miami-Dade and Monroe counties.: Anheuser-Busch nixed the planned sale of a distributor to a rival. Byline: Patrick Danner Jun. 14 2007 Distributor Eagle Brands was in line to be sold for $62 million to rival company Gold Coast Beverage Distributors of Miami. But Anheuser-Busch quashed the deal, saying Gold Coast would have a virtual monopoly on beer distribution in the two counties. Now Eagle Brands is demanding the $62 million from Anheuser-Busch, the brewer says. And the St. Louis-based father of Budweiser is asking a federal judge to rule that its action did not violate Florida beer-franchise law, in a nine-page lawsuit filed Tuesday in U.S. District Court in Miami.... Food Service Distributors • • • • Sysco – Market Cap of $14.0 billion U.S. Foodservice Performance Food Group As wholesale consolidation enters next phase do they jump in? Food Brokers: an oligopoly in the middle Even more dramatic than the concentration of supermarkets has been the concentration of food brokers, the middlemen in the food industry. There are now just three privately held companies in the U.S. that dominate this field: Acosta, Advantage Sales and Marketing, and Crossmark. All three have quadrupled in size over the past decade. At that point there were around 2,500 regional grocery brokers. Through acquisition and hard competition, these three dominate the majority of the business between them. They are now working on expanding abroad, buying up local distributors from Europe to Australia. Broker are in charge of selling and stocking products to food sales outlets from supermarkets to convenience stores to corner grocers. The advantage they give is that they can coordinate sales nationwide and manage warehousing and delivery efficiently, something most food manufacturers have traditionally not wanted to do or couldn't afford to do. Retailer Consolidation Retailer Consolidation • Comes in many shapes and sizes - • • • • • • Bricks and mortar Internet Grocery, Drug, Liquor, Hotels, Restaurants Country by country It’s happening all over the globe It will definitely impact our US market Significant attempts to deregulate the alcohol market “Global” pricing threatens large supplier margins Vertical integration either literal or through private label Not sure the crafters of the 21st Amendment thought about the need to protect us from very large retailers Large Supermarkets Wal*Mart $204.0 Tesco $38.4 Carrefour $25.7 Costco $22.0 Kroger $17.2 Royal Ahold $11.2 Safeway $9.0 Sainsbury $7.0 Supervalu $3.0 Publix $0.0 Coles Myers $0.0 Woolworths $0.0 Aldi $0.0 Delhaize $0.0 Supermarket Consolidations FTC Approves Sale of Albertson's BOISE, Idaho -The Federal Trade Commission on Tuesday approved the $9.7 billion sale of Albertson's Inc., the nation's second-largest grocery store chain, to a consortium led by Minnesota-based grocer Supervalu Inc. and drugstore chain CVS Corp, reported the Associated Press. Arnault looks to increase Carrefour Stake Source: Financial Times By Scheherazade Daneshkhu in Paris Published: Jul 19, 2008 Billionnaire Bernard Arnault is intent on increasing his stake in Carrefour with Colony Capital, his joint venture partner, but does not seek to take control of the French retailer, according to a regulatory filing. Blue Capital, the investment vehicle held equally by Colony and Mr Arnault, who is also chairman of LVMH, the luxury goods group, has taken advantage of Carrefour's weak share price to increase its stake over recent days. How stores pile alcohol high and sell it cheap Last updated at 00:52am on 15th February 2008 Supermarkets are selling alcohol at a loss to pull in customers. They are offering shoppers savings worth millions, particularly around the time of sporting events and national holidays. Evidence supplied to a Competition Commission inquiry suggests the big four - Tesco, Asda (Wal*Mart), Sainsbury's and Morrisons - sold an estimated £100 million worth of beer, wines and spirits below cost at the time of the World Cup in 2006. Recent promotions of cheap lager and cider have brought down the cost of alcohol to below the prices charged for some bottled water. Australia: Battle of the booze February 5, 2006 Retail giants Coles Myer and Woolworths have a new battleground - booze. Or, more specifically, discount booze sold in warehouse-style facilities: what they call, unglamorously, their "big-box liquor offer". And as in most of their colossal battles over the years, there will be winners - the two retailers and probably consumers - and losers - anyone in the industry who gets in the way of these market titans or can't adapt to serve them. Large Drug Chains CVS $39.0 Walgreen's $21.9 Rite Aid $0.5 Drug Chain Consolidations Rite Aid To Buy Two Rival Chains HARRISBURG, Pa., Aug. 24, 2006 (AP) Rite Aid Corp., the nation's third-largest drugstore chain, said Thursday it will purchase the U.S. Eckerd and Brooks operations of Canada's Jean Coutu Group Inc. for about $2.55 billion in cash and stock. The deal, Rite Aid's first major acquisition since a turnaround team arrived to bring the company back from the brink of bankruptcy six years ago, will make it the largest drugstore chain operator on the East Coast, Rite Aid said. However, it will still trail Walgreen and CVS nationally. CVS, Longs merger in sight Source: Retailing Today Oct 22nd After a three-month battle with Walgreens, CVS Caremark's bid for Longs has prevailed. The company announced this week that its tender offer for shares of common stock of Longs Drug Stores at a price of $71.50 per share has been successful. Large Restaurant Chains Darden $2.8 Brinker $1.0 IHOP $1.0 Buffalo Wild Wings $0.6 Texas Roadhouse $0.5 Cheesecake Factory $0.5 Red Robin $0.2 Ruby Tuesday $0.1 Carlson $0.0 Outback Steakhouse $0.0 Hooters $0.0 Restaurant Consolidations Darden Acquires RARE Hospitality Publication: Foodservice Equipment and Supplies Date: Saturday, September 1 2007 Darden Restaurants Inc. signed an agreement to purchase RARE Hospitality International Inc., an operator of 317 restaurants, including 287 LongHorn Steakhouse and 28 Capital Grille restaurants. The total purchase price is approximated at $1.4 billion. The offer is expected to close in October. Headquartered in Orlando, Fla., Darden owns and operates nearly 1,400 Red Lobster, Olive Garden, Bahama Breeze, Smokey Bones and Seasons 52 restaurants with annual sales of $5.6 billion. RARE’s annual sales average around $1 billion. Large Hotel Chains Marriott $6.5 Starwood $3.7 Intercontinental $2.2 Hilton $0.0 Accor $0.0 Carlson $0.0 Hyatt $0.0 Cendant $0.0 Hotel Consolidations Liquor Store Chains Liquor Stores Income Fund Announces the Planned Acquisition of 12 Liquor Stores in Calgary EDMONTON, May 31, 2006 - Liquor Stores Income Fund announced today the planned acquisition of 12 additional stores in Alberta. The Fund will be acquiring 12 of the 14 stores operated by Willow Park Group in Calgary. Willow Park Group is the 6th largest independent chain of liquor stores in Alberta. EDMONTON, ALBERTA, April 10, 2007 – Liquor Stores Income Fund (“Liquor Stores”)(TSX:LIQ.UN) announced today that it has made an offer to acquire all of the outstanding trust units of Liquor Barn Income Fund (“Liquor Barn”) (TSX: LBN.UN). The two businesses provide an excellent strategic fit and together will create the leading independent liquor retailer in Alberta and B.C. with 176 liquor stores, providing a strong platform for future growth; Liquor Store Chains Liquor Stores Income Fund Enters U.S. Market (In Anchorage, Alaska) With the Strategic Acquisition of 19 Liquor Stores From Brown Jug Inc. Tuesday, July 22, 2008 5:03 PM Liquor Stores Income Fund (the "Fund") (TSX:LIQ.UN) announced today that the Fund has signed a definitive agreement for the acquisition of 19 liquor stores in greater Anchorage by a whollyowned subsidiary of the Fund. Irving Kipnes, CEO of the Fund, stated, "We are very pleased with the planned acquisition of the Brown Jug stores as our initial entry into the U.S. market, as well as the addition of our new Canadian stores. Liquor Store Chain Players • • • • • • • • • ABC - Florida Spec’s Centennial Twin Liquor Total Bevmo PLCB NHSLC 50 / 60 Others Other Consolidation Other Consolidation • Raw Material consolidations - Paraxylene Glass bottles • Shipping consolidations - Truck lines Rail lines • All of the above can impact service / cost! • Control State consolidations? • Trade association consolidations (NABCA acquires DISCUS) Exit Questions • • • • • • • • How does this overall landscape potentially affect your operations? Will you be under more pressure or less in the future? How do you maintain a level playing field? What, if anything, can you do about it? Does it help or endanger the future of the control states? What impact might this have on the concept of the three tier system? What impact does this have on alcohol’s status as “something different” What impact might all this have on responsible consumption? Questions? Thank You!