Exponential Function

advertisement

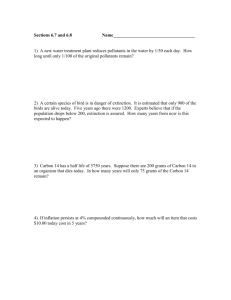

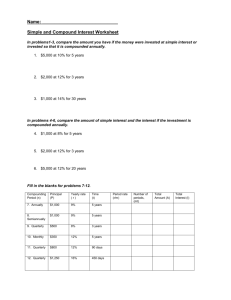

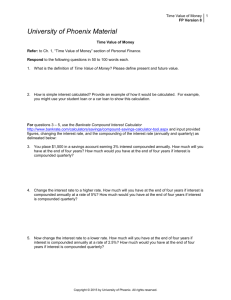

Section 3.3 Exponential Functions 1. Use a calculator to evaluate, rounding to three decimal places. 1. a. e 2 b. e -2 c. e ½ 1. a. ≈ 7.289 b. ≈ 0.135 c. ≈ 1.649 2. Express as a power of e a. e 5 e -2 b. e5 e3 c. e 5e 1 e 2e a. = e 5+(-2) = e 3 b. e 3-2 = e 2 a. = e 5(1) e 21 = e4 e 1 = e 4-(-1) = e 5 3. Graph y = 3 x on a graphing calculator. - 5 < x < 5 and -1 < y < 100 4. Graph y = (1/3) x on a graphing calculator. - 5 < x < 5 and -1 < y < 100 5. Evaluate e 1.74 using a calculator. e 1.74 = 5.696 6. BUSINESS: Interest - Find the value of $1000 deposit in a bank at 10% interest for 8 years compounded a. anually b. quarterly c. continuously a. For n = 1 m = 1 (annual compounding), P(1+r/n)nt simplifies to P(1+r)t when P = 100, r = 0.1, and t = 8. The value is 1000(1 + 0.1)8 = 1000 (1.1) 8 = 2143.59 The value is $2143.59 b. For quarterly compounding, n = 4, P = 1000, r = 0.1, and t = 8. Thus 1000(1+(0.1/4) 4x.8 = 1000(1 + 0.025) 4x.8 = 1000 (1.025) 32 = 2203.76 The value is $2203.76 c. For continuous compounding P = 1000, r = 0.10, and t = 8. Thus 1000e 0.1x8 – 1000e 0.8 = 2225.54 The value is $2225.54 7. Personal Finance: Interest - A loan shark lends you $100 at 2% compound interest per week (that is a weekly, not annual rate). a. How much will you owe after 3 years? b. In “street” language, the profit on such a loan is known as the “vigorish” or the “vig”. Fins the shark’s vig. a. P = 100, r = 0.02, and n = 3, compounded weekly, which is 52 timer per year. this gives a value of 100(1 + 0.02) 52x3 = 100(1.02) 52x3 = 100(1.02) 156 = $2196 b. The “vig” is equal to the amount owed after three years minus the amount loaned. This is $2196 - $100.00 = $2096 8. Personal Finance: Annual Percentage Rate (APR) - Find the error in the ad shown below, which appeared in a New York paper. [Hint: Check that the nominal rate is equivalent to the effective rate. For daily compounding, s some banks use 365 days and some use 360 days in the year. Try both ways. At T&M Bank, flexibility is the key word. You can choose the length of time and the amount you deposit, which will earn an annual yield of 9.825% based on a rate of 9.25% compounded daily. The stated rate of 9.25% (compounded daily) is the normal rate of interest. To determine the effective rate of interest, use the compound interest formula, P (1 +r) n, with r = 9.25%/ number of days and n = number of days in a year. Since some banks use 365 days and some use 360 in a year, we will try both ways. If n = 365 days then, r 9.25% 0.0925 0.0002543 365 365 Then P(1+r) n = P(1.0002534) 365 ≈ 1.0969%. Subtracting 1 gives 0.0969, which expressed as a percent gives the effective rate of interest as 9.69% r 0.0925 0.0002569 360 If n = 360 days then Then P(1+r) n = P(1.0002569) 360 ≈ 1.0969% and the effective rate is also 9.69% Thus, the error in advertisement is 9.825%. The annual yield should be 9.69% (based on the nominal rate of 9.25%) 9. Personal Finance: Present Value - A rich uncle wants to make you a million. How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? If the amount of money P invested at 8% compounded quarterly yields $1,000,000 in 60 years then r 0.08 0.02 and n = 604 = 240. 4 1,000,000 = P(1 +0.02) 240 P 1,000,000 240 $8629 (1 0.02) 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold zero-coupon $1000 bonds maturing in 3 years with an annual yield of 10%. Find the price. [Hint: the price is the present value of $1000, 3 years from now at the stated interest rate] For 10% compounded annually, r = 0.10 and n = 3. Present value = p 1000 $751.31 (1 r)n (1 0.10)3 11. General: Compound Interest - Which is better 10% interest compounded quarterly or 9.8% compounded continuously? To compare two interest rates that are compounded differently, convert them both to annual yields. 10% compounded quarterly: P(1+r) n = P(1.025) 4 ≈ P(1.1038) Subtracting 1, 1.1038 – 1 = 10.38%. 9.8% compounded continuously, Pe rn = Pe 0.098 ≈ P(1.1030) Subtracting 1: 1.130 – 1 = 0.1030 The effective rate of interest is 10.30%. Thus, 10% compounded quarterly is better than 9.8 compounded continuously. 12. Personal Finance: Depreciation - A Toyota Corolla automobile lists for $15,450, and depreciates by 35% per year. Find the values after: a. 4 years b. 6 months Since the depreciation is 35% per year, r = 0.35. a. P(1 +r) n = 15,450(1 – 0.35) 4 ≈ $2758 b. P(1 +r) n = 15,450(1 – 0.35) 0.5 ≈ $12,456 13. General Nuclear Meltdown: - The probability of a “severe core meltdown accident” at a nuclear reactor in the U.S. within the next n years is 1 – (0.9997) 100n. Find the probability if a meltdown: a. within 25 years. b. within 40 years a. 1 = (0.9997) 100(25) ≈ 0.5277 b. 1 – (0.9997) 100(40) ≈ 0.6989 14. General: Population - As stated earlier, the most populous state is California, with Texas second but gaining. According to the Census Bureau, x years after 2005 the population of California will be 36e0.013x and the population of Texas will be 22e 0.019x (all in millions) a. Graph these two functions on a calculator on the window [0,100] by [0,150]. b. In which year is Texas projected to overtake California as the most populous state? [hint: use INTERSECT] a. b. During the year 2087 (x ≈ 82.08) And 2005 + 82 = 2087.

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)