MAGNUM HUNTER'S BANKRUPTCY PLAN SLASHES

advertisement

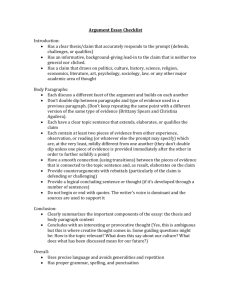

DEBTWIRE BROADCAST: MAGNUM HUNTER’S BANKRUPTCY PLAN SLASHES FUNDED DEBT TO ZERO… SO WHAT’S THE CATCH? Debtwire’s team of reporters and analysts host a roundtable discussion to explore Magnum Hunter’s plan to eliminate its entire prepetition funded debtload, as well as highlight how the deal architects potentially skirted some of the stumbling blocks that cropped up in other recent court proceedings. | 17 December 2015 AGENDA Opening Remarks: Kate Marino The Eureka Factor: Alexander Gladstone Case Overview Financial Analysis: Thomas Rorick First Day Hearing: Patrick Holohan Legal Analysis: Richard M. Goldman Concluding remarks: Alexander Gladstone What’s next? 2 THE EUREKA FACTOR: CASE OVERVIEW Magnum Hunter’s bankruptcy filing: Oil price decline prompts capex curtailment, liquidity crisis Strategic options center on stake in Eureka Hunter Holdings Failure to achieve asset sales Status of second lien claim on Eureka Second lien and unsecured holders collaborate on rescue loan to buy time 3 FINANCIAL ANALYSIS: ADJUSTED CAPITAL STRUCTURE PRO FORMA ADJUSTED SUMMARY CAPITAL STRUCTURE (USD m) L+ 8.0% Face Amount 200 Market Amount - (200) Pro Forma Face Amount 0 L + 4.0% 70 70 (70) 4.25% - 8.7% 13 13 L + 7.5% 337 Capital Structure as of 15 Dec. 2015 DIP Term Loan Facility Coupon First Lien Bridge Financing Facility Yield Maturity - - 15 Apr 2016 0 - - 15 Dec 2015 0 13 - - 2016-2024 195 (337) 0 58.0 26.9% 22 Oct 2019 420 278 (607) 13 600 189 (600) 0 1,020 467 (1,207) 13 2 2 (1) 1 Liquidation Preference 1,018 Face Amount 465 Market Amount $25 100 1 (100) 0 $0.18 $50 221 0 (221) 0 $0.10 $25 95 0 (95) 0 $0.02 4 4 884 888 $0.02 1,438 471 2 Equipment & real estate notes payable Second lien term loan Price 1 3 Total secured debt Senior unsecured notes 9.75% Total debt Cash and cash equivalents Net debt Series C cumulative perpetual preferred stock Series D cumulative preferred stock 4 4 Series E cumulative convertible preferred stock Market value of common stock 4 5 Enterprise value LTM Adjusted EBITDAX 48 2016P Adjusted EBITDAX 2 Adj. Adj. 12 Pro Forma Face Amount 2016P Pro Forma Face Leverage 5.7x 5.7x 31.5 48.9% 15 May 2020 5.7x 5.2x Price 900 Asset Retirement Obligations USD 28m 1) The DIP Term Loan Facility is subject to a 1% Libor floor. The DIP Term Loan facility will mature the earlier of a) nine months after the closing date, b) 30 days after entering into the Interim DIP Order approving the DIP Facility if the Final DIP Order has not been entered into by the Bankruptcy Court prior to the 30 day period, c) effective date of plan of reorganization or liquidation or d) termination by the DIP Facility Lenders following an event of default. 2) Absent an event of default the Bridge Financing Facility is due on the earlier of 30 December 2015 or the filing of a Chapter 11 case. 3) The second-lien term loan is subject to a 1% LIBOR floor. 4) On 9 October, MHR suspended the monthly dividends on its preferred stock. Unpaid dividends will continue to accumulate from 31 October and afterward. 5) Under the RSA, the total enterprise value assumed is USD 900m. Sources: SEC Filings, MarketAxess, Markit, Debtwire Analytics, FINRA. 4 FINANCIAL ANALYSIS: DIP FINANCING SOURCES & USES Sources DIP Term Loan Facility Uses 200 Total Sources 200 Repayment of First Lien Bridge Financing Facility 70 Commitment fee 4 Cash collateralize letters of credit 39 General unsecured claims 67 Cash used during bankruptcy 20 Total Uses 200 PLAN RECOVERIES (USDm) Class Portion of New Common Equity Value of Equity Received Claim Estimated Recoveries 31.800% 212 200 107.8% Second Lien Lenders 36.9% 245 341 71.9% Senior Noteholders 31.3% 208 632 33.0% DIP Lenders 1 1) Our recovery for DIP Lenders includes the 3% Backstop Fee payable in New Common Equity. Sources: 3Q15 10-Q Report, Court Filings, Debtwire Analytics. 5 FINANCIAL ANALYSIS: CASH BUDGET CASH BUDGET USD m Beginning Cash Fcst Fcst Fcst Week 1 Week 2 Week 3 12/18/15 12/25/15 1/1/16 Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Week 11 Week 12 Week 13 1/8/16 1/15/16 1/22/16 1/29/16 2/5/16 2/12/16 2/19/16 2/26/16 3/4/16 3/11/16 - 40 37 30 23 37 33 37 29 28 21 20 4 40 - - - 96 - - - - - - - - 1st Lien Roll-up - - - - (70) - - - - - - - - Net Operating Receipts 0 3 - 0 1 0 5 0 0 1 5 - 0 Net Operating Disbursements - (1) (0) (1) (3) (1) (0) (4) (0) (5) (0) (3) (1) Total Capital Expenditures - - (1) (1) (1) (1) (1) (0) (0) (0) (0) (2) (2) Ch.11 Relief / Financing Costs / Other - (5) (6) (5) (9) (1) (1) (3) (1) (2) (6) (11) (1) 40 37 30 23 37 33 37 29 28 21 20 4 1 DIP Draw Ending Cash Balance Source: Interim DIP Order. 6 FINANCIAL ANALYSIS: MGT. PROJECTIONS PROJECTIONS $ in millions, except pricing data) Net Production Oil (Boe) Gas (Bcf) NGL (Mboe) Total Net Production (Bcfe) Realized Prices Oil ($/Bbl) Gas ($/Mcf) NGL ($/Bbl) Cash Flows Oil Gas NGL Total Oil & Gas Revenue Other Revenue-Oilfield Services Total Revenue Operating Expense-Upstream Operating Expense-Oilfield Services G&A Expenses EBITDAX Capex-Williston Hunter Capex-Triad Capex-MH Production Capex-Alpha Hunter Drilling Discretionary Cash Flow Working Capital Other Free Cash Flow Items Unlevered Free Cash Flow Source: Lender Presentation. Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017 FY 2018 FY 2019 FY 2020 0.2 7.0 0.3 9.8 0.2 7.5 0.3 10.4 0.2 7.8 0.3 10.5 0.2 8.3 0.3 10.9 0.7 30.5 1.1 41.5 0.1 9.1 0.2 11.4 0.1 8.0 0.2 10.2 0.1 7.2 0.2 9.3 0.1 10.3 0.2 12.5 0.6 34.6 0.9 43.5 0.5 47.7 0.8 55.4 0.4 60.4 0.7 66.9 0.4 74.7 0.7 81.2 $36.22 $2.08 $13.96 $37.99 $2.06 $14.52 $39.07 $2.14 $14.85 $40.04 $2.24 $15.14 $38.27 $2.13 $14.61 $40.97 $2.68 $15.42 $41.74 $2.48 $15.64 $42.45 $2.54 $15.85 $43.20 $2.66 $16.09 $42.06 $2.60 $15.74 $44.62 $2.66 $16.50 $46.41 $2.76 $17.04 $47.59 $2.87 $17.40 7 15 4 25 2 27 20 2 7 28 (1) -(12) -(0) (13) (2) -(14) 7 15 4 27 3 30 21 3 7 31 (0) -(6) -(0) (6) (1) (0) (7) 7 17 4 27 3 31 20 3 7 30 1 -(12) -(0) (11) 1 -(10) 7 19 4 29 2 31 21 2 6 29 3 -(12) -(0) (10) (2) -(11) 27 65 17 108 11 120 81 9 27 117 2 -(41) -(0) (39) (3) (0) (43) 6 24 4 34 2 36 20 2 6 28 8 -(6) -(0) 2 (3) -(1) 6 20 4 29 2 32 19 2 6 27 5 -(17) -(0) (12) 7 -(5) 6 18 3 28 2 30 17 2 6 26 4 -(42) -(0) (37) 3 (0) (34) 6 28 4 37 2 39 21 2 6 29 10 -(33) -(0) (23) 2 -(21) 24 90 14 128 9 137 77 8 25 110 27 -(97) -(0) (70) 9 (0) (61) 21 127 13 161 16 178 86 14 25 126 52 -(105) -(0) (53) (12) (0) (65) 19 167 12 197 16 214 93 14 25 133 81 -(101) -(0) (21) 1 -(20) 18 214 12 245 17 261 107 14 25 146 115 -(111) -(0) 4 (4) -0 LEGAL ANALYSIS Debtor in possession financing Restructuring support agreement Industry comps – Samson Resources and Sabine Oil & Gas Throwing a wrench in the works 8 CONCLUDING REMARKS: WHAT’S NEXT? What happens to Eureka stake? How can Magnum generate value for post-reorg equity holders? 9 DISCLAIMER We have obtained the information provided in this report in good faith from publicly available data as well as Debtwire data and intelligence, which we consider to be reliable. This information is not intended to provide tax, legal or investment advice. You should seek independent tax, legal and/or investment advice before acting on information obtained from this report. We shall not be liable for any mistakes, errors, inaccuracies or omissions in, or incompleteness of, any information contained in this report, and not for any delays in updating the information. We make no representations or warranties in regard to the contents of and materials provided on this report and exclude all representations, conditions, and warranties, express or implied arising by operation of law or otherwise, to the fullest extent permitted by law. We shall not be liable under any circumstances for any trading, investment, or other losses which may be incurred as a result of use of or reliance on information provided by this report. All such liability is excluded to the fullest extent permitted by law. Any opinions expressed herein are statements of our judgment at the date of publication and are subject to change without notice. Reproduction without written permission is prohibited. For additional information call Debtwire Analytics at (212) 686-5374. Copyright 2015 S&P Capital IQ (and its affiliates, as applicable). This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor's. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES. OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

![[#FWDIP-74] PVSS invalid Bits (including range) are not all reflected](http://s3.studylib.net/store/data/007282728_1-8b675e5d894a5a262868061bfab38865-300x300.png)