Chapter 4 Internal Control and Cash

advertisement

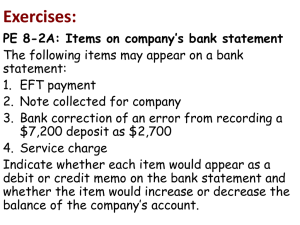

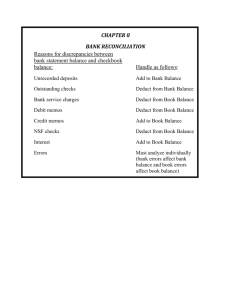

ACG 2021 Financial Accounting Internal Control and Cash Learning Objectives • Understand Internal Control • Use a bank reconciliation as a control device • Account for Petty Cash • Use a budget to manage cash Internal Control Internal control is an organizational plan and related measures that an entity adopts to reach various Goals: – Safeguard assets – Encourage adherence to company policies – Promote operational efficiency – Ensure accurate and reliable accounting records Failures of Internal Control • • • • Enron WorldCom Others Led to Congress Passing SarbanesOxley Act – Address Public Concerns over failed • Audits of Public Companies • Internal Controls at Public Companies Bank Accounts as Controls • All cash should be deposited into a bank account daily. • To draw money from the account, a check is written • Three parties to a check: – maker – signs the check – payee – to whom the check is written – bank – on which the check is drawn • Remittance advice is an optional attachment that gives the reason for the payment. Cash Control Definitions • Monthly bank statements are sent to the account holder and should be reconciled. – to check (a financial account) against another for accuracy (Webster Online Dictionary) • Electronic fund transfer (EFT) is the electronic transfer of cash. No check is written. – Payments on behalf of account holder. – Deposits made from customers to account holder. • Bank statements include both physical checks and EFT payments as well as other transactions on the account. Bank Reconciliation • Comparison of: – Two independently maintained records of a business’s cash • The company’s Cash account (T-Account, the book balance) • The bank statement • Differences between the two records generally arise because of timing differences. – Deposits were made but after the bank statement was printed and mailed. – Checks were written but have not cleared the bank when the bank statement was printed mailed. • Reconciliations ensure that the two records agree. Bank Reconciliation Items for reconciliation: • Items RECORDED by the company but not yet recorded by the bank: – Deposits in transit – Outstanding checks Bank Reconciliation Items for reconciliation: • Items recorded by the bank BUT NOT YET recorded by the company. – Bank collections • deposits received directly by the bank from customers – Electronic funds transfers • Both payments and deposits – Service charges and the cost of printed checks – Interest revenue earned on checking account – Nonsufficient funds (NSF) checks • These are checks deposited from a business’ customers that don’t have sufficient funds – So they ‘bounce’ • Errors by the company or the bank Bank Reconciliation • The adjusted bank balance must equal the adjusted books balance – Book Balance = Ending Cash Account • This is how we ensure Control over Cash Reconciling Items Bank Balance • Add deposits in transit • Subtract outstanding checks • Add or subtract corrections of bank errors, as appropriate Book Balance • Add bank collection items, interest revenue, and EFT receipts • Subtract service charges, NSF checks, and EFT payments • Add or subtract corrections of book errors, as appropriate. Bank Reconciliation • Journal entries are only made for: – Adjustments to Book Balance • Bank collection items, interest revenue, and EFT receipts • Service charges, NSF checks, and EFT payments • Errors made by the company – (bank errors do not require journal entries on the company’s books). Bank Reconciliation Illustrated Business Research, Inc., shows a balance on its bank statement of $5,931.51 on January 31. The company Cash account has a balance of $3,294.21. 1. 2. 3. 4. 5. 6. The January 30 deposit of $1,591.63 does not appear on the bank statement. The bank erroneously charged to the account a $100 check (No. 656) written by Business Research Associates. Five company checks, totaling $1,350.14, issued late in January and recorded in the journal have not been paid by the bank. The bank received $904.03 by EFT on behalf of Business Research, Inc. The bank collected on behalf of the company a note receivable, $2,114 (including interest revenue of $214). The bank statement shows interest revenue of $28.01. Bank Reconciliation Illustrated 7. Check number 333 for $150 paid to Brown Company on account was recorded as a cash payment of $510. 8. The bank service charge for the month was $14.25. 9. The bank statement shows an NSF check for $52. 10. Business Research pays insurance expense by EFT and has not recorded this $361 payment. Bank Reconciliation Business Research, Inc. Bank Reconciliation January 31, 20X6 Bank Balance, January 31 Add: 1. Deposit of January 30 in transit 2. Correction of bank error – Research Associates check 656 erroneously charged against company account Books $5,931.51 1,591.63 100.00 7,623.14 Less: Outstanding Checks No. 337 $286.00 No. 338 319.47 No. 339 83.00 No. 340 203.14 No. 341 458.53 (1,350.14) Adjusted bank balance $6,273.00 Balance, January 31 $3,294.21 Add: 4. EFT receipt of rent revenue 904.03 5. Bank Collection of note receivable including interest revenue of $214 2,114.00 6. Interest revenue earned on bank balance 28.01 7. Correction of book error – overstated amount of check no. 333 360.00 6,700.25 Less: 8. Service charge $14.25 9. NSF check 52.00 10. EFT payment of insurance expense 361.00 (427.25) Adjusted book balance $6,273.00 Journal Entries from Reconciliation (4) Cash Rent Revenue Receipt of monthly rent 904.03 904.03 (5) Cash 2,114.00 Notes Receivable 1,900.00 Interest Revenue 214.00 Note receivable collected by the bank (6) Cash Interest Revenue Interest earned on bank balance 28.01 28.01 (7) Journal Entries from Reconciliation Cash 360.00 Accounts Payable Correction of check no. 333 (8) (9) (10) Miscellaneous Expense Cash Bank Service Charge Accounts Receivable Cash NSF customer check returned by bank Insurance Expense Cash Payment of monthly insurance 360.00 14.25 14.25 52.00 52.00 361.00 361.00 ACG 2021 Financial Accounting Petty Cash Cash Budgets, and Cash on the Balance Sheet Petty Cash • Petty cash fund is to pay for minor expenses. • Fund is opened with a particular amount of cash. • A custodian issues cash when needed and places all petty cash tickets and receipts in the box with the remaining cash. • The sum of the remaining cash and petty cash tickets should equal the amount established for the fund. • Petty cash is an example of an imprest fund. • Beginning Cash + Added Cash – Receipts = Ending Cash Petty Cash Receipts Beg Bal Added Cash End Bal Petty Cash Journal Entries Petty Cash 500.00 Cash To establish Petty Cash Fund Postage Expense 70.00 Office Supplies Expense 180.00 Miscellaneous Expense 125.00 Cash To Reimburse the petty cash fund 500.00 375.00 Cash Budgets • Budget – a financial plan • Cash budget – plans cash receipts and cash payments Beginning cash Plus: Expected Receipts Less: Expected Payments Equals: Expected Ending cash • Allows mangers to know in advance whether they will likely need to borrow money. Reporting Cash on the Balance Sheet • Cash and Cash Equivalents – liquid assets such as time deposits and certificates of deposit • Restricted cash must be disclosed separately. – Collateral – Other non-Operating uses • Compensating balances are not included as cash. – Minimum cash balance required for loan End of Chapter 4