Exercises: PE 8-2A: Items on company`s bank

advertisement

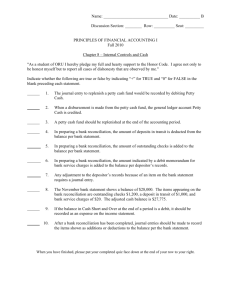

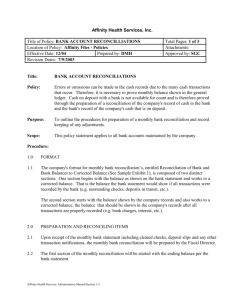

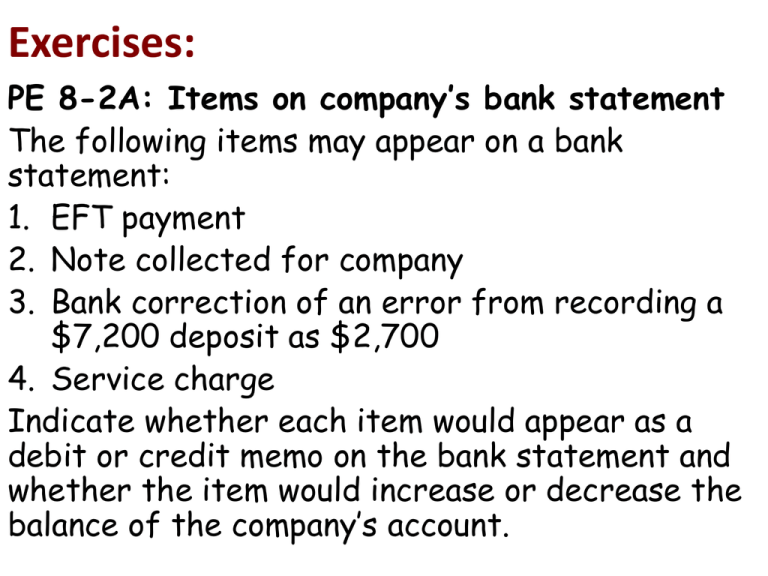

Exercises: PE 8-2A: Items on company’s bank statement The following items may appear on a bank statement: 1. EFT payment 2. Note collected for company 3. Bank correction of an error from recording a $7,200 deposit as $2,700 4. Service charge Indicate whether each item would appear as a debit or credit memo on the bank statement and whether the item would increase or decrease the balance of the company’s account. PE 8-2B: Items on company’s bank statement. The following items may appear on a bank statement: 1. EFT check 2. Bank correction of an error from posting another customer’s check to the company’s account. 3. Loan proceeds 4. EFT deposit Indicate whether each item would appear as a debit or credit memo on the bank statement and whether the item would increase or decrease the balance of the company’s account. BE 8-3A: Bank reconciliation: The following data were gathered to use in reconciling the bank account of a company: Balance per bank Balance per company records Bank service charges Deposit in transit NSF check Outstanding checks $25,500 $27,475 75 7,500 3,400 9,000 A) What is the adjusted balance on the bank reconciliation? B) Journalize any necessary entries for the company based on the bank reconciliation. BE 8-3B: Bank reconciliation: The following data were gathered to use in reconciling the bank account of a company: Balance per bank Balance per company records Bank service charges Deposit in transit Note collected by bank with $360 interest Outstanding checks $17,400 $5,765 125 3,000 9,360 5,400 A) What is the adjusted balance on the bank reconciliation? B) Journalize any necessary entries for the company based on the bank reconciliation. PE 8-4A: Petty cash fund Prepare journal entries for each of the following: a. Issued a check to establish a petty cash fund of $800 b. The amount of cash in the petty cash fund is $225. Issued a check to replenish the fund, based on the following summary of petty cash receipts: repair expense $450, and miscellaneous selling expense $75. Record any missing funds in the cash short and over account. PE 8-4B: Petty cash fund Prepare journal entries for each of the following: a. Issued a check to establish a petty cash fund of $750 b. The amount of cash in the petty cash fund is $325. Issued a check to replenish the fund, based on the following summary of petty cash receipts: store supplies $300, and miscellaneous selling expense $100. Record any missing funds in the cash short and over account. EX 8-16 Bank reconciliation Identify each of the following reconciling items: (non of the transactions reported by bank debit and credit memos have been recorded by the company) 1) Bank service charges $120 2) Check of a customer returned by bank to company because of insufficient funds 4,200 3) Check for $240 incorrectly recorded by the company as $420 4) Check for $1000 incorrectly charged by bank as $10,000 5) Deposit in transit $24,950 6) Outstanding checks $18,100 7) Note collected by bank $15,600 EX 8-18 Bank reconciliation 1) Cash balance according to the company’s records at July 31, $15,600. 2) Cash balance according to the bank statement at July 31, $16,230. 3) Checks outstanding, $3,180 4) Deposit in transit, not recorded by bank $2,950 5) A check for $270 in payment of an account was erroneously recorded in the check register as $720 6) Bank debit memo for service charges, $50 a. Prepare a bank reconciliation b. Must a bank reconciliation always balance (reconcile)? EX 8-22 Bank reconciliation Identify the errors in the following bank reconciliation Alma Co. Bank reconciliation for the month ended Nov 20 2012 Cash balance according to bank statement $12,090 Add: outstanding checks: No.915 $850 No.960 $615 No.964 $850 No.965 $775 $3,090 = $15,180 Deduct: deposit of Nov 30,not recorded by bank $4000 Adjusted balance $11,180 ______________________________________________________________________ Cash balance according to company’s records $4,430 Add: proceeds of note collected by bank: Principle $5,000 Interest $200 = $ 5,200 Service charges $30 = $ 5,230 = 9660 Deduct: Check returned because of insufficient funds $1,100 Error in recording Nov 23 deposit of $6100 as $1600 $4500 = 5,600 Adjusted balance $4,060