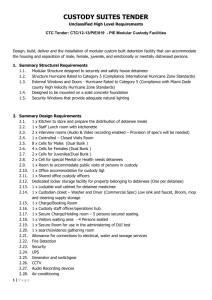

Custody of Client Assets

advertisement

• Michael Sherman, Partner, Dechert • Francine Rosenberger, General Counsel, Steben & Co. • Karen Huey, Founder/CEO, Professional Compliance Assistance, Inc. Custody of Client Assets “Custody” means holding, directly or indirectly, client funds or securities or having any authority to obtain possession of them and includes actual possession, automatic fee billing arrangements, or being the general partner of a pooled investment vehicle client. Generally, Rule 206(4)-2 provides that it is a fraudulent practice for an adviser to have custody of client assets unless: – the funds or securities are held by a “qualified custodian” and the adviser notifies clients of the custodial arrangement; and – the adviser reasonably believes (after due inquiry) that the custodian sends clients quarterly account statements and, in most cases, the adviser undergoes an annual surprise audit. 2 Independent Verification and Control Report Subject to certain exceptions, if an adviser has custody of client funds or securities: – Such funds or securities must be verified by an annual surprise examination by an independent public accountant; and – If the adviser or one of its related persons actually maintains client funds or securities as a qualified custodian, the adviser must obtain an internal control report from an independent public accountant on an annual basis in addition to the surprise examination. In these cases, the independent public accountant must be PCAOB-registered and inspected. – Exceptions are available where (i) the related custodian is “operationally independent” and (ii) for certain pooled investment vehicles. 3 Annual GAAP Audit for Private Funds Advisers to private pooled investment vehicles can use the “Audit Method” to comply with Rule 206(4)-2, which permits such advisers to comply with the Rule’s independent verification (“surprise audit”) and quarterly account statement requirements by: – Undergoing an annual audit by an independent public accountant that is registered with, and subject to examination by, the Public Company Accounting Oversight Board; and – Distributing to investors audited GAAP annual financials within 120 days after the end of the pool’s fiscal year (180 days for funds-of-funds). 4 Form ADV Part 1A, Item 9 Part 1A has only six custody questions but there are lots of implications! • The instructions are sparse. ~ Item 9A asks about “You” This is the Adviser, not a person. ~ Item 9B asks about “Related Persons” This term includes “Affiliates”, which may be persons or entities. SEC-registered firms are specifically directed to answer “No” to custody if the only reason for custody is fee deduction. 5 Form ADV Part 1A, Item 9 • State-registered firms must also answer Custody questions on Part 1B, which is the state addendum to Part 1A. • Some states have a specific protocol follow, so do your research. • States vary widely on their interpretations of Custody. Examples: Tennessee North Carolina 6 Form ADV Part 1A, Item 9 Implications of Item 9 Disclosures: 1. State-registered firms are usually required to have audited financials if they have Custody 2. Can cause confusion if firm answers incorrectly 3. Can raise the firm’s risk rating with yes answers 4. Might accidentally indicate that firm has a related person that is a Qualified Custodian 7 Form ADV Part 1A, Item 9 Don’t miss completing Item 9F. – Even if the only custody-related activity you conduct is the debiting of advisory fees, you need to answer Item 9F. – If this is you, count the number of custodians from which you debit fees. 8 Common Mistakes #1 – Failure to recognize Custody Exam staff has as much confusion as advisers, so be informed – it’s complicated! Don’t forget the SEC FAQs: https://sec.gov/divisions/investment/custody-faq-030510.htm #2 – Failure to confirm Custody (don’t assume) Log-in credentials; Trustees; SLOAs #3 – Failure to test Ongoing review to confirm you do/don’t have custody 9 Common Mistakes #4 – Failure to draft adequate written procedures (and therefore risk of violating several rules at once) #5 – Failure to conduct due inquiry regarding those custodial statements #6 – Failure to act if errors are discovered - much better for you to find and correct errors instead of exam staff 10 Common Mistakes #7 – Failure to ensure that clients are notified of the Qualified Custodian #8 – Failure to remind clients to compare adviserprepared statements to custodian-prepared statements #9 – Failure to ensure the private fund audit is completed and sent to investors within 120 days of year-end #10 – Failure to file Form ADV-E 11 Compliance Issues with Custody • Not realizing the adviser has custody of client assets – Authority to transfer assets from client account at the qualified custodian – Broader disbursement authority for financial affairs – Client login credentials for website that allows transfer of funds or securities – Standing letters of authorization to custodian where adviser has some discretion as to disbursements from client account – Inadvertent custody in receiving client funds or securities – Acting as a trustee to a client account – Serving as a general partner to a pooled investment vehicle – Being a managing member of a limited liability company 12 Compliance Issues with Custody • Complicated rule, not a technicality – Use a checklist or flowchart to follow through on types of accounts, access to funds / securities, and requirements – Review all contracts, powers of attorneys – Maintain log of receipt of checks and securities received as well as disposition – Keep internal control documents up to date on how systems and processes work – If use an auditor, confirm that it is registered with the Public Company Accounting Oversight Board – Undertake a practice audit – Conduct training to develop awareness of circumstances that will result in custody of client assets 13 How Custody is Addressed in Exams • SEC (or state) exam staff will review ADV Part 1A before exam • SEC requests certain information in document request letters – On the “Master Client List” item of the request letter there will be a column for you to indicate yes/no for custody • SEC reviews whether custodian sends periodic account statements directly to clients – They used to contact clients directly but generally don’t now • Exam staff will review your internal controls to be sure they are robust enough to protect clients (and will look for documentation that such procedures are being followed) • SEC reviews copies of initial engagement letters – Must retain accountant within six months of having custody 14 Enforcement Cases on Custody • 2013 Trio of Custody Administrative Proceedings – First Case: (1) Failed to arrange an annual surprise examination to verify the funds’ assets, (2) Fund investors did not receive quarterly account statements from a qualified custodian of the funds – Second Case: (1) Firm used pre-signed letters of authorization and then transferred client funds without always obtaining contemporaneous client signatures, (2) Inaccurate Form ADV disclosures about the amount of client assets in custody and its custody arrangements – Third Case: (1) Private funds where adviser served as general partner did not have funds’ financial statements audited or distributed, (2) Alternatively the funds were not subject to annual surprise examinations or fund investors did not receive quarterly account statements from qualified custodian 15 Enforcement Cases on Custody • 2014 Administrative Proceedings – Sands Brothers Asset Management • SEC issued prior order for custody violations noted in OCIE examinations in 1999, 2004 and 2009 • Repeated failure to distribute audited financial statements to investors of pooled investment vehicles within 120 days of end of the fiscal year – Vero Capital Management • Among other allegations, the SEC alleged that the fund manager violated custody rules because it had not: (1) Provided notice to investors in the funds upon opening an account with a custodian for the funds, (2) Established a reasonable belief upon due inquiry that the custodian had delivered account statements to investors in the fund at least quarterly, and (3) Undergone an annual surprise examination by an independent public accountant 16 Insight on the Surprise Exam and An Accountant’s Report • Surprise examinations will not apply to advisers: ‒ who have custody solely because of their authority to deduct advisory fees from client accounts; or ‒ to a pooled investment vehicle that is subject to an annual financial statement audit by an independent public accountant. • Advisers subject to surprise examinations must enter into a written agreement with an independent public accountant to conduct the surprise examinations. • Reports to the SEC are required within one business day of finding any material discrepancy during the examination. • Form ADV-E must be filed within 120 days of the surprise examination. • Advisers that maintain custody of privately offered securities on behalf of clients are also subject to the surprise examination requirement. • SEC has provided guidance for accountants regarding surprise examinations. 17 Testing Ideas Wide variation in testing among firms, depending upon size and complexity • Do you have a written policy (i.e., we do or do not have Custody), with procedures (i.e., who does what and when?) to back it up? • Test the controls around improperly drawn checks or certificates arriving in the mail • Check whether you have custody with respect to each new account opened • Document custody on new account opening procedures and test this as part of annual review • Maintain a running list of custody accounts and test against new accounts opened for a period of time (ex: check every 6 months) • Review your full client list to look for account names that stand out (e.g., trusts, estates, partnerships) • Determine whether your custody procedures are robust enough • – Ask employees for input on potential gaps – Is there separation of duties/controls? If you have made a determination that you do not have custody, revisit at least annually to be sure nothing has changed 18 Application of Custody Rule to Private Equity and Private Funds: Special Purpose Vehicles • RIAs use Special Purpose Vehicles (“SPVs”) to facilitate investments in certain securities by pooled investment vehicles that the RIA manages. • These SPVs are typically controlled by the RIA or the RIA’s related persons. • RIA can (a) treat a SPV as a separate client, or (b) treat the SPV’s assets as assets of the funds over which it has indirect custody (i.e., rely on the audit exemption). • RIA may treat the assets of a SPV as assets of the funds if (a) an SPV is owned by affiliated funds managed by the adviser and (b) the SPV is within the scope of the funds’ financial statement audits. • However, if the SPV has third-party owners, the RIA needs to treat the SPV as a separate client. 19 Application of Rule 206(4)-2 to Private Equity and Private Funds: Escrow Accounts • Funds held in escrow may violate Rule 206(4)-2 if they belong to both the adviser’s pooled investment vehicle clients and third-party sellers and if they are maintained by a “sellers’ representative” • SEC clarified that placing client funds in an escrow account can be permitted if: 1. the client is a pooled investment vehicle that relies on the audit provision and includes the portion of the escrow attributable to the pooled investment vehicle in its financial statements; 2. the escrow is in connection with the sale or merger of a portfolio company; 3. the escrow contains an amount of money agreed upon as part of a bona fide negotiation; 4. the escrow exists for a certain agreed upon period of time; 5. the escrow is maintained at a qualified custodian; and 6. the “sellers’ representative” is required to promptly distribute the funds at the end of the escrow. 20 16th Amendment Advisors LLC • SEC provided no-action relief on March 23, 2015. • Certain provisions of Rule 206(4)-2 do not apply to a private investment fund if its investors consist solely of the fund manager’s principals (a “Principal Person”) and their spouses and minor children. • A Principal Person is an individual who: 1. has plenary access to information concerning the management of the funds; 2. is listed as “control person” in Schedule A to Form ADV; AND 3. has a material ownership in the investment adviser. • No-Action relief is unlikely to apply to most ”friends-and-family” funds because the relief only applies to spouses and minor children. • The RIA must still maintain the fund’s cash and its securities with a qualified custodian. 21