CISI - Directions Online Career Service

advertisement

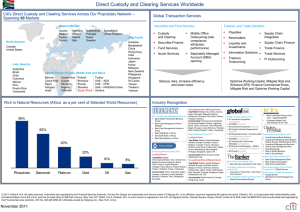

Careers in Investment Operations Siân Lloyd MBA ASIP Chartered FCSI Senior Adviser Step into Financial Services, London: 27th June 2012 www.cisi.org Discussion Points Overview of Investment Operations Transaction Processing Global Custody & Asset Servicing Global Custody Investment Administration Valuation and Performance Measurement Operational Risk Qualifications & Career Entry Investment Industry Basics The UK Investment Management Industry has over £4 trillion under management which is roughly split into: 2/3 institutional, pension fund & insurance mandates, and 1/3 retail assets (e.g. ISAs, unit trusts) & private wealth. Managers are expected to make the money grow! Efficient operational activities, robust and flexible reporting systems, and good risk management can make huge differences to performance, reputation and client retention Clients pay a small percentage fee for each service: investment management, custody, asset servicing and reporting, and trading. Operational activities may be conducted in: investment firms (often in a separate location); third party administrators; global custodian banks; broking firms; clearing houses; stock exchanges. Many are located outside London. Operational Activities Decision & Trade Execution Transaction Processing Global Custody & Asset Servicing Investment Administration Risk Management Data Management Pre & Post Trade Compliance IT & Systems Management Reconciliation, Reporting & Analysis Transaction Processing Decision & Trade Execution (investment manager or trader) Broker Investment Operations Clearing House Global Custodian (client’s bank) Matching & confirmation, implementing margin (if derivatives), settlement, registration of ownership, notification & reporting Risk Management Data Management Pre & Post Trade Compliance Systems Management Reconciliation, Reporting & Analysis Global Custody Global Custodian (client’s bank) Clearing Houses, Exchanges Investment Operations Clients Portfolio accounting; cash management; safe custody of assets; stock lending; corporate action & income processing; reporting to regulators, clients and investment management firms Risk Management Data Management Pre & Post Trade Compliance Systems Management Reconciliation, Reporting & Analysis Investment Operations Investment Operations Investment Managers Clients Global Custodian (client’s bank) Internal transaction processing; portfolio valuation & fund accounting; liquidity management; reconciliation with custodian’s records; performance measurement & analysis; daily internal reports; periodic regulatory & client reports Risk Management Data Management Pre & Post Trade Compliance Systems Management Reconciliation, Reporting & Analysis CISI Qualifications: Operations Qualifying Advanced QCA Levels 3-4 / EQF Levels 4-5 EQF Level 6/7 Investment Operations Certificate (IOC) Advanced Certificate in Global Securities Operations Introduction to Investments + Regulatory Module + 1 technical module: Global Securities Operations Advanced Global Securities Operations Asset Servicing (Corporate Actions) - Collective Investment Schemes Administration - CREST Settlement - Exchange-Traded Derivatives Administration - Global Securities Operations - IT in Investment Operations Operational Risk - OTC Derivatives Administration - Private Client Administration - Risk in Financial Services - ISA Administration Advanced Operational Risk Operational Risk Advanced Operational Risk IT in Investment Operations Introduction to Investments Regulatory Module IT in Investment Operations Diploma in Investment Operations 1 Advanced Certificate + Global Operations Management CISI Qualifications What do Operational Staff learn about? • Financial markets, instruments, products, systems • Overview of investment & economics theory • Role- ready knowledge of investment processes & risk management • Portfolio accounting and performance measurement • Where and how specific roles fit within the wider business • Industry rules and regulations • Clients: investment agreements and reporting requirements • Supervision and project management skills Careers in Investment Operations What do I need? • Good A-levels and/or a degree in Maths, Business, Finance, IT, Accounting, Economics or another relevant related discipline • Professional, service- orientated attitude • Good reputation for “getting things done” (despite fluctuating workloads, conflicting priorities and tight deadlines) • Excellent communication skills • Appetite for analytical problem-solving • Adaptable team player • Interest in how systems, processes and people interact Willingness to progress through widening experience, professional qualifications and other training (e.g. project management, soft skills) Careers in Investment Operations Where to start? • Some firms recruit graduates in Business, Finance, Accounting, Economics, IT or another relevant discipline • Others have apprenticeship schemes for school leavers • Work experience programmes – 2-3 month contracts that can lead to a permanent position • http://www.insidecareers.co.uk (Banking, Securities & Investment) • www.apprenticeships.co.uk • http://www.directions.org.uk/careers/ (work experience) Questions later on please! Sian Lloyd MBA ASIP Chartered FCSI Email: sian.lloyd@cisi.org.uk Phone: 44 (0) 207 645 0696

![Naukri SukumarK[8y 0m] (2) (2)](http://s2.studylib.net/store/data/026239289_1-0cbcc1e5f7eddde1769f2093c2f11db9-300x300.png)