Slide 2 - Ace MBAe Finance Specialization

Forex Market Structure

•

The increase in world trade and the lowering of capital controls have led to tremendous growth in the foreign exchange markets over the years.

•

It is a market that trades 24 hours a day and spans the globe.

•

Participants in this market take position in currencies of various countries, and trade heavily in those currencies in order to generate profits for their organizations.

•

In this process, they expose the organizations to foreign exchange risk.

Forex Market Structure

•

When goods traded across boundaries, the selling and buying firms prefer to receive/pay consideration in a currency of their choice.

•

Further, firms as well as governments borrow both domestically and internationally.

•

When they trade or borrow internationally, multiple currencies come into play.

•

Thus, there has to be a market that enables participants to buy and sell currencies in such a way that they can convert the inflow or outflow into the currency of their choice.

•

The market that facilitates such exchange of currencies is the foreign exchange market.

Forex Market Structure

•

The world is emerging as a global economy because of flow of goods, services and capital.

•

For each transaction of goods and services, there is a corresponding currency transaction, which forms part of an international network of payments.

•

The foreign exchange market is that in which currencies are bought and sold against each other.

Forex Market Structure

The Nature and Structure Of Global Foreign

Exchange Markets

1.

Types Of Settlement—Spot &Forward

2.

Types Of Participants/Players

3.

Global Trading Locations

4.

Settlement Procedures

5.

Major Currencies

6.

Volume Of Transaction

7.

The Dealing Room

8.

The System Of Limits

9.

Obtaining Price Information

Forex Market Structure

Types Of Settlement—Spot &Forward

•

Foreign exchange trading may be for spot or forward delivery.

•

Generally, spot transactions are undertaken for an actual exchange of currencies two business days later ( the value date ).

•

Forward transactions involve a delivery date further into the future, possibly as far as a year or more ahead.

•

By buying or selling in the forward market a bank can, on its own behalf or that of a customer, protect the value of anticipated flows of foreign currency, in terms of its domestic currency, from exchange rate volatility.

Forex Market Structure

Types Of Participants/Players

•

Broadly speaking, there are three types of participant in the market:

• customers,

• banks and

• brokers.

•

Customers, such as multinational corporations, are in the market because they require foreign currency in the course of their cross border trade or investment business.

•

For example, an engineering firm based in the United Kingdom might use the foreign exchange market to buy the dollars it needs to pay to a firm in America selling it raw materials;

•

In this instance it would sell sterling and buy dollars.

Forex Market Structure

•

Commercial banks are by far the most active participants in the foreign exchange market.

•

Some deal with other financial institutions and corporations who contact them, typically by telephone, to ask for their rates, and may then buy foreign currency from, or sell, to the bank at those rates.

•

This is known as market making :

•

The banks will at all times quote buying or selling rates for pairs of currencies - dollars to the pound, Japanese yen to the dollar and so on.

•

The market makers earn a profit on the difference between their buying and selling rates, but they have to be ready to change their prices very quickly in order to avoid holding a currency whose value is falling

(depreciating) , or being short of a currency which is rising

(appreciating) .

Forex Market Structure

•

Banks also deal on behalf of corporations and other, typically smaller, banks.

•

The third type of participant, the brokers, act as intermediaries between the banks.

•

They are specialist companies with computer links or telephone lines to banks throughout the world so that at any time they should know which bank has the highest bid

(buying) rate for a currency, and which the lowest offer

(selling) rate.

•

By using a broker it should, therefore, be possible for banks to find the best dealing rate currently available.

•

The broker does not deal on its own account, but charges a commission for its services.

Forex Market Structure

Global Trading Locations

•

The foreign exchange market is largely an over-thecounter (OTC) market.

•

This means that there is no single market place or organized exchange, electronic or physical (like stock exchange), where all trades are executed between exchange members.

•

The traders sit in the offices (foreign exchange dealing rooms) of major commercial banks around the world and communicate with each other through telephones, telexes and other electronic means of communication.

Forex Market Structure

•

The market spans all the time zones of the world and functions virtually round-the-clock enabling a trade to offset a position created in one market using another market.

•

The major market centers are London, New

York and Tokyo.

•

Other important centers are Zurich,

Frankfurt, Hong Kong and Singapore.

Forex Market Structure

Settlement Procedures

•

Once a deal has been agreed upon, the dealers will also simultaneously specify where they want the currencies delivered.

•

For a dollar: euro transaction, for example, the buyer of dollars might require the dollars to be credited to his account with his own New York branch; the receiver of euros will similarly specify that the euros should be credited to his account with his banks in Frankfurt.

•

Given the volume of transactions - running literally into a few trillion dollars of transfers between banks everyday - payment and settlement systems are crucial to the smooth functioning of the market.

•

Most major banks use automated interbank fund transfer systems.

Forex Market Structure

•

The best known of these are

– Clearing House Interbank Payments System (CHIPS) in New York,

– Clearing House Automated Payment Systems (CHAPS) in London, and

– Euro Banking Association (EBA) in Europe.

•

On the communication side, the Society for Worldwide

Interbank Financial Telecommunications (SWIFT), a specialized non-profit cooperative owned by the banks, is the most important private message courier.

•

SWIFT transmits messages in standardized formats electronically for execution through their clearing house.

•

SWIFT has, over the years, become an integral part of many interbank payment systems.

Forex Market Structure

•

Settlement of transaction takes place by transfer of deposits between two parties.

•

The day on which these transfers are effected is called the settlement date or value date.

•

Obviously, to effect the transfers, banks in the countries of the currencies must be open for business.

•

The relevant countries, the currencies of which are exchange, are called settlement locations.

Forex Market Structure

•

The locations of the two banks involved in the trade are the dealing locations, which need not be same as settlement locations.

•

Thus, a London-based bank can sell Japanese yen against USD to a Paris-based bank.

•

The settlement locations here are New York and

Tokyo, while the dealing locations are London and

Paris.

•

The transaction can be settled only on a day on which both the US and the Japanese banks are open.

Forex Market Structure

STRUCTURE OF THE FOREIGN EXCHANGE

MARKETS

•

The market for foreign exchange exists at the retail as well as the wholesale level.

•

In the retail market for foreign exchange, travelers and tourists exchange one currency and average transaction size are very small.

•

The spread between buying and selling prices is very large.

•

The retailer buys or sells foreign currency from banks and other institutions which are authorized to deal in foreign exchange.

Forex Market Structure

•

The wholesale market is often called interbank market.

•

The participants in this market are commercial banks, investment banks, corporations and central banks,

•

The average transaction size is very large (deals may be for several millions of US dollars [USD] or equivalent in order currencies).

•

Foreign exchange market, globally as well as domestically, have trillion per day, of which about USD 2 trillion are in spot, forwards and FX swaps, and about USD 1.2 trillion in

OTC derivatives such as cross-currency swaps and options and all interest rate derivative contracts.

Forex Market Structure

•

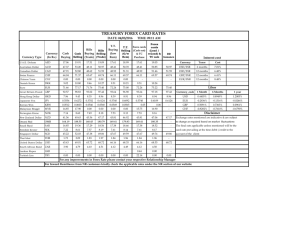

Instrument

•

Spot transactions

•

Outright forwards

•

Foreign exchange swaps

•

Estimated gaps in reporting

•

Total "traditional" turnover

Table: Global foreign exchange turnover

Daily average in April, in billions of US dollars

1989

317

1992

394

1995

494

1998

568

27

190

56

58

324

44

97

546

53

128

734

60

590 820 1,190 1,490

2001

387

131

656

26

1,200

Turnover at April 2004 exchange rates

650 840 1,120 1,590 1,380 1,880

•

1.

Adjusted for local and cross-border double-counting.

•

2.

Non-US dollar legs of foreign currency transactions were converted into original currency amounts at average exchange rates for April of each survey year and then reconverted into US dollar amounts at average April 2004 average rates.

•

Source : BIS-Triennial Central Bank Survey

2004

621

208

944

107

1,880

Forex Market Structure

The most active foreign exchange trading centers are:

Location

• United Kingdom

• United States

• Japan

• Singapore

• Germany

• Hong Kong

• Australia

• Switzerland

• France

Market Share

31%

19%

8%

5%

5%

4%

3%

3%

3%

Forex Market Structure

MARKET INFRASTRUCTURE

•

Technological advancements have improved the infrastructure of foreign exchange markets.

•

The infrastructure essentially consists of dealing rooms, where transactions are entered into, and information, dealing and payment communication systems.

Forex Market Structure

Dealing Rooms

•

Dealing rooms have become sophisticated in terms of computer and communication infrastructure.

•

Banks have been investing huge amounts in building this infrastructure, considering that treasury profits that arise from foreign exchange trading contribute substantially to their bottom-line

.

•

This infrastructure is necessary for efficient functioning of trading rooms.

•

A major bank's dealing room today may have 100 plus traders active at the same time.

•

The latest trends are towards integrated dealing rooms, which not only handle foreign exchange but also fixed income and money markets as well as derivatives like swaps, futures and options.

Forex Market Structure

•

While banks remain the major players in the market, a few large multinationals too have treasury operations and dealing rooms comparable to those of major banks in sophistication and size.

•

They are in the market not only to cover or manage exposures in various currencies brought about by the commercial operations of the multinationals, but actively speculate on currency movements, just like banks.

•

The dealers who trade and speculate to generate profits need an efficient information system that provides real time quotes, data and other relevant information.

Forex Market Structure

Information and Dealing Systems

•

The introduction of Reuter Monitor service in 1973 as a major change in the infrastructure of traditional markets.

•

Initially this was only an information system, providing subscribers, on video terminals, the bid and offer quotations of contributing banks in real time.

•

Since then, the services provided by Reuters have grown in coverage and sophistication.

Forex Market Structure

•

Reuters dealing systems allow deals to be struck (and settlement instructions given) through the system.

•

Reuters further introduced systems that act as an electronic broker by matching the quoted rates of subscribing banks.

•

It provides services at a much cheaper cost than the traditional voice broker.