Workshop Penelitian Perpajakan

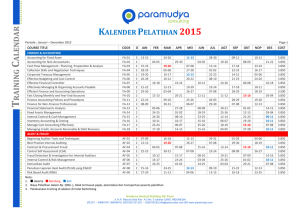

advertisement

PENELITIAN PERPAJAKAN Agenda 1 Bidang Penelitian Perpajakan 2 Metodologi Penelitian 3 Perkembangan Penelitian Pajak terkini 4 Penelitian pajak di Indonesia 2 Penelitian Pajak • Penelitian pajak sebelum pertengahan 1980 menurut Shackelford dan Shevlin (2001) dikategorikan menjadi: – legal research, mengevaluasi efek pajak pada transaksi exogenous, dan biasanya dipublikasikan pada jurnal hukum; dan – policy studies, mengevaluasi distribusi atau efisiensi efek pajak, biasanya dipublikasikan di jurnal akuntansi publik. • Riset banyak dijumpai dalam jurnal akuntansi seperti TAR, JAR, JAE. • Riset pajak bersifat multidisipliner sehingga dikaitkan dengan makro ekonomi, perilaku, kebijakan publik National Tax Journal, Journal of Public Econmics, Journal of Accounting and Public Policy 3 Penelitian Pajak • Paper pajak dalam tiga jurnal akuntansi terkemuka. 4 Klasifikasi Penelitian Pajak • Klasifikai penelitian pajak menurut Shevlin (1999) – Riset kebijakan bagaimana pajak meningkatkan aktivitas ekonomi, mendistribusikan kekayaan dan bagaimana meningkatkan pajak. Evaluai atas kebijakan pajak apakah dapat mencapai tujuannya. (JATA & NTJ) – Perencanaan pajak bagaimana individu dan perusahaan merespon peraturan pajak. – Kepatuhan pajak judgemnet and decision making sehingg banyak dipengaruhi oleh bidang psikologi 5 Klasifikasi Penelitian Pajak • Klasifikasi penelitian pajak menurut Shacklelford dan Shevlin (2001) – Trade off pajak dan non pajak Perencanaan pajak mempengaruhi pilihan akuntansi keuangan dan pertimbangan akuntansi keuangan mempengaruhi perencanaan pajak (tidak independen) • Pelaporan keuangan (inventory, intertemporal income shifting, • Agency cost – Pajak dan penilaian saham dampak pajak atas M&A, capital structure, pengaruh pajak investor terhadap harga saham – Multijurisdictional perusahaan multinasional dan perusahaan multistate 6 Klasifikasi Penelitian Pajak • Klasifikasi penelitian pajak menurut Hanlon dan Heitzman (2010) : – peran informasi beban pajak penghasilan perbedaan antara laba akuntansi dengan penghasilan kena pajak terkait dan implikasinya terhadap pelaporan keuangan; – tax avoidance (penghindaran pajak) perusahaan; – efek pajak terhadap pengambilan keputusan perusahaan termasuk investasi, struktur modal, dan bentuk organisasi, serta kebijakan pajak mana yang efektif dilihat dari implikasi nyatanya terhadap keputusan perusahaan. – pajak investor (investor level taxes) dan penilaian aset (asset pricing) – terkait riset mengenai dampak dari pajak dividen untuk investor dan pajak atas capital gains 7 Klasifikasi Penelitian Pajak • Klasifikasi penelitian akuntasi pajak menurut Graham et al (2012) : – earnings management valuation allowance, diskresi pelaporan beban pajak,pendapan – hubungan antara perbedaan nilai buku dengan nilai pajak (book-tak differences) dengan karakteristik/kualitas laba; dan – Pengaruh informasi pajak terhapda nilai saham 8 Metodologi Penelitian Pajak • Coyne (2010) – Analitis – Archival / empiris – Eksperimental – Metode lainnya • Klasifikasi lain – teoritis, normatif – Behavioral / judgement and decision making – Review / deskriptif – Survey; studi lapangan 9 Book Tax Different / Gap PSAK Undang-Undang AKUNTANSI PAJAK PERBEDAAN Permanen Penelitian: Book tax Gap Eff Tax Rate Tax Avoidance Temporer Pajak Tangguhan: Aktiva/utang Beban/Pendapatan 10 A Review of Tax Research Michelle Hanlon and Shane Heitzman, Journal of Accounting and Economics (2010) (50) 127-178. Review Tax Research The informational role of accounting for income taxes Taxes, book-tax tradeoffs, and real corporate decisions Review Tax Research corporate tax avoidance Taxes and asset pricing Introduction • Shackelford and Shevlin (2001) limit their review to research published in accounting outlets and describe the development of the relatively young archival, microeconomic-based income tax literature that arose from the Scholesand Wolfson framework. • Maydew(2001) emphasizes the need for tax researchers in accounting to think more broadly and to incorporate more theory and evidence from economics and finance. • Tax research has along history in many disciplines. • The goal in this paper is to integrate the theoretical and empirical tax research from accounting, economics, and finance, to summarize what is known and unknown, and to offer suggestions for future research. Informational role of AFIT A taxonomy of the literature and review of the evidence • Inferences from book-tax differences about current and future earnings. • Are earnings managed through the tax accounts? • Do changes in the valuation allowance reveal manager’s private information about future performance? Book-tax conformity Sources of differences between book and taxable income The informational role of accounting for income taxes Summary and suggestions for the future Tax Avoidance Theory of corporate tax avoidance • • • • • • Measuring tax avoidance Effective tax rate measures Effective tax rate measures Long-run effective tax rates Book-tax differences Discretionary or ‘‘abnormal’’ measures of tax avoidance Unrecognized tax Tax shelter firms benefits (UTB) Determinants of tax avoidance corporate tax avoidance The consequences of tax avoidance Summary and suggestions for the future Pengukuran Tax Avoidance Metode Pengukuran GAAP ETR Cara Perhitungan Keterangan Total tax expense per dollar of pre-tax book income Current ETR Current tax expense per dollar of pre-tax book income Cash ETR Cash tax paid per dollar of pretax book income Long-run cash Sum of taxes paid per over n ETR years divided by the sum of pretax earnings over n years ETR Differential Statutory ETR- GAAP ETR The differences of between the statutory ETR and the firm´s GAAP ETR DTAX Error term from following regression : ETR differential The unexplained portion of the x Pre-tax book income = a +b x controls + e ETR differential 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑡𝑜𝑡𝑎𝑙 𝑖𝑛𝑐𝑜𝑚𝑒 𝑡𝑎𝑥 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑡𝑡𝑎𝑙 𝑝𝑟𝑒 − 𝑡𝑎𝑥 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑡𝑎𝑥 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑡𝑡𝑎𝑙 𝑝𝑟𝑒 − 𝑡𝑎𝑥 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑐𝑎𝑠ℎ 𝑡𝑎𝑥𝑒𝑠 𝑝𝑎𝑖𝑑 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑡𝑡𝑎𝑙 𝑝𝑟𝑒 − 𝑡𝑎𝑥 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑐𝑎𝑠ℎ 𝑡𝑎𝑥𝑒𝑠 𝑝𝑎𝑖𝑑 𝑤𝑜𝑟𝑙𝑑𝑤𝑖𝑑𝑒 𝑡𝑡𝑎𝑙 𝑝𝑟𝑒 − 𝑡𝑎𝑥 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒 Sumber : Hanlon dan Heitzman (2010) 16 Tax Avoidance Metode Pengukuran Total BTD Temporary BTD Abnormal total BTD Unrecognized tax benefit Cara Perhitungan Keterangan Pre-tax book income – ((U.S. CTE + Fgn CTE / U.S. STR) The total differences between – (NOLt – NOLt-1)) book and taxable incomes Deferred tax expense/ U.S. STR Disclosed ammount post-FIN-48 Tax shelter activity Indicator variable for firms accused of engaging in a tax shelter Marginal tax rate Simultated marginal tax rate A measure of unexplained total book-tax differences Tax liability accrued for taxes not yet paid on uncertain positions Firms identified via firm disclosures, the press, or IRS confidential data Present value of taxes on an additional dollar income Sumber : Hanlon dan Heitzman (2010) 17 Tax & Corporate Decison • • • • • • • Investment Theory of investment and taxes: a brief background Taxes and investment: some evidence Investment in intangibles Investment location decisions The reinvestment or repatriation decision Corporate inversions to tax havens Summary and thoughts for future research • • • • Capital structure Estimating the tax benefit of debt Measuring leverage Summary and thought for the future Payout policy Taxes, book-tax tradeoffs, and real corporate decisions Taxes and other dec: transfer pricing, aquistioan and compensation Transfer pricing Merger and aquisition Executive compensation Executive trading Organizational form The choice of organizational form Summary and thought for future research Tax & Aset Pricing Thoughts for future research • • • • • • Deviden taxation The economic effects of dividen taxation: a brief introduction Log-horizon returns: the effect of dividend yiled on expected returns Event study predictions: the valuation of dividend tax rate change Ex-devidend day study Evidence from valuation models Summary Investor-level taxes and asset prices Capital gains taxation: capitalization & lock-in • Capital gains taxes and expected return • Stock market realization and lock-in effect Remaining issues and Ques for future research • How relevant the marginal investor? • Are dividend taxes priced differently across firms • Asset pricing in the open economy Research in Accounting for Income Taxes Earnings management Research in Accounting for Income Taxes The association between booktax differences Graham, et al. (2011) Earnings characteristics, and the equity market pricing of information in the tax accounts. Tema Penelitian Pajak • Faktor yang mempengaruhi BTD/BTG value relevant tax information • BTD Tax Avoidance – Agency ownership – Ethic governance, CSR • BTD Tax Management – Earning management • Tax sheltering • International Tax – – Income shifting transfer pricing – Thin capitalization 21 Overview Tax Research • A review of Tax Research, Michelle Hanlon and Shane Heitzman, Journal of Accounting and Economics (2010) (50) 127-178. • Research in accounting for income taxes, John R.Graham, Jana S.Raedy , Douglas A.Shackelford Journal of Accounting and Economics (2011) Nov. 412-434. • The Future of tax Reserach: From an Accounting Proffessor’s Perspective, Terry Shevlin, the Journal of the American Taxation Association, Fall 2007; 87 • Empirical tax research in accounting Douglas, “A.Shackelford, Terry Shevlin, Journal of Accounting and Economics (2001) 321-387. 22 BTD & ETR • Determinants of the Variability in Corporate Effective Tax Rates, Evidence from Longitudinal Data, Sanjay Gupta and Kaye Newberry, Journal of Accounting and Public Policy, 16, (1997), 1-34. • Tax Avoidance: Does Tax-Specific Industry Expertise Make a Difference?, Sean T. McGuire, Thomas C. Omer, Dechun Wang, The Accounting Review, Vol. 87, No. 3, 2012, pp. 975–1003. • Determinants of the variability in corporate effective tax rates and tax reform: Evidence from Australia, Grant Richardson, Roman Lanis, Journal of Accounting and Public Poliy, 26, 689-704. 23 BTD & QUALITY OF INCOME • • • • • Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence, Bradley Blaylock, Terry Shevlin, Ryan J. Wilson, The Accounting Review, Vol. 87, No. 1 (2012), pp. 91–120 Taxable Income as a Performance Measure:The Effects of Tax Planning and Earnings Quality, Benjamin C. Ayers, John Xuefeng Jiang and Stacie K Laplante, Contemporary Accounting Research, Vo 26, No 1 (Spring 2009) pp. 15-54 The Persistence and pricing of earning accrual, and cash flows when firms have large book tax difference, Michelle Hanlon, The Accounting Review, Vol 80 No 1, (2005) pp 137-166. The Persistence, Forecasting and Valuation Implication of Tax Change Component of Earnings, Ancrew P. Shmidt, The Accounting Review, May 2006:81 An uninteded consequence of book-tax conformity: A loss of earnings informativeness, Michelle Hanlon, Edward L. Maydew, Terry Shevlin, Journal of Accounting and Economics 46 (2008) 294-311. 24 BTD & ASET PRICING • Uday Chandra and Byung T. Ro, The Association between Deferred Taxes and Common Stock Risk, Journal of Accounting and Public Policy, 16, 311333 (1997) 25 Tax Avoidance & Earning Management • • • • • Can book–tax differences capture earnings management and tax Management? Empirical evidence from China, Tanya Tang, Michael Firth, The International Journal of Accounting 46 (2011) 175–204. Tax Reporting Aggressiveness and Its Relation to Aggressive Financial Reporting, Mary Margaret Frank, Luann J. Lynch, Sonja Olhoft Rego, The Accounting Review, 2009, Vol 84 No 2 pp.467-496 Creating a Bigger Bath Using the Deferred Tax Valuation Allowance, Theodore E. Christensen, Gyung H. Paik and Earl K. Stice,Journal of Business Finance & Accounting, 35(5) & (6), 601–625, June/July 2008. Earning Management: New Evidence Based on Deferred Tax Expense, John Philips and Porton Pincus, Sonja Ofhoft Rego, The Accounting Review, Apr 2003:78. Dhaliwal, D., C Gleason, dan L. Mills. (2004). Last chance earnings management: using the tax expense to meet analysts’ forecasts, Contemporary Accounting Research 21 (2): 431-457. 26 Tax Behavior • • • • The impact of audit risk, materiality and severity on ethical decision making: An analysis of the perceptions of tax agents in Australia, Rex Marshall, Malcolm Smith, Robert Armstrong, Managerial Auditing Journal, 21 5, 2006, 497-519 Social responsibility, Machiavellianism and tax avoidance: A study of Hong Kong, tax professionals, William E. Shafer, Richard S. Simmons, Accounting, Auditing & Accountability Journal, Vol. 21 Iss: 5, (2008), pp. 695 – 720. The importance of faith: Tax Morale and religiosity, Benno Torgler, Journal of Economic Behavior & Organization, 2006:81-109 A Note on the Relation between Frames, Perceptions, and Taxpayer Behavior, Scot B. Jackson and Richard C. Hatfield, Contemporary Accounting Research Vol. 22 No. 1 (Spring 2005) pp. 145-64 27 Tax Avoidance, CG, CSR • Tax avoidance, tax management and corporate social responsibility, Fariz Huseynov, Bonnie K. Klamn, Journal of Corporate Finance, 18 (2012), 804827 • Minnick, Kristina dan Tracy Noga. (2010). Do Corporate Governance Characteristics Influence Tax Management?. Journal of Corporate Finance, 16, 703-718 28 International Tax • • • • The determinants of thinly capitalized tax avoidance structures: Evidence from Australian firms, Grantley Taylora, Grant Richardsonb, Journal of International Accounting, Auditing and Taxation 22 (2013) 12– 25. The demand for tax haven operations, Mihir A. Desai, C. Fritz Foley, James R. Hines Jr. Journal of Public Economics 90 (2006) 513– 531. International Corporate Tax Avoidance Practices: Evidence from Australian Firms, Grantley Taylor and Grant Richarson, The International Journal of Accounting, 47 (2012) 469–496. Cross-Jurisdictional Income Shifting by U.S. Multinationals: Evidence from International Bond Offerings Kaye J. Newberry; Dan S. Dhaliwal Journal of Accounting Research, Vol. 39, No. 3. (Dec., 2001), pp. 643-662.) 29 Book Tax Gap The Persistence and pricing of earning accrual, and cash flows when firms have large book tax difference, Michelle Hanlon, The Accounting Review, Vol 80 No 1, (2005) pp 137-166. 30 Book Tax Gap Tax Avoidance, Large Positive Temporary Book-Tax Differences, and Earnings Persistence, Bradley Blaylock, Terry Shevlin, Ryan J. Wilson, The Accounting Review, Vol. 87, No. 1 (2012), pp. 91–120 ABSTRACT: We investigate why temporary book-tax differences appear to serve as a useful signal of earnings persistence (Hanlon 2005). We first test and show that temporary book-tax differences provide incremental information over the magnitude of accruals for the persistence of earnings and accruals. We then opine that there are multiple potential sources of large positive book-tax differences. We predict and find that firms with large positive book-tax differences likely arising from upward earnings management (tax avoidance) exhibit lower (higher) earnings and accruals persistence than do other firms with large positive book-tax differences. Finally, we find significant variation in current-period earnings and accruals response coefficients and insignificant hedge returns in period tþ1, consistent with investors being able to look through to the source of large positive book-tax differences (earnings management and tax avoidance), allowing them to correctly price the persistence of accruals for these subsamples. 31 Book Tax Confirmity Atwood, T.J., Drake, M.S., & Myers, L.A. (2010). Book-tax conformity, earnings persistence and the association between earnings and future cash flows. Journal of Accounting and Economics, 50, 111–125. Calls for eliminating differences between accounting earnings and taxable income in the US have been debated extensively. Proponents of increased book-tax conformity argue that tax compliance will increase and earnings quality will improve. Opponents argue that earnings quality will decline. We examine whether the level of required book-tax conformity affects earnings persistence and the association between earnings and future cash flows. We develop a comprehensive book-tax conformity measure and find that earnings have lower persistence and a lower association with future cash flows when conformity is higher. Our evidence suggests that increased book-tax conformity may reduce earnings quality. 32 Book Tax Confirmity Home country tax system Characteristics and corporate tax avoidance: international Evidence, T.J. Atwood, Michael S. Drake, James N. Myers Linda A. Myers, The Accounting Review, ol 87, No 6 (2012) pp.1831-1860 We examine whether three tax system characteristics—required book-tax conformity, worldwide versus territorial approach, and perceived strength of enforcement— impact corporate tax avoidance across countries after controlling for firm-specific factors previously shown to be associated with tax avoidance (i.e., performance, size, operating costs, leverage, growth, the presence of multinational operations, and industry) and for other cross-country factors (i.e., statutory corporate tax rates, earnings volatility, and institutional factors). We find that, on average, firms avoid taxes less when required book-tax conformity is higher, a worldwide approach is used, and tax enforcement is perceived to be stronger. However, the relations between tax avoidance and all three tax systems characteristics are contextual and depend on the extent to which management compensation comes from variable pay, including bonuses, stock awards, and stock options. 33 TERIMA KASIH Profesi untuk Mengabdi pada Negeri Dwi Martani 081318227080 martani@ui.ac.id atau dwimartani@yahoo.com http://staff.blog.ui.ac.id/martani/