competition (new window)

advertisement

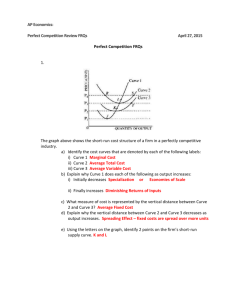

PERFECT COMPETITION ECO 2023 Principles of Microeconomics Dr. McCaleb Perfect Competition 1 TOPIC OUTLINE I. Perfectly Competitive Markets II. The Short Run III. The Long Run IV. Incentive Effects of Profits and Losses Perfect Competition 2 Perfectly Competitive Markets Perfect Competition 3 PERFECTLY COMPETITIVE MARKETS Classification of Markets Four types of market structure • Perfect competition • Monopoly • Monopolistic competition • Oligopoly Perfect Competition 4 PERFECTLY COMPETITIVE MARKETS Characteristics of Perfect Competition Definition A market in which there are many sellers, each selling an identical product, with unrestricted or low-cost long-run entry and exit of resources. Key characteristics • Many buyers and sellers • Product homogeneity • Unrestricted entry and exit Perfect Competition 5 PERFECTLY COMPETITIVE MARKETS Characteristics of Perfect Competition Many buyers and sellers No individual buyer or seller is large enough to affect the market price. Each seller can sell whatever quantity it wants at the market price, but an increase or decrease in the quantity supplied by any one seller has no effect on the market price. Sellers in a perfectly competitive market are price takers, not price makers. Perfect Competition 6 PERFECTLY COMPETITIVE MARKETS Characteristics of Perfect Competition Product homogeneity All sellers produce and sell identical products. Consumers view each seller’s product as a perfect substitute for any other seller’s product. Unrestricted entry and exit In the long run, there are no barriers to the entry of new resources into a perfectly competitive market where sellers are earning profits and no limitations on the exit of resources from a perfectly competitive market where sellers are incurring losses. Perfect Competition 7 PERFECTLY COMPETITIVE MARKETS Demand and Marginal Revenue Demand Market demand The market demand curve is negatively-sloped. Market quantity demanded is inversely related to market price. Demand facing an individual seller Consumers’ demand for the product of any individual seller is perfectly elastic at the market price. The seller can sell as much or as little as it wants without affecting the market price. Perfect Competition 8 PERFECTLY COMPETITIVE MARKETS Demand and Marginal Revenue Marginal revenue equals price When an additional unit is sold, the increase in total revenue equals the price: (TRQ)=MR=P The seller’s marginal revenue curve is the same as the demand curve facing the seller. The marginal revenue curve, like the demand curve, is perfectly elastic. Perfect Competition 9 PERFECTLY COMPETITIVE MARKETS Demand, Price, and Revenue In part (a), market demand and market supply determine the price at which each seller can sell its output. Perfect Competition 10 PERFECTLY COMPETITIVE MARKETS Demand, Price, and Revenue In part (b), the market price determines the demand facing the individual seller and its marginal revenue. Perfect Competition 11 PERFECTLY COMPETITIVE MARKETS Demand, Price, and Revenue In part (c), if Dave sells 10 cans of syrup a day, his total revenue is $80 a day at point A. Perfect Competition 12 PERFECTLY COMPETITIVE MARKETS Demand, Price, and Revenue Dave’s total revenue curve is TR. The table shows the calculations of TR and MR. Perfect Competition 13 The Short Run Perfect Competition 14 THE SHORT RUN Seller’s Short-Run Equilibrium What is the objective of a seller in the short run? Maximize profits or, if profits are not possible, minimize losses. A seller maximizes profits or minimizes losses by producing and selling the quantity where marginal revenue equals marginal cost: Profit maximizing QMR=MC This is just a variation of the basic economic decision rule: choose the amount of every activity where MB=MC. The seller’s marginal revenue is equivalent to marginal benefit. Perfect Competition 15 THE SHORT RUN Seller’s Short-Run Equilibrium Quantity Marginal revenue is perfectly elastic at $8 per can. Perfect Competition 16 THE SHORT RUN Seller’s Short-Run Equilibrium Quantity Marginal cost decreases at low outputs but then increases. Perfect Competition 17 THE SHORT RUN Seller’s Short-Run Equilibrium Quantity Profit is maximized (or losses are minimized) when marginal revenue equals marginal cost at 10 cans a day. Perfect Competition 18 THE SHORT RUN Seller’s Short-Run Equilibrium Quantity If output increases from 9 to 10 cans a day, marginal cost is $7, which is less than the marginal revenue of $8 and profit increases. Perfect Competition 19 THE SHORT RUN Seller’s Short-Run Equilibrium Quantity If output increases from 10 to 11 cans a day, marginal cost is $9, which exceeds the marginal revenue of $8 and profit decreases. Perfect Competition 20 THE SHORT RUN Seller’s Short-Run Equilibrium Profits or losses? Marginal revenue and marginal cost tell you the revenue and cost of the incremental or marginal units of the good only. They do not tell you the revenue and cost of all units sold. MR=MC is consistent with either profits or losses. It only identifies the quantity at which the profits are largest or the losses are smallest. Perfect Competition 21 THE SHORT RUN The Shutdown Decision Why would a seller incurring losses continue to operate in the short run? A seller never operates if price is less than average variable cost because those costs can be avoided by ceasing operations. Fixed costs, however, are unavoidable. Even if the seller ceases to operate, it still must pay the fixed costs. Therefore, a seller continues to operate if price is at least as high as average variable cost even If it doesn’t earn enough to pay its fixed costs. Perfect Competition 22 THE SHORT RUN Short-Run Supply Individual seller’s supply The individual seller’s short-run supply curve shows what happens to the profit-maximizing or loss-minimizing quantity when the price increases or decreases. If P>AVC, the marginal cost curve is the individual seller’s short-run supply curve. At any P<AVC, the individual seller’s quantity supplied is zero. Thus, the segment of the marginal cost curve that lies above the average variable cost curve is the individual seller’s supply curve. Perfect Competition 23 THE SHORT RUN Deriving the Seller’s Shortrun Supply Curve At any price less than $3, P<AVC and the firm shuts down--Q=0. This is the shutdown point. At P=$3, MR also equals $3. The short-run equilibrium quantity is 7 cans a day. The combination of P=$3 and Q=7 is shown as point S on the seller’s short-run supply curve in the lower diagram. Perfect Competition 24 THE SHORT RUN Deriving the Seller’s Shortrun Supply Curve At P=$8, MR is also $8. The marginal revenue curve is MR1. The short-run equilibrium quantity is 10 cans a day. The combination of P=$8 and Q=10, shown by the black dot in the lower diagram, is another point on the seller’s short-run supply curve. Perfect Competition 25 THE SHORT RUN Deriving the Seller’s Shortrun Supply Curve At P=$12, MR is also $12, and the marginal revenue curve is MR2. The short-run equilibrium quantity is 11. The combination of P=$12 and Q=11, shown by the second black dot in the lower diagram, is another point on the seller’s short-run supply curve. Perfect Competition 26 THE SHORT RUN Deriving the Seller’s Shortrun Supply Curve Connecting the dots, the blue curve in the lower diagram is the seller’s short-run supply curve. At any P<$3, the seller shuts down and the short-run equilibrium quantity is 0. At any P>$3, the short-run equilibrium quantity is shown by a point on the MC curve. The segment of the MC curve that lies above AVC is the seller’s short-run supply curve. Perfect Competition 27 THE SHORT RUN Deriving the Short-run Market Supply Curve At the shutdown price of $3, each seller produces either 0 or 7 cans a day. For example, with 10,000 identical sellers, market quantity supplied is between 0 and 70,000. Perfect Competition 28 THE SHORT RUN Deriving the Short-run Market Supply Curve At a price of $8, each seller produces 10 cans a day. Market quantity supplied is 100,000 cans a day. Perfect Competition 29 THE SHORT RUN Deriving the Short-run Market Supply Curve At a price of $12, each seller produces 11 cans a day. Market quantity supplied is 110,000 cans a day. Perfect Competition 30 THE SHORT RUN Deriving the Short-run Market Supply Curve Market quantity supplied at each price is the sum of the quantities supplied by the individual sellers at that price. The blue line is the market supply curve. The market supply curve is perfectly elastic at the shutdown price. Perfect Competition 31 THE SHORT RUN Short-run Market Equilibrium Do sellers in the short-run earn profits, break even, or incur losses? Price is revenue per unit of output. Average total cost is cost per unit of output. • If P>ATCSellers earn profits • If P<ATCSellers incur losses • If P=ATCSellers break even (zero economic profit or a normal accounting profit) Perfect Competition 32 THE SHORT RUN Short-run Market Equilibrium: Profit If market demand is D1, the market equilibrium price is $8 per can, shown in part (a) where market demand intersects market supply. Perfect Competition 33 THE SHORT RUN Short-run Market Equilibrium: Profit When market price is $8, Dave’s marginal revenue is also $8. His optimal quantity is 10 cans a day, where marginal revenue equals marginal cost. Perfect Competition 34 THE SHORT RUN Short-run Market Equilibrium: Profit At the optimal quantity of 10, price ($8) exceeds average total cost ($5.10), so Dave makes an economic profit shown by the blue rectangle. Perfect Competition 35 THE SHORT RUN Short-run Market Equilibrium: Loss If market demand is D2, the market equilibrium price is $3 per can, shown in part (a) where market demand intersects market supply. Perfect Competition 36 THE SHORT RUN Short-run Market Equilibrium: Loss When market price is $3, Dave’s marginal revenue is also $3. His optimal quantity is 7 cans a day, where marginal revenue equals marginal cost. Perfect Competition 37 THE SHORT RUN Short-run Market Equilibrium: Loss At the optimal quantity of 7, price ($3) is less than average total cost ($5.14), so Dave incurs an economic loss shown by the red rectangle. Perfect Competition 38 THE LONG RUN Short-run Market Equilibrium: Breakeven In part (a), with market demand curve D3 and market supply curve S, the price is $5 a can. Perfect Competition 39 THE LONG RUN Short-run Market Equilibrium: Breakeven When price is $5, Dave’s marginal revenue is also $5, so in part (b) he produces 9 cans a day, where marginal cost equals marginal revenue. Perfect Competition 40 THE LONG RUN Short-run Market Equilibrium: Breakeven At the equilibrium quantity (9), price equals average total cost ($5). Dave earns zero economic profit or a normal accounting profit. Perfect Competition 41 The Long Run Perfect Competition 42 THE LONG RUN Long-Run Equilibrium Definition In the long run, sellers choose whether to stay in a market or exit the market and enter a new market. The long-run decision is market entry or exit. A market is in long-run equilibrium when there is no incentive for new sellers to enter the market and no incentive for existing sellers to exit the market--the market is neither expanding nor contracting. Perfect Competition 43 THE LONG RUN Long-Run Equilibrium Long-run response to short-run economic profits If short-run profits are positive, • new sellers enter the market • market supply increases • equilibrium price decreases • economic profits decrease until they are zero. Perfect Competition 44 THE LONG RUN Long-Run Equilibrium Long-run response to short-run losses If short-run profits are negative (losses), • existing sellers exit the market • market supply decreases • equilibrium price increases • economic losses decrease until they are zero. Perfect Competition 45 THE LONG RUN Long-Run Equilibrium Sellers earn zero economic profit in long-run equilibrium Only if long-run profits are zero is there no incentive for new sellers to enter the market and no incentive for existing sellers to exit the market. Therefore, a market is in long-run equilibrium only when there are neither profits nor losses. In long-run equilibrium in a perfectly competitive market, sellers break even and economic profits are zero. Perfect Competition 46 THE LONG RUN Long-Run Equilibrium Why do sellers continue to operate in the long run if they earn no profit? In the long-run equilibrium, sellers in a competitive market earn zero economic profit (neither a profit nor a loss). Zero economic profit is the same as a positive but normal accounting profit. Zero economic profit means sellers earn enough to cover total opportunity cost, including a return on the owners’ and shareholders’ investment equal to what they could earn in any other business or activity. Perfect Competition 47 THE LONG RUN Changes in Equilibrium: Increase in Demand In the initial long-run equilibrium, P=$5 and Q=90,000 cans a day. Demand increases from D0 to D1. P increases to $8. At $8, P>ATC and sellers earn profits. New sellers enter the market. Supply increases from S0 to S1. As supply increases, P decreases back to $5, where economic profits (or losses) are zero. Q increases from 100,000 to 140,000. Perfect Competition 48 THE LONG RUN Changes in Equilibrium: Decrease in Demand In the initial long-run equilibrium, P=$5 and Q=90,000 cans a day. Demand decreases from D0 to D2. P decreases to $3 a can. At $3, P<ATC and sellers incur losses. Sellers exit the market, and supply decreases from S0 to S2. As supply decreases, P increases back to $5, where economic profits (or losses) are zero. Q decreases from 100,000 to 40,000 cans a day. Perfect Competition 49 THE LONG RUN Changes in Equilibrium Increase in cost If cost increases, sellers incur short-run losses • Existing sellers exit the market • Market supply decreases • Equilibrium price increases • Economic losses decrease until they are zero. Perfect Competition 50 THE LONG RUN Changes in Equilibrium Decrease in cost If cost decreases, sellers earn short-run profits • New sellers enter the market • Market supply increases • Equilibrium price decreases • Economic profits decrease until they are zero. Perfect Competition 51