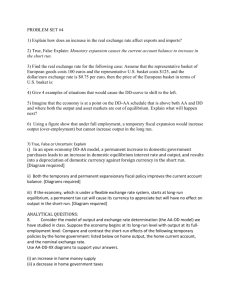

Problem set #4

advertisement

FNCE 423 – International Finance Problem Set 4 1. Contrary to our standard assumptions, suppose that investors now always expect the exchange rate in the future to equal its value today [Hint: think about the implication of this on the expected rate of depreciation and the UIP condition]. a. Compare the effects of a temporary increase in the money supply on the exchange rate and output under our standard assumption and this new assumption about Ee. Give an intuitive explanation as well as graphical illustrations. b. Compare the effects of a temporary increase in the government spending on the exchange rate and output under these two different assumptions about Ee. Give an intuitive explanation as well as graphical illustrations. 2. True, False or Uncertain: Explain (i) In an open economy DD-AA model, a permanent increase in domestic government purchases leads to an increase in domestic equilibrium interest rate and output, and results into a depreciation of domestic currency against foreign currency in the short run. (ii) Both the temporary and permanent expansionary fiscal policy raises the current account balance. [Diagrams required] (iii) If the economy, which is under a flexible exchange rate system, starts at long-run equilibrium, a permanent tax cut will cause its currency to appreciate but will have no effect on output in the short-run. 3. Imagine the economy is at a point on the AA-DD diagram which is below both the DD schedule and the AA schedule but output is greater than equilibrium output. Explain what will happen?