bonds - Faculty Directory | Berkeley-Haas

advertisement

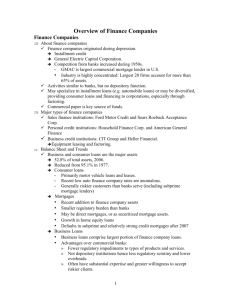

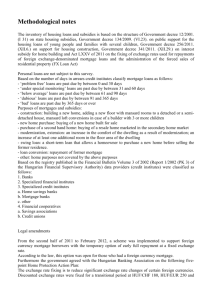

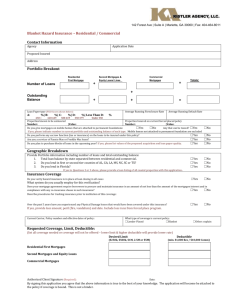

October 2010 Special Talk for PBL The Great Recession: How did it happen & where do we go from here? David Robinson © D. Robinson, 2010 Disclaimer: This lecture contains opinion—your interpretation may differ Many Causes to the Current Recession 1. Government overspending 2. Misjudging interest rates 3. The housing “bubble” and the underlying mortgage crisis How Mortgages are supposed to work • Mortgages are essential for home ownership • Why they are considered safe investments • How securitization increased the availability of mortgages • Expanding mortgages further Mortgages help people buy houses Home ownership is part of the American Dream Mortgages help people buy houses • Definition: Mortgage—a loan secured by real estate. • If you don’t pay, you get thrown out and the bank takes the house (repossession) then resells the house and pays off the loan Without Mortgages • Without mortgages, you have to save and save and save and buy a smaller house when you are in your 50s Why Conventional Mortgages were very safe: “Conforming Loans” • Historically, you had to have good credit to buy a house • Loan payments could not be more than 28 percent of your income • The loan-to-value had to be 80 percent Why 90 percent made sense for “First Time Borrowers” Introduction to Securitization of Mortgages Without the “Secondary Mortgage” Market Depositors put money into the bank that the bank loans as a mortgage Mortgage Game over ! With the “Secondary Mortgage” Market Sell the mortgage to an investor—now the bank has more money to lend! Mortgage The Mortgage Process Conforming Loans Originator Local bank or mortgage company Fannie & Freddie Investment Banks Bond holders The Mortgage Process Conforming Loans Originator Fannie & Freddie Bond money Investment Banks Bond holders Were they/weren’t they “Government bonds”? Introducing Fannie, Freddie & Ginnie Government Sponsored Enterprises (GSEs) Fannie Mae, Freddie Mac and Ginnie Mae GSE’s were set up to purchase and “securitize” the loans • “Fannie Mae” Federal National Mortgage Association • Depression era Government agency • Set up to buy mortgages, so banks had money to lend • In 1968, Johnson “sold” FNMA off as a publicly traded company • “Backed by the US Government” • Reason: To get rid of their debt from the Federal Budget (!) More “GSEs” (Government Sponsored Enterprises) • Federal Home Loan Mortgage Corporation (“Freddie Mac”) created 1970 to purchase mortgages from “Savings & Loans” • (There are no more S&Ls, they are now converted to banks) • Ginnie Mae is part of HUD (not a corporation) • Manages government program mortgages, such as – Veterans loans, – First-time homeowner programs, etc The GSEs bought “conforming” loans— but others could be sold to banks Conforming Loans Originator Packaged & sold, say 5,000 mortgages Fannie & Freddie Non-conforming loans Investment Banks Bond holders The Mortgage Process Originator Fannie & Freddie Investment Banks Who are the bond holders? “Institutions” (= life insurance, pensions, government agencies), other countries + a few wealthy individuals Bond holders The Mortgage Process How do I know if this stuff is any good? Bond holders Investor The Mortgage Process How do I know if this stuff is any good? Bond holders Investor Ratings Agencies Standard & Poors, Moody’s and Fitch Securitization of mortgages Bank Loans Investors Securitization of mortgages These are bonds “I promise to repay” Bank Loans Investors If one loan goes bad, it’s made up for by a pretty good interest rate on the other loans Bank Loans Investors If one loan goes bad, plus we can foreclose, resell the property and get our money back Bank Loans Investors So How Do I Know if this Stuff is Safe? How do I know if this stuff is any good? Bond holders Investor Ratings Agencies Standard & Poors, Moody’s and Fitch The Mortgage Process How do I know if this stuff is any good? Bond holders Investor Ratings Agencies Standard & Poors, Moody’s and Fitch Ratings Agencies: Hey! This stuff is as safe as houses! Ratings Agencies “It’s AAA rated!” Investor Ratings Agencies Standard & Poors, Moody’s and Fitch Expansion of Mortgage Credit Easier to get a loan • Home ownership is considered good for society • Why? • Clinton administration relaxed the rules, specifically to get more minority home ownership • Even George Bush preached “The Ownership Society” Easier to get a loan • No longer 20 percent down • Not perfect credit—no worries! • Can’t quite afford to repay all? We’ll add what you owe to the principal Faulty Assumptions • No longer 20 percent down • Not perfect credit—no worries! • Can’t quite afford to repay all? We’ll add what you owe to the principal • House prices will grow so fast, the low downpayment won’t matter • People with poor credit will become Boy Scouts once they are in a home • Everyone’s income will go up like an intern MD Summary about Mortgages • Home ownership is generally considered to be a societal “good thing” • Mortgages are essential for broad home ownership • Securitization makes funds from investors available for mortgages • Regulations were relaxed to encourage more people to own homes Credit Default Swaps Why did Warren Buffet famously describe these as “financial weapons of mass destruction”? Credit Default Swaps (CDS) Originator Fannie & Freddie Investment Banks Bond holders Hmm… what if these guys default ? Credit Default Swaps (CDS) Originator Fannie & Freddie No problem! We’ll write you a CDS Investment Banks Bond holders Hmm… what if these guys default ? Credit Default Swaps (CDS) Who are these guys? Other banks, Insurance Cos (AIG), Hedge funds No problem! We’ll write you a CDS Investment Banks Bond holders Hmm… what if these guys default ? How a CDS works • Investor “A” owns $1 million of bonds of bank “B” • There’s a 2 percent chance that bank B won’t payoff and A would have a loss of $1 million. • A is prepared to pay 0.02 X $1 million = $20,000 for “insurance” (a CDS) that says: • “If Bank B goes into default, then entity C will pay investor A the sum of $1 million. • C gets $20,000 as “pure profit” right now Definitions • Hedge fund: • A financial management firm that takes money from big investors and seeks out long-term high-risk (& potentially high reward) investments » Buying up and fixing failing companies » Trading across different markets • Derivative • By definition, a financial instrument whose value depends on the value of another financial product. » Example, a “Future” the right to buy a stock at a specific price » In general, listed and regulated by certain stock or commodity exchanges Credit Default Swaps (CDFs) C Hmm, is this Insurance or a “derivative”? Who are these guys? Other banks, Insurance Cos (AIG), Hedge funds No problem! We’ll write you a CDS B Investment Banks A Bond holders Hmm… what if these guys default ? Fade to black How it all went wrong Credit Default Swaps Why did Warren Buffet famously describe these as “financial weapons of mass destruction”? Credit Default Swaps (CDFs) Who are these guys? Other banks, Insurance Cos (AIG), Hedge funds No problem! We’ll write you a CDS Investment Banks Bond holders Hmm… what if these guys default ? How CDSs Blew Up • So many firms laid off risk to each other that there were $60 Trillion (Yes! Trillion) of Swaps trading when the music stopped • [The whole US economy is about $14 Trillion, the GDP of the whole World is about $69 Trillion] • No one had priced in “event risk”—that something would go wrong • No one had factored in declining house prices (guess what? It’s happened before!) How it went wrong when the music stopped House prices didn’t go up & up forever and ever Securitization of mortgages These are bonds “I promise to repay” Bank Loans Investors If one loan goes bad, it’s made up for by a pretty good interest rate on the other loans Bank Loans Investors Fannie and Freddie went on a drunken binge Fannie and Freddie grew too big • 70 percent of all mortages • ? Public “guarantee” • But! Private $alaries • Lots of commissions to Wall Street Banks • Huge lobbying expenditures to congress Why were people buying this junk? 1. Interest rates were very low—everyone was looking for a “good return”—why not mortgages? 2. They were sold as AAA rated—as safe as houses Breakdown of the Mortgage Process More business = more commissions! Conforming Loans weakened! Originator Outright fraud— why? Fannie & Freddie Investment Banks Bigger means more bonuses! Ratings agencies offered false reassurance Bond holders Desperate for “a return” Interest rates were too low “I was wrong in my assumptions” • Why? • Y2K then dot.com meltdown • Avoided a recession, but . . . • Huge “asset bubble” (house prices) • Why? Because loans were cheap What assumptions were wrong? “I was wrong in my assumptions” • [Alan Greenspan, long-term Chairman of the Federal Reserve] Result of too-low interest rates 1. Asset bubble—rise in house prices much faster than the general rate of inflation 2. Vast overbuilding of housing stock Result of loan standards that were too lax: Everyone could buy • Good news! It’s really easy to get a loan! • Bad news—my hairdresser just got approved for $700K! • Prices bid up Housing prices became a classic “bubble” • We all know what happens to bubbles . . . • Define bubble? • Prices go up faster than value • Then everyone wants to buy—even at high price—in the hope of making even more money Investors—including other nations(!) — were encouraged to buy Bank Loans “Hey these things return a bit more interest, and are very highly rated . . .” Investors If more than a few loans go bad, you’ve got big trouble Bank Loans Investors Then, as house prices fall, the loans are bigger than what the house is worth! Bank Loans Investors What happens when the bubble bursts? • When the loan is larger than the house, why keep making the payments? • It takes at least 6 months to get someone out of a foreclosed home • With prices dropping, you can no longer recover the amount loaned on the mortgage (More) What happens when the bubble bursts? • Whole neighborhoods have too many foreclosed homes—who would want to buy there? • Impact for cities: Unpaid taxes, but huge public safety burdens (More)Why it was impossible to quickly resolve the “Sub-prime Crisis” • People with poor credit have poor judgment • • • • As house prices went up, they borrowed more and Spent it on consumption (vacations) That money is gone They may not have the ability to service the debt It gets worse: Tranches “Tranche 1” Bank Loans Investors “Tranches” • I-bank issues a bond, split into five “tranches” • “Tranche 1” accepts the first 10 percent of defaults (and gets more of the interest) • The I-Banks kept a lot of these—that’s why they’re in trouble • “Tranche 2” gets hit with the next 10 percent of defaults, etc • The Tranches mean it’s almost impossible to unwind these loans— who owns which loan? Why it was impossible to quickly resolve the “Sub-prime Crisis” • Each mortgage was owned (in part) by up to 5,000 investors • How do you get them to agree to a “restatement”, a “short sale” or a “haircut”? • Definitions: Preview: None of these are going to work • Restatement: Bank agrees borrower can pay less per month • “Short sale”: Bank agrees house can be sold for less than the mortgage is worth • “Haircut”: Bank keeps homeowner in the home and agrees they owe less money Update! (Fall 2010): The MERS Mess • But aren’t the mortgages backed by real houses? • Can’t you just sell them off and make the bondholders happy? Update! (Fall 2010): The MERS Mess 1. It’s very unclear who owns which mortgage (It’s been sliced and diced into so many bonds and tranches) 2. Selling all the houses (about 25+ percent of the US housing stock) is depressing prices 3. In some cases, banks can’t find the signed paperwork • But aren’t the mortgages backed by real houses? • Can’t you just sell them off and make the bondholders happy? The Executive Branch Response The Executive Branch Response First: Bush II The “End of Wall Street “ • Bear Stearns: A “sweetheart” deal sold to JP Morgan/Chase • The government agreed to “back” some of BS’s losses • AIG—it’s an insurance company! • $85 Billion in loans from the NY Fed (why?) • Whoops, another $38.6 billion • Lehman Bros • Tough luck! File for bankruptcy Lurching, inconsistent and incomprehensible 1. 2. 3. 4. 5. Nationalized Fannie and Freddie after swearing that they weren’t really government owned Bailed out Bear Stearns, but threw Lehman under the bus AIG is not a bank $700 Bn [Tarp] is not nearly enough to mop up the bad loans None—none!—of the “mortgage modification” programs worked The Executive Branch Response Now: Obama Well-intentioned, but not bearing the pain to work this through 1. 2. 3. Fannie and Freddie have grown from monster-sized to “the great blob” (The government owns your mortgage) Super-low interest rates have allowed the Banks to make a profit—but they aren’t loaning to business Haven’t yet realized: None—none!— of the “mortgage modification” programs will work The Housing crisis is not-much improved since 10/2009 Hoping for a miracle? Where do we go from here? I: Managing the mortgage mess President Obama began calling people out: • “This crisis is neither the result of a normal turn of the business cycle nor an accident of history. We arrived at this point as a result of an era of profound irresponsibility . . .” 75 1. Keep people in their homes • Less social disruption • Tends to preserve the value of the neighborhood 1. Keep people in their homes • Less social disruption • Tends to preserve the value of the neighborhood • Non-payment on mortgages hurts the bondholders • That’s your grandma, your state’s pension plan • Uncertain homeowners won’t (or don’t have the money to) keep the place up 2. Renegotiate the Principal • You bought too high! • Let’s just make your $800K mortgage now $400K—that’s all you owe! 2. Renegotiate the Principal • You bought too high! • Let’s just make your $800K mortgage now $400K—that’s all you owe! • Punishes prudent borrowers who bought within their means • Enriches the foolish • Violates contract law— it can’t happen • Robs from the bond holders (your grandma) 3. Lower the interest rate so much that the monthly mortgage payment is cheaper • This is the current approach • Mortgage rates are their lowest for 50 years • About 4.5 percent (6.0 is typical—often more) • The “good” homeowners are all refinancing 3. Lower the interest rate so much that the monthly mortgage payment is cheaper • This is the current approach • Mortgage rates are their lowest for 50 years • About 4.5 percent (6.0 is typical—often more) • The “good” homeowners are all refinancing • Doesn’t help those who’ve lost their jobs • Doesn’t help those who really couldn’t afford a house anyway • Government now owns 90 percent of all new mortgages! • These are low going to pay a low return for a long time • Immobility: Once mortgage rates return to normal, people will be reluctant to move for job changes 4. Pop the Bubble: Foreclose on everything • Prices will drop low enough that investors will buy the houses • Rent out to people who used to own • (House prices are already back to 2003 levels in SF Bay Area) 4. Pop the Bubble: Foreclose on everything • Prices will drop low enough that investors will buy the houses • Rent out to people who used to own • (House prices are already back to 2003 levels in SF Bay Area) • Massive social disruption • Families move • Angry voters • Kids moved from schools • Many bonds will lose much of their value when the houses are sold at less than the mortgage Where do we go from here? I: What will happen to the Economy? The Economic Outlook • Stimulus funding has staved off a huge “crash” • But it’s led to the “jobless recovery” • Longer we wait to process all the “underwater homes” the longer the recession will continue • Popping the zit will hurt, yes • We are looking to at least 2 – 3 more years before there’s a turn-around Reasons to be Pessimistic • Earlier this year I gave a talk with the title: Reasons to be Pessimistic • Earlier this year I gave a talk with the title: Why We Are Toast Possible Scenarios A. Mortgage crisis + fear of the National Debt total = Double dip “W-shaped” recession B. Second round stimulus and eventually we grow out of it A. Unlikely to happen if you don’t deal with housing C. Endless stimulus and overspending = We become Japan: 1 percent or less growth for 2 decades (3 percent is typical for the US) • No jobs for college grads Summary • The “melt-down” was no surprise—you have to pay the piper sometime • Nearly a decade of Federal fiscal irresponsibility is catching up with us • We can work out these problems over a decade or so. . . if we have the political will to address them • It won’t be easy