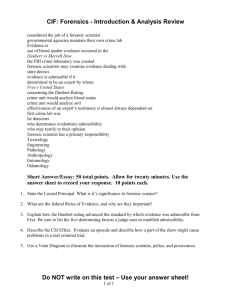

Speaker Material - CIT Portal, ICAI

advertisement

Areas of Practice for Forensic Auditors and Fraud Detection Experts CA. Indresh Palan ACA, FAFD(ICAI), UGC-NET, M.Com Forensic Auditing and Fraud Detection “The world has enough for everyone's need, but not enough for everyone's greed.” ― MAHATMA GANDHI Climb the Ladder and Reach Pace is Yours OPPORTUNITIES AHEAD the Sky! Why we need to learn Forensic Accounting/Auditing? Economic crime remains a fundamental fact of life for every segment of the global business community and is a persistent threat to business and business processes Fraud is a major concern among companies, regulators, shareholders, and law enforcement agencies across the globe Cybercrime continues to remain a tough challenge for organizations. Over the years there has been a significant increase in the number of cybercrime attacks prompting organizations to stay alert, seek means to fight cybercrime threats Forensic Auditors 1. 2. 3. Forensic Auditors are hired either to look in to alleged or actual fraudulent activities to assist in prevention of such activities. In law matters accounting, auditing and investigative skills used for forensic accounting. There are three main sections – litigation, investigation and solution of the dispute. Forensic Auditors The professionals in these fields are called Forensic Accountants Forensic Auditors use professional accounting, law, finance and investigation related techniques to evaluate the validity of any activity. Forensic Accountants are the experienced auditors who protect the accounts of an organization and stop any type of fraud The first line of defense against any cyber threat is increasing perception and awareness of cybercrimes What Does a Forensic Accountant Do? Forensic accountants are trained to look beyond the numbers and deal with the business realities of situations Analysis, interpretation, summarization and the presentation of complex financial and business related issues are prominent features of the profession A forensic accountant will also be familiar with legal concepts and procedures Public practice or insurance companies, banks, police forces and government agencies are major employers of forensic accountants Accounting fraud Financial statements are a fundamental barometer of a business Accounting fraud includes misleading or falsely prepared financial statements can deceive banks, lessors, vendors, and investors into risky or misguided decisions Due to the use of financial statements and financial data throughout business operations, this kind of economic crime impacts a variety of business processes Accounting fraud has consistently been one of the major crimes reported in all the survey Global Economic Crime Key Highlights from the U.S. Survey, As per above report more than 1 in 3 organization impacted by economic crime Economic crime continues to remain in the forefront of corporate concern, posing a threat to fundamental business processes 45% of organizations in the U.S. suffered from some type of fraud in the past two years, more than the global average of 37%. 57% of U.S. respondents indicated their organizations pursued opportunities in markets with high levels of corruption risk within the past 24 months, versus 38% of global respondents 2014: Most internal frauds are now perpetrated by middle management Particulars 2011 Number of Frauds by Middle Management 2014 45% 54% Number of frauds committed by Junior Staff 50% 31% Detecting Fraud Fraud at U.S. organizations initially detected by external measures or by accident 15% 32% Particulars Economic crime is committed External Actors 45% Internal Actors 50% Evolution of reported rate of economic crime (GECS) Year of survey release-Reported Global Fraud Rate 100 75 % of all respondents About the survey 5,128 respondents from 99 countries 50 25 43 37 45 43 30 34 37 0 2001 2003 2005 2007 2009 2011 2014 Source: The 2001 through 2014 Global Economic Crime Survey (PWC) Cybercrime survey report 2014, KPMG in India Engineering 4% Manufacturing 5% 12 4 5 14 Electronics 8% 8 10 FMCG 10% Telecom & communications 12% 12 15 20 Source: Cybercrime survey report 2014, KPMG in India Financial services 20% Automobile 15% Information technology 14% Chemicals & pharmaceuticals 12% Cybercrime survey report 2014, KPMG in India Cybercrime In a digital age, internet users and governments face increased risks of becoming the targets of cyber attacks As cyber criminals continue to develop and advance their techniques Criminals focusing less on theft of financial information and more on business espionage and accessing government information To fight fast-spreading cybercrime, businesses and governments must collaborate globally to develop an effective model that can control the threat Threat perception of Cybercrime in India Cybercrime is not strictly speaking a technology problem. It is a strategy problem, a human problem and a process problem. After all, organisations are not being attacked by computers, but by the people Cybercrime has seen an increase in frequency in India at Individual and corporate level Distinctly, about 51 per cent perceive themselves to be an easy target for cyber attacks due to the nature of their business. Out of these 51 per cent, about 68 percent respondents claim that they monitor their cybercrime threats on a daily basis The first line of defense against any cyber threat is increasing perception and awareness of cybercrimes Impact of cybercrime in India Impact of cybercrime in India 80 60 40 20 0 45 48 43 48 27 18 30 16 Damages/Loss THE DAMAGE Whether financial or collateral, the stakes and the costs are very high Economic loss is not the only concern that companies face when combating fraud • Damage to employee morale, corporate and brand reputation, and business relations as some of the most severe nonfinancial impacts of economic crime Access to money • Access to customer confidential information • Disruption of production and business processes • Loss of Mental Peace • Harassment People commit Fraud Why? FRAUD-TRIANGLE . The Fraud Triangle Motive gambling addiction, a mistress, living beyond their means, desire to inflict damage, etc. Rationalization “I believe I’m underpaid,” “I believe I’m overworked,” “My company earns too much.” etc. Opportunity Opportunity usually results as a flaw in the company’s internal control system. This internal control flaw provides the chance to steal company assets. One bookkeeper receiving customer payments and paying vendors, therefore it would be much easier to cover up the fraud by “cooking the books.” Profile of cyber attackers Internal sources External sources Disgruntled employees Cyber terrorists defacement) Managed services personnel Professional hackers/hacking crime syndicates) (focussed on Malicious personnel (focussed on Novice hackers industrial/ commercial espionage) Many of the incidents are not publicly known and have not been reported by the media The Financial Services (FS) sector: Overall key findings Root cause of most cyber attacks is monetary/ financial gain 45% of Financial Services organisations have suffered economic crime compared to only 34% across all other industries 1 in 5 internally perpetrated frauds still involve senior management, though the majority of such fraud tends to be committed by junior staff or middle management. The sector remains a key target for criminals, and asset misappropriation is still the primary type of reported economic crime Cybercrime, bribery and corruption appear to be increasingly common in the sector PwC’s seventh Global Economic Crime Survey The Financial Services (FS) sector: Overall key findings: Money laundering remains a hot topic in the FS sector, where it is almost five times more likely to occur than in other industries Almost 30% believed that the most severe impact is reputational Whistleblowing mechanisms appear to be more prevalent than before, however doubts remain over their effectiveness PwC’s seventh Global Economic Crime Survey Top 5 types of economic crime experienced by the FS sector 80% 60% 40% 20% 0% 67% 67% 39% 38% 24% 24% 26% 21% 16% 20% 2014-FS 2011-FS . Financial Forensic Engagements Financial forensic engagements may fall into several categories Economic damages calculations Post-acquisition disputes such as breaches of warranties Bankruptcy, insolvency, and reorganization Securities fraud-stock fraud and investment fraud Business valuation Computer forensics/e-discovery. Tax fraud Religious fraud 419 fraud Financial forensic engagements may fall into several categories Banking fraud Benefit fraud, committing fraud to get government benefits Counterfeiting of currency, documents or valuable goods Creation of false companies False advertising False billing Forgery of documents or signatures Health fraud Identity theft Lottery fraud Financial forensic engagements may fall into several categories Forensic accountants are also engaged in marital and family law of analyzing lifestyle for spousal support purposes determining income available for child support and equitable distribution Forensic accountants, investigative accountants or expert accountants may be involved in recovering proceeds of crime and in relation to confiscation proceedings concerning actual or assumed proceeds of crime or money laundering The List is endless..... Detecting fraud Methods of fraud detection fall into one of three categories Corporate Controls Corporate Culture Beyond Corporate Control RED FLAGS The most common behavioral red flags displayed by perpetrators Living beyond one’s means or Experiencing financial difficulties SARADHA SCAM RED FLAGS Saradha installment plans with tenure varying from 12 to 60 months where minimum investment is Rs100 and ranging from Rs.10,000 to 1,00,000 Opened as many as 200 new companies to create more cross-holdings Investors had options to either opt for land/flat or get the refund where returns varied from 12 to 24% The land/flat allotted to the investors are not pre-determined or identified. Investors had no control on the scheme and the property Like all Ponzi schemes, Saradha Group promised astronomical returns in fanciful but credible investments As much as 25–40% of the deposit was returned to these agents as commissions and lucrative gifts to quickly build up a wide agent pyramid To keep ahead of regulators, the group used a nexus of companies to launder money Why do so many FRAUDS keep happening ? Human Greed for High Returns Lack of proper Investment Avenues (especially small investors) General awareness missing in general public Inaction of Law enforcing authorities / Laws without teeth, fraudsters daring the system to catch them. Low conviction rate even when the frauds are detected. Whether it is bank fraud, insurance fraud, ecommerce fraud, or any other type of fraud, two points are very clear First Second • The first is the importance of detecting fraud as quickly as possible so that criminals can be stopped before too much damage • As business processes become faster and more automated, the time margins for detecting fraud are becoming narrower and increasing the call for real time solutions. What Forensic Auditors JOB? A major responsibility of Forensic Accountant is to investigate fraud and collect evidence for civil and criminal trials In the vast majority of cases, the evidence is in digital format residing in the computerized system As a result essential knowledge and skills for forensic accounts include systematic approaches to acquiring, cataloging, and presenting computerized and digital data in a manner sufficient to meet the rigorous standards that courts require for admissibility in evidentiary proceedings Digital data exits in many different types of systems, accounting information systems in business environments. Forensic Accountants are in unique position to investigate frauds in computerized accounting systems. and especially in 37 Career Path for Forensic Auditors Forensic Accounting Services Defined Forensic accounting services include dispute resolution, litigation support, bankruptcy support, and fraud and special investigations, among many other services. Forensic accounting services utilize the practitioner’s specialized accounting, auditing, economic, tax, and other skills to perform a number of consulting activities. The provision of forensic accounting services often requires the practitioner to serve as an expert or fact witness, depending on the assignment. Career Path for Forensic Auditors Financial forensic engagements may fall into several categories Economic damages calculations, whether suffered through tort or breach of contract Post-acquisition disputes such as breaches of warranties Bankruptcy, insolvency, and reorganization Securities fraud Due Diligence Business valuation and Computer forensics/e-discovery Career opportunities for Forensic Auditors Potential places of employment within the country: The Financial Intelligence Unit (FIU), Serious Fraud Investigation Office (SFIO), Economic Offence Wing (EOW) The Department of Defences, Law enforcement Banking Sectors Insurance Corporations Private practice INTERNATIONAL Opportunity the FBI and the CIA) the Government Accountability Office (GAO) World Bank International Monetary Fund and Enforcement Agencies Major corporations Small and mid-size businesses The nonprofit sector Banking, brokerage, insurance and other financial-services industries Private practice List goes on………………… Career opportunities Fraud for Forensic Auditors Preventive approach will create more job opportunities Thank You CA Indresh Palan 9702043750 indresh.palan@gmail.com