Presentation - Accountants One

advertisement

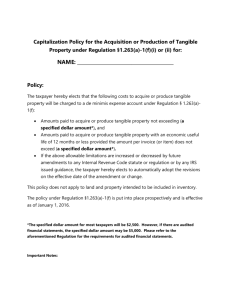

Atlanta and San Francisco | 678-964-4721 | www.hpccpa.com 1 The Final Tangible Property Regulations An Overview Presented by William C. Harshman 2 Background • Disputes Between Taxpayers & IRS • IRS has lost many of the disputes • Beginning approximately 3 years ago IRS issued Temp Regulations − − Delayed several times New Final Regulations effective 1/1/14 3 Five major areas of change • Treatment of amounts paid for improvements to tangible property • Treatment of expenditures for materials & supplies • Treatment of repair & maintenance expenditures • General rules for capital expenditures • Treatment of amounts paid for purchase/production of tangible property 4 New Annual Elections • The final and proposed regulations have many new annual elections including 1. Election to capitalize and depreciate certain materials and supplies (§1.162-3(d) 2. A TP may elect to treat as a capital expenditure and to treat as an asset subject to the allowance for depreciation the cost of any rotable spare part, temporary spare part, or standby emergency spare part De minimis safe harbor election (§1.162-3(f)(1) A TP with and without an AFS may not capitalize any amount paid in the taxable year for the acquisition or production of a unit of tangible property nor treat as a material or supply under §1.162-3(a) any amount paid in the taxable year for tangible property if the amount specified meets the rules ($500 and $5,000 per invoice respectively) 5 New Annual Elections 3. Election to capitalize amounts paid for employee compensation or overhead as amounts that facilitate the acquisition of property (1.263(a)-2(f)(iv)(B)) 4. Safe harbor for small taxpayers (1.263(a)-2(h)(1) A TP may elect not to capitalize improvements or repairs to an eligible building property ) if the total amount paid during the taxable year for repairs, maintenance, improvements, and similar activities performed on the eligible building property does not exceed the lesser of— 2% of the unadjusted basis of the eligible building property; or $10,000 6 New Annual Elections 5. Election to capitalize repair and maintenance costs(1.263(a)-2(n)(1) A taxpayer may elect to treat amounts paid during the taxable/year for repair and maintenance (as defined under §1.162-4) to/tangible property as amounts paid to improve that property/under this section and as an asset subject to the allowance for depreciation if the taxpayer incurs these amounts in carrying on the taxpayer’s trade or business and if the taxpayer treats these amounts as capital expenditures on its books and records 7 New Annual Elections • Disposition of a portion of an asset (aka partial disposition • election) (§1.168(i)-8(d)(2) • A taxpayer may make an election under this paragraph (d)(2) to • apply this section to a disposition of a portion of an asset • Must make the election by the due date (including extensions) of • the original federal tax return for the taxable year in which the • portion of an asset is disposed of by the TP • This listing does not include the numerous GAA • elections addressed in the PRs 8 New Provisions Are Not Elections • Most of the new final and PR TPRs are not elections, but rather are method changes first Example For the Safe harbor for routine maintenance on property (1.263(a)-2(i)(1) one has to first have the applicable final TPR method change filed first • Change procedures for the final TPRs are expected to be issued in October 2013 9 The Allowed or Allowable Rule • Points 1. Section 1.1016-3 remains part of the TPRS – the IRS will use this in their audits of Taxpayers to deny depreciation deductions 2. Use 2013 (i.e. tax depreciation schedules as of 12-312012) to correct any errors in prior year depreciation, and 10 Errors in Depreciation Fixes • Cannot fix depreciation errors by “catching up” on prior year errors • Only filed one return? The taxpayer has not adopted an accounting method, either Previously filed return can be amended to make the correction, OR IRS will allow A CAM by filing a 3115 with the current year’s return WITH A 481(a) adjustment on the current year’s return 11 Errors in Depreciation Fixes • Filed two (or more) returns? • The taxpayer HAS adopted an accounting method May only file a 3115 to correct Incorrect depreciation deduction due to a mathematical or posting error? A TP is not considered to have adopted an accounting method regardless of the number of returns that have been filed So … May only file amended returns for open years 12 Errors in Depreciation Gains & Losses • The rule requiring basis reduction for unclaimed (allowable) depreciation applies for purposes of determining gain or loss • When computing depreciation recapture, a TP need not recapture as ordinary income unclaimed depreciation A TP should, however, amend returns for open years to claim any unclaimed depreciation (or to reduce the amount of depreciation claimed in the open years in the case of a negative 481(a) adjustment 13 Depreciation Errors and TPR to Check for that Need Correction • Bonus depreciation (if taken on some, but not on all applicable assets – 3115; if not taken but now want to take = need letter ruling to change; • Improper lives for assets (need 3115) • Depreciation taken on assets now owned or owned (need 3115) 14 Index of Regulation Sections Temporary • • • • • • 1.162-3T = rules for materials and supplies 1.162-4T = rules for amounts paid or incurred for repairs and maintenance 1.263(a)-1T = general rules for capital expenditures 1.263(a)-2T = rules for amounts paid or incurred for the acquisition and production of tangible property 1.263(a)-3T = rules for amounts paid or incurred for the improvement of tangible property Are effective for taxable years beginning on or after January 1, 2014, with earlier application permitted 15 Index of Regulation Sections Final and Proposed (PRs) • 1.162-3 = “Materials and supplies” • 1.162-4 = “Repairs” (rules for amounts paid or incurred for repairs and maintenance) • 1.263(a)-1 = “Capital expenditures; in general” • 1.263(a)-2 = “Amounts paid to acquire or produce tangible property” • 1.263(a)-3 = “Amounts paid to improve tangible property” 16 Index of Regulation Sections Final and Proposed (PRs) • • • • 1.263(a)-6 = “Election to deduct or capitalize certain expenditures” 1.168(i)-1 = GAA 1.168(i)-8 = Dispositions of MACRS property Are effective for taxable years beginning on or after January 1, 2014, with earlier application permitted 17 Capitalization Foundation Rules • Section 263(a) (relating to the capitalization requirement) states that no deduction is allowed for 1. Any amount paid out for new buildings or permanent improvements or betterments made to increase the value of any property, or 2. Any amount expended in restoring property or in making good the exhaustion thereof for which an allowance has been made 18 Background … • 263(a) Regulations state that capital expenditures include amounts paid or incurred to Add to the value, or substantially prolong the useful life, of property owned by the TP, or Adapt the property to a new or different use Amounts paid or incurred for incidental repairs and maintenance of property (as defined by 162 and §1.162-4 (relating to the deduction for ordinary and necessary trade or business expenses) are not capital expenditures under §1.263(a)-1 19 Temporary or Final Regulations Do Not Change • §263(a) • §263A and the regulations under §263A • Which require TPs to capitalize the direct and allocable indirect costs, including the cost of materials and supplies, to property produced or to property acquired for resale §1.471-1 • Which requires TPs to capitalize amounts paid to improve tangible property and Which requires TPs to include in inventory certain materials and supplies §1016 on “use it or lose it” rule 20 Unit of Property (UoP) • Is a very important element to these and other regulations • Does the client first need to change its Unit of Property before it makes a method change under the new TPRs? 21 Unit of Property (UoP) • Unit of Property is a very important issued, why? It is an important criteria in the decision whether a Taxpayer can write off an expenditure as a R& M • Generally The small the Unite of Property the more likely the expenditure has to be capitalized • This issue should almost always be considered in TR issues, most of the time, early • If your current Unit of Property does not match what you need/want to do-you must ????? an accounting method change to get it corrected (T method 162, F is?) 22 Rules for Determining a UoP §1.263(a)-3T(e) and -3(e) for Final For property other than buildings, • Defines a UoP as consisting of all the components of the UoP that are based upon the functional interdependent standard, but there are special rules for Plant equipment, network assets, leased property, and improvements to property Additional rules if A Tax Payer has assigned different MACRS classes or depreciation methods to components of property, or Subsequently changes the class or depreciation method of a component 23 Unit of Property (UoP) for Buildings 1.263(a)-3(e)(2) • Building Structure • Building Systems (9) Defines building systems to include: 1) 2) 3) 4) 5) 6) 7) 8) 9) the heating, ventilation, and air conditioning systems (HVAC); the plumbing systems; the electrical systems; all escalators; all elevators; the fire protection and alarm systems; the security systems; the gas distribution systems; and, any other systems identified in published guidance. 24 Building and Structural Components 1.263(a)-3T(e)(2) and 3(e)(2) Final General rule that the UoP for a building is • T: comprised of the building and its structural components • F: each building and its structural components 25 Building and Structural Components 1.263(a)-3T(e)(2) and 3(e)(2) Final Improvements to a building • T: Requires that a TP apply the improvement standards separately to the primary components of the building, that is, the building structure or any of the specifically defined building systems • F: Requires that a TP apply the improvement rules separately to the building structure (a building structure consists of the building and its structural components, other than the structural components designated as building systems) or its building systems (these are separate from building structure, and to which the improvement rules must be applied) A UoP is a method of accounting 26 Building and Structural Components 1.263(a)-3T(e)(2) and -3(e)(2) Defines the building structure as • T: the building (§1.48-1(e)(1)) and its structural components (§1.48-1(e)(2)) other than the components specifically enumerated as building systems • F: each building and its structural components (as defined in §1.48-1(e)(2)) is a single unit of property (“building”) A cost is treated as a capital expenditure if it results in an • T: improvement to the building structure or to any of the specifically enumerated building systems • F: improvement to building structure or any of the building systems 27 Building and Structural Components for Partial Dispositions (1.168(i)-8(d)(2) • The proposed regulations (PR) change the unit of property rule in Temp Reg. §§1.168(i)-1T and1.168(i)-8T that each structural component of a building, condominium, or cooperative is the asset for tax disposition purposes • The PR provide that a building (including its structural components), a condominium (including its structural components), or a cooperative (including its structural components) is the asset for disposition purposes 28 Further Review of the Final TPR Issues • §1.162-3 Rules for materials and supplies; • §1.162-4 Repairs and maintenance; • §1.263(a)-1 General rules for capital expenditures; • §1.263(a)-2 Rules for amounts paid for the acquisition or production of tangible property; • §1.263(a)-3 Rules for amounts paid for the improvement of tangible property 29 Material and Supplies Reg. §1.162-3 • The F TPRs expand the definition of M & S to include property that has an acquisition or production cost of $200 or less (increased from $100), clarify application of the optional method of accounting for rotable and temporary spare parts, and simplify the application of the de minimis safe harbor to M & S • Add a new definition for “standby emergency spare parts” • Add a new election to capitalize and depreciate M & S but limit that capitalize choice to only rotable, temporary and standby emergency spare parts 30 Material and Supplies Reg. §1.162-3 • Election to capitalize and depreciate is made on Taxpayer’s timely filed original tax return • Taxpayer can make that election item by item • Final TPRs coordinate the de minimis rules for unites of property (§1.162-3(f)) and M & S (Reg. §1.162-3(f)) The Taxpayer must apply the de minimis safe harbor to amounts paid for all M & S, except for those M & S that the Taxpayer elects to capitalize and depreciate • Non-incidental and incidental M & S rules of the temporary TPRs remain • All final M & S require a method change filing 31 Material and Supplies Reg. §1.162-3 • If a Taxpayer choses to make the election to capitalize and depreciate certain M & S for its tax year 2012 and 2013, the Taxpayer can still make the election by filing an amended return on or before 180 days after the extended due date, even if the return was not extended • A Taxpayer may choose to apply the temporary M & S rules for §1.162-3T for 2012 and 2013 • See Appendix ????? For Final TPR examples, list 1 32 Repair—Reg. §1.162-4 • Is a simple, straight-forward rule, that is the opposite of capitalization Amounts paid for repairs and maintenance to tangible property are deductible if the amounts paid are not required to be capitalized under Reg. §1.263(a)-3 • Same rule as from temporary TPRs • A change to comply with this is a change in method of accounting to which the provisions of §§446 and 481 and the accompanying regulations apply • No examples in Final TPRs 33 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • Prior (can apply to 2012 and 2013) de minimis was not a “safe harbor” Taxpayer could deduct certain amounts paid for tangible property if the Taxpayer had an AFS, had written account policies for expensing amounts under specific dollar amounts, and treated those amounts as expenses on its AFS Ceiling was the great of 1) 0.1 percent of the Taxpayer’s gross receipts for the tax year as determined for tax purposes; or 2) 2 percent of the Taxpayer’s total depreciation and amortization expense for the tax year as determined on the Taxpayer’s AFS 34 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • Final (can apply to 2012 and 2013 but must apply 2014 and after) de minimis safe harbor Ceiling has been eliminated New safe harbor determined at invoice item level, but same on policies for books and records If AFS, Taxpayer may rely on the de minimis safe harbor only if the amount paid for property does not exceed $5,1000 per invoice or per item as substantiated by the invoice This amount is subject to change by the IRS in future guidance 35 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • The de minimis safe harbor has been expanded to include amounts paid for property having an economic useful life or less than 12 months, provided the amount per invoice or item does not exceed $5,000 • A $500per item de minimis rule is also included for taxpayers without an AFS, but still have to have accounting procedures in place to deduct amounts paid for property costing less than specified amount or amounts paid for property with life of 12 months or less • If cost exceeds $500 per invoice, no portion will qualify for the safe harbor 36 37 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • Same rule as in the temporary TPRs The de minimis safe harbor does not precluded a Taxpayer from reaching an agreement with the IRS that the examining agents will not review certain items • Examining agents do not need to revise their materiality thresholds in accordance with the safe harbor limitation • The de minimis safe harbor is elected annual by including a statement on the Taxpayer’s tax return for the year elected • An election to use the safe harbor may not be made through the filing of an application for change in accounting method 38 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • For consolidated groups, if a Taxpayer’s financial results are reported on the AFS for a group of entities, then the group’s AFS may be treated as the AFS of the Taxpayer • A Taxpayer is not required to include in the cost of the property the additional costs if these costs are not included on the same invoice as the tangible property • However, a Taxpayer electing the de minimis must included in the cost of the property all additional costs (for example, delivery fees, installation services, or similar costs) of acquiring or producing the property if these costs are included on the same invoice with the tangible property 39 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • If an invoice includes amounts paid for multiple tangible property and the invoice includes additional invoice costs related to the multiple property, then the taxpayer must allocate the additional invoice costs to each property using a reasonable method • The de minimis safe harbor must be applied to all eligible M & S (other than rotable, temporary, and standby emergency spare parts subject to the election to capitalize or to rotable and temporary spare parts subject to the optional method of accounting for such part(s) if the Taxpayer elects the de minimis safe harbor 40 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 • Taxpayers that do no elect the de minimis safe harbor must treat amounts paid for materials and supplies in accordance with Reg. §1.162-3 • Taxpayers subject to 263A can not avoid those provision by using the de minimis • Safe harbor does not apply to inventory, land items it capitalizes, and the optional method of rotable parts • Safe harbor is deducted as ordinary and necessary expense 41 De Minimis Safe Harbor-Reg. §§1.162-3(f) and 1.263(a)-1(f) Repairs-Reg. §1.162.4 (Effective Dates) • Except for the de minimis election, changes apply to taxable years on or after 1-1-14 • If doing the de minimis election, it will only apply to transactions after 1-1-14 • Even for the de minimis election, a Taxpayer may choose to adopt to amounts paid or incurred in taxable years on or after 1-1-12 • Transition rule for de minimis election on 2012 and 2013 returns apply A Taxpayer may choose to apply the temporary de minimis rules for Reg. §1.263(a)-1T for 2012 and 2013 42 Amounts Paid to Acquire or Produce Tangible Property-Reg. §1.263(a)-2 • Temporary TPRs provided rules for 263(a) to amounts paid to acquire or produce a unit of real or personal property • These rules are generally retained in the final TPRs Requirements to capitalize amounts paid to acquire or produce, To capitalize amounts paid to defend or perfect title and The de minimis safe harbor was moved to §1.263(a)-1(f) to reflect its broader application amounts paid to tangible property, including amounts paid for improves and M & S, except for those subject to 263A 43 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3 • This final TPR section covers the following sections a) Provides the requirement to capitalize amounts paid to improve tangible property and provides the general rules for determining whether a unit of property (UoP) is improved b) Rules for determining the UoP c) Rules for leasehold improvements d) Rules for determining improvement costs in particular contexts, including indirect costs incurred during an improvement, removal costs, aggregation of related costs, and regulatory compliance costs 44 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3 • This final TPR section covers the following sections h) Safe harbor for small taxpayers i) Safe harbor for routine maintenance costs j) Whether amounts are paid for betterments to UoP k) Whether amounts are paid to restore the UoP l) Rules for amounts paid to adapt the UoP to a new or different use m) An election to capitalize R & M consistent with books and records n) an (o) the treatment and recovery of amounts capitalized under this section p) and (q) accounting method changes and state the effective/applicability date for the rules of this Section 45 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(d) • Requirement to capitalize amounts paid for improvements • A Taxpayer generally must capitalize the related amounts paid to improve a UoP owned by the Taxpayer • A UoP is improved if the amounts paid for activities performed after the property is place din service by the Taxpayer − 1. Are for betterment to the UoP 2. Restore the UoP or 3. Adapt the UoP to a new or different use 46 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(e) • Determining the UoP • UoP determination is based upon the function interdependence standard • Special rules are provided for: Buildings Plant property Network assets Leased property (leased buildings and leased property other than building), and Improvements to property 47 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(e) • Additional rules are provided if a Taxpayer has assigned different MACRS classes or depreciation methods to components of property or subsequently changes the class or depreciation method of a component or other item of property. 48 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(e) • Determining the UoP − Leased Building • In the case of a Taxpayer that is a lessee of all or a portion of a building such as an office, floor or certain square footage), the UoP is each building and it structural components or the portion of each building subject to the lease and the structural components associated with the leased portion 49 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(e) • An amount is paid to improve a least building property if the amount is paid for an improvement, to any of the following Entire building, portion of a building • Other than a building All the components that are functionally interdependent comprise a single UoP 50 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(e) • Determining the UoP − Other • In the case of plan property, the UoP is further divided into smaller units comprised of each component (or group of components) that performs a discrete and major function or operation within the functionally interdependent machinery or equipment • In the case of network assets, UoP is determined by the Taxpayer’s particular facts and circumstances • Leased property OT buildings UoP may not be larger than the property subject to the lease 51 Amounts Paid to Improve Tangible Property-Reg. §1.263(a)-3(e) • Determining the UoP − Improvements • An improvement to a UoP is not a UoP separate from the UoP improved • UoP must be treated as a separate UoP if, at the time the UoP is initially placed in service by the Taxpayer, the Taxpayer has properly treated the component as being within a different class of property • In any taxable year after the UoP is initially placed in service by the Taxpayer, if the Taxpayer or the IRS changes the treatment of that property (or any portion thereof) to a proper MACRS class or a proper depreciation method (for example, as a result of a cost segregation study or a change in the use of the property), then the Taxpayer must change the UoP determination for that property 52 Improvements to Leased Property−Reg. §1.263(a)-3(f) • Taxpayer can apply either the safe harbor for small taxpayers or de minimis safe harbor to leased property. • A Taxpayer lessee must capitalize the related amounts that it pays to improve a leased property except to the extent that section 110 applies to a construction allowance received by the lessee for the purpose of such improvement or when the improvement constitutes a substitute for rent • A Taxpayer lessee must also capitalize the related amounts that a lessor pays to improve a leased property if the lessee is the owner of the improvement 53 Special Rules for Determining Improvement Costs−Reg. §1.263(a)-3(g) Certain costs incurred during an improvement • A Taxpayer must capitalize all the direct costs of an improvement and all the indirect costs (including, for example, otherwise deductible repair costs) that directly benefit or are incurred by reason of an improvement • Indirect costs arising from activities that do not directly benefit and are not incurred by reason of an improvement are not required to be capitalized under Section 263(a), regardless of whether the activities are performed at the same time as an improvement 54 Special Rules for Determining Improvement Costs−Reg. §1.263(a)-3(g) Removal Costs− • If a Taxpayer disposes of a depreciable asset, including a partial disposition under Prop. Reg. §1.168(i)-1e)(2)(ix), and has taken into account the adjusted basis of the asset or component of the asset in realizing gain or loss, then the costs of removing the asset or component are not required to be capitalized • If a Taxpayer disposes of a component of UoP, but the disposal of the component is not a disposition, then the Taxpayer must deduct or capitalize the costs of removing the component based on whether the removal costs directly benefit or are incurred by reason of a repair to the UoP or an improvement to the UoP 55 Safe Harbor for Small Taxpayers−Reg. §1.263(a)-3(h) • Certain Taxpayers may elect to no apply the capitalization requirements to an eligible building property if the total amount paid during the taxable year for R & M, improvements, and similar activities performed on the eligible property does not exceed the lesser of− i. ii. 2 percent of the unadjusted basis (is defined in (h)(5) with special rules for leased property) of the eligible building property; or $10,000 • “Amount paid” do not include items capitalized under de minimis safe harbor or those amounts deemed not to improve under the safe harbor for routine maintenance 56 Safe Harbor for Small Taxpayers−Reg. §1.263(a)-3(h) Qualifying Taxpayer− • In general−the term qualifying Taxpayer means a Taxpayer whose average annual gross receipts for the three preceding taxable years is less than or equal to $10,000,000 Rules for Taxpayers in existence for less than three years Short year−annualize Gross receipts are defined in the F TPRs 57 Safe Harbor for Small Taxpayers−Reg. §1.263(a)-3(h) Election • Attach a statement to the Taxpayer’s timely filed original return for the taxable year in which amounts are paid for R & M, improvements, and similar activities performed on the eligible building property providing that such amounts qualify under the safe harbor 58 Safe Harbor for Small Taxpayers – Reg. §1.263(a)-3(h) • Safe harbor exceeded If total amounts paid by a qualifying TP during the year for R & M, improvements, and similar activities performed on an eligible building property exceed the safe harbor limitations, then the safe harbor election is not available for that eligible building property and the TP must apply the general improvement rules Safe Harbor for Routine Maintenance (RM) Reg. §1.263(a)-3(i) • An amount paid for RM on a unit of tangible property, or in the case of a building, on any of the properties is deemed not to improve that UoP • RM for a building is the recurring activities that a TP expects to perform as a result of the use to keep the building structure/system in its ordinarily efficient operating condition Safe Harbor for Routine Maintenance Reg. §1.263(a)-3(i) • RM activities include The inspection, cleaning, and testing of the building structure or each building system, and The replacement of damaged or worn parts with comparable and commercially available replacement parts • RM may be performed any time during the useful life of the building structure or building systems Safe Harbor for Routine Maintenance Reg. §1.263 (a)-3(i) • The activities are routine only if performed more than once during the 10-year period beginning when placed in service • Factors to be considered? Include the recurring nature of the activity, industry practice, manufacturers’ recommendation, and the TP’s experience with similar or identical property • With respect to a TP that is a lessor of a building or a part of the building, the TP’s use of the building UoP includes the lessee’s use of its UoP Safe Harbor for Routine Maintenance Reg. §1.263(a)-3(i) • RM for property other than buildings is the recurring activities that a TP expects to perform as a result of the TP’s use of the UoP to keep the UoP in its ordinarily efficient operating condition • The activities are routine only if, at the time the UoP is placed in service by the TP, the TP reasonably expects to perform the activities more than once during the class life (i.e., the ADS class life) of the UoP Safe Harbor for Routine Maintenance Reg. §1.263(a)-3(i) • RM does NOT include Betterments, replacements where the TP took a loss, sold it, casualty loss, deteriorated to disrepair, new or different use, etc. Capitalization of Betterments Reg. §1.263(a)-3(j) • An amount is a betterment to a UoP only if it: Ameliorates a material condition or defect that either existed prior Is for a material addition, including a physical enlargement, expansion, extension, or addition of a major component to the unit of property or a material increase in the capacity Is reasonably expected to materially increase the productivity, efficiency, strength, quality, or output Capitalization of Betterments Reg. §1.263(a)-3(j) (slide 2) • Application of betterment rules The applicability of each quantitative and qualitative factors to a particular UoP depends on the nature of the UoP For example, if an addition or an increase in a particular factor cannot be measured in the context of a specific type of property, this factor is not relevant in the determination of whether an amount has been paid for a betterment to the UoP An amount is paid to improve a building if it is paid for an increase in the efficiency of the building structure or any one of its building systems (for example, the HVAC system) Capitalization of Betterments Reg. §1.263(a)-3(j) (Slide 3) • Appropriate comparison In cases in which an expenditure is necessitated by normal wear and tear or damage to the UoP that occurred during the TP’s use of the UoP, the determination of whether an expenditure is for the betterment of the UoP is made by comparing the condition of the property immediately after the expenditure with the condition of the property immediately prior to the circumstances necessitating the expenditure Capitalization of Restorations Reg. §1.263(a)-3(k) • A TP must capitalize as an improvement an amount paid to restore a UoP, including an amount paid to make good the exhaustion for which an allowance is or has been made • An amount restores a UoP only if it Is a replacement where TP deducted a loss, taken into account the basis in a sale, casualty loss Capitalization of Restorations Reg. §1.263(a)-3(k) Returns the UoP to its ordinarily efficient operating condition if the property has deteriorated to a state of disrepair and is no longer functional for its intended use; Rebuilds the UoP to a like-new condition after the end of its class life Is for the replacement of a part or a combination of parts that comprise a major component or a substantial structural part of a UoP Capitalization of Restorations Reg. §1.263(a)-3(k) • The IRS must have thought that this was an important section as it has 30 examples • • • • • • • Replacement of loss and sold components. Restoration after casualty loss and casualty event Restoration in a state of disrepair Rebuild to a like new condition before and after the end of class life Not a rebuild to a like-new condition Replacement of major component or substantial structural part Repair performed during restoration Capitalization of Restorations Reg. §1.263(a)-3(k) • The IRS must have thought that this was an important section as it has 30 examples – continued Numerous examples of not and replacement of major component or substantial structural part Replacement of major component or substantial structural part; windows and floors Capitalization of Amounts to Adapt Property to a New or Different Use-Reg §1.263(a)-3(l) • A TP must capitalize as an improvement an amount paid to adapt a UoP to a new or different use • An amount is paid to adapt a UoP to a new or different use if the adaptation is not consistent with the TP’s ordinary use of the UoP at the time originally placed in service by the TP • Just like in the sections on betterments, restorations, there are no accounting method changes required to adopt Election to Capitalize Repair and Maintenance Costs – Reg §1.263(a)-3(n) • A TP may elect to treat amounts paid during the taxable year for R & M to tangible property as amounts paid to improve that property and as an asset subject to the allowance for depreciation if the TP incurs these amounts in carrying on the TP’s trade or business and if the TP treats these amounts as capital expenditures on its books and records regularly used in computing income Election to Capitalize Repair and Maintenance Costs – Reg. §1.263(a)-3(n) • A TP that elects to apply this in a taxable year must apply this paragraph to all amounts paid for R & M to tangible property that it treats as capital expenditures on its books and records in that taxable year • Any amounts for which this election is made shall not be treated as amounts paid for repair or maintenance under §1.162-4 Election to Capitalize Repair and Maintenance Costs – Reg. §1.263(a)-3(n) • Election By attaching a statement to the TP’s timely original Federal tax return for the taxable year in which the TP pays amounts applicable • The statement must be titled “Section 1.263(a)-3(n) Election” and include the TP’s name, address, TP identification number, and a statement that the TP is making the election to capitalize repair and maintenance costs under §1.263(a)3(n) Accounting Method Changes for §1.263(a)-3 • A change to comply with this section is a change of accounting to which 446 and 481 and the accompanying regulations apply • A TP seeking to change to a method of accounting in 1.263(a)-3 must secure the consent of the IRS Accounting Method Changes for §1.263(a)-3 • Applies to taxable years on or after 1-1-14, except for (h) the safe harbor for small taxpayers, (m) the optional regulatory method, and (n) the election to capitalize R & M apply to amounts paid on or after 1-1-14 • Except for (h), (m), and (n), a TP may choose to apply this section to taxable years beginning on or after 1-1-2012. A TP may choose to apply (h), (m), and (n) to amounts paid in taxable years beginning on or after 1-1-2012 Temporary to Final Transition New Elections • As the final regulations are generally applicable to 1-1-14 and after, several sections of the final permit TPs to adopt certain new final TPR elections for 2012 or 2013, by filing an amended Federal tax return for the applicable taxable year on or before 180 days from the due date including extensions of the taxpayer’s Federal tax return for the applicable taxable year, notwithstanding that the taxpayer may not have extended the due date Temporary to Final Transition New Elections • Those new elections include those to 1. Capitalize and depreciate certain M & S 2. De minimis safe harbor 3. Election to capitalize amounts paid for employee compensation or overhead as amounts that facilitate the acquisition of property (1.263(a)-2(f)(iv)(B)) 4. Safe harbor for small taxpayers (1.263(a)-2(h)(1)) 5. Election to capitalize repair and maintenance costs (1.263(a)-2(n)(1)) 6. Disposition of a portion of an asset (aka partial disposition election) (1.168(i)-8(d)(2)) The Proposed MACRS Disposition Regulations • Disposition Rules – address • • • • • • Structural Components Partial Dispositions – Assets Not Included in General Asset Accounts (GAAs) Partial Dispositions – Assets Included in GAAs Components Disposition Definition GAAs – Qualifying Disposition Election • Basis and Identification of Disposed or Converted Asset • Single Asset Account Disposition Rules for MACRS • Structural Components • The proposed regulations (PR) change the rule in Temp Reg. §1.168(i)1T and 1.168(i)-8T that each structural component of a building, condominium, or cooperative is the asset for tax disposition purposes • The PR provide that a building (including its structural components), a condominium (including its structural components), or a cooperative (including its structural components) is the asset for disposition purposes Disposition Rules for MACRS • Structural Components • This rule change, if finalized, allows TPs to forgo a loss upon the disposition of a structural component of a building without making a general asset account election as required under the temporary regulations • A TP desiring to claim a loss on a retired structural component outside of a GAA is now required to make a partial disposition election • This is a new term and is further described in following slides Partial Dispositions – Assets Not Included in General Asset Accounts • The PRs allow a TP to claim a loss upon the disposition of a structural component (or a portion thereof) of a building or upon the disposition of a component (or a portion thereof) of any other asset (a “partial disposition” of an asset) without identifying the component as an asset before the disposition by making a partial disposition election Partial Disposition – Assets Not Included in General Asset Accounts • While the partial disposition rule is generally elective, the rule is required to be applied to Disposition due to casualty event Disposition of a portion of an asset for which gain is not recognized in whole or part under 1031 or 1033 Sale or transfer of a portion of an asset Disposition Definition • The proposed regulations define ”disposition” to provide that a disposition of a structural component (or a portion thereof) of a building only if the partial disposition rule applies to the structural component (or a portion thereof) GAA Qualifying Disposition Election • Temporary TPR’s expanded the definition of a qualifying disposition on which gain or loss could be effectively recognized to include the disposition of most assets, including structural components Basis and Identification of Disposed or Converted Asset • Temporary Reg. §1.168(i)-1T and 1.168(i)-8T provide that, where it is impracticable from the TP’s records to determine the unadjusted depreciable basis of the disposed-of asset, the TP may use any reasonable method that is consistently applied to the taxpayer’s general asset accounts, multiple asset accounts, or larger assets • Final retain these rules but explain them better Basis and Identification of Disposed or Converted Asset • The PRs provide examples of reasonable methods 1. Discounting the cost of the replacement asset to its placed-in-service year cost using the CPI; 2. A pro rata allocation of the unadjusted depreciable basis of the GAA or multiple asset account, as applicable, based on the replacement cost of the disposed-of asset and the replacement cost of all of the assets in the general asset account or multiple asset account, as applicable; and 3. A study allocating the cost of the asset to its individual components