Chapters 18 (17) and 19 Fixed Exchange Rate Regimes & Intl

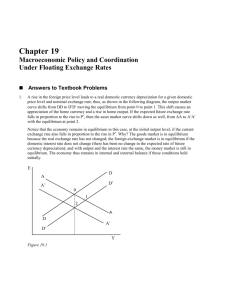

advertisement

Macroeconomic Policy Objectives Internal balance • Full employment…maximum output • Stable prices – “Overemployment” rising prices – Less-than-full-employment falling prices – Volatile aggregate demand and output lead to volatile prices. – Price level volatility uncertainty inefficiency External balance: Current account – not so much in deficit to be unable to repay foreign debt – not so much in surplus that foreigners can’t repay their debts Achieving Internal and External Balance Pegged rates Fiscal policy effective Exchange rate can be changed – Devaluation/revaluation Tools: • Expenditure changing: fiscal policy • Expenditure switching: exchange rate setting – Need as many tools as you have objectives For external balance, XX – G up Y up CA down … unless E up (devaluation) For internal balance, II – E down (revaluation) CA down Y down … unless G up Internal Balance (II), External Balance (XX) “Four Zones of Economic Discomfort” The Open-Economy Trilemma The Impossible Trilogy Impossible for a country to achieve more than two items from the following list: 1. Exchange rate stability…fixed (or managed) rates 2. Monetary policy for internal balance. 3. Freedom of international capital movements. The Policy Trilemma for Open Economies Macroeconomic Policy Under the Classical Gold Standard: 1870–1914 Mechanisms keeping official gold flows (the balance of payments) from becoming too positive or too negative. Gold stock Money supply Price level Current account Hume’s Specie Flow Mechanism Gold stock Money supply Output&income Current account Gold stock Money supply Interest rate Capital flows Central banks management of bank rate – Keep private capital flows ≈ Current account “Rules of the game” not followed Gold stock Financial influence Sterilize gold inflows Central bank cooperation – Lending to keep gold stocks stable The Gold Standard and Internal Balance • The US economy, 1873 – 1913 – Deflation – Frequent financial crises – Frequent recessions – 1890 – 1913 unemployment: 6.8% on average – 1946 – 1992 unemployment: 5.7% on average WW I: Capital flight breakdown of gold standard Interwar turbulence – Legacies of WW I – Redrawn borders disrupted trade patterns – Overhang of “Old Debts”: » reparations/inter-allied loans – Labor empowered: The eight hour day Excessive claims hyperinflation Gold Standard Nostalgia • Restore London dominance $ Dominance/New York Dominance Classical gold standard, 1870 – 1914 • £ dominant despite US economic prowess – US banks couldn’t branch overseas – Bimetalism and its legacy $ looked risky WW I £ instability $ denominated transactions w/Latin America, Asia – Federal Reserve fostered market in int’l acceptances – Benjamin Strong and his legacy – Post-war credit in $s – European government bonds denominated in $s – National City Bank/Others/Branching Abroad US financial dominance: from mid-1920s • International economy disrupted in depression, WWII ‘20s Halting return to gold Prelude to depression – The Economic Consequences of Mr. Churchill General Strike – US monetary expansion – help to Britain Roaring ’20s – Capital flow reversal European downturn le and collapse – Bu b b ‘30s World in Depression: Who Leads? UK couldn’t …US wouldn’t Protection … beggar thy neighbor 1931 European banking crises and contagion – Creditanstalt German banks British investment banks Flight from the £ September 1931: Britain leaves gold – US defends gold standard Crisis and the Great Depression Golden fetters – Halting recovery: monetary expansion/fiscal measures/rearmament Postwar: Restore Stability Bretton Woods System IMF a bank/World Bank a fund $ pegged to gold … N – 1 currencies pegged to an elastic $ IMF: International lender of last resort Capital controls on international financial transactions • support pegs • allow devaluation when fundamental disequilibrium • Protect financial account/Prevent balance of payments crisis Currencies were convertible to encourage trade in goods and services Fiscal policy the principal tool for internal balance Principal tools for external balance • borrowing from the IMF • restrictions on financial asset flows • infrequent changes in exchange rates. Policy Mix for Internal and External Balance: 2 Goals – 2 Tools Starting with CA Deficit and Underemployment Fiscal stimulus + Devaluation • Under the fixed exchange rates of the Bretton Woods system, devaluations were supposed to be infrequent – • • • fiscal policy was supposed to be the main policy tool to achieve both internal and external balance. In general, fiscal policy cannot attain both internal balance and external balance at the same time. A devaluation, however, can move toward both internal balance and external balance at the same time. Speculator anticipation of devaluation greater internal or external imbalances. Reserve Currencies in Int’l Monetary System Bretton Woods: $ Standard…more flexible than gold Each central bank fixed the dollar exchange rate of its currency through foreign exchange market trades for $s • Exchange rates between any two currencies fixed by arbitrage. The US could use M-policy for macroeconomic stabilization despite fixed rates. Purchase of domestic assets by the Federal Reserve leads to – Excess US demand for foreign currencies in the foreign exchange market – Purchases of $s by foreign central banks to keep $ from depreciating Expansionary monetary policies by all other central banks – Higher world output … and/or INFLATION Bretton Woods System Problems/breakdown: – Speculative attacks against weak currencies – Gold & $ Shortage Buildup of $ reserves > US gold stock – $ Glut Vietnam era expansion Pus up overvalued $ Rush out of $s…try to redeem gold the US doesn’t have – Nixon Economic Program, August 15, 1971 – Close gold window…8% devaluation against gold in 12/71 – Import surcharge – Wage/price controls – 1973 Collapse of Bretton Woods system – Foreign central banks refused to buy overvalued $ assets Exporting US Inflation: 1966–1972 Effect on Internal and External Balance of a Rise in the Foreign (US) Price Level, P* The “simple” solution for the £, DM, ¥, FF, … • Revalue against the $ The Case for Floating Exchange Rates • Monetary policy autonomy…w/o capital controls – Each country can choose “appropriate” long-run inflation rate • Symmetry – $ can “devalue” as necessary…not constrained as leader – Other countries can use monetary tool • Exchange rates as automatic stabilizers – Floating cushions output against real shocks – Something’s gotta adjust…if not E, then Y – Depreciation in the face of reduced demand for a nation’s exports restores equilibrium automatically – Unlike Bretton Woods » there would be a “fundamental disequilibrium” » and ongoing CA deficit and loss of reserves » until price level fell or currency devalued The Case for Floating Exchange Rates Effects of a Temporary Fall in Export Demand Exchange rate, E DD2 DD1 2 E2 (a) Floating exchange rate 1 E1 Depreciation leads to higher demand for and output of domestic products AA1 Y2 Y1 Exchange rate, E Output, Y DD2 DD1 (b) Fixed 1 exchange rate E 3 1 AA2 Y3 Y2 Y1 Fixed exchange rates mean output falls as much as the initial fall in aggregate demand AA1 Output, Y The Case Against Floating Exchange Rates Lack of discipline … but a floating exchange rate bottles up inflation in a country whose government is “misbehaving”. Destabilizing speculation • Hot money …but “fundamental disequilibrium” one-way bet under fixed rates • Countries can be caught in a “vicious circle” of depreciation and inflation. E deprec Pim up CoL up W up P up E deprec • Floating exchange rates make a country more vulnerable to money market disturbances: L up R up E-apprec. CA & Y down – Fixed rates cushion output against monetary shocks L up M up nothing shifts under fixed rates The Case Against Floating Exchange Rates A Rise in Money Demand Under a Floating Exchange Rate Exchange rate, E DD 1 E1 2 E2 AA1 AA2 Y2 Y1 Output, Y What really matters? Recall: • With fixed rate, monetary policy is ineffective (given free • capital flows) – Similarly, monetary shocks have no real effect With floating rates, fiscal policy is ineffective – Similarly, temporary real shocks [like drop in demand for exports] have little real effect – Permanent real shocks have “no” real effects The Case Against Floating Exchange Rates Injury to International Trade and Investment • Exporters and importers face greater exchange risk. – But forward markets can protect traders against foreign exchange risk. • International investments face greater uncertainty about payoffs denominated in home country currency. Uncoordinated Economic Policies • Countries can engage in competitive currency depreciations. …under Bretton Woods, policies “coordinated” via US privilege • A large country’s fiscal and monetary policies affect other economies …aggregate demand, output, and prices become more volatile across countries if policies diverge. Free Float Really Managed Float • Fear of depreciation – inflation spiral intervention The Case Against Floating Exchange Rates • Speculation and volatility in the foreign exchange market • If traders expect a currency to depreciate in the short run, they may quickly sell the currency to make a profit, even if it is not expected to depreciate in the long run. • Expectations of depreciation lead to actual depreciation in the short run. • The assumption we’ve been using that expectations do not change when temporary economic changes occur is not valid if expectations change quickly in anticipation of even temporary economic changes. • In fact, exchange rate volatility has increased since 1973 Macroeconomic Data for Key Industrial Regions, 1963–2009 The Case Against Floating Exchange Rates Floating and Discipline: Inflation Rates in Major Industrialized Countries, 1973-1980 (percent per year) Nominal and Real Effective Dollar Exchange Rate Indexes, 1975–2006 Purchasing Power Parity??? Source: International Monetary Fund, International Financial Studies. Due to contractionary monetary policy (Volcker disinflation) and expansive fiscal policy (Reagan tax cut and military buildup, the $ appreciated by about 50% relative to 15 currencies from 1980–1985. growing US CA deficit & rest-of-world capital shortage Major efforts to influence exchange rates: • The 1985 Plaza Accord reduced the value of the dollar relative to other major currencies… “bringing down dollar” • The 1987 Louvre Accord: intended to stabilize exchange rates – Specified zones of +/- 5% around which current exchange rates were allowed to fluctuate. – Quickly abandoned – The October 1987 stock market crash made production, employment and price stability the primary goals for the U.S. » Did tightening to support $ trigger “Black Monday”? » After Black Monday, exchange rate stability became less important. – New targets were (secretly) made after October 1987, but central banks had abandoned these targets by the early 1990s. Macroeconomic Interdependence Under Floating Rate The Large Country Case • Effect of a permanent monetary expansion by US – $ depreciates, US output rises – Foreign output may rise or fall. – Foreign’s currency appreciates Foreign’s output falls – US economy expands Foreign sells more to US • Effect of a permanent fiscal expansion by US – US output rises, US currency appreciates – Foreign output rises – Foreign’s currency depreciates Foreign’s output rises – US economy expands Foreign sells more to US Large Country => Locomotive Exchange Rate Trends and Inflation Differentials, 1973–2009 High-inflation countries have tended to have weaker currencies than their low-inflation neighbors. Source: International Monetary Fund and Global Financial Data. Global External Imbalances, 1999–2009 Source: International Monetary Fund, World Economic Outlook database. • The U.S. has run a current account deficit for many years due to its low saving and high investment expenditure. Rebalancing: As foreign countries spend more and lend less to the U.S., interest rates may rise the U.S. dollar will depreciating the U.S. current account will improve (becoming less negative). • • • Long-Term Real Interest Rates for the United States, Canada, and Sweden, 1999–2010 Source: Global Financial Data and Datastream. Real interest rates are six-month moving averages of monthly interest rate observations on ten-year inflation-indexed government bonds. Macroeconomic Interdependence Under Floating Rate Unemployment Rates in Major Industrialized Countries, 1978-2000 (percent of civilian labor force) What Has Been Learned Since 1973? • After 1973 central banks intervened repeatedly in the foreign exchange market to alter currency values. – To stabilize output and the price level when certain disturbances occur – To prevent sharp changes in the international competitiveness of tradable goods sectors • Monetary changes had a much greater short-run effect on the real exchange rate under a floating nominal exchange rate than under a fixed one. • The international monetary system did not become symmetric until after 1973. – Central banks continued to hold dollar reserves and intervene. • The current floating-rate system is similar in some ways to the asymmetric reserve currency system underlying the Bretton Woods arrangements … exorbitant privilege What Has Been Learned Since 1973? The Exchange Rate as an Automatic Stabilizer • Experience with the oil shocks of 1973 and 1979 favors floating exchange rates. • The effects of the U.S. fiscal expansion after 1981 provide mixed evidence on the success of floating exchange rates. Discipline • Inflation rates accelerated after 1973 and remained high through the second oil shock. • The system placed fewer obvious restraints on unbalanced fiscal policies. – Example: The high U.S. government budget deficits of the 1980s. What Has Been Learned Since 1973? Destabilizing Speculation • Floating exchange rates have exhibited much more day-today volatility. – The question of whether exchange rate volatility has been excessive is controversial. • In the longer term, exchange rates have roughly reflected fundamental changes in monetary and fiscal policies and not destabilizing speculation. • Experience with floating exchange rates contradicts the idea that arbitrary exchange rate movements can lead to “vicious circles” of inflation and depreciation. International Trade and Investment • For most countries, the extent of their international trade shows a rising trend after the move to floating. Many fixed exchange rate systems have developed since 1973. • European monetary system and euro zone • The Chinese central bank currently fixes the value of its currency. • ASEAN countries have considered a fixed exchange rates and policy coordination.